Skip to comments.

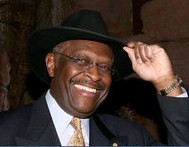

Herman Cain Promotes FairTax

THE FREEDOM POST ^

| April 18, 2011

| Matthew Burke

Posted on 04/18/2011 8:51:01 PM PDT by TheFreedomPoster

VIDEO of probable presidential candidate Herman Cain promotes replacing the current "messed-up tax code" with the FairTax, a single rate consumption tax, on the Neil Cavuto show today...

(Excerpt) Read more at myfreedompost.com ...

TOPICS: Business/Economy; Government; Politics

KEYWORDS: fairtax; hermancain; neilcavuto

Navigation: use the links below to view more comments.

first 1-20, 21-40 next last

To: TheFreedomPoster

too bad it wasn’t the flat tax.

2

posted on

04/18/2011 8:54:19 PM PDT

by

GeronL

(The Right to Life came before the Right to Happiness)

To: GeronL

Either one would be better than what we have.

3

posted on

04/18/2011 8:58:47 PM PDT

by

Army Air Corps

(Four fried chickens and a coke)

To: GeronL

No flat tax... still requires the IRS and requires taxpayers to report income to the government. Does nothing to address the underground economy and continues to encourage tax cheating. The government would continue to collect taxes under the threat of imprisonment as they do now, and the jack-booted agents would continue to audit all phases of your life — and most of all, keeps allowing congress to engage in social engineering by allowing deductions, tax incentives, etc.

While the national sales consumption tax isn’t perfect, it’s a darn site better than the alternatives.

4

posted on

04/18/2011 8:59:26 PM PDT

by

Froggie

(uires)

To: GeronL

the fairtax is better than the flattax I hear. Flattaxes production while fair taxes consumption but exempts the poor from paying it. Encouraging production = society become richer. Encouraging consumption = society become poorer

5

posted on

04/18/2011 9:01:57 PM PDT

by

4rcane

To: Froggie

The FAIR tax plan I read was inspid and a socialist dream.

The whole “prebate” thing is a joke, what kind of bureaucracy will that require?? Massive. Who gets refunds? Those who paid nothing still get them from those who get to pay higher taxes.

It’s still progressive in other words.

I can already see Democrats running on the plan to raise the prebates for the “poor and middle class” while bashing those greedy Republicans.

Silly.

6

posted on

04/18/2011 9:04:01 PM PDT

by

GeronL

(The Right to Life came before the Right to Happiness)

To: 4rcane

You are talking about a sales tax?

The “fairtax” will require massive bureaucracy to keep track of who gets what in their “prebate”, which means we will still have to report income to said bureaucracy and the poor still get more than they paid.....

It’s like rearranging the deck chairs on the Hindenburg

7

posted on

04/18/2011 9:06:07 PM PDT

by

GeronL

(The Right to Life came before the Right to Happiness)

To: GeronL

I don’t know the full details, but as I understand it fairtax is basically a sale tax with the poor exempted from paying it

8

posted on

04/18/2011 9:09:35 PM PDT

by

4rcane

To: 4rcane

and how do you exempt the poor? Because we will ALL have to report our income to the Leviathan who will have to have agents to make sure we are all telling the truth.

Plus all of the plans I read have rebates for the poor for money they never paid.

9

posted on

04/18/2011 9:11:32 PM PDT

by

GeronL

(The Right to Life came before the Right to Happiness)

To: GeronL

http://en.wikipedia.org/wiki/FairTax

The current system we have is where we pay taxes on production, in which the government use the taxes to erect welfare services. This replaces it with a sale taxes in which the government simply hand out living allowance, so yes those who never paid into the system will get paid. Its an improvement to the welfare system, where individuals allocate resources instead of central planner

10

posted on

04/18/2011 9:27:42 PM PDT

by

4rcane

To: K-oneTexas; Tucker822; Kartographer; freekitty; carmody; Dead Corpse; MsLady; Publius772000; ...

11

posted on

04/18/2011 9:35:41 PM PDT

by

justsaynomore

("We cannot fight a war being 'politically correct'." - Herman Cain)

To: 4rcane

What a joke. So the Congress no longer writes the budget? sure.

12

posted on

04/18/2011 9:50:25 PM PDT

by

GeronL

(The Right to Life came before the Right to Happiness)

To: TheFreedomPoster

Fair Tax, Flat Tax, Progressive Tax, Representative apportionment Tax .... PEOPLE, THE PROBLEM IS NOT TAX COLLECTION! We are already receiving 19% of the GDP! We are at top revenue. At best, we may be able to squeek out another percentage point.

THE PROBLEM IS SPENDING! We are past the point where we determine who’s pocket book is going to get soaked the most in taxes. We have to cut back to no more than 18% of GDP.

In 2010 the CIA world fact book estimates the total US GDP at $14.72 trillion. 18% works out to about $2.65 trillion in total spending. The 2010 budget was 3.36 trillion.

In 2011 That picture is even WORSE. The GDP is expected to shrink to a total of 13.5 Trillion. 18% of that is 2.43 trillion. But our fearless and free spending Politicians will increase spending to 3.83 trillion. We need to be cutting and cutting big time.

We have to cut back some 1.4 trillion in spending. 2/3rds of that needs to come out of mandatory spending. 934 Billion out of Social Security, Medicare, Medicaid, and other mandatory programs. This will require cuts in benefits. We also need to slash descressionairy spending by 467 Billion.

That will require across the board and deep cuts. To programs that I dearly love and yes it will impact people I love. But if we do not do it now, the problem will only get worse.

To: taxcontrol

“We are already receiving 19% of the GDP! We are at top revenue.”

Not exactly. Last year we collected 14% on an economy that grew at 1.something percent after a severe contraction the previous year, a 5% haircut that likely came from losses being written off. And so there’s a bit of a problem when spending was based on projection and the revenue side had the bottom fall out over a multi-year scenario. Of course, that would likely happen no matter how we collect revenue. The fair tax would be particularly subseptable to demand shocks, while a flat tax not so much. We would still end up with a spending problem in a down economy.

But even more than that, the current revenue system in combination with the entitlement state is a disaster for average working folks, and the economy in general, as it taxes things like payroll and discourages saving/investing. We need to do something to change that because what we have just doesn’t work well with the new economic reality.

14

posted on

04/19/2011 1:21:55 AM PDT

by

dajeeps

To: 4rcane

“...exempts the poor from paying it...”

and that’s a major problem. Why should anyone be excused from paying for government spending ? Even if somebody earns minimum wage, they should pay 10% of their income toward government spending rather than expecting their neighbor to shoulder their burden.

The FairTax would be fine if it did NOT attempt to untax the “necessities of life” via a prebate, and did not try to soak the rich by combining SS/M funding into the FairTax. Leave SS/M as a separate issue and omit the prebate and you could have all the advantages of the FairTax but the rate would only need to be 10% instead of 23%.

15

posted on

04/19/2011 1:27:05 AM PDT

by

Kellis91789

(There's a reason the mascot of the Democratic Party is a jackass.)

To: GeronL

Exactly right.

Not to mention the way it attempts to completely shift the burden for SS/M entirely onto the rich. I say “attempts” because the rich would flee the country since the FairTax gives them that legal option. The rich spending their money elsewhere would leave a $500B/yr hole in the “projected” FT revenues. That fact alone guarantees the FairTax rate would need to be much higher than 23%.

16

posted on

04/19/2011 1:34:20 AM PDT

by

Kellis91789

(There's a reason the mascot of the Democratic Party is a jackass.)

To: taxcontrol

Aren’t you neglecting the denominator of that formula ?

If the GDP grows, the percentage represented by spending will fall even if the dollar amount of spending does not. Even without spending cuts, if the increases could be held to 1% per year while GDP grew at 6% per year, we’d have a balanced budget in ten years. (Not that I wouldn’t love to see spending cuts, but they seem hard to come by in Congress. I don’t see why we have to fight on a thousand different cuts when using the 2000 budget and just adjusting for inflation a 2012 budget would only be $2.5T.)

Economic growth can be a part of the solution. Economic growth requires good tax policy and good regulatory policy. Good tax policy is one which does not discourage success as progressive tax systems do. Good tax policy does not encourage unproductive behavior and does not interfere with free markets.

So tax reform is not a pointless exercise, but needs to be an integral part of getting things back on track. Just eliminating the corporate income tax would boost GDP, employment, and tax revenues, while shifting 20M people from recipients of government largess to actual tax revenue contributors. So let’s not belittle tax reform.

17

posted on

04/19/2011 2:06:12 AM PDT

by

Kellis91789

(There's a reason the mascot of the Democratic Party is a jackass.)

To: GeronL

The whole “prebate” thing is a joke, what kind of bureaucracy will that require??

Far less bureaucracy than what the prebate will replace and is required to keep track of the multitude of income tax forms requiring people to fill out quarterly or annually.

Who gets refunds?

Anyone who wants to file for the prebate. It won't be mandatory.

I can already see Democrats running on the plan to raise the prebates for the “poor and middle class” while bashing those greedy Republicans.

I wish that were the case. The fact is they have fought against The Fair Tax because they realize it will take power away from the federal government by allowing people to decide when and how often they are taxed instead of the federal government confiscating the people's hard earned money before people get their paychecks.

To: Kellis91789

I say “attempts” because the rich would flee the country since the FairTax gives them that legal option.

The "rich" however defined have been fleeing the country for decades as the overall income tax burden has increased. They will return with The Fair Tax since their productivity will no longer be taxed.

To: Defend Liberty

In 2009, the top 1% of taxpayers paid 17% effective income tax rate. The prebate is insignificant at that level of income, so the FairTax is equivalent to a 23% income tax rate for them, since all income is eventually spent. The only way for them to lower their tax burden would be to spend their money outside the country. You can bet that is what they’ll do, and it will leave a $500B/yr hole in the tax revenues HR25 expects.

Check it yourself at http://fairtaxcalculator.org/ and plug in $1M income and $0 savings.

On the other hand, if the FairTax rate was just 10%, all those high income people really would come back to the country the way you thought. Without the Prebate and the misguided attempt to wrap SS/M into it, a 10% rate would be enough to completely replace all the income taxes. Like I said, all the advantages and none of the disadvantages of HR25.

20

posted on

04/19/2011 1:46:53 PM PDT

by

Kellis91789

(There's a reason the mascot of the Democratic Party is a jackass.)

Navigation: use the links below to view more comments.

first 1-20, 21-40 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson