Skip to comments.

It Is Mathematically Impossible To Pay Off All Of Our Debt

Zero Hedge ^

| 5/22/15

| Michael Snyder/Tyler Durden

Posted on 05/22/2015 5:14:38 PM PDT by fhayek

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-134 next last

To: fhayek

Repudiate the debt. Inflate the money. Financial armageddon. LOL. Do you think there is the political will to do that? Those aren't easy answers, they are fantasy solutions.

41

posted on

05/22/2015 5:54:21 PM PDT

by

kabar

To: fhayek

I have taken a crash course in growing food. But, its because I like gardening. No really, I mean that is is all because I like gardening.

Yeppers, just because I like gardening.

42

posted on

05/22/2015 5:55:47 PM PDT

by

Mad Dawgg

(If you're going to deny my 1st Amendment rights then I must proceed to the 2nd one...)

To: fhayek

Oh, don’t worry so. The government and technology are working very hard and fast to get you into virtual money. You know, zeros on a computer screen. That way they add a few zeros to your accounts, take them away from you as virtual taxes and voi`le. Debt paid.

I know it sounds like sarcasm but I’ve been told this is how they’ll fix everything.

43

posted on

05/22/2015 5:56:49 PM PDT

by

lucky american

(Progressives are attacking our rights and y'all will sit there and take it.)

To: St_Thomas_Aquinas

Anyway, we all know that SS will come to an end. And in practice it will mean most parents will have to move in with their children, which will probably be a good thing. It's the way it was done for generations before the government stepped in. It is the other way around now. A record 57 million Americans, or 18.1% of the population, lived in multigenerational arrangements in 2012, according to the Pew Research Center. That's more than double the 28 million people who lived in such households in 1980, the center said. The sluggish job market and other factors have propelled the rise in millennials living in their childhood bedrooms.

About 23.6% of people age 25 to 34 live with their parents, grandparents or both, according to Pew. That’s up from 18.7% in 2007, just prior to the global financial crisis, and from 11% in 1980.

For the first time, a larger share of young people live in multigenerational arrangements than of Americans 85 and older.

44

posted on

05/22/2015 5:58:28 PM PDT

by

kabar

Comment #45 Removed by Moderator

To: PeterPrinciple

NOthing changes until the money runs out..........

Agreed.

kind of.

Our Federal budget operates on the “Use it or lose it” model.

They hit/spend their budget allocations and then they can get more money for the next year. Many agencies actually struggle to spend their money. Some advertise and pay people to sign up folks to get free stuff from the gov’t. They come up with insane “Mandates” and tell the states that they can get fed money if they adopt these mandates.

The states need to start saying no to the money.

The/our Government is basically a “Pass through” entity with massive infrastructure costs along with the power to dictate more and more regulations on the states.

I’m a Federalist.

I say freeze the Government.

Roll back the mandates.

Say no to the money.

This would actually flood the Feds with cash. More cash than they could possibly spend if the proper controls are put in place. They already have more cash than they need but are allowed to spend it under any variety of protocols, most of which require them to create a “Need”.

46

posted on

05/22/2015 6:01:07 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: Las Vegas Ron

47

posted on

05/22/2015 6:01:25 PM PDT

by

Las Vegas Ron

("Medicine is the keystone in the arch of socialism" Vladimir Lenin)

To: fhayek

Nothing new here.

We have known since the 1970s that it would be mathematically impossible to pay even the unfunded pensions we were in the process of creating back then.

The newspapers where I grew up addressed the math often.

So here we are. People didn’t care. The reckoning was far off in the future, and an unseen solution would pop up to save us.

Or it wouldn’t.

48

posted on

05/22/2015 6:02:07 PM PDT

by

MrEdd

(Heck? Geewhiz Cripes, thats the place where people who don't believe in Gosh think they aint going.)

To: fhayek

Yeah, that was an expensive lesson.

To: fhayek

Nuke the Chinese and most of our debt is gone (so is China)./s

50

posted on

05/22/2015 6:02:27 PM PDT

by

umgud

(When under attack, victims want 2 things; God & a gun)

To: fhayek

It is ridiculous to assume that the US should be paying down all of its debt as a goal.

This attitude is so off base it is not even wrong, because it is incoherent.

To: Zeneta

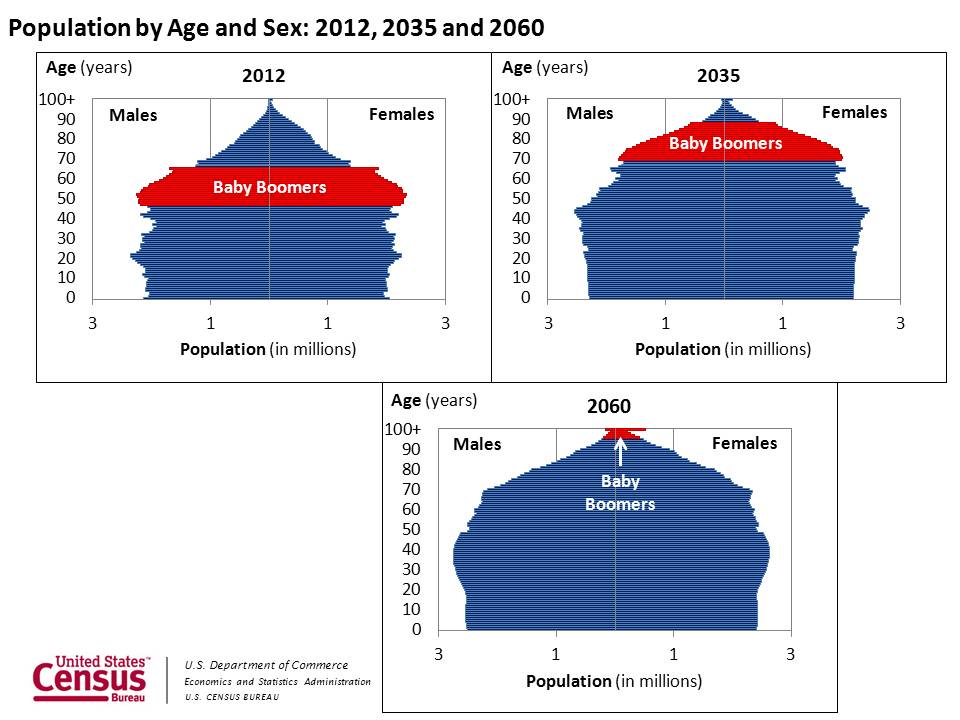

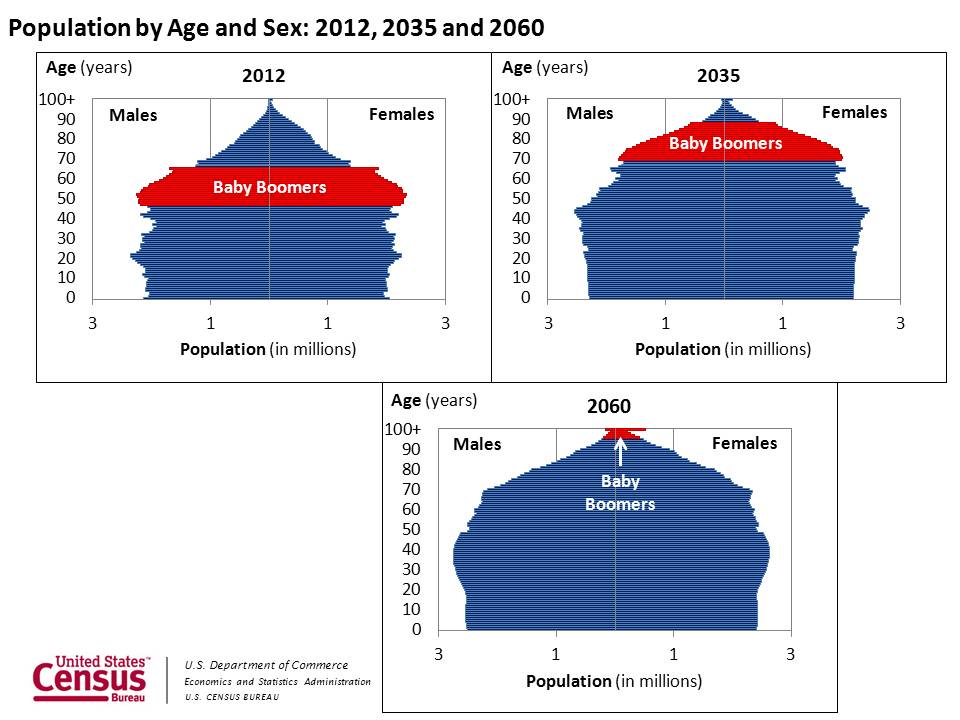

?It has been projected that “mandatory” federal spending on programs such as Social Security, Medicaid and Medicare plus interest on the national debt will exceed total federal revenue by the year 2025. This is the problem. We have 10,000 baby boomers retiring every day for the next 20 years. By 2030, one out of five residents of this country will be 65 or older. In 1950 there were 16 workers for every retiree; today it is three; and by 2030 it will be two to one. How much should we tax the young to pay for our entitlement/welfare system?

Basically, tell the feds “your are responsible for x, and those funds will flow. However, you, the feds, cannot take on any additional liabilities after a certain point.

Medicare, SS, Obamacare, and Medicaid are enough liabilities to strangle our economy. 40% of all Medicare expenditures come from the general fund. And the demographics will ensure that this continues to rise.

52

posted on

05/22/2015 6:05:21 PM PDT

by

kabar

To: Iron Munro

Look, here is how I see the scenario playing out. Americans hold dollars, of course. But so do other’s around the world. Euro dollars, Petrodollars. Countries have held American dollars as a stable store of value. If they start dumping them, the Fed may feel that they would be forced to raise interest rates to stop the bleeding, Unfortunately, they will have to raise rates HARD. High rates will kill our economic growth AND make government debt payments more difficult. Hard times, my friend, hard times.

53

posted on

05/22/2015 6:07:30 PM PDT

by

fhayek

To: kabar

54

posted on

05/22/2015 6:07:52 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: fhayek

I have known for awhile now that the US will eventually default on it’s debt.

The real question is not will we default, but what will happen to average citizens savings when it happens. Will the government simply freeze bank accounts one day like they did in Greece?

55

posted on

05/22/2015 6:10:21 PM PDT

by

TexasFreeper2009

(You can't spell Hillary without using the letters L, I, A, & R)

To: Dad was my hero

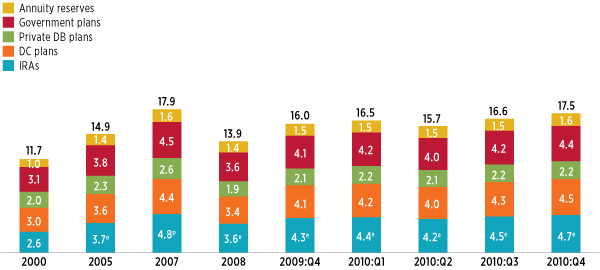

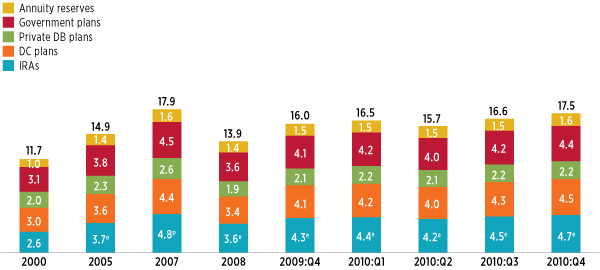

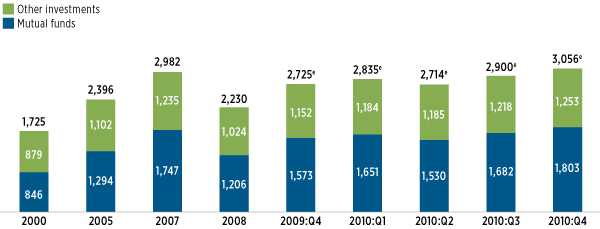

Assets in individual retirement accounts (IRAs) totaled $4.7 trillion at the end of 2010, up 5.3 percent from the end of the third quarter. Defined contribution (DC) plan assets increased 5.1 percent in the fourth quarter, hitting $4.5 trillion. Government pension plans— including federal, state, and local government plans — held $4.4 trillion in assets as of December 31, up 6.9 percent from September 30. Private-sector defined benefit plans held $2.2 trillion in assets at year-end and annuity reserves outside of retirement accounts accounted for another $1.6 trillion.

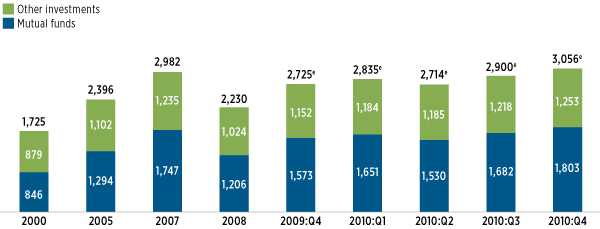

Americans held $4.5 trillion in employer-based DC retirement plans on December 31, 2010, of which $3.1 trillion was held in 401(k) plans. Those figures are up from $4.3 trillion and $2.9 trillion, respectively, on September 30, 2010. Mutual fund managed $2.5 trillion of assets held in 401(k), 403(b), and other DC plans at the end of 2010, up from $2.3 trillion at the end of the third quarter. Mutual funds managed 54 percent of DC plan assets at year-end 2010.

56

posted on

05/22/2015 6:11:23 PM PDT

by

kabar

To: kabar

There will certainly be “Legacy debt” or commitments.

The fundamental question is “How do you break a Ponzi scheme?”

There’s plenty of money.

57

posted on

05/22/2015 6:11:27 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: VerySadAmerican

the military will never do their bidding.

the robot army they are working on will though.

58

posted on

05/22/2015 6:11:28 PM PDT

by

TexasFreeper2009

(You can't spell Hillary without using the letters L, I, A, & R)

To: Zeneta

There is not plenty of money and future liabilities represented by the entitlement programs are $58 trillion. Unless you reform these programs by reducing benefits and/or increase taxes, you are just on an endless treadmill to oblivion. The number of people over 65 will double in the next 20 years.

59

posted on

05/22/2015 6:15:42 PM PDT

by

kabar

To: TexasFreeper2009

I have never been afraid of robot armies. Like Dr. Smith, all you have to do is remove their power pack.

60

posted on

05/22/2015 6:15:43 PM PDT

by

fhayek

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-134 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson