Skip to comments.

U.S. Adds 113,000 Jobs, in Latest Worrying Sign on Growth

The Wall Street Journal ^

| February 7, 2014

| Eric Morath And Josh Mitchell

Posted on 02/07/2014 5:41:02 AM PST by John W

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120 ... 141-144 next last

To: Wyatt's Torch

That “churn” is grinding us right straight toward depression, not recovery from anything. With the fake unemployment rate down to 6.6 % we gotta be just a few weeks away from the Kenyan claiming we are at full employment——wait for it. And now that the Kenyan has liberated everyone from those boring drudgery jobs by giving them part time ones it shouldn’t be long before he announces the plan to pay the rent/mortgages for part-time liberated.

I notice in the above chart that gov’t employment is down. Who believes that? And that pretty much makes all the gov’t reporting suspect if not out and out corrupt.

81

posted on

02/07/2014 11:01:50 AM PST

by

cherokee1

(skip the names---just kick the buttz)

To: fhayek

Well you can look at the chart:

At 334k it's on the low end of the range. Only a few times since the 1970's have dropped below 300K.

Some starts by president:

Obama's average(since January 2009) is 431,262 (low is 304,750, high is 660,250, media is 407,500)

W's average (Jan 2001 - Dec 2008) was 366,181 (low was 286,500, high was 564,000, median was 353,000)

Clinton's average was 328,568 (low was 266,520, high was 393,000, median was 330,625)

Reagan's average was 407,144 (low was 287,250, high was 674,250, median was 390,250)

To: Conservative Gato

You are seriously clueless. When you can’t post any rebuttal to the statistics that tells me all I need to know about your analytic capabilities.

Have a good day.

To: cherokee1

Government employment is down... sorry it doesn’t fit your narrative.

People can ignore the data. If so you are missing out on some fantastic market returns. I’ve tried giving you the numbers. If you choose to not believe them then I just cannot help you.

To: Wyatt's Torch

This is the kind of reply I get from liberals that see government as the end all, or to put it another way, in big government we trust.

Question: Given all the lies and deception we have gotten from the government and democraps in recent years, why do you trust their statistics now?

CGato

“Fool me once, shame on you, fool me twice, shame on me”

To: Conservative Gato

And making paranoid posts about government manipulation of data and calling people names is the kind of reply I expect from people on this board. Sadly it didn’t used to be this way. This place has changed a lot since I joined in 1999...

Why do I believe the numbers? Because it’s what I see in the market every day. I do financial and economic forecasting for a living. These numbers are very consistent with the results I see in my company.

“The essence of knowledge is, having it, to apply it; not having it, to confess your ignorance.”

~ Confucius

To: Wyatt's Torch

Paranoid? We have deceptions and lies from Obamacare, Benghazi, IRS scandal, Fast & Furious, just to name a few, to draw from and you think I’m paranoid? What kind of false reality do you live in? Liberals live in a false reality to, just saying...

CGato

PS, I’ve been here from the beginning as well but just started posting because I am so sick of this big-government-is-the-end-all statist culture we live in now. If that hits close to home, so be it.

To: Conservative Gato

I’ve never disagreed with “deceptions and lies from Obamacare, Benghazi, IRS scandal, Fast & Furious’ so I have no clue what you are talking about...

And seriously, enough with the name calling. It just make you look foolish.

When you have something substantive to discuss regarding finance/economics I’ll respond. Until then I’m done with this conversation. It’s a waste of my time.

To: John W

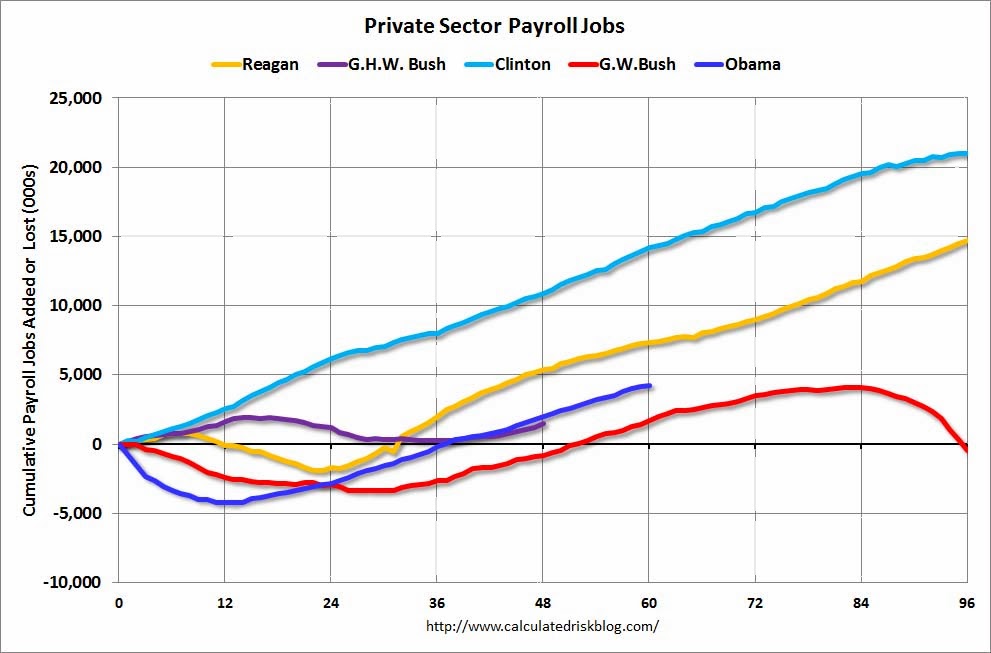

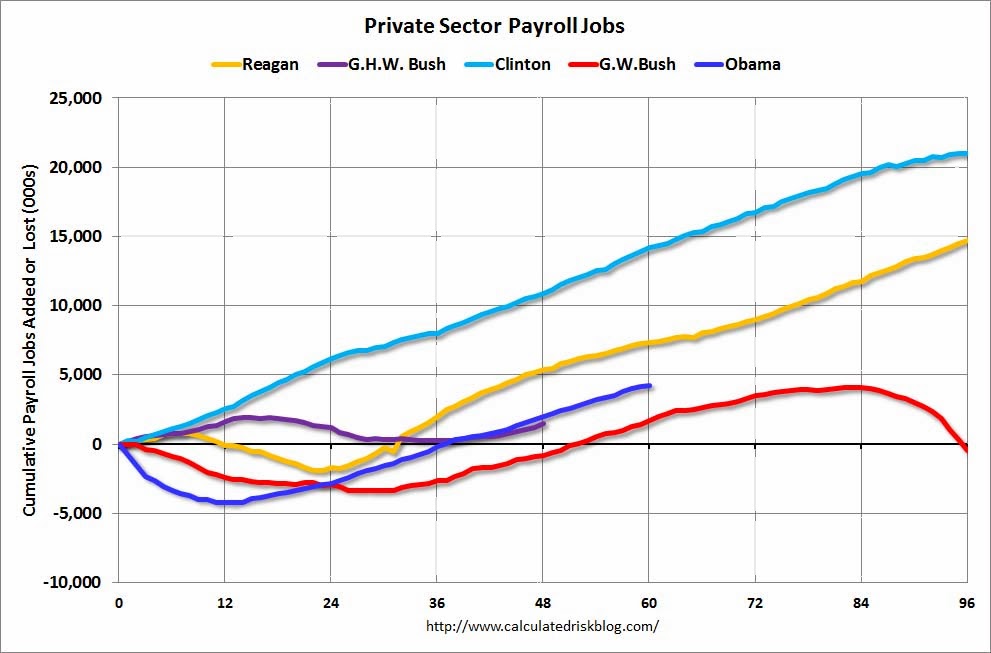

Good charts on Private vs Public Sector jobs (from Bill McBride's Calculated risk blog)

Private sector:

Public sector:

To: Wyatt's Torch

I have a question please regarding this post, in which deflation was mentioned and of the danger of such and is why you supported QE. My question ... How is inflation better for the economy than deflation?

I do agree that in a perfect world there would be neither deflation or inflation but with QE inflation was guaranteed. Incomes, for families, has decreased. How is inflation better for families when families have less money due to inflation?

90

posted on

02/07/2014 12:23:12 PM PST

by

no-to-illegals

(Scrutinize our government and Secure the Blessing of Freedom and Justice)

To: Conservative Gato

Funny thing about government statistics: the methodology used in the manner they are created is announced. It's somewhat odd that you would accuse someone of being a "liberal" for posting them, when they can be refuted by the information the agencies that post them provide.

So you are either lazy for not refuting them, or simply whining that someone is posting statistics with which you disagree.

91

posted on

02/07/2014 12:28:06 PM PST

by

1rudeboy

To: Wyatt's Torch

Nothing to do with the chart but along the same line as was my prior post ...

Since wages have Deflated or remained flat (no growth) yet goods and services have Inflated or the prices have increased giving families less money with which to purchase goods and services, is this a cycle of growth or simply a cycle of wage deflation and goods and services inflation with growth an illusion based on QE?

92

posted on

02/07/2014 12:34:44 PM PST

by

no-to-illegals

(Scrutinize our government and Secure the Blessing of Freedom and Justice)

To: no-to-illegals

Deflation is far worse because of what it does on the asset value side and the result of that. When you are levered you are paying for that asset in current dollars when the value of that asset is declining. It leads to loans going under water. Creditors calling loans. Defaults. etc. Then it's much harder to sell assets when people expect the price to fall. the overall price level of everything falls including nominal wages. That's why it is often referred to a "deflationary spiral" or some call it a "death spiral". Look at Japan and what has happened to them over the last 20 years. Inflation is much easier to deal with.

Here's a good essay by noted supply sider Jude Wanniski called the Deflation Monster

The deflationary spiral:

To: Wyatt's Torch

Does not inflation eventually cause goods and services to create a similar cycle?

94

posted on

02/07/2014 12:37:01 PM PST

by

no-to-illegals

(Scrutinize our government and Secure the Blessing of Freedom and Justice)

To: Wyatt's Torch

my apology ... question should read ... Does not Inflation eventually cause goods and services prices to create a similar cycle if not identical cycle as Deflation?

95

posted on

02/07/2014 12:39:02 PM PST

by

no-to-illegals

(Scrutinize our government and Secure the Blessing of Freedom and Justice)

To: no-to-illegals

Good question. Real wages have declined really due to a lack of inflation which is “good” for the economy. When we see real inflation you will see rising wages. Right now there is slack in the labor market which is also not putting pressure on wages.

There is some commodity “inflation” but I’m not sure it’s monetary inflation as the overall price level has remained relative stable to slightly increasing. Things like oil, gold, corn are subject to exogenous factors not related to the monetary level.

Bernanke’s PhD was on the Great Depression and he believes that the Fed tightened too fast and caused the deflationary recession in 37-38. He has always said that he would never make that same mistake again. He was true to his word :-)

To: no-to-illegals

It’s the reverse but yes similar. It’s just much easier to correct than deflation. The medicine is tough (see Volcker in 1981-82) but relatively short lived.

To: Wyatt's Torch

Bernanke maybe was a PhD but ... we are now in uncharted territory (imho).

98

posted on

02/07/2014 12:43:53 PM PST

by

no-to-illegals

(Scrutinize our government and Secure the Blessing of Freedom and Justice)

To: no-to-illegals

Re: Why is deflation bad?

Individuals make economic decisions based on future expectations.

If you have deflation, then a rational consumer will put off all purchases until some time in the future, since stuff will be cheaper tomorrow.

When people delay purchases, economic activity decreases, and the depression gets worse ( a downward spiral).

To: Wyatt's Torch

(imho) a huge maybe ... it worked then because the tax code was reformed and made more business friendly. (imho) we do not have that similar situation as was at that time instead we have just the opposite. Still of the opinion we are in uncharted territory. Don’t know how this will end and we all have to wait and see because government has deemed it to be as such. Might be a long, long ride this time though with reform to the tax code making the tax code business friendly.

100

posted on

02/07/2014 12:46:55 PM PST

by

no-to-illegals

(Scrutinize our government and Secure the Blessing of Freedom and Justice)

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120 ... 141-144 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson