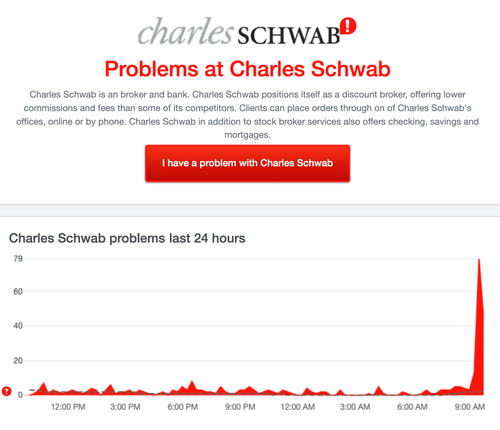

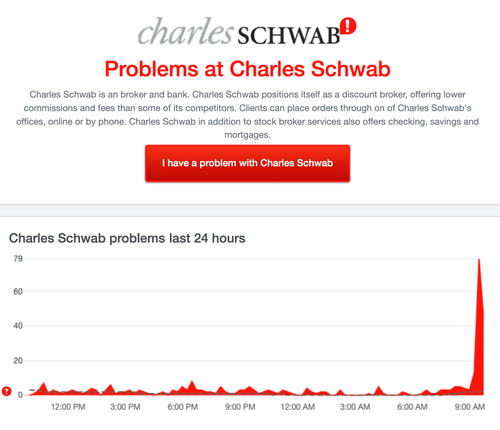

The list of discount brokerage houses experiencing issues and outages this morning continues to expand. Add Charles Schwab to the mix.

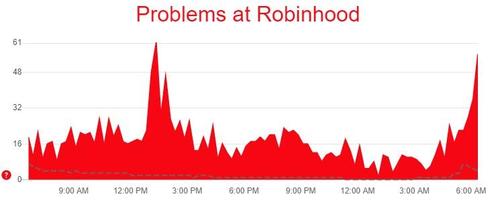

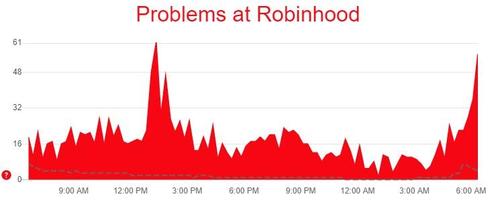

TIMELINE OF ISSUES AND OUTAGES AT ROBINHOOD

Posted on 02/01/2021 7:40:09 AM PST by SeekAndFind

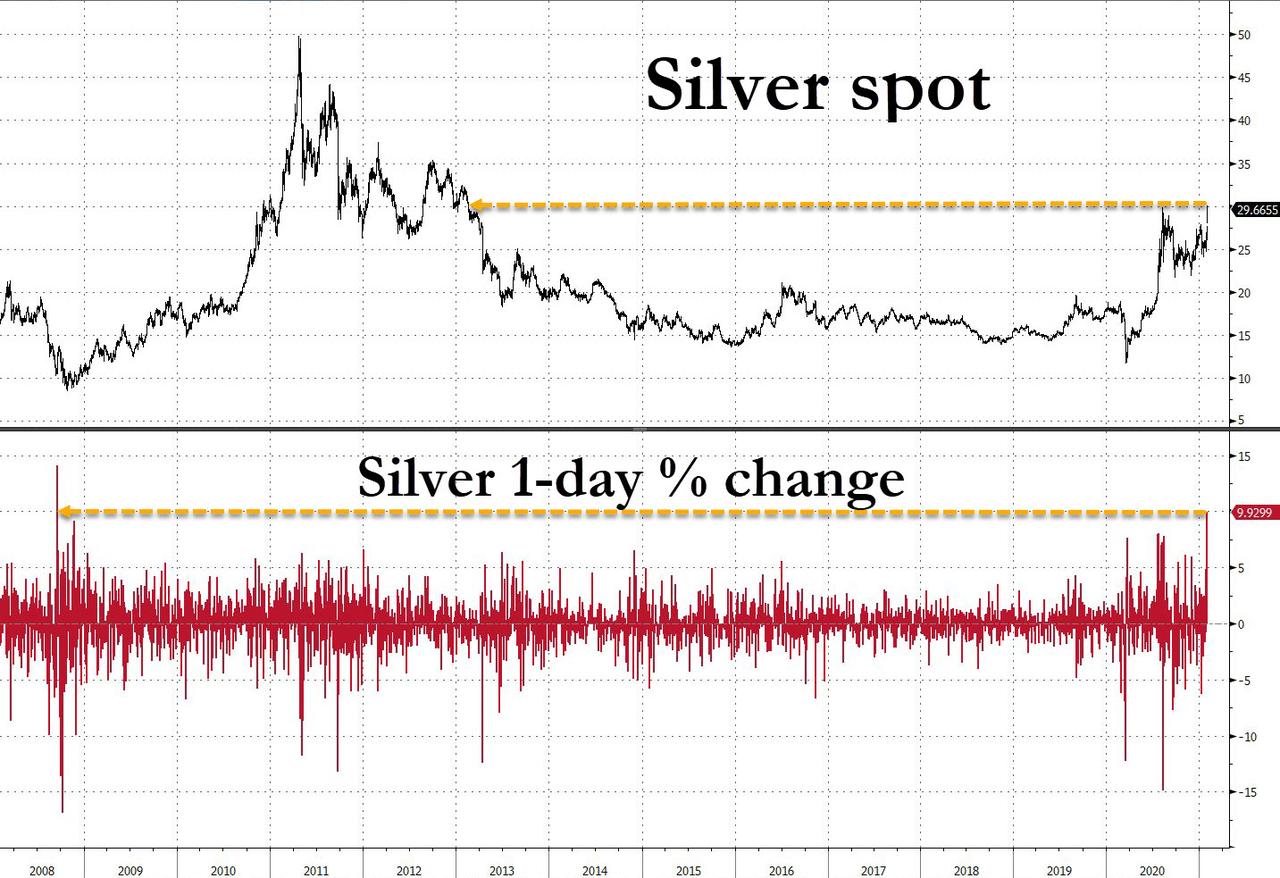

$💰 There were some references about the reddit crew going for silver last night on FR.

RE: There were some references about the reddit crew going for silver last night on FR.

Yep, see the discussion here:

https://freerepublic.com/focus/f-news/3930592/posts

An investment advisor once told his readers that ETFs were bets against stocks. Not always, and his explanation wasn’t accurate at all. I stopped receiving his spam long ago. ETFs are interesting, though.

ETFs

https://www.investopedia.com/articles/01/082901.asp

Every Democrat wants a Silver Spoon ?

These boys have nothing on the Hunt Brothers.

It’s starting to fall back now.

First Majestic Silver Corp. (AG) going wild today...

RE: It’s starting to fall back now.

It’s like two armies making war with one another - the Hobbits, Dwarves and the Elves ( Reddit traders ) and the Orcs ( Giant Hedge Funds ).

The cure for high price is always increased supply.

Painful lessons waiting for those people - silver is massively different from GME and AMC stock.

400,000 new accounts opened at Fidelity over the weekend ! WOW !

Back down to $27.86.........fake news.......

Silver is trading as expected today. Sellers (miners) happy to sell into the hype.

Asian and Europe are buyers so the metals usually having a stronger bid side bias and the prices go up. Buyers buy. North and South America is where the suppliers (miners) are located, so when they wake up (US daytime) they are sellers and the market has a stronger ask side bias and the prices go down.

I remember years back where some were claiming the London AM and PM price fixes were rigged because one was statically different than the other over time. Well of course, due to the above.

Pump and dump.

Just checked who I usually buy from.

All the bullion and silver bars are sold out.

Asian and Europe are buyers so the metals usually having a stronger bid side bias - Left out - US nighttime.

Anyone who thinks this synthetic /SI ramp will sustain is IMO mistaken. There is no good comparison w/GME. Might silver gain a buck or two and then sit there for 2-6 months? Sure.

With GME, there is a precise, known number of shares that have been issued. The market can, indeed, be “cornered”. With silver, despite hearing the same silly line for 20 years, there is NO shortage of silver and there is NO known precise number of ounces that exist....that matters. Indeed, high silver prices will bring out sellers. The number of silver holders who have been trapped in silver since $26-30-35 in the last runup is large.

Don’t get me wrong, I love and own plenty of silver.

Secondly, it’s always remarked how there is a perpetual dominant short interest in silver. This is true. It has been true for 20+ years. It is also relatively meaningless. It is because silver miners (there is almost no such thing, other than Hecla and Coeur D’Elene) must sell their production forward in order to pay their expenses and meet their payrolls) They do this by selling /SI futures. Covered calls, if you will. If they are called upon to make delivery, guess what? They have tens of thousands of ounces they dig up out of the ground every month to do just that. Those shorts show up as short interest in the futures market. And they’ve been there every time I have looked for 20 years.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.