- Hell NO!!!!!! ~0%.........maybe???????? No dice!

- Fine, then we will only charge them 15% on their imports to us. It's 10% now, so it's a win win for us.

Actually, it's a win-win for China — they really wanted this one-off deal. Trump needed to show something for all the bluster and "Tariff Man" talk before the U.S. markets tank deeper and the economy slows down even faster due to tariffs (i.e., excise taxes on purchasers and end users of certain goods and services)**** despite the "fiscal stimulus" provided by huge increase in spending and national debt increasing by $1.2T last fiscal year...

So Lighthizer, Mnuchin and Kudlow had no choice but to pick up the phone and make a call, and Chinese were only happy to "give in" and use it to get what they currently urgently need while letting Trump take the credit. They'll be happy to do one-off trades for a while if Peter Navarro and Wilbur Ross insist on fundamental restructuring of their economy while using blunt tools that only impede U.S. and global economy, e.g., Japan's economy has sharply contracted in recent quarter and is on the verge of recession when only 6-9 months ago it was one of the most stable economies in the world.

Here's how this really works:

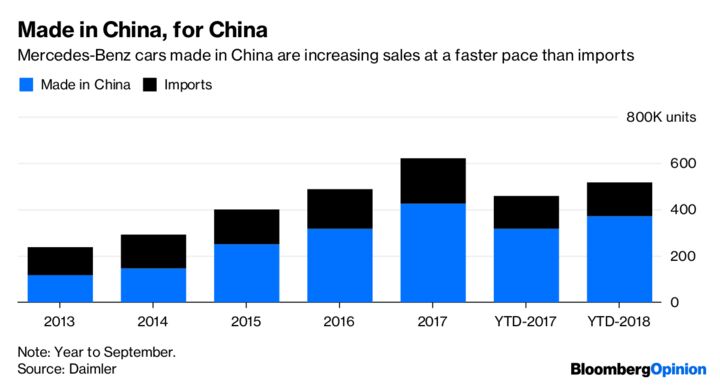

China needs more soybeans and sorghum than they can currently get from Brazil due to seasonality after they cancelled purchases from U.S. farmers. U.S. used to be main supplier of these ag products to China but after China imposed retaliatory tariffs and stopped buying soybeans from the U.S.*** their price crashed and some have been rotting in the fields or stored in silos / storage at extra cost. So now they get to buy enough of what they urgently need, at a fraction of the price they were buying before (while Brazil and other suppliers are ramping up all-year production to assure China's needs and independence from U.S. farmers), in return for meaningless "concessions" on autos which have a small market share in China**. BTW, Tesla, BMW and Volvo are setting up JV factories in China so they wouldn't be held hostage to U.S. government's whims, steel and aluminum, re-imported parts and other tariffs; and besides, China, India and Asia / PacRim — that's where their largest market is or will soon be while in the U.S. the Big Three automakers are losing market share and overall sales are slowing despite long-standing protectionist Chicken Tax" (25% tariffs on foreign light trucks / pickups still in effect since imposed in 1964 by LBJ).

______________________________________________________________________

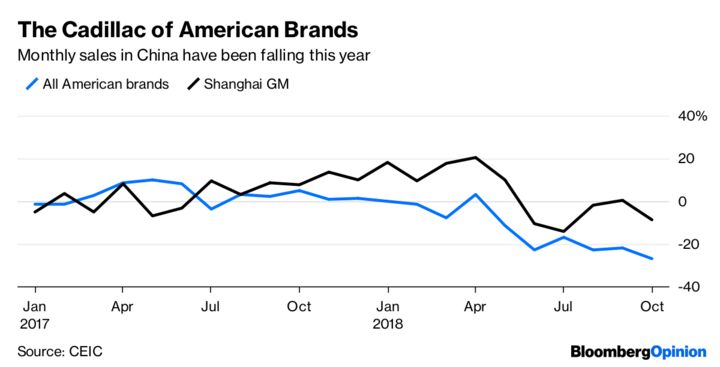

** State of the auto market in China:

From A Win on China Car Tariffs Is Irrelevant for Automakers - BLQ, by Anjani Trivedi, 2018 December 05

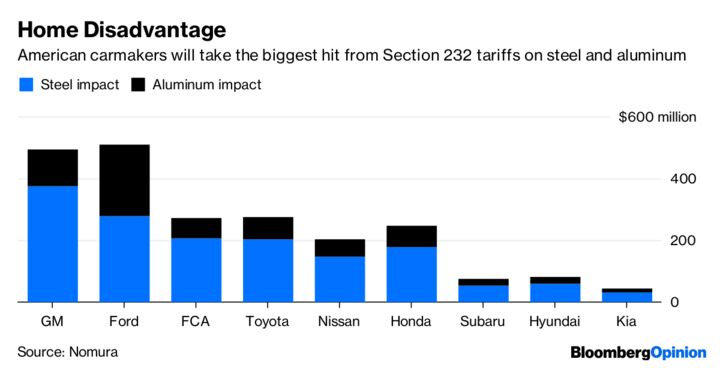

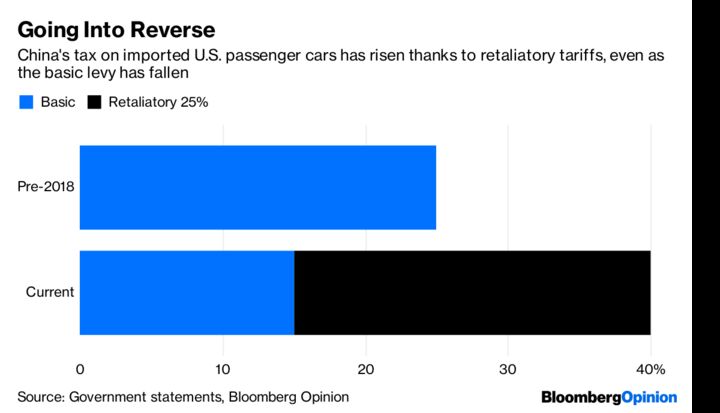

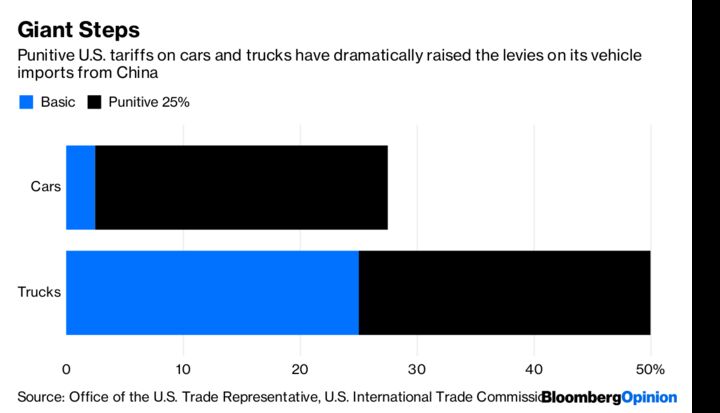

..... To recap: China lowered import tariffs to 15 percent on autos and components, from 25 percent for passenger cars and 20 percent on trucks, starting July 1. It then raised the duty to 40 percent for American autos in retaliation against Trump's trade actions. The U.S. has a 27.5 percent tariff on Chinese car imports, and 25 percent on trucks. Whether China reduces or removes tariffs is largely immaterial because the vast majority of vehicles in the world's largest auto market are made there. China imports about 1 million cars a year – less than 5 percent of a market that totals an annual 27 million vehicles. Ford Motor Co. brought just over 30,000 U.S.-made cars into China last year. BMW AG has been reducing imports and recently doubled down on making more vehicles locally. Daimler AG is also considering raising its stake in its Chinese joint venture, Bloomberg News reported Tuesday. Granted, some foreign-made models such as the Benz GLE and those sold by Tesla Inc. would get a bump if tariffs were cut. But the opportunity for overseas automakers lies mostly in manufacturing in China. What matters more for the industry are the U.S. import tariffs of 25 percent on steel and 10 percent on aluminum that went into effect in March. Given Trump's political commitment to revive the U.S. steel industry, these are probably here to stay. Temporary exemptions for Mexico and Canada ran their course in May. The broad goal was to push up prices of the metals by capping imports. Trump's executive order set an 80 percent capacity utilization target for U.S. aluminum and steel, and if one country gets a waiver from the tariffs it would be at the expense of others, as Nomura Holdings Inc. analysts note. Prices have risen relative to those in China and Europe, ..... < snip > ..... But all this has come at a major cost to the auto industry. How much steel or aluminum goes into a car depends on the type of car and its construction: Sedans are lighter, with the chassis and bodywork more or less one piece, whereas SUVs and pickups – increasingly popular in the U.S. – are frame-based and heavier. That means steel content could be as much as 70 percent of an average car's weight. Total raw material costs have risen from around $800 per average unit to over $1,000. < snip > ..... These tariff-related costs will only rise. In the plateauing U.S. car market, more than 70 percent of vehicles sold are now SUVs and pickups. ..... < snip > ..... Trump's tariffs will hurt most at home. The likes of GM have already had to announce restructurings and job cuts. Ford may have to make even larger reductions, analysts have said. For all the jobs that may be created for steel workers, more will be lost by autoworkers. Anyone hoping lower tariffs in China will save American automakers should think again. ..... < snip >

The "will they, won't they" chatter over China's car tariffs misses where the real action is for automakers. ..... < snip >

From China's Auto Tariff Reversal Looks Like a Lemon - BLQ, by Anjani Trivedi, 2018 December 12

A premature President Donald Trump tweet, a phone call between trade negotiators and then days later, China may be backing down on a key bone of contention: An elimination of retaliatory tariffs on U.S. automobiles ..... < snip > ..... The optics weaken China's hand. But the economics don't. To begin with, earlier this year China lowered import tariffs to 15 percent on autos and components, from 25 percent for passenger cars and 20 percent on trucks. It then added a punitive 25 percent for American autos in retaliation against Trump's trade actions. The U.S. has an equivalent 25 percent China-specific levy on top of its general 2.5 percent tariff on car imports, and 25 percent on trucks – longstanding measures that protect a domestic truck industry dominated by Detroit's big three. < snip > ..... Painful as it sounds, imports from the U.S. barely account for 5 percent of China's car market, the largest in the world. As we wrote last week, most automakers make in China, for China. In addition, the ones that would get a slight bump would mostly be the Europeans, since German carmakers account for an estimated $7 billion of the $11 billion value of U.S. car exports to China. Of U.S. companies, Tesla Inc. would get the biggest benefit – but Elon Musk has already cut himself a great deal with Beijing and is building a factory alongside the government to produce cars in China. ..... < snip > < snip > ..... At this point, automakers need China: Margins are still juicy in global terms, and even if pricing pressures rise, where else will Cadillac have record sales? Sales of electric cars continue to grow rapidly, and China is probably happy to bring in new technology that the U.S. is increasingly averse to supporting. The long game here is the only one that matters ..... < snip > ..... To quell Trump's public hankering, Beijing has given him a win to tweet about, but withheld an economic victory. ..... < snip > ..... That's the art of the deal, the Chinese way.

China has capitulated on cars. Or so it may seem to trade-war watchers.

From Tesla cuts China car prices to absorb hit from trade war tariffs - Reuters via CNBC, 2018 November 22

The electric carmaker, led by billionaire CEO Elon Musk, said it will cut prices of the two models by 12 percent to 26 percent to make the cars more "affordable" in the world's top auto market, where sales of so-called new-energy vehicles are rising fast. ..... < snip >

< snip > ..... Tesla is cutting the price of its Model X and Model S cars in China, the U.S. firm said on Thursday, in a shift in strategy that will see it take more of a hit from tariffs linked to a biting trade war between China and the United States.

From Tesla cuts prices on Model X and Model S in China after Beijing reduces US auto tariffs - CNBC, by Robert Ferris, 2018 December 14

The electric car maker has been hit hard by the steep duty on all vehicles imported to the country. The tariff on imported vehicles into China had originally been 25 percent, a policy that had been in place since China joined World Trade Organization, Dziczek said. On July 1, the country lowered the duty to 15 percent for every other member of the WTO except the United States, she said. China then boosted the tariffs solely on U.S.-made vehicles to 40 percent on July 6 in retaliation for U.S. duties on Chinese imports. ..... < snip >

< snip > ..... Tariffs on U.S.-made cars and light trucks will be temporarily reduced to 15 percent from Jan. 1 until March 31, which temporarily brings tariffs on U.S. exports in line with other World Trade Organization member countries, said Kristin Dziczek, vice president of industry, labor & economics at the Center for Automotive Research.

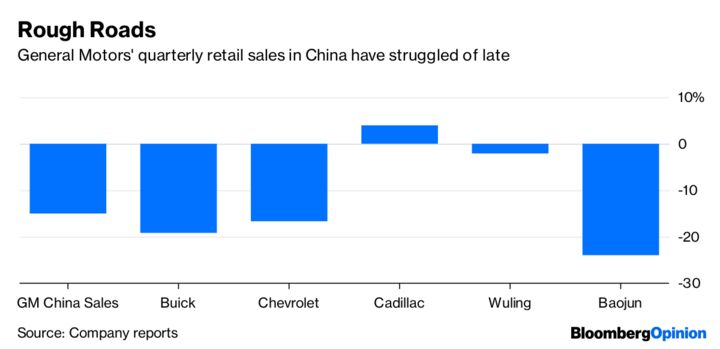

From GM Needs China More Than It Fears Trump - BLQ, by Anjani Trivedi, 2018 November 28

..... Why, on the face of it, would GM walk away from the world's largest car market? Despite falling volumes, the company still expects to book $2 billion of equity income in China this year. While its market share has plummeted, margins still remain close to 9 to 10 percent there, higher than 6 percent to 7 percent for the company as a whole. ..... < snip > < snip > ..... China isn't just large and lucrative, though, and CEO Mary Barra will have to steer carefully. As we've written before, American carmakers can no longer take success for granted. Overall, Chinese auto sales have fallen for four straight months, with only luxury holding up. ..... < snip > < snip > ..... Barra, who said she'd visited China twice in October, also said on an earnings call the company is watching the market there very closely. It wouldn't be surprising to see GM double down on luxury models, if it can afford to do so. In Shanghai last year, Barra said "China is playing a key role in the company's strategy" as she talked up electrification, autonomous vehicles and ride-sharing. The push to leverage Beijing's generosity – rather than Trump's threats – may now be far more appealing to GM as it takes multibillion-dollar write-downs amid soaring costs. ..... < snip >

Sorry, Donald Trump: General Motors Co. isn't leaving China anytime soon. It can't and it won't. ..... < snip >

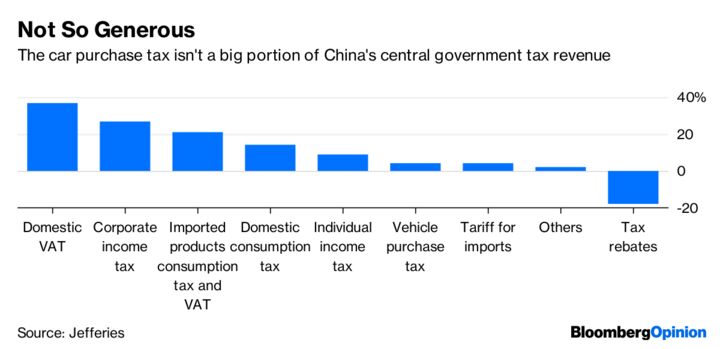

From Carmakers' China Tax Joy Will Be Short-Lived - BLQ, by Anjani Trivedi, 2018 October 30

..... As economic growth has stumbled, China's latest bout of fiscal stimulus has come in the form of tax cuts instead of the usual boost to investment and spending. As a result, investors have been keenly awaiting some type of aid for the car market. Most were looking for a value-added tax cut or a reduction in the tax on auto-related investments. Given the government's fiscal constraints and that VAT accounts for around 40 percent of the central government revenue, such large-scale help was unlikely to be forthcoming. ..... < snip > < snip > ..... The purchase tax was an easy choice, considering it provided only about 4.3 percent of central government revenue last year. ..... < snip >

< snip > ..... The National Development and Reform Commission proposes to halve the tax on auto purchases to 5 percent from 10 percent. ..... < snip > ..... Shares of Chinese and global carmakers from Geely Automobile Holdings Ltd. and Volkswagen AG to BMW AG jumped, paring their declines over the past year. ..... < snip >

From Boeing to Open Its First 737 Plant in China Under Shadow of a Trade War - BLQ, 2018 December 14

..... The Zhoushan facility, with roots on both sides of the Pacific, is emblematic of the balancing act for Boeing in China. The planemaker's ties date to President Richard Nixon's 1972 arrival in China aboard a Boeing 707. Chinese workers at the new plant will put the finishing touches on U.S.-built planes flown over from a Seattle-area factory, before delivering them to local customers. "It's difficult to overestimate the importance right now of China as a customer," said Ken Herbert, analyst with Canaccord Genuity. ..... < snip >

< snip > ..... The Chicago-based planemaker will inaugurate its completion and delivery center in Zhoushan, 90 miles southeast of Shanghai, on Saturday, after more than a year of construction. The facility marks a rare industrial foray outside of the U.S. for Boeing and a joint venture with state-owned planemaker Commercial Aircraft Corp. of China Ltd. ..... < snip >

______________________________________________________________________

*** State of soybeans market in the U.S.:

China buys two/thirds of world's soybean exports and was buying on average 60% of U.S. annual production (spending $12.25B last year) until first round of trade war and cancelling orders in spring of 2018 they have bought just 17%. Brazil is the world's top soybean exporter, but it's now cheaper for them to buy and import from U.S. while diverting local production to China.

From China bought 500,000 tons of U.S. soybeans. But that's just a drop in the U.S. export bucket - CNBC, by John W. Schoen, 2018 December 12

..... The deals - valued at some $180 million - helped propel U.S. soybean prices to a 4-1/2-month high on the futures market ..... < snip > ..... But the purchases will do little to make up for lost sales by American soybean producers, who have been scrambling to find other buyers as this year's harvest has backed up in storage facilities. China is the largest buyer of U.S. soy, but has purchased little since Beijing slapped steep tariffs on U.S. shipments on July 6 in retaliation for duties on Chinese goods. ..... < snip > So far this year, American farmers have sold some 8.2 million metric tons of soybeans to China, down from 21.4 million metric tons during the same period in 2017, according to the latest USDA figures. For the month of October, soybean sales to China fell from 7.1 million metric tons last year to just 300,000 metric tons this year. U.S. soybean farmers have made some strides in finding new markets, but export shipments in October were a little more than half the level seen last October. China last year purchased about 60 percent of U.S. soybean exports in deals valued at more than $12 billion. With those exports gone, soybean prices had tumbled to their lowest in a decade, heaping pain on U.S. farmers, a key Trump constituency. ..... < snip > ..... For its part, China faces shortages of soybeans if it can't find sufficient supplies from other producers. In September, Chinese officials floated the idea of cutting the soy ration for hogs to reduce domestic demand. ..... < snip >

< snip > ..... China is back in the market for U.S. soybeans, but the recent purchases represent just a fraction of sales American farmers have lost since the Trump administration embarked on a trade war with Beijing in July. ..... < snip >

From Current US soybean prices don't support farmers paying bills, says top industry official - CNBC, by Jeff Daniels, 2018 July 12

< snip > ..... Findlay said another ripple effect is farmers holding off buying farm equipment because "they won't have the funds to make that purchase." According to the soybean industry official, the administration's trade policies have "hurt" U.S. soybean prices. He called the situation "very frustrating," even for supporters of President Donald Trump. ..... < snip >

< snip > ..... U.S. soybean futures have fallen nearly 20 percent since China announced on April 4 plans to slap a 25 percent tariff on 106 U.S. products, including soybeans. At the same time, Brazilian soybeans are fetching a significant premium over the Chicago prices due to increased demand from Chinese buyers. ..... < snip >

From Damaged soy crop hits farmers reeling from U.S.-China trade war - Reuters, by Karl Plume, 2018 September 27

Late-season storms, including bands of showers from Hurricane Florence, soaked ripe soybeans from Memphis, Tennessee, to northern Louisiana over the past two weeks, enhancing mold and fungus growth and causing some beans to rot in their pods, grain traders said. Now those soybeans do not meet the market's crop quality guidelines, so farmers that sold soybeans through forward contracts are facing a penalty because they cannot deliver beans with the quality required, they said. The crop quality woes come as farm income has plunged by half over the past 5 years and as the deepening U.S.-China trade war harms demand for soybeans, the most valuable U.S. agricultural export product. ..... < snip >

A rain-damaged soybean harvest in the U.S. Mississippi Delta is heaping more pain on farmers already suffering from a damaging trade war between the United States and China that has dragged prices to lows not seen in a decade.

From Don't be fooled by China's soybean buy; crude, LNG, coal are the big fish - Reuters, by Clyde Russell, 2018 December 13

..... China ended a six-month boycott of buying U.S. soybeans on Wednesday, with state-owned companies purchasing at least 500,000 tonnes of the oilseed, traders said. Traders also said it appears the Chinese may seek more soybeans in coming weeks as they are struggling to meet all their import requirements from other suppliers. ..... < snip > ..... But it's also worth putting things in context. China used to be the biggest buyer of U.S. soybeans, taking about 60 percent of exports in 2017, worth an estimated $12 billion. ..... < snip > What this shows is that China would have to dramatically boost its buying from the United States to return to former levels, which makes the recent 500,000-tonnes purchase a spit in the bucket. It's also likely that China finds it convenient to go back to the U.S. market at the present time, given the U.S. crop is ready for export, while that from southern hemisphere rival Brazil isn't. GIVE TRUMP A BONE This means there is a seasonal element to trade in soybeans, and the Chinese government may have had little choice but to resume U.S. imports, but they have done so in a way that delivers Trump a little victory that may appease the mercurial U.S. president. What would be far more significant than buying some cargoes of soybeans, which China needs anyway, is the resumption of imports of energy commodities. One of Trump's aims in starting a trade fight with Beijing was that he wanted to reduce the U.S. trade deficit with China, but the opposite has proven to be the case. While Trump focused on putting tariffs on imports from China, the Chinese simply stopped the one area of trade that was growing rapidly and helping lower the trade imbalance, namely imports of crude oil, liquefied natural gas (LNG) and coal. ..... < snip > ..... Obviously this situation can change, and Chinese importers of crude, LNG and coal may well choose to resume buying from the United States. But, perhaps unlike soybeans, they don't have to as there are currently plenty of alternative suppliers. ..... < snip >

There is a risk that investors will get carried away with optimism over an easing of the U.S.-China trade dispute on the back of China resuming purchases of U.S. soybeans. < snip > .....

______________________________________________________________________

****

Capital, including human, goes where it's welcome and stays where it's well treated. - Walter Wriston

One of the great mistakes is to judge policies and programs by their intentions rather than their results. - Milton Friedman

Nothing is so admirable in politics as a short memory. - John Kenneth Galbraith

Beatings will continue until morale improves.