Skip to comments.

DETAILS: THE PLAN TO STEAL YOUR 401(k)

www.RushLimbaugh.com ^

| November 29, 2012

| Rush Limbaugh

Posted on 12/06/2012 4:40:06 AM PST by Yosemitest

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-100 last

To: Yosemitest

Depending on your age a 72T will not permit much to come out per year, and will last at a minimum of 5 years for payout. Really not much help.

81

posted on

12/08/2012 7:02:14 AM PST

by

jdsteel

(Give me freedom, not more government.)

To: chrisser

I understand you are very limited in your ability to have your employer modify their plan document to include non-hardship withdrawals. Many new plans have them, though. It does benefit the highly compensated employees to have the NHEW feature, and if your employer has NOT reviewed their plan (and documented it) they are taking a huge risk. If I were you I would ask your employer to speak with their attorney about the NEW business and PERSONAL risks they face if they do not have documented proof of a plan comparison under the new ERISA laws. They will be shocked, and it might just give you some leverage. I am totally serious; most business owners have no clue of their new fiduciary responsibilities as of this summer. If they listen to you they will go from disbelief to gratitude quickly.

82

posted on

12/08/2012 7:12:07 AM PST

by

jdsteel

(Give me freedom, not more government.)

To: jdsteel; others

Folks, we ALL have to stop playing the “SAFE” game... it doesn’t exist! Whether you have money invested in a 401k or an IRA it isn’t really yours! It’s just a bunch of electronic blips on some computer tape or hard-drive. If you want to save your money, you have to physically possess it and paper money is only worth whatever scrap paper will bring.

Gold and silver sales are going through the roof right now, as are purchases of farmland. Granted that precious metals may not deliver a safe 3-6% profit like those funds promise (?), but they will hold their value over the years. Land will do much the same if you can hold it in the face of rising property taxes.

Too many of us are still thinking of retiring with a comfortable retirement incom. Except in a very few cases - IT AIN’T GONNA HAPPEN! When TSHTF most of us will be lucky to survive. Remember, Agenda 21 is designed to reduce the population, not to make it comfortable. I’m 78 yrs old and I don’t expect to survive it. I do hope to prepare my grandkids well enough that they survive though. If I’m successful they’ll be the most valuable treasure I can preserve.

83

posted on

12/08/2012 8:13:16 AM PST

by

oldfart

(Obama nation = abomination. Think about it!)

To: jdsteel

I talked to a Certified Public Accountant (CPA) familiar with 72Ts and he told me

that if you've had you funds in an IRA for more than one year, you can use the 72T if you're within 5 years of 59 1/2 years old, to withdraw funds out of the IRA and not pay the 10% penalty. There are three different withdrawal time lines to go by.

I asked if I could zero out the account by the time I reached 59 1/2, and he said yes.

The cost to do my taxes each year would only be a couple of hundred dollars each year, depending on my other tax situations.

But it's

very important to talk to a CPA

BEFORE you start withdrawals.

It's

best to have the CPA help you qualify, to avoid the 10 percent penalty.

84

posted on

12/08/2012 12:07:37 PM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: Yosemitest

What will they do with self-directed IRAs that are invested in real property, I wonder.

85

posted on

12/08/2012 12:37:32 PM PST

by

RightField

(one of the obstreperous citizens insisting on incorrect thinking - C. Krauthamer)

To: RightField

You'll just have to talk to a CPA who's experienced with 72Ts.

Mine is in real gold and silver, not paper.

86

posted on

12/08/2012 12:46:49 PM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: Yosemitest

Take a look at the allowable percentages that you can remove under the 72T. Even with the largest permitted cashflow you will find it impossible to drain your account as quickly as 5 years. Everything you've stated is accurate but it is not complete. Also, this topic was 401(k) plans and you are talking IRA’s....no problem but let's be clear about the difference. I work with this stuff all of the time. Do an internet search for “72T calculator” and you can crunch the numbers to your hearts content based on the size of your IRA, your age and the assumed interest rate you choose. You will see what I mean.

87

posted on

12/10/2012 5:09:59 AM PST

by

jdsteel

(Give me freedom, not more government.)

To: Yosemitest

Oops, on re-reading your post there is something you posted that is wrong. Assuming you aren't talking about an IRA that you inherited, there are NOT 3 timelines as you said. You must continue the 72T for 5 years OR until you reach 59 1/2, which ever takes LONGER. That is it. The 10% penalty you avoided comes due in in the year that you break that deal, which includes taking more or less out per year. It must be exactly the same each year for at least 5 years and you must reach 591/2 in order to avoid the 10% penalty. If you screw it up in year 5 you owe the IRS that 10% for ALL of the years you didn't pay it. Also, you do not have to be within 5 years of 59 1/2 to start the 72T. You can start at any age, but the younger you are the less you can get out each year.

88

posted on

12/10/2012 5:21:58 AM PST

by

jdsteel

(Give me freedom, not more government.)

To: jdsteel

I stayed up all night before last, working out a division on my PM IRA that was close enough to balance out with the cash in the account to make five even withdrawals, and slept most of this yesterday afternoon,

just to listen to the CPA tell me that she had made a mistake. She said, after talking to another CPA who was more familiar with 72Ts, that all three methods given

the life expectancy method - calculated under the minimum distribution rules;

the amortization method - amortize account balance using life expectancies and a reasonable interest rate;

and the annuitization method - account balance divided by an annuity factor using both a reasonable mortality table and interest rate

for

Substantially Equal Periodic Payment Plans (SEPP) under Section 72(q) or 72(t) offer a little over 4.5 % of the total value of the IRA.

Either way, it's not worth the cost of the CPA's labor plus the 10% additional tax, and the risk, if it's not done right,

You may have to pay a 25%, rather than a 10%, additional tax if you receive distributions from a SIMPLE IRA before you are age 59½.

After taking a rough estimate on my taxes, if I withdraw the entire IRA at one time, the tax cost would be about 33% of the value of the IRA, and my IRA is large at all.

My learned lesson to tell others,

DON'T TRUST THE GOVERNMENT!

Be VERY CAUTIOUS before opening an IRA or a 401K.

You're setting yourself up to be ripped off by the government.

Better to pay the taxes NOW, and be responsible for your own retirement.

I don't know what I'm going to do, but I've got to decide in two days, what to do.

If I start my early withdrawal plan, even if a only draw out 20% of the IRA, I'm subject to a 10% penalty tax on the ENTIRE IRA.

In layman's terms:

Someone asked earlier:

"What is holding the market up if those who have IRAs know the government is about to rob them?"

Good question.

I think

your answer is "God sends them a POWERFUL DELUSION".

89

posted on

12/11/2012 5:20:31 AM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: jdsteel

One other thing.

The CPA told me that it'd be better to wait until AFTER I turned 59 and 1/2.

Then I could draw it ALL out and NOT be subject to a penalty tax of 10% or more

( unless the law CHANGES between now and the time I reach 59.5 years old).

It's like

trusting "the Democrats not to steal".

My dad's friend, a retired Navy man of 26 years, worked for GM building starters for 21 years after coming out of the Navy.

He didn't make much, but if it wasn't for his Navy enlisted retirement check and benefits, he and his family would be out in the cold.

His GM retirement was his GM 401K, all in GM secured bonds.

Obama and the Democrats stoled over $120,000 from his family, and the GM Union, didn't do a damned thing for him.

90

posted on

12/11/2012 5:34:20 AM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: Yosemitest

CORRECTION:

"... and my IRA is NOT large at all."

91

posted on

12/11/2012 5:37:16 AM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: Yosemitest

A few more points: 1: if your money is in an IRA, not a 401(k), you shouldn't go off the deep end and start withdrawing money to keep Obama’s hands off of it. IRA’s and 401(k)’s are different creatures. 2. If you are close to 59 1/2 it is probably better to wait than do a 72 T. 3: You should not do business with an accountant that gave you bad advice on something as simple as a 72T. 4: IF you still do a 72T, don't confuse the tax law definition of “reasonable” with what the word really means. You can pick the highest possible number as long as you feel confident that your IRA will not run dry before the 5 years or 59 1/2 minimums. 5: The calculations to do a 72T aren't hard, and should not cost you annual fees. Once again, check out one of many online calculators.

92

posted on

12/11/2012 6:15:52 AM PST

by

jdsteel

(Give me freedom, not more government.)

To: Yosemitest

Sorry about your friend, but HE CHOSE the investments inside his 401(k). He takes some of the blame, but yes...he and many others got royally screwed when Obama essentially broke the law by bailing out Unions rather than bondholders.

93

posted on

12/11/2012 6:19:39 AM PST

by

jdsteel

(Give me freedom, not more government.)

To: jdsteel

My calculations would carry it just beyond 59.5, and having to do at least five years, would mean that, no matter the highest calculation, I could zero out my IRA faster by just waiting until reaching 59 and a half years old.

I'm within 5 years of that requirement.

If you believe the

Democrats Fabian Fascists and their ILLEGAL Leader, the Arab-Kenyan, will do what they say they will do,

then it's a 10 % cost to save 67 % of your money to do it.

If

If you believe the value of our dollar will continue to be devalued by the

Democrats Fabian Fascists and their ILLEGAL Leader, the Arab-Kenyan,

then you believe that the value of gold and silver will only increase.

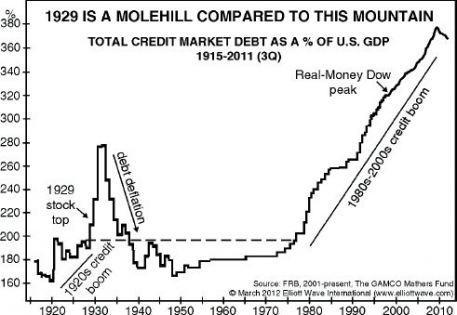

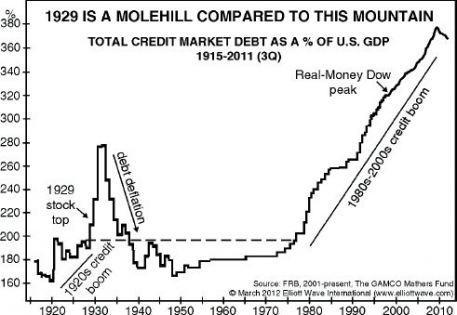

" ...the huge problems with debt we had in 1929-30 and today that we did not have in 1965.

This creates much more of a need for deflation today than in 1965.

The whole point of the Inflation Cycle is to move out of the Growth Cycle into the Rest Cycle.

The economy grows for 18 years and then rests for 18 years.

The Rest Cycle is just as important for the process as is the Growth or the Inflation Cycle.

Deflation Cycles need to1) destroy debt;

2) move the country away from the speculative frenzy of the Inflation Cycle which favors the rich and special interests;

3) close the gap between the rich and the poor, so the country can avoid civil war;

4) raise interest rates to do all of these things, destroy debt and reward savers especially.

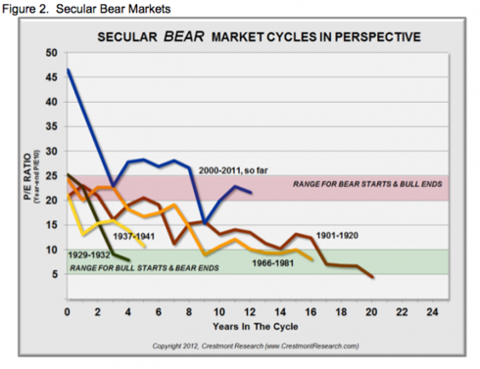

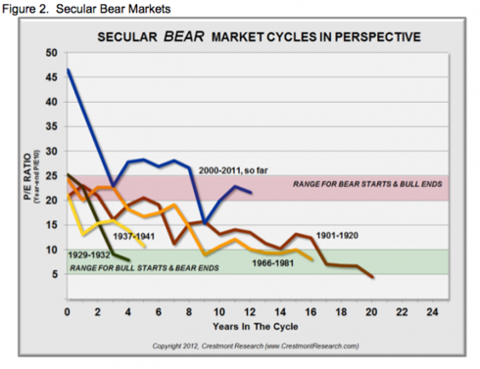

Easterling's point, in the second chart, is that stocks need to decline back to the green band at the bottom of the chart before another Bull Market can begin again.

I say this decline needs to be done by 2019, since geometry is the trump card in all of this.

... Any and every period of extended forced lower interest rates is inflationary because of what it does to the local currency, the US Dollar in our instance.

Dollar devaluation has been the policy of the Fed throughout most of the Inflation Cycle (and attempted Reflation Cycle -- which has been, in fact, the Disinflation Cycle).

More dollars circulated, even if just circulated between the banks and the US Treasury, via the Fed, reduces the value of the Dollar --meaning that 'real' profits from stock gains are being diluted by low interest rates.

That is why the Dow/Gold ratio makes sense to consider, since gold is a Dollar-Inverse indicator.

In this chart, the higher the price, the greater 'real' stock profits.

So, although the Deflation Cycle 1965-1983 looked minor, benign, costing the investor Time only, in terms of real profits in stocks, the period was catastrophic.

So, since 2001, real stock profits are being gored by a declining dollar.

Deflation Cycles often 'appear' to be sideways markets only -- a loss for investors of 18 years of potential profits

-- but when viewed through the prism of lower 'captive' interest rates, the decline in stock values since 2001 is also catastrophic, as the chart below demonstrates.

Note how this chart of stocks priced in gold corresponds almost perfectly to my Deflation and Inflation Cycles(1911-1929 Inflation; 1929-1947 Deflation;1947-1965 Inflation; 1965-1983 Deflation; 1983-2001 Inflation; 2001-2019 Deflation).

Source - Michael J. Clark, Hanoi, Vietnam

So do I lose 33 percent of my labor from many years, in closing out my IRA now,

or do I risk losing it all into a devalued dollar that is rolled into the Social Security plan, like

Rush explained?

" Okay, so to review this, these two sound bites, I just wanted to get them out there, Teresa Ghilarducci.

Here is the plan.

What she wants to do is take your 401(k) at the August 2008 level, whatever it was worth then,that's what you are going to be given the equivalent of.

That will be put in your Social Security account, and then the government, not you, is going to invest that money,your Social Security plus whatever the amount of your 401(k) is,

they're gonna invest that money that they take from your retirement account.

"We're gonna buy a government bond with what we take, that will guarantee you 3% plus inflation,

and then we will require that you put 5% of your pay into your 401(k) every year,although it's not yours anymore, it's the government's."

So the government is getting all of the money up front.

What they're doing is eliminating the deduction. You don't get a tax break anymore.

The government is taking all the money and holding it at a promised 3% plus inflation return for your retirement.

And so whatever the amount of your Social Security was in August of 2008, added to your Social Security trust fund account,whatever the hell that is when you retire,

divided by whatever monthly is what you will end up with.

The reason they're doing this is because the tax deduction is costing the government $240 billion a year.

All the 401(k) holders combined are contributing $240 billion total to the 401(k),

government doesn't get that, and they need it now, see.

Government needs it. I mean, we got a real problem.

We got a fiscal cliff.

They need the money, not you.

So the original rule that you started your 401(k) is now being yanked out from underneath you.

And, see, whatever you have in your 401(k) now, you will keep. It's a tax break.

Everybody that has their 401(k) plan will be grandfathered in, but instead of getting a tax deductionlike a decrease in your taxes by whatever your tax rate is,

then you're gonna get $600 a year.

This was four years ago, folks,

and now today two magazines have revised this,and, by the way, the magazines just didn't out of thin air say,"You know what? Let's do a 401(k) story."

Somebody at the regime calls 'em and leaks it.

Okay, time to put this into play now.

So TIME is complying with the regime, and The Atlantic complying with the regime, and they're putting it in play now. "

94

posted on

12/11/2012 8:33:53 AM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: Yosemitest

Based on your age I agree a 72t would not be in your best interest. My 2 cents about the rest? I don't trust charts. There are plenty of technicians out there; I'm not one of them. It's dangerous to make long term financial decisions based on the current president. It's doubly dangerous to make financial decisions based on charts AND politics. At your age make that triple dangerous. It's your money and your life though. Good luck.

95

posted on

12/11/2012 7:04:26 PM PST

by

jdsteel

(Give me freedom, not more government.)

To: jdsteel

Thank you for your time about the 72t.

I still believe

that if the Communists will do it to 401Ks,

the Traditional IRAs aren't far behind in their plans to "Collapse the System" with government overspending.

I won't do it, but my instincts are SCREAMING AT ME, to "DO IT ! " .

Thanks again.

96

posted on

12/12/2012 10:07:05 AM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: jdsteel

Reference "financial decisions", hat do you make YOUR decisions on?

How can you leave "current politics" out of it?

Charts aren't everything, but they are a good way to put forth a vast amount of information in an understandable way, quickly.

Plus,

Biblical knowledge tells us that the system will get worse,

until weacknowledge and repent our sins as a nation to God,

then ask for forgiveness,

and return to God's laws, statutes, and judgments as a nation,

... and return to God.

97

posted on

12/12/2012 10:58:13 AM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: Yosemitest

I had a wonderful 401(k), but I was on a fishing trip and my canoe turned over and...

If you still have an IRA or 401(k), you trust these criminals more than I ever have. It's been clear for at least 3 years that they would be confiscated.

Get out now, pay the tax, and invest in brass, lead, protein, carbohydrate, and maybe silver.

98

posted on

12/12/2012 11:01:45 AM PST

by

Jim Noble

(Diseases desperate grown are by desperate appliance relieved or not at all.)

To: Yosemitest

I am pretty well stocked on LEAD, which will be the real precious metal, and am changing my invested portfolio from time to time but not bailing out. Good luck to you.

99

posted on

12/13/2012 6:51:35 AM PST

by

jdsteel

(Give me freedom, not more government.)

To: jdsteel

Lead, I have, and the ability to project it within an inch or two of where I want it.

My portfolio has oil and natural gas, in small amounts, and a little cash.

Have you seen these articles?

100

posted on

12/13/2012 7:30:47 AM PST

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-100 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

In layman's terms:Someone asked earlier:

In layman's terms:Someone asked earlier: