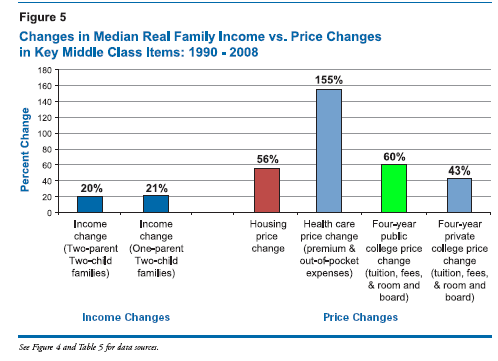

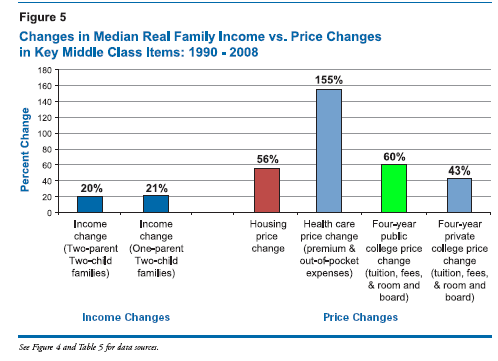

A recent study from the Commerce Department shed some light on an issue that we already know. Over the past 20 years the middle class has been falling behind:

Posted on 11/06/2010 10:43:37 AM PDT by FromLori

A problem which Obama inherited, no doubt. </sarc>

Jim forgets one very important point.

The Fed is the one who determines the value of its assets - and we can't call them on the lie since we can't (or won't) audit them.

The Fed has nothing to worry about, unlike us.

Actually every president since 1913 has inherited this problem. The Fed has been running the economy, into the ground, ever since. Which is why your dollar is now worth 3 cents, compared to 1913.

But Obama has piled on and has absolutely no clue what he is doing and the disaster he will create. Or if you listen to Rush, he knows very well and that is the intention. Take your pick.

If they go bankrupt, let them go bankrupt

This is a false argument if you're talking about dollars earned today.

You need to consider the labor that goes into earning a dollar. People used to have to work more hours to purchase the same good and/or service than we have to today.

A loaf of bread takes much less labor to purchase - so while it may cost more dollars it is easier to attain.

If you're talking about a dollar held in a 0% savings account since 1913 then, yes, it has depreciated around 97%.

However, why would somebody hold a bond (dollar) for that long that pays 0% interest and has instant maturity. That's not very smart money management.

It has to be the latter. Rush is right. Obama’s despicable actions speak even louder than his incessant flow of words.

“A problem which Obama inherited, no doubt. </sarc>”

Ummm.. Yes and every President but the one who signed the act into law since 1913... It is time to abolish it. Go to the Gold Standard where ever it may be for the dollar at this point and fix it.

Plenty of wrong is being done all the time.. let US ascribe blame fairly.

W

I urge everyone to flee the U.S. as fast as possible.

A gold standard wouldn't fix anything - since our money would still be based on debt.

It's not until our US Treasury issues our nation's currency that we can truly be rid of debt-backed currency.

Beginning in the coastal states and working inward... :-)

:o

Honestly, I agree Cloward-Pivens

I need a Passport in a hurry .....

The Fed IS bankrupt.

That not what last week's H.4.1 report said.

A recent study from the Commerce Department shed some light on an issue that we already know. Over the past 20 years the middle class has been falling behind:

But such "greenbacks" remain fiat currency, backed by nothing but the full faith and credit of the US government.

Agreed...

Close the Fed.. Go get the money and Gold back from whomever ran off with it.. Send the US Military and CIA Overseas and just take it back..

Congress thru the US Treasury becomes the only people who issue a Gold and Silver backed currency. With public audits.

Better? W

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.