This year was fun because we didn't

have to text in our vote, and I got a field trip

Posted on 01/01/2009 9:44:55 AM PST by Sub-Driver

We’ll see. We’ve got a 3% pop so far.

180-240 days ago with +13% exports and a $300 billion stimulus from BORROWING. Stop looking in the rear view. You think the BDI dropped 95% for no reason in the last 5 months?

Do you think there is no borrowing during good times? I would venture a guess that the amount of borrowing now is much less than during any period in the last 20 or so years. It’s just that government is doing it, not private interests. Why does it somehow negate what I’m saying that our exports have increased? To me, it just shows that the market is adjusting to changed circumstances. I would be a whole lot more worried if I saw no change in the markets. It really is amazing how fast they are adjusting—a whole lot faster than government is adjusting. Here in Orlando, home sales are up because prices have dropped so much. I would never have guessed that real estate would adjust so fast.

This recession was not caused by a freezing of the machinery of production, hence little change in output or employment.

What really happened is that people who thought they had a lot of wealth now realize they don’t. For the most part, those folks were the wealthy since by definition people who have wealth are wealthy. I fail to see why the disappearance of wealth should cause the economy to buckle on the order you’re talking about. You’ll see people spend a little less, that’s true, but retail sales have not fallen off a cliff as you might expect. For the most part, the decline is going to come in the area of investment, since the wealthy invest a lot of money, and now they won’t. But investment is not what drives the economy anyway. It’s consumer spending that drives the economy. A decline in investment might actually be good for the economy in the long run, since it will undoubtedly lead to higher economic returns to capital. The truth is that we’ve over-invested in capital during the last 15 years or so.

And even the decline in wealth has not been all that catastrophic. The stock market is at about 2003 levels, as is the real estate market. Folks forget that the reason the market has dropped so much is that it went up so much in the last few years. If you did not buy the Dow on Oct. 1, 2008, then you did not lose 40%. If you bought it earlier, then you probably lost less. It’s only if you bought at the peak that you took that bath everyone talks about. And because the market went up almost as fast as it came down, there weren’t that many people who bought at that peak. If there is the beginning of a recovery in the next several months, the stock market will probably recover some of its losses and we’ll have a positive wealth effect.

Don’t be so negative. The idea that this is somehow worse than the last several recessions is largely in your head—at least at this point.

Look--if you want to bury your head in the sand--so be it. The economy has literally gone off a cliff since late September and continues to accelerate to the downside. Show me ONE economic statistic indicating a turn around in sight. Just one. Bump this thread in one year and let's see who is close to right.

This year was fun because we didn't

have to text in our vote, and I got a field trip

BTW-—Retail sales HAVE gone off a cliff—I’m in corporate management for a retailer in 22 states. We have gone from +5% YoY comps to -11% YoY in 6 months—and we sell groceries! You’re kidding yourself. The #s for retailers as a whole show a -5% (Nov) & -8% (Dec) for December and that’s before factoring in inflation AND expansion of stores AND before backing out a Walmart with slightly positive sales.

In my humble opinion the blame should be shared between the media, Democrats in congress and senate and Alan Greenspan.

I said that before the housing meltdown started when Alan Greenspan kept saying the sky is going to fall and people abruptly stopped buying homes even though we had good employment and lowest interest rates in my lifetime, no better time to buy a home, but Greenspan was determined to put the cloud of doom over things. All you have to do is walk thought Lowes or Home Depot to see how many different businesses were affected when housing crashed and then we had the boomerang of $4 gasoline which really sped up the entire process, in the meantime the media had been telling everyone for the last 8 years we were going in the toilet financially (Krugman) and it became a self-fulfilling prophecy.

Until housing turns around nothing is going to turn around, too many businesses depend on a healthy housing industry.

They justified that comment based on what?

Yes, and homes selling at 10x median income (despite historically selling at 2.5x median income) had nothing to do with housing prices going off a cliff! The last 10 years have been nothing but a debt bubble.

But, in an odd way Greenspan and the democrats are responsible for that, too.

It doesn't matter to you and it matters to me and lots of people do it your way and that's fine.

The thing is that when I work with numbers and money I always make sure records exist elsewhere that back me up. That way others know I got my facts straight and my checks won't bounce.

In business, we understand debt better when we also see the assets, so here's the debt numbers along with the private assets/gdp ratio.

Showing assets and debts together tells a lot more about America's financial position. The space between assets and debt is the net-worth, or wealth, which has been growing a lot over the decades.

It's only in politics that people show just the side that supports their cause; showing one side can either support America or bash America, depending on the slant.

I get it. Yes, the weaker dollar increased exports. Yes, our exports are likely to be weaker in the next quarter because foreign economies are weakening even faster than we are, and the dollar has been going up due to lower oil prices. But we don’t have an economy that relies entirely on exports. Additionally, lower oil prices are not a negative, even if they cause the dollar to appreciate.

Like I said, I expect a weaker economy. Driving off a cliff is not just a weaker economy, though. Driving off a cliff is a depression, and we ain’t got that, nor will we have a depression unless Obama makes some pretty big mistakes down the road, which I would not expect even from him, and in any event, you can’t simply assume those mistakes are inevitable just because we are in a recession. Our weak economic statistics tell you nothing about the likelihood of Obama making mistakes.

We’ve been in lots of recessions. We’ve had lots of instances when you could have pointed to similar weakness and shouted the “D” word. But so long as the machinery of industry keeps humming it’s just a matter of time before we come out of it—provided that government doesn’t keep throwing new monkey wrenches into the gears. You could even have said that about the Great Depression itself. The reason it did not work during the Great Depression is that an activist government that did not have the modern tools of economics at its disposal did all the wrong things. That is not happening now.

At this point, I would say that the government has reacted appropriately to the problem, even if somewhat clumsily. They aborted the financial industry meltdown. Bush stopped the auto meltdown, at least at GM. Obama would do well to tell the UAW that he’s not going to reverse Bush’s requirement that they reduce their compensation. The Fed has doubled the money supply almost over night. The stock market seems to have bottomed, and even gone up a bit.

Next week, the Fed is expected to increase its purchases of asset backed securities, which it should have done sometime back. That will increase liquidity dramatically.

These are positives, not negatives. In fact, it may be that we will soon be dealing with the opposite problem—too much money and growth that is too fast. Then the Fed will have to reverse course and undo some of the things it is now doing. But we can worry about that when and if it happens. For now, you address the problem you’ve got—not the problem you might have tomorrow.

Personally, I think that they have done a pretty good job of reacting to the recession—at least as good as you could have expected. The problem is that it was government that caused the recession in the first place.

Retail sales are down, they are not off a cliff. Here is what they say for November:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $355.7 billion, a decrease of 1.8 percent (±0.5%) from the previous month and 7.4 percent (±0.7%) below November 2007. Total sales for the September through November 2008 period were down 4.5 percent (±0.5%) from the same period a year ago. The September to October 2008 percent change was revised from -2.8 percent (±0.5%) to -2.9 percent (±0.2%).

Retail trade sales were down 2.0 percent (±0.5%) from October 2008 and were 8.5 percent (±0.7%) below last year. Motor vehicle and parts dealers sales were down 25.2 percent (±2.3%) from November 2007 and gasoline stations sales were down 22.0 percent (±1.7%) from last year.

Motor vehicle sales are depressed, I’ll grant you that. Gasoline sales are down because the price of gas is down—hardly a negative. The rest of the retail sales report is consistent with a typical recession. In fact, motor vehicle sales are also consistent with a typical recession. When I lived in Detroit, they used to say that when the US economy sneezes, Detroit gets triple pneumonia.

You can plainly see from your second and third charts that there is nothing unusual about the rise in the debt in this recession, nor in fact in the last 10 years. It’s been going up steeply for more than 10 years. Were you worried about a depression during the 90’s or during the 2001 recession? Debt is a crucial ingredient of our economic brew. Right now, in fact, a little more borrowing would be a good thing.

You seem like a smart guy. Read a book called “Hamilton’s Blessing.” It explains that Alexander Hamilton wrote to a confidant that one of his goals as Secretary of the Treasury would be to build up a body of US government debt because he believed that it would be a blessing to the nation. Most folks would say that’s nuts. Debt is not a blessing but a liability. Why would you want to encourage that?

But Hamilton was a financial genius, and he understood that the debt would be traded as money, and that would encourage commerce. Ultimately, federal debt was made legal tender, and broken up into standard denominations so that it could be more easily used as money. If you look at a dollar bill, it says “Federal Reserve Note.” These days, federal treasuries are used and accepted as money on a regular basis, particularly when cash is not available. All you are doing when you increase federal borrowing is you are increasing the money supply. And if you don’t believe me, then consider that it’s very easy for the Fed to convert federal debt to money. All it does is print more money and buy a t-bill.

So the issue is not debt, but money. Is the money supply growing too fast? I don’t think so. We’re in a recession, so that tends to show that it is not. What about when the recession ends? Well, when that happens, the Fed may need to tighten up in order to siphon off some of the money it is now printing.

Recession and inflation don’t usually come together, so you don’t need to deal with them at the same time. They certainly did not come together this time. When they do come together, it is usually because of a supply shock, or because you had inflation first, and are trying to wring it out of the system. We don’t have either of those, so we have the luxury of focusing on ending the recession and worrying about inflation later, if at all.

Assets dropped $7 trillion just in stock market value the last year while debt soared. Asset values (like real estate/oil) were propped up by debt and nothing more. The values are now plummetting but debt remains. Private debt is well over 200% now so I’m not sure where you got that chart from.

Oh, most definately—but Republicans (especially Bush) seemed eager to go along with it as well.

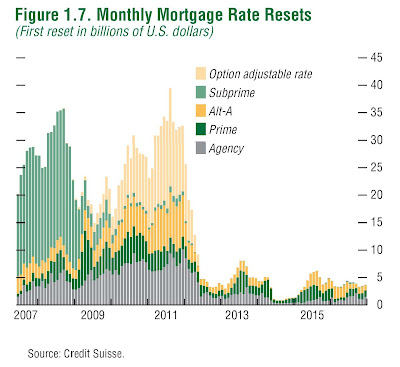

You did catch the -8.5% YoY in this post which is photoguy bad..and that was in October. It has gotten much worse the last 2 months. We can go round and round on this forever. Let’s check back in a year and we’ll see if things are improving or getting worse and how much GDP we’ve dropped. My bet is -7-10% from the end of Q3 2008 and with the Option Arm/Alt A reset coming at the end of this year and 2010 we MAY bottom in the middle of 2010. This will not be a V shaped recession. L shaped at best, depression becoming highly likely.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.