Skip to comments.

When dollar falls, European exporters count their bruises

LA Times ^

| 17 November 2007

| Geraldine Baum

Posted on 11/17/2007 10:16:45 AM PST by shrinkermd

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 141-160, 161-180, 181-200 ... 401-410 next last

To: Toddsterpatriot

do they do the things you claim?You mean that Greenspan claims.

To: shrinkermd

My husband travels to Sweden, on business, once a quarter. Usually this time of year he comes back with all sorts of goodies. Teas, candies, toys, cookies, clothes, crystal, etc. This year he just skipped it with the poor exchange rate.

162

posted on

11/21/2007 4:28:16 PM PST

by

riri

To: Toddsterpatriot

You can look up the national debt. You can multiply.

To: AndyJackson

You claimed within the last week that the Fed deals directly with the Treasury when they buy or sell Treasury securities. You also claimed "that whenever the US government has been running a bit short it just prints some more”

I didn't see Greenspan claim that in the last week. Maybe if you had a Greenspan quote claiming the same, a little more recently than 40 years ago, you might have a point.

164

posted on

11/21/2007 4:33:47 PM PST

by

Toddsterpatriot

(What came first, the bad math or the goldbuggery?)

To: AndyJackson

Ah, the look it up yourself defense. That’s funny!

the total outstanding treasury debt times the reserve fraction that that amount of debt represents.

Okay, outstanding debt is about $9 trillion. What do you mean by "reserve fraction that that amount of debt represents"? I know what a reserve requirement is, but haven't heard of "reserve fraction". Maybe you can rephrase or better explain what you meant?

165

posted on

11/21/2007 4:36:50 PM PST

by

Toddsterpatriot

(What came first, the bad math or the goldbuggery?)

To: dollarbull

I had no idea that the fact that we monetize / retire the national debt through inflation was an issue that was the least bit controversial.

It is not a 'conspiracy' and when we bear the world's security costs, I am not even sure that monetizing the costs of that with a reserve currency and making the rest of the world pay "its share" thereby is immoral. While it would be politically difficult to tax the citizens of the world directly for our service, they have not seemed to have minded this too much.

When, however, what we monetize and spread internationally is not just the cost of sending the US army to Iraq, keeping the 7th fleet in the far east, etc., but also our speculative excesses in dot-coms and real estate, the world might have reason to balk, and in fact are balking.

We got gready and killed the leaden goose that was laying gold-plated eggs.

To: Toddsterpatriot

That the Federal Reserve monetizes the debt is entirely uncontroversial within conventional economic circles and only seems to be a point of contention with a couple of ostriches who bury their heads here. You can read all about how we monetize the debt at http://en.wikipedia.org/wiki/United_States_public_debt#_note-macro and more particularly references therein.

To: AndyJackson; groanup; expat_panama

Wow, Wikipedia. Really impressing us with your scholarly sources. So what did your source actually say?

When the expenses of the U.S. Government exceed the revenue collected, it issues new debt to cover the deficit. This debt typically takes the form of new issues of government bonds which are sold on the open market.

So far, no backup for your claim.

However, the debt can also be monetized by which the Federal Reserve creates an entry on its books to credit the US Government for an amount equal to the dollar amount of the bonds the Federal Reserve is acquiring.

We don't need to discuss the difference between the things the Fed can do and the things you claim they do on a regular basis, do we?

And let's examine the rest of that sentence again.

by which the Federal Reserve creates an entry on its books to credit the US Government for an amount equal to the dollar amount of the bonds the Federal Reserve is acquiring.

Now see, that's something you could prove, if it occurred. You could find the entry, try this decade, not the 1960s, in the Feds books where they break down exactly how much they credited the US Government for those bonds they acquire directly from the US Government.

I prefer my info from a little more reliable source, like Richard W. Fisher , President and Chief Executive Officer Federal Reserve Bank of Dallas

In this environment, the markets, if left to their own devices, would produce higher interest rates to ration money and balance the demand and supply of capital. If the Federal Reserve were to resist the upward pressure on interest rates, it would in effect monetize the burgeoning fiscal deficits. The Federal Reserve has staunchly resisted monetizing deficits for more than a quarter century, and I feel strongly that it can ill afford to monetize them today.

That speech was given in 2005, so I'm guessing it's more relevant that the 40 year old speech you referenced.

168

posted on

11/21/2007 5:34:19 PM PST

by

Toddsterpatriot

(What came first, the bad math or the goldbuggery?)

To: Toddsterpatriot

And in that speech Fisher said "If the Federal Reserve were to resist the upward pressure on interest rates, it would in effect monetize the burgeoning fiscal deficits.

The Federal Reserve has staunchly resisted monetizing deficits for more than a quarter century, and I feel strongly that it can ill afford to monetize them today.So, when Greenspan frog-marched interest rates down to the 1.0% to 2.0% post the dot-com bubble burst and flogged exploding 1.75% ARMs on the public , he was doing nothing to "resist upward pressure on interest rate?"

Fine, go believe what you want.

To: AndyJackson; groanup; Fan of Fiat; expat_panama; Mase

So, when Greenspan frog-marched interest rates down to the 1.0% to 2.0% post the dot-com bubble burst and flogged exploding 1.75% ARMs on the public , he was doing nothing to "resist upward pressure on interest rate?"Read the quote again, "If the Federal Reserve were to resist the upward pressure on interest rates, it would in effect monetize the burgeoning fiscal deficits"

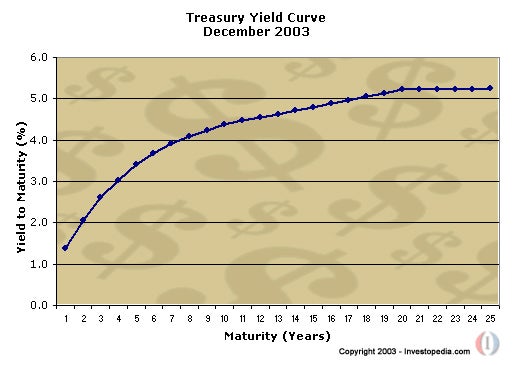

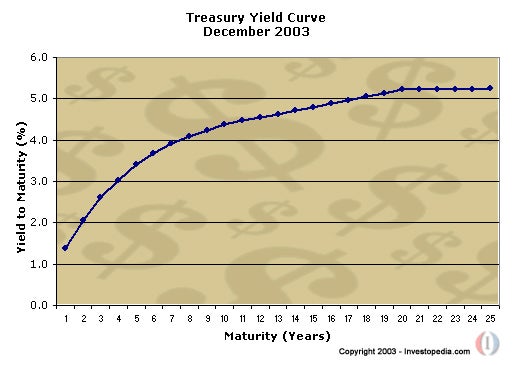

You think the Fed was resisting the upward pressure on interest rates in the second half of 2003, when the Fed Funds rate was 1.0%? I guess that upward pressure would be evident in an ever increasing spread between the overnight and the 30 year rates?

Maybe more recently when the yield curve was inverted?

Nothing proves the Fed is "resisting the upward pressure on interest rates" than overnight rates higher than the 30 Year Treasury rate. LOL!

Fine, go believe what you want.

I believe you should stop making claims about things you obviously don't understand. Like monetization.

170

posted on

11/21/2007 6:39:03 PM PST

by

Toddsterpatriot

(What came first, the bad math or the goldbuggery?)

To: Toddsterpatriot

To: Toddsterpatriot

You think the Fed was resisting the upward pressure on interest rates in the second half of 2003, when the Fed Funds rate was 1.0%? I guess that upward pressure would be evident in an ever increasing spread between the overnight and the 30 year rates?A 4% spread between the short end and the long end of the curve in 2003 isn't rather high? And yes we know that Bernanke jacked up rates and boom!

If you think the Federal reserve does not monetize the debt then don't believe it. I really don't care.

To: Fan of Fiat

Nice chart. The problem is that you are not arguing with goldbugs. Most of us merely advocate a sound stable currency.

To: dollarbull; Toddsterpatriot

1) The fed prints all the new money. The fed continuously prints new money. Not true. Go back to your econ 101 book and re-read how banks create money.

2) The fed never decreases the money supply on a net basis (over the long run)

Over the long run of course not. Why would the Fed take a long term view that GDP shouldn't grow?

Banks do not ever decrease the supply of credit except when forced to temporarily by "the business cycle" - this is happening right now.

Well then banks DO decrease credit, right? When forced to, or when they have been lending to any and every shyster in the world.

4) The US Government borrows money. It always increases its debt on a net basis. It has no intention of ever paying it off.

You are probably right. But I'll vote for a guy who says he will.

the ultimate source that allows all that borrowing is the fed and the banking system.

Even if the gov't were fiscally responsible you wouldn't want the Fed or anybody else to end the availability of credit.

The concept of using the $US as the world's reserve currency is flawed.

Why? I like the idea of putting my money into the strongest economy in the world, able to defend its borders from attack and able to manage reserves so that inflation doesn't erode the value of my assets.

The dollar is falling because it is losing its status as the 1 and only reserve currency.

Maybe so, but as an investment vehicle currencies are like trending machines. The largest spec market in the world, and for a good reason. The trends last for months and years. This has happened before and the world didn't end. Europe should have gone bankrupt after the Euro debuted and crashed for a couple of years.

174

posted on

11/21/2007 6:56:40 PM PST

by

groanup

(Lawyers never create anything, especially wealth, but they sure steal a lot of it.)

To: Toddsterpatriot

Also your last chart commits the fallacy of the supressed zero. By showing a very narrow range (y-axis - you know - the up down part of the graph) what is actually a pretty flat yield curve is made to look like all kinds of squirly stuff is going on that isn’t really.

To: dollarbull; Toddsterpatriot

how does currency in circulation and the monetary base increase over time Bank credit. You can't grow the economy without it.

176

posted on

11/21/2007 6:58:54 PM PST

by

groanup

(Lawyers never create anything, especially wealth, but they sure steal a lot of it.)

To: AndyJackson

you have lectured us all on how the Fed controls bank credit expansion through market operations designed to "control" bank reserves. Then pray tell how DOES the Fed manage short term rates?

177

posted on

11/21/2007 7:00:37 PM PST

by

groanup

(Lawyers never create anything, especially wealth, but they sure steal a lot of it.)

To: groanup

he fed prints all the new money. The fed continuously prints new money. ... Not true. Go back to your econ 101 book and re-read how banks create money.We have been through that point ad nauseum. That the banking system, through fractional reserves, takes the original dollar from the fed and through a cycle of credits and deposits makes the sum total a lot larger does not mean that anyone besides the fed is creating the currency.

If anyone else prints the original dollar, he gets a visit from the FBI.

To: AndyJackson

the total outstanding treasury debt times the reserve fraction that that amount of debt represents.Okay, outstanding debt is about $9 trillion. What do you mean by "reserve fraction that that amount of debt represents"? I know what a reserve requirement is, but haven't heard of "reserve fraction". Maybe you can rephrase or better explain what you meant?

You ever gonna explain this? Or is it worth the same as the rest of your posts, nothing?

179

posted on

11/21/2007 7:06:14 PM PST

by

Toddsterpatriot

(What came first, the bad math or the goldbuggery?)

To: Toddsterpatriot

Navigation: use the links below to view more comments.

first previous 1-20 ... 141-160, 161-180, 181-200 ... 401-410 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson