Skip to comments.

I Want My Bubble Back!

http://www.fool.com/news/commentary/2006/commentary06060918.htm ^

| 6-9-06

| Seth Jayson

Posted on 06/12/2006 8:31:04 AM PDT by Hydroshock

click here to read article

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-44 next last

To: Hydroshock

I hate bubbles.

Little packing-container bubbles, soap-bubbles, bubbles on the Lawrence Welk show, price bubbles, Don Ho singing 'Tiny Bubbles', the stripper chick down at the Pink Pony called Bubbles....

I hate bubbles.

2

posted on

06/12/2006 8:33:49 AM PDT

by

Lazamataz

(First we beat the Soviet Union. Then we became them.)

To: Lazamataz

Everyone will hate this bubble before it is all over.

3

posted on

06/12/2006 8:35:33 AM PDT

by

Hydroshock

( (Proverbs 22:7). The rich ruleth over the poor, and the borrower is servant to the lender.)

To: Lazamataz

Remember that troll we had that kept posting "bubblin, bubblin?"

Second-greatest FR troll after Toiletman. They just don't make 'em like that any more.

4

posted on

06/12/2006 8:36:53 AM PDT

by

dirtboy

(When Bush is on the same side as Ted the Swimmer on an issue, you know he's up to no good...)

To: Lazamataz

5

posted on

06/12/2006 8:37:21 AM PDT

by

OB1kNOb

(This is no time for bleeding hearts, pacifists, and appeasers to prevail in free world opinion.)

To: dirtboy

Remember that troll we had that kept posting "bubblin, bubblin?"Your problem be, you ain't been bubblin' and glistenin' on em. YOU GOT TO BE BOVINE BUBBLIN'! You got to be bovine bubbling and glistening on em till you be doublin' platinum. Platinum be doubling on cadmium. Platinum be bubblin' and glistenin' on em. Youe problem be, you ain't been pushin' no Bently's like Steve Forbes be pushin. You pushing Mercedes. Pat Buchanan be pushin' Mercedes, and he bubblin' and glistenin' on em. He doublin' platinum by bubblin' and glistenin' on em. He doublin' platinum by pushin' Mercedes. Steve Forbes ain't doubling platinum, he pushing Bently's on em.

6

posted on

06/12/2006 8:40:29 AM PDT

by

Lazamataz

(First we beat the Soviet Union. Then we became them.)

To: Hydroshock

Housing is not at all inflated in South Bend, IN, nor in most parts of the country. People who talk about a "national housing bubble" of some kind don't understand the issue.

The bubble only exists in certain markets, and in many places the current slowdown will only moderate buying conditions.

And in others, it will actually ruin people who bought at the top of the market.

To: Lazamataz

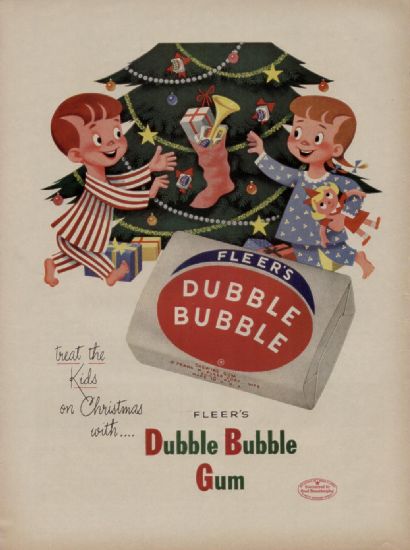

This guy likes 'em...

8

posted on

06/12/2006 8:41:35 AM PDT

by

VictoryGal

(Never give up, never surrender!)

To: Lazamataz

I love bubble gum. Especially Bubble Yum and Double Bubble.

9

posted on

06/12/2006 8:42:11 AM PDT

by

Sensei Ern

(http://www.myspace.com/reconcomedy/ "I'M YOUR WORST NIGHTMARE...AN AMERICAN...and I am voting!")

To: Hydroshock

Interest-sensitive housing markets = "Bubbles" Vulnerable = "Ready to pop" The U.S. real estate experience over the last thirty years offers plenty of evidence that the interest-rate/property-price correlations are overrated. For one, each of the three property bear markets during that time (1974-75, 1980-82, 1990-92) occurred amidst falling rates, while the last great U.S. real estate market (1976-1980) occurred as the prime rate raced into the double digits. As a matter of fact, the prime-lending rate rose from the single digits in 1976 all the way to 19 percent in 1979 while real estate values took off. By 1979, the value of individually owned dwellings reached $1.3 trillion dollars, twice the worth of individually owned corporate stock. Half of all the new multimillionaires in 1978 earned their fortunes in real estate.

10

posted on

06/12/2006 8:43:05 AM PDT

by

Mase

To: Lazamataz

To: Hydroshock

It should have been completely obvious to anyone with a loan calculator and a glance at wage increases that those months of industry bubble denials were just wishful thinking. I remember when a house price should be equivalent to a years salary. Then, when I wnr house shopping, I was told that a house price should be about 2 years salary. And lately, I've hear that a home price should be 5 times yearlt salary. The plain and simple truth is that house prices have gone up much, much faster than wages and I blame the exotic loan industry. By offering "cheap" money, it increased demand which pushed housing prices into the stratosphere. I'm in the tampa Bay area and it is ridiculus to think that median housing prices have 'risen' to the level of median household income. Median prices are in the mid $200K range, but household income is in the $35-40K range. And rents are going up just as fast so I don't see this as a big bubble in this area.

12

posted on

06/12/2006 8:44:00 AM PDT

by

doc30

(Democrats are to morals what and Etch-A-Sketch is to Art.)

To: Lazamataz

To: OB1kNOb

Based on that pic, I think I want to be a bubble.

14

posted on

06/12/2006 8:45:18 AM PDT

by

lesser_satan

(EKTHELTHIOR!!!)

To: Hydroshock; ex-Texan

15

posted on

06/12/2006 8:49:37 AM PDT

by

Hydroshock

( (Proverbs 22:7). The rich ruleth over the poor, and the borrower is servant to the lender.)

To: Hydroshock

What about all those poor HGTV-addled suckers -- oops, I mean investors -- who've been buying property on interest-only ARMs with the hopes of flipping it for an easy profit?

I have a question for you and others who gloat over "the bubble".

Why do you have so much scorn for and glee at the prospect of financial ruin for enterprising Americans who plunge into real estate investment? (and who make up a rather small segment of real estate purchasers, BTW)

During the dot.com era I do not remember seeing this extent of high-fiving the end of irrational exuberance and gloating over losses of investors who were only trying to make a buck....some perhaps for your retirement funds that affect large numbers of us. Real estate has transformed many a landless and poor person into someone with wealth. Yet you smack your lips over the prospect of investors, ordinary people with big dreams, losing everything.

So what gives?

Envy? Feeling self-righteous over your own caution and more prudent investment efforts? Just a thought.

16

posted on

06/12/2006 8:49:39 AM PDT

by

silverleaf

(Fasten your seat belts- it's going to be a BUMPY ride.)

To: Hydroshock

"

Of course, housing, over the long run, is not a good investment, except for a very savvy few. It's a roof over your head that tends to keep pace with inflation, but not in a straight line."

Obvious, like the nose on your face, except to those folks buying those "get rich in real estate" plans, hawked to morons, by people who make a living (and not in real estate) shearing sheeple.

As long as there are bridges, there will be bridge buyers.

17

posted on

06/12/2006 8:50:15 AM PDT

by

G.Mason

(I wouldn't have wanted to live without having disturbed someone)

To: silverleaf

18

posted on

06/12/2006 8:51:21 AM PDT

by

Hydroshock

( (Proverbs 22:7). The rich ruleth over the poor, and the borrower is servant to the lender.)

To: G.Mason

That ans trying to warn people to beware.

19

posted on

06/12/2006 8:52:01 AM PDT

by

Hydroshock

( (Proverbs 22:7). The rich ruleth over the poor, and the borrower is servant to the lender.)

To: Hydroshock

PING myself to read later.

20

posted on

06/12/2006 8:52:20 AM PDT

by

Paperdoll

(.........on the cutting edge)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-44 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

![]()