Posted on 02/24/2024 5:59:01 AM PST by SpeedyInTexas

China needs to be removed from supply chains.

Trumps 60% tariff on all Chinese goods is needed.

“China has sanctioned U.S. drone manufacturer Skydio, a key supplier for Ukraine, blocking critical components and batteries. Skydio is now scrambling for alternative suppliers amid the supply chain crisis, per Financial Times.”

https://x.com/NOELreports/status/1851903193455751245

Sweet!

“Satellite images reveal the aftermath of a missile strike on an ammo depot in Luhansk, showing significant damage: three or four buildings destroyed and one damaged.”

https://x.com/NOELreports/status/1851894969130172815

“British finance minister Rachel Reeves said today she would provide the UK defence ministry with an additional 2.9 billion pounds next year and promised an annual 3 billion-pound support for Ukraine would continue for “as long as it takes”.”

https://x.com/NOELreports/status/1851753600071958687

“Ukrainian FPV drone of the 129th Territorial Defence Brigade does everything to make a bad Russian “good””

https://x.com/GloOouD/status/1851677588038807950

Got to give them credit for boosting GDP by increasing fencing industry😎

What does 2400 buy at 10% inflation and 21% interest rates. If they have Cc I wonder what that rate is🤔

Dragon-type drone dropping white phosphorus or similar would work wonders on that flammable netting.

Butter prices are breaking records. What will happen next? Three alarming points

The cost of butter has already increased by more than 25% this year. And it continues to grow. Some media outlets have even started comparing the situation to “Armageddon.” In reality, everything is not that critical, at least for now. But there are things worth paying attention to.

Firstly, there are several reasons for the rapid growth of butter prices. The key ones are the increase in production costs and the containment of prices in previous years. Now, in fact, producers are trying to make money, realizing how much they lost in previous years. The rise in prices coincides with a reduction not only in production, but also in imports (including due to sanctions).

Secondly, paradoxically, the reason for the deficit is the increase in consumption of butter and dairy products in general. “There is more money on hand. Welfare has increased, people began to buy things they could not afford before,” explains a source in the government. He confirmed that welfare has increased primarily due to military payments. The market is currently responding to increased demand with higher prices. It is important that demand is unlikely to fall even in the medium term.

Thirdly, how can this situation be resolved? If you remember, we went through an egg crisis a year ago. The situation is different here, because eggs are easier and faster to produce than dairy products. What actions will the authorities take? The introduction of price caps on butter is currently being discussed. The problem is that this will only postpone price increases, as was the case in previous years. There are also proposals to reduce prices by reducing product quality. Manufacturers are against this, but the authorities are leaning towards this scenario. Traditional marketing ploys: reducing pack size and lack of promotions will also be actively used.

In short, there will be butter . But for now it will either be expensive or of poor quality, which is not always healthy. The government directly says that rising butter prices increase inflation, which means that in the short term, prices for other product categories will rise. It is impossible to quickly increase production itself, including due to the lack of free production capacity. There will be an attempt to import more actively, but this will only further inflate prices.

Shahlai is a very senior IRGC Quds Force commander responsible for the deaths of US servicemembers and planning terrorist attacks on US soil. Shahlai planned an attack targeting a US base in Karbala, Iraq, in 2007 in which Asaib Ahl al Haq fighters kidnapped and executed four US servicemembers.[124] Shahlai was also sanctioned for providing weapons to Iranian-backed Iraqi militias to conduct attacks targeting US and Iraqi forces throughout Iraq.[125] Shahlai, as the commander of the IRGC Quds Force's external operations wing, also planned a terrorist attack in Washington, DC, in 2011 that attempted to assassinate the Saudi Ambassador to the United States.[126]

https://www.understandingwar.org/backgrounder/iran-update-october-30-2024

There are also proposals to reduce prices by reducing product quality. Manufacturers are against this, but the authorities are leaning towards this scenario.

—

They can use the Chinese solution - use industrial oils instead.

Biden/Harris have not come through for Ukraine, despite the rhetoric and posturing - halfway through the year, and not even 10% of the budgeted aid provided:

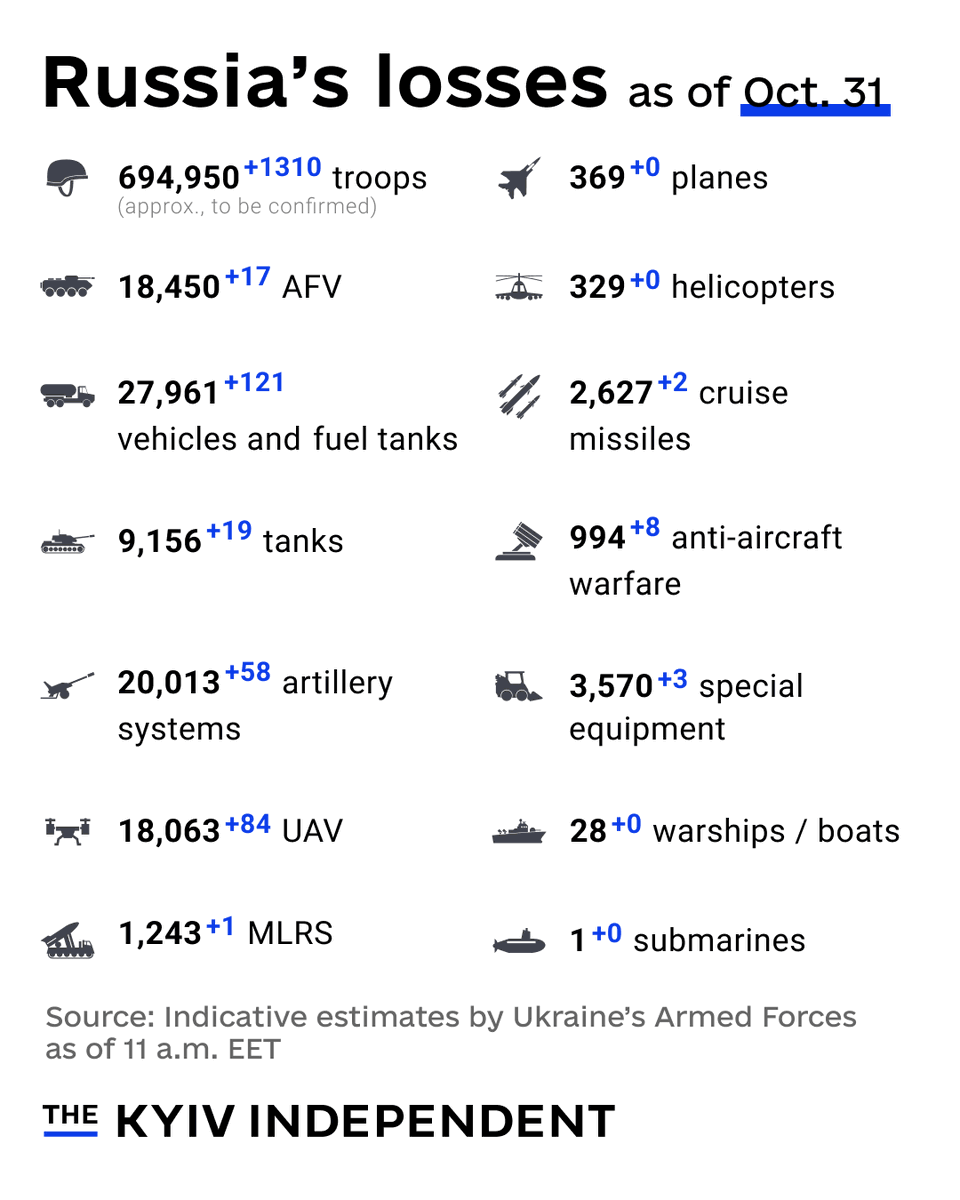

Kyiv Independent reports:

“The U.S. has transferred nearly (not even) 10% of the aid approved by Congress in April 2024 to Ukraine, President Volodymyr Zelensky said at a press conference on Oct. 30.

After months of political infighting and a worsening situation on the battlefield, the U.S. House of Representatives finally passed the foreign aid package on April 20, which included $60.84 billion in support for Ukraine...

...(President Zelensky) noting that Ukraine had planned its military actions relying on the promised assistance “at a certain time.”

Zelensky also said NATO... had promised to provide “six or seven” air defense systems to protect Ukraine’s airspace. “But today, we haven’t received this number.”

OilPrice.com reports:

“A Reuters poll released Thursday paints a lackluster future for oil in 2025, with a cocktail of sluggish demand growth and supply glut concerns pulling prices down. Analysts now see Brent crude averaging $80.55 per barrel this year and $76.61 in 2025— a steady downgrade from earlier projections.

The pessimistic shift stems from a trio of factors. China’s lukewarm demand, despite its role as the world’s top oil consumer, casts a long shadow. Meanwhile, oil supplies from key producers are poised to swell, especially with OPEC+ eyeing an output hike in December. And the geopolitical storms that once rattled markets, particularly fears of escalations in the Middle East, have calmed. As Ole Hansen, Saxo Bank’s head of commodity strategy, noted, these flare-ups may stir oil prices, but the risk of real disruption is, well, limited...

When the geopolitical winds ease and China’s economy stalls, crude prices might just hit the snooze button for a while.”

“Biden/Harris have not come through for Ukraine”

Its crunch time.

Biden needs to flood the zone with arms between election day and inauguration day.

Leave no money for the next president to spend or refuse to spend.

Like EVs or not, China has gone all in. China’s oil demand may peak soon.

S&P Global:

“China’s peak oil demand looms”

“China guzzled roughly 16.5 million b/d of the world’s oil supply in 2023, all liquids included. As the world’s second-largest oil consumer, accounting for about 16% of global demand, a peak or plateau in its refined oil product demand is crucial to the oil market. The timing of the peak and the pace of oil demand decline from there on will affect global oil balances and, consequently, oil prices.

“With a total oil demand tripling that of India’s, the world’s third-largest oil consuming nation, China is the only major developing country that is likely to see demand of gasoline and gasoil/diesel to reach a plateau at present or in the near future,” said Kang Wu, global head of oil demand research at S&P Global Commodity Insights. “While oil demand in nearly all developed countries has peaked, the vast majority of developing countries other than China will see their oil demand continue to grow in the foreseeable future.”

“As such, China is a decisive force in determining if and when the global oil demand will peak,” Wu added.

Analysts have varying views on the year when China’s oil demand will peak, but most of them agree the decline will not be so dramatic as to trigger a sharp downturn in global oil demand.

Commodity Insights projects China’s total refined product demand, excluding direct crude burn and all NGLs, will peak in 2027 at 16.4 million b/d. It consumed 15.5 million b/d in 2023. Global refined product demand is forecast to peak in 2028 at 91.5 million b/d, compared with 88.4 million b/d demand in 2023.”

However, China’s oil demand growth in the second quarter of 2024 – merely 16 months after reopening from pandemic-related restrictions – has been slower than expected, with a year-on-year reduction in crude throughput. The combination of rapid growth in the displacement of road transportation fuels, muted demand from construction and manufacturing sectors, and extreme weather disruptions hit consumption.

The average utilization of independent refineries in China’s Shandong province fell to 52% in June 2024, the lowest level since March 2020, when the country’s oil demand was slowly recovering from the pandemic outbreak, data from local information provider JLC showed. China’s independent refineries are swing suppliers and their activity directly reflects the country’s oil demand.

Gasoil, the largest component of China’s oil barrel, accounting for about 22% or 3.8 million b/d of the country’s refined product demand, either already has or is close to reaching peak as growing sales of LNG-fueled heavy-duty trucks displace conventional diesel-powered trucks, analysts said.”

Russia just hit Odesa residential areas with cruise missiles with cluster munitions.

We need Trump to get in there and end this.

Sour grapes Russia trying to get their final licks in before Trump’s back in office.

He loaded all his guns.

Maybe he has 250,000 rounds in his closet too...

What can I say?

I yearn for the days of Reagan and Bush Sr.

https://x.com/metzgov/status/1852042687517487576

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.