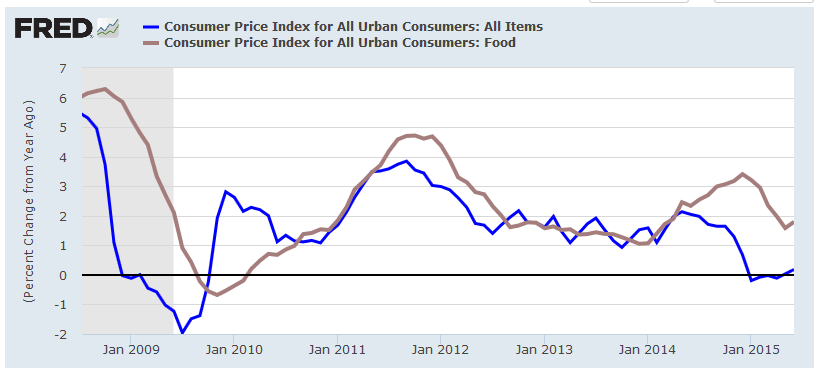

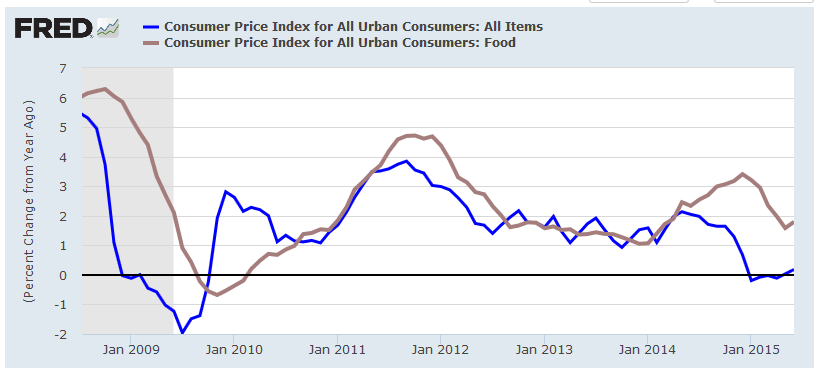

imho this will either postpone any fed rate move or it'll make a rate hike super problematic.

Posted on 07/22/2015 4:13:03 AM PDT by expat_panama

Things are not so sweet for the sugar market. Prices have been tumbling and reached a six-year low on Monday on news that Brazil's cane growers are in for a bumper harvest.

But while gold made the headlines, the dramatic fall in the sugar price was widely overlooked, despite closing down 4.4pc, compared with a 2.3pc slump in the price of bullion.

Over the past year alone, sugar prices have fallen by a quarter. So why has everything turned sour?

Bumper Harvest

Monday's sharp price drop was driven by signs that Brazil, the world's biggest producer of sugar, is on track for a larger harvest than expected.

[snip]

China increases alternatives

The price of sugar has also been impacted by a rapid increase in artificial sweetener production in China, which has flooded the market and depressed...

[snip]

The dollar

The US dollar has been growing stronger, boosted by a resurgent American economy and the prospect for a rate rise in the next few months. The US dollar index, which tracks the price of the US dollar against the world’s currencies, has increased by more than 20pc within the past year.

The value of the US dollar typically follows an inverse relationship with commodities. When the dollar strengthens against other major currencies, the prices of commodities - such as sugar - typcially drop. When the dollar weakens, commodities generally move higher.The main reason for this is because most commodities are freely traded in international markets and prices are quoted in US dollars.

Foreign buyers will purchase commodities with dollars, so, when the value of the dollar drops, they will have more buying power, and demand increases. Similarly, when the value of the dollar rises, they have less buying power and commodities become more expensive, muting demand and sending commodity prices lower.

(Excerpt) Read more at telegraph.co.uk ...

imho this will either postpone any fed rate move or it'll make a rate hike super problematic.

So now’s the time to stock up on snickers bars?

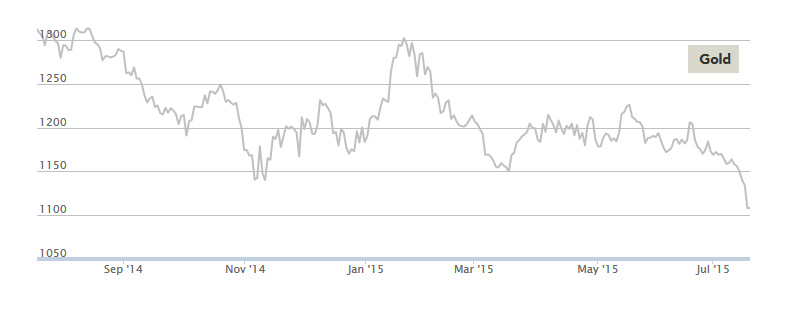

Gold is at the bottom of its range for the 52-week range.

Now is the time to end the sugar monopoly and let Americans buy sugar on the open market.

Good morning everyone, it's raining falling prices outside! Futures see metals today at -1.23% and stock indexes -0.51%. Whild this may be just another day of profitaking for stocks after yesterday's pullback in mixed trade, metals are in freefall: gold'n'silver $1,094.92 and $14.85. If that weren't enough we also got this:

7:00 AM MBA Mortgage Index

9:00 AM FHFA Housing Price Index

10:00 AM Existing Home Sales

10:30 AM Crude Inventories

“So now’s the time to stock up on snickers bars?”

Apparently Kim Kardasian has been. If she gets any bigger she will be in a tank as Sea World! ;-)

“Kanbo International, the Chinese producer of artificial sweetener Sucralose, has announced plans to push into the North and South American food and beverage market.”

More Chinese chemicals in our food supply. Not a good thing.

“Kanbo International, the Chinese producer of artificial sweetener Sucralose, has announced plans to push into the North and South American food and beverage market.”

More Chinese chemicals in our food supply. Not a good thing.

Not anymore...

I like Chinese food as do most red-blooded Americans.

I read somewhere of a proposed Brazilian ethanol pipeline

Just imagine the possibilities for theft and the ensuing sales of moonshine, white lightening, vodka

rather than candy, the markets will produce ethanol to run automobiles

Exactly. It's time to lay off the "diet" foods.

Hard to find good crab Rangoon but there is one place close by. I can take or leave most Chinese food but love the crab Rangoon.

I thought this sugar substance you speak of was banned for the common people in the US along with salt, butter and bacon.

I like Chinese cuisine, but I will not eat anything that is produced or processed in China. Lord knows what’s in it.

you are correct-

But mooochele and barry will allow all the sugar

you can get - IF IT COMES FROM CUBA.

Now is the time to end the sugar monopoly and let Americans buy sugar on the open market.

*********************

That’s CRAZY TALK ,,, that’ll keep bakeries and candy manufacturers from closing down or relocating to Mexico and we can’t have that... (Grupo Bimbo , MEX of course , has taken over the baked goods/bread aisle in American grocery stores because of the sugar import duties here...)

Many do not realize the US has a rather large sugar price support program, as do a number of other countries. Worldwide glut of sugar means low market prices and high subsidies. More insanity.

At the same time the left is ranting about so-called “oil subsidies”. A year or two a buddy of mine complained about it and what it turned out to be is that somebody found some form of oil industry profit that hadn’t been taxed yet —that they were calling that a “subsidy”!

Good point! Plus, what about the environmental benefits from sugar cane farming in Florida? /s

(Sorry about your horse.)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.