Skip to comments.

Would You Let the I.R.S. Prepare Your Taxes?

New York Times ^

| 04/16/2015

| Farhad Manjoo

Posted on 04/16/2015 7:28:04 AM PDT by SeekAndFind

Around this time every year, Joseph Bankman, a professor of tax law at Stanford Law School and a longtime advocate of using technology to simplify tax filing, gets on the phone with reporters to explain what is wrong with how we do our taxes in the United States. Every year he says pretty much the same thing: No other industrialized country asks its citizens to jump through as many hoops to calculate their taxes as ours.

It isn’t just lawmakers or the hapless-seeming Internal Revenue Service that is perpetuating the annoyance of tax time, he adds. Instead it is the private sector — specifically, the software company Intuit, which makes TurboTax, the most popular tax program in the country.

For more than a decade, Mr. Bankman and a small group of tax experts have called on the government to create a tax preparation method that they say would vastly reduce the time and cost of tax-filing for most people. Intuit has been a primary obstacle to the effort.

The reform plan would work like this: Today, employers, banks, brokerage firms and pretty much every other financial organization in the country send the federal government detailed records about our economic activity every year. These organizations also send you, the taxpayer, a similar set of documents, which are forms with names like W-2 and 1098. After you file your taxes, the government matches its two sets of documents to make sure you have filed correctly.

To Mr. Bankman, this double documentation doesn’t make much sense. If the government is already collecting financial data from employers and banks, why can’t the I.R.S. use that information to precalculate our tax returns for us? At the very least, why can’t tax software just connect to the government’s database to download all the information

(Excerpt) Read more at nytimes.com ...

TOPICS: Culture/Society; Government; News/Current Events

KEYWORDS: bureaucracy; intuit; irs; taxes; turbotax

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

To: SeekAndFind

Well, the IRS doesn’t have all information on us.

The IRS doesn’t know about charitable contributions I make during the year. I get a statement from the charities I support. But do the charities furnish this to the IRS? If not, there’s one key area where we would need to change a tax return the IRS pulls together on us.

Does the IRS know how much I pay in property taxes? I get a statement, but I don’t think the county submits this to the IRS, do they?

There are probably other areas as well, which the IRS doesn’t get information regarding tax deductions you are allowed to take.

To: SeekAndFind

I am all for limiting the IRS tax form to a 3 x 5 postcard printed in 12 point font with one side for the form, the other side limited to addresses and postage.

That would simplify the hell out of the tax code.

To: SeekAndFind

At the very least, why can’t tax software just connect to the government’s database to download all the information And why not have a federally-controlled website where everyone can sign up for their government-mandated health-insurnace? It will easily and flawlessly link you to the various state exchanges where you can buy from one of the many wonderful choices available?

/s

4

posted on

04/16/2015 7:36:27 AM PDT

by

PGR88

To: SeekAndFind

We should at least go to the flat tax that Steve Forbes proposed in 1996. Just going to that flat tax would save Americans 75% of the estimated US$1 TRILLION per year in compliance and economic opportunity costs of the current tax system (as of 2014 calendar year).

5

posted on

04/16/2015 7:37:10 AM PDT

by

RayChuang88

(FairTax: America's economic cure)

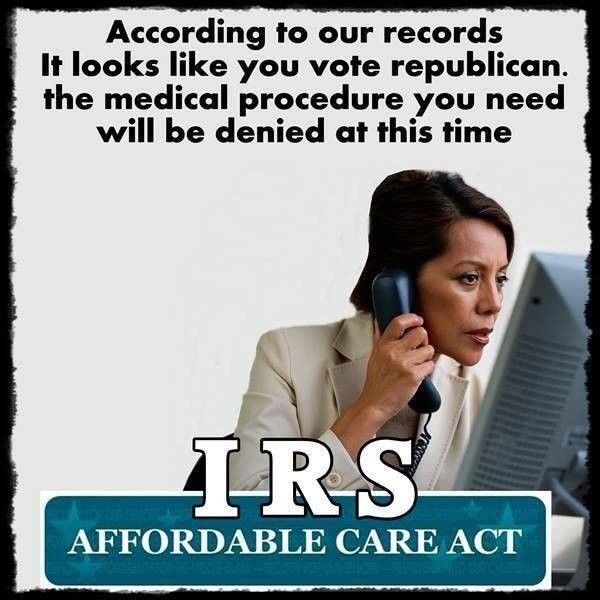

To: SeekAndFind; All

6

posted on

04/16/2015 7:38:36 AM PDT

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: taxcontrol

7

posted on

04/16/2015 7:38:48 AM PDT

by

BenLurkin

(The above is not a statement of fact. It is either satire or opinion. Or both.)

To: SeekAndFind

Well, the law already allows the IRS to “impute” income to you and tax you accordingly.

8

posted on

04/16/2015 7:40:06 AM PDT

by

null and void

(He who kills a tyrant (i.e. an usurper) to free his country is praised and rewarded ~ Thomas Aquinas)

To: SeekAndFind

Not all income is reported to IRS. Deductible expenses are not reported either. They already have too much information.

9

posted on

04/16/2015 7:41:58 AM PDT

by

Raycpa

To: Taxman

10

posted on

04/16/2015 7:42:40 AM PDT

by

TADSLOS

(A Ted Cruz Happy Warrior! GO TED!)

To: SeekAndFind

The IRS doesn’t have all the information required. For example, if you do landscaping on your rental property, whether you depreciate the cost or deduct depends on how close you planted the plants to the building. College credits can depend on if you bought the books from the University or Amazon. Who gets to claim a kid after the divorce depends on a variety of things, including how many nights the child spent with a given parent.

Is it a hobby or a business? How much did you spend for stamps? Do you have a business plan?

If tax laws only involved W2s, we could all file a 1040EZ in 5 minutes. But the laws are written to control every aspect of our lives, and that requires answering a lot of questions. As long as tax laws are used to reward some groups and punish others (single people and anyone who is successful), preparing taxes will be complex.

11

posted on

04/16/2015 7:51:41 AM PDT

by

Mr Rogers

(Can you remember what America was like in 2004?)

To: Mr Rogers

Sorry. Landscaping splits between adding to the cost of the property and deducting. I’m tired this morning.

12

posted on

04/16/2015 7:53:33 AM PDT

by

Mr Rogers

(Can you remember what America was like in 2004?)

To: SeekAndFind; Man50D; Principled; EternalVigilance; phil_will1; kevkrom; Bigun; PeteB570; FBD; ...

Professor Bankman is wasting his time!

Better he spend it advocating for the FairTax!

It is nobody’s business how much income a person or a company generates!

The concept is called: FREEDOM!

Go to http://www.fairtax.org to get more information.

13

posted on

04/16/2015 7:54:57 AM PDT

by

Taxman

(I'M MAD AS HELL AND I'M NOT GOING TO TAKE IT ANYMORE!)

To: Taxman

14

posted on

04/16/2015 7:56:06 AM PDT

by

TADSLOS

(A Ted Cruz Happy Warrior! GO TED!)

To: SeekAndFind

A tax form could be a handful of lines long, if our taxes were structured sanely:

1. Write down your income

2. Subtract standard deduction and write down taxable income

3. Multiply line 2 by tax rate

4. Write down tax withheld

5. If line 3 is greater than line 4 subtract line 4 from line 3. This is the amount owed.

6. If line 4 is greater than line 3, subtract line 3 from line 4. This is the refund amount due.

A flat tax rate for all taxpayers and a standard deduction for all taxpayers would make filing taxes simple and would be better economically than the current system.

15

posted on

04/16/2015 7:56:32 AM PDT

by

stremba

To: SeekAndFind

Letting the IRS prepare our taxes is like letting a serial rapist run a teenage girl’s social life. No, thank you.

16

posted on

04/16/2015 8:23:30 AM PDT

by

Pollster1

("Shall not be infringed" is unambiguous.)

To: SeekAndFind

Would You Let the I.R.S. Prepare Your Taxes? No, I don't think so.

That would keep the 3 or 4 people who work for the IRS who actually understand most of their convoluted abortion of a tax code REAL, REAL busy...

17

posted on

04/16/2015 8:31:12 AM PDT

by

kiryandil

(Egging the battleship USS Sarah Palin from their little Progressive rowboats...)

To: stremba

Make everybody fill out the 1040EZ, and be done with mortgage deductions, charitable deductions, depreciation, capital loss, child credit, etc.

18

posted on

04/16/2015 8:32:06 AM PDT

by

Yo-Yo

(Is the /sarc tag really necessary?)

To: SeekAndFind

LEARN THE FACTS: HTTP://WWW.FAIRTAX.ORG

When will America FINALLY rid itself of a slave tax system better suited to a third world banana republic dictatorship and is as much about having a mechanism by which the political class can reward its friends and punish its enemies than it is about raising the revenue for the Constitutional and necessary functions of government!

Then there’s THIS. I have a number of issues with ol’ Honest Abe, but he got THIS ONE SPOT ON:

“The tariff is the cheaper system, because the duties, being

collected in large parcels at a few commercial points, will

require comparatively few officers in their collection; while by

the direct (income) tax system, the land must be literally

covered with assessors and collectors, going forth like swarms of

Egyptian locusts, devouring every blade of grass and other green

things.”

President Abraham Lincoln. The quote comes from “Campaign Circular from Whig Committee” written on March 4, 1843. It was co-authored by Lincoln It can be found in volume 1 of the Collected Works of Abraham Lincoln,page 309.

19

posted on

04/16/2015 9:08:15 AM PDT

by

Dick Bachert

(This entire "administration" has been a series of Reischstag Fires. We know how that turned out!)

To: Mr Rogers

If tax laws only involved W2s, we could all file a 1040EZ in 5 minutes. But the laws are written to control every aspect of our lives, and that requires answering a lot of questions. As long as tax laws are used to reward some groups and punish others (single people and anyone who is successful), preparing taxes will be complex. This is exactly why the whole idea of the flat tax will not accomplish anything at all to reduce the insane power of the IRS. A national sales tax of 10% is really the only solution.

We need a constitutional amendment that does 2 things.

- Abolish the IRS

- Establish a national sales tax of 10% with the rate set in the amendment itself so congress can't change it without going through the amendment process

Why 10%? Simple. God only asks for 10%, the government doesn't deserve more than the Lord.

20

posted on

04/16/2015 9:36:37 AM PDT

by

zeugma

( The Clintons Could Find a Loophole in a Stop Sign)

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson