Skip to comments.

Something weird is going on --Investor Thread March 29, 2015

Weekly investment & finance thread ^

| Mar. 29, 2015

| Freeper Investors

Posted on 03/28/2015 3:17:44 PM PDT by expat_panama

(excerpt from) ...Despite experiencing a healthy pace of job growth, the US economy has largely disappointed economists' expectations by delivering a series of weaker-than-expected economic reports. (excerpt from) ...Despite experiencing a healthy pace of job growth, the US economy has largely disappointed economists' expectations by delivering a series of weaker-than-expected economic reports.

The unexpected plunges in retail sales and durable goods orders stand out as they reflect weakness in both consumers and businesses.

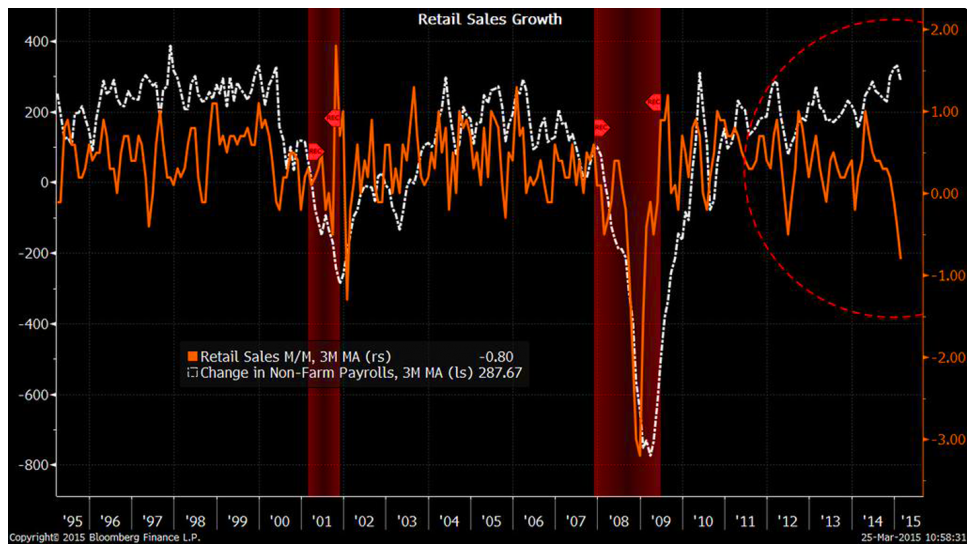

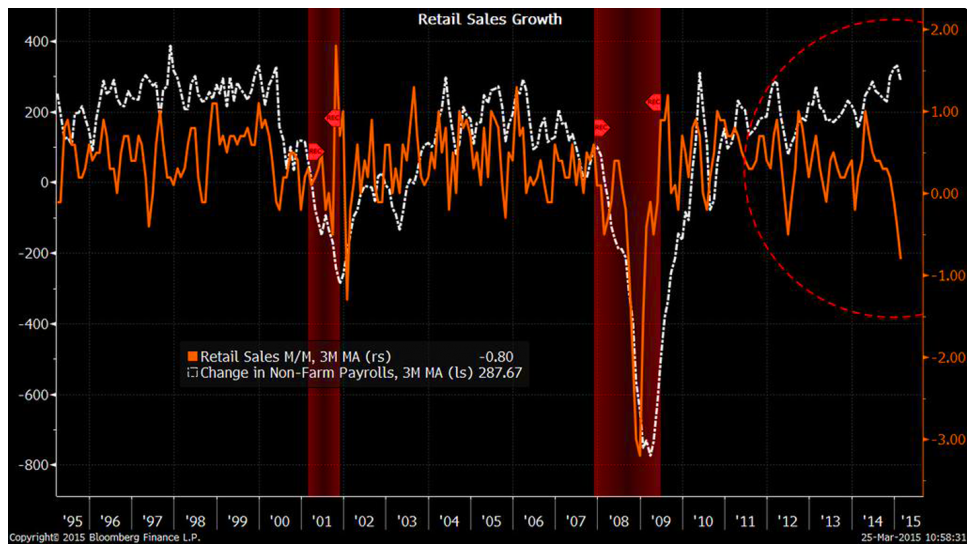

On Wednesday, Bloomberg LP Chief Economist Michael McDonough tweeted a chart of the unprecedented divergence between job growth and retail sales growth. This is concerning as personal consumption accounts for roughly 70% of US GDP.

It's particularly concerning considering all of the extra spending money Americans supposedly have thanks to falling gas prices.

"Recent US data have been disappointing," Goldman Sachs Kris Dawsey said late Thursday. Dawsey thinks GDP growth could tumble to 1.4% in Q1 from 2.2% growth in Q4 of last year. Economists had previously expected GDP growth to accelerate in Q1 to around 3%.Q2 Comeback?

For the most part, economists have attributed much of the recent weakness to unusually harsh winter weather and the plunge in oil prices, which has slammed the spending plans of US drillers. For this reason, economists are optimistic that weakness in Q1 could be offset by a rebound in Q2.

Dawsey specifically sees three reasons to be bullish on Q2:

Consumers will bounce back: "While some of this output may be lost for good (i.e. people won't eat two restaurant meals the next time they go out to make up for snow-delayed date night), a simple bounce-back to the prior level of spending would boost the growth rate in Q2 by roughly the same amount as the Q1 drag. In addition, some of the activity may just be shifted into Q2, in particular with regard to residential investment, resulting in an even bigger potential boost." Energy companies will bounce back... [snip] Gas savings will fuel spending...

|

|

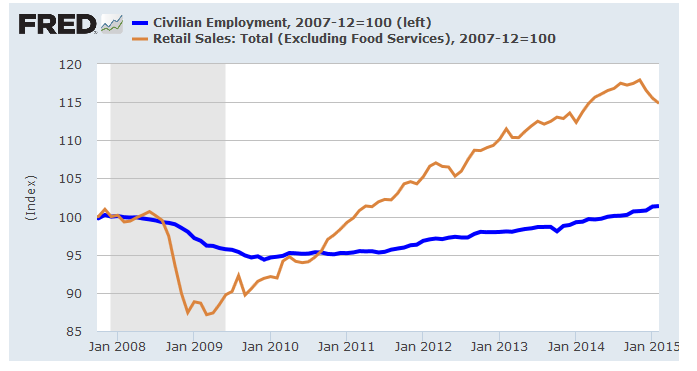

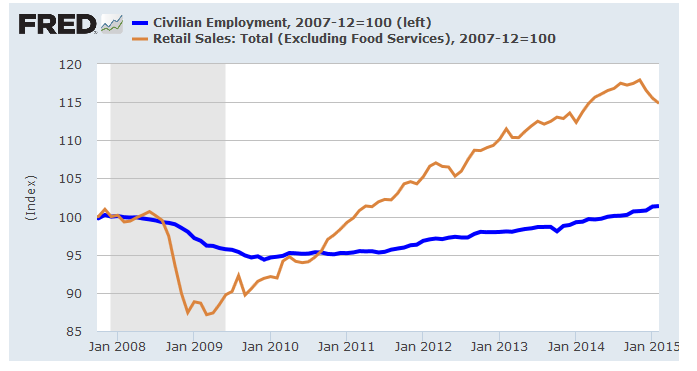

--is that (1) this "weird" stuff really is happening, (2) but not the way BI said, and (3) it's actually a good thing. In the first place BI's numbers are real and true. However the article uses them to support the belief that we got "...plunges in retail sales... ...the unprecedented divergence between job growth and retail sales growth." Reality is that for years now we've not seen falling sales and rising employment, we've had falling employment and climbing sales.  The 'misunderstanding' (a kind way of saying "deceit") was caused by allowing monthly changes in jobs'n'sales to pass for what's really going on with jobs'n'sales. Reality is that the actual cumulative increase in sales since the recession, is really a 15% climb, while total employment's dragged up a meager one percent. Job stagnation looks even worse when we take into account population growth over the period --17 million more people is a 6% expansion that shows how our 1% employment increase is truly inadequate. But we digress. But as long as we're digressing how about we also remember that this so-called 15% boom in sales ignores inflation and population growth. Taking those factors into account we find that real per capita sales is down 5% from the pre-recession high and remember that for decades Americans had been enjoying continuous sales growth-- OK so the economy sucks but that's still not the point. The BI writer (he holds a BA in Religion from Boston University) screwed up by passing on the idea that the drop in sales was an "unprecedented divergence" along with a the graphic that circled an era going back years. Coming back to the Planet Earth the divergence that we do have does not span "years". It's been going on now more like for a couple months. Hey, remember that everyone says "size doesn't matter" so let's be happy with what we got because there're a number of reasons why falling sales and rising employment can even be good for us. For starters it means that people are getting back to work and they're saving for hard times ahead. Americans. Ya can't beat 'em. Another reason is that the past few years of stagnant jobs and rising sales has only been possible because of the rise of spending by the elite wealthy. Whoa --we're not going into some goofy income inequality shtick because equal incomes is what Marx advocated. Bad idea. Our problem is that until recently the risk has been a separation between the rich and poor --an opportunity deficit that threatened to close the book on America's success stories. These past few months offer reassurance that wealth class structure is not that solid after all. Finally my take is that at the very least falling sales --while short term pain-- can be a 'wake-up-call' for the policy wonks that don't know or don't want admit the economy sucks. They might even get off our backs and let us get back to work... |

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; recession; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

To: Chgogal

Sounds dreamy! This year’s visit will just be a one night stop as we’re quick hopping around seeing all the kids. Would dearly love to relive my hometown longer sometime...

To: expat_panama

On Friday it is supposed to snow! : (

62

posted on

04/02/2015 8:18:25 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

Sounds beautiful —having grown up w/ snow but learned driving a car in L.A... Somehow to me “heavy snowfall” still just means “no school”.

To: central_va

Envy causes cancer, and they always die a horribly lonely and painful death.

64

posted on

04/02/2015 8:33:31 AM PDT

by

MaxMax

(Call the local GOP and ask how you can support CRUZ for POTUS, Make them talk!)

To: expat_panama

To me it means a bending shovel and a possible hearth attack.

Snow is beautiful when you live in Panama, not so much close-up. : )

65

posted on

04/02/2015 8:35:40 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

beautiful when you live in PanamaMaybe not, my wife was raised in Galveston & has absolutely no desire to live in snow, but somehow all I can remember emotionally is the magic and fun. When I think about it I have to admit that most of the time snow was grey and black with dirt and slush, and sidewalks were icy while the ground was soggy. Doesn't matter, I still miss it.

To: expat_panama

My brother-in-law feels the same way until he is here during Xmas. You should see how miserable he looks while walking the dogs along the lake! Yet, he misses it when in sunny balmy Florida.

The markets are shrugging off the 0% GDP. Here is a tidbit. My BIL is starting a new company. He was meeting up with the big cruise lines. Because of the strong dollar, the switched 40% of food purchases from the US to Europe.

67

posted on

04/02/2015 9:51:53 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: MaxMax

Envy causes cancer...Never saw that study but I believe it. Envy is not only a sick hateful perversion but it's an evil pride before our Creator. I'd comment on how much the left likes to indulge in it but I need to breath into a paper bag for a bit first...

To: Chgogal

“.....they switched....” sorry!

69

posted on

04/02/2015 9:53:06 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

shrugging off the 0% GDPBeen hearing that but last week's report from the BEA had the final number at 2.2%, same as was reported last month. Many people are talking about more slowing down but today's factory orders are up +2.2% (market expected -0.5%) and before that consumer confidence lept to 101.3% when analysts were expecting it to fall to 96.4%.

It's taken 8 years but things really are improving in places.

To: expat_panama

Things were super busy in Florida.

71

posted on

04/02/2015 10:20:07 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

72

posted on

04/02/2015 4:59:44 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

A worthwhile read.

http://blogs.wsj.com/totalreturn/2015/04/02/are-you-overlooking-big-threats-to-your-finances/

Apr 2, 2015

Are You Overlooking Big Threats to Your Finances?

By Jonathan Clements

There are two ways that wealth can slip away: slowly and quickly.

Today, many folks are well aware of the slow erosion caused by high fund expenses, hefty advisory fees and big investment-related tax bills, as evidenced by the growing enthusiasm for exchange-traded funds, robo advisers and tax-loss harvesting.

My fear: While investors are focusing on these relatively modest drags on their annual investment returns, they may be overlooking big gaps in their financial plan that could quickly destroy the savings they have accumulated.

We are talking here about mistakes such as failing to buy life, health and disability insurance; holding a badly diversified investment portfolio; wagering on one or two heavily mortgaged rental properties; or betting big on stocks when you don’t really have the stomach for it.

snip

73

posted on

04/03/2015 2:40:38 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Not to worry, everyone can go back to bed because the markets are closed for Good Friday. I know, this year the federal government's ignoring it and the Unemployment rate's coming out (as if anyone could care) but for the rest of us it's a 3 day weekend.

Wishing everyone a very special Easter!

To: expat_panama

Back to bed!?!?!? Doncha know MONEY NEVER SLEEPS, PAL!!

75

posted on

04/03/2015 4:44:04 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

To: expat_panama

glad it is closed today. with the jobs report today it would have probably been another down day.

77

posted on

04/03/2015 6:49:44 AM PDT

by

Qwackertoo

(Worst 8 years ever, First Affirmative Action President, I hope those who did this to us SUFFER MOST!)

To: Qwackertoo

hard to say; futures had started upbeat and my take is that serious people have long since given up on the headline unempl. rate. As it is we added 34M jobs and 277M to the “not in the labor force”. That has to mean something.

To: expat_panama

“Wishing everyone a very special Easter!”

Thank you Expat, and same to you.

What are your thoughts about the fallout from the probable Iran ‘deal’? In particular oil, the US Dollar, and defense contractors like Lockheed and Raytheon?

Seems to me the ME just got a lot more dangerous, especially for Israel.

79

posted on

04/04/2015 12:19:11 AM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: MichaelCorleone

imho it’s a total wild card —probably amounting to nothing but HUGE downside potential all over the place. That’s also what I’m getting from the pundit/analysts too, that nobody’s got a clue here —but one thing for sure is it’s important and I’ll have to include it in the next week’s tread —tx!

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

(excerpt from)

(excerpt from)