Skip to comments.

Something weird is going on --Investor Thread March 29, 2015

Weekly investment & finance thread ^

| Mar. 29, 2015

| Freeper Investors

Posted on 03/28/2015 3:17:44 PM PDT by expat_panama

(excerpt from) ...Despite experiencing a healthy pace of job growth, the US economy has largely disappointed economists' expectations by delivering a series of weaker-than-expected economic reports. (excerpt from) ...Despite experiencing a healthy pace of job growth, the US economy has largely disappointed economists' expectations by delivering a series of weaker-than-expected economic reports.

The unexpected plunges in retail sales and durable goods orders stand out as they reflect weakness in both consumers and businesses.

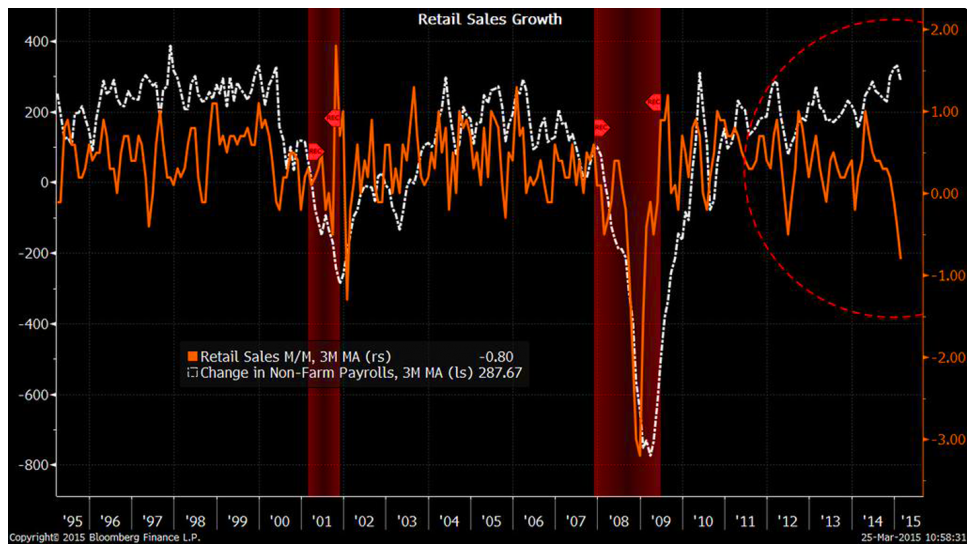

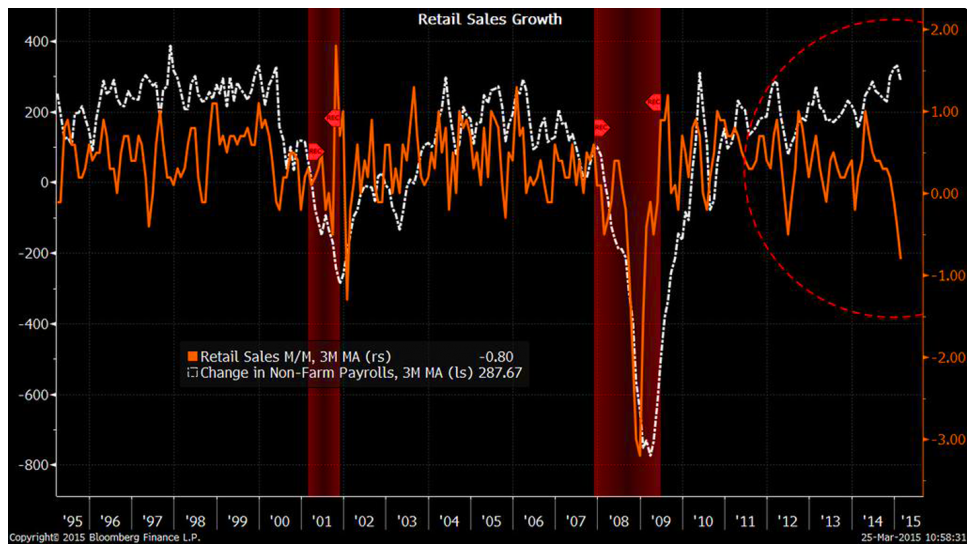

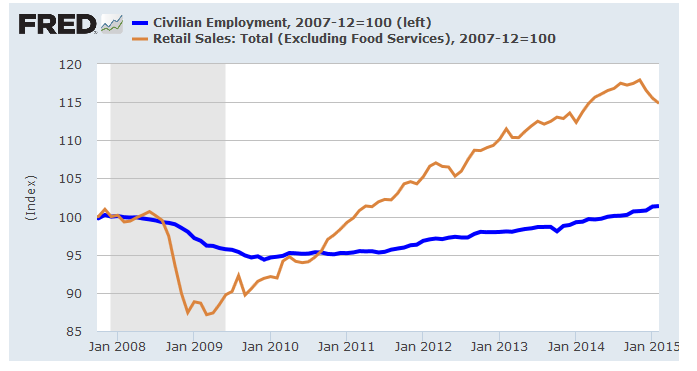

On Wednesday, Bloomberg LP Chief Economist Michael McDonough tweeted a chart of the unprecedented divergence between job growth and retail sales growth. This is concerning as personal consumption accounts for roughly 70% of US GDP.

It's particularly concerning considering all of the extra spending money Americans supposedly have thanks to falling gas prices.

"Recent US data have been disappointing," Goldman Sachs Kris Dawsey said late Thursday. Dawsey thinks GDP growth could tumble to 1.4% in Q1 from 2.2% growth in Q4 of last year. Economists had previously expected GDP growth to accelerate in Q1 to around 3%.Q2 Comeback?

For the most part, economists have attributed much of the recent weakness to unusually harsh winter weather and the plunge in oil prices, which has slammed the spending plans of US drillers. For this reason, economists are optimistic that weakness in Q1 could be offset by a rebound in Q2.

Dawsey specifically sees three reasons to be bullish on Q2:

Consumers will bounce back: "While some of this output may be lost for good (i.e. people won't eat two restaurant meals the next time they go out to make up for snow-delayed date night), a simple bounce-back to the prior level of spending would boost the growth rate in Q2 by roughly the same amount as the Q1 drag. In addition, some of the activity may just be shifted into Q2, in particular with regard to residential investment, resulting in an even bigger potential boost." Energy companies will bounce back... [snip] Gas savings will fuel spending...

|

|

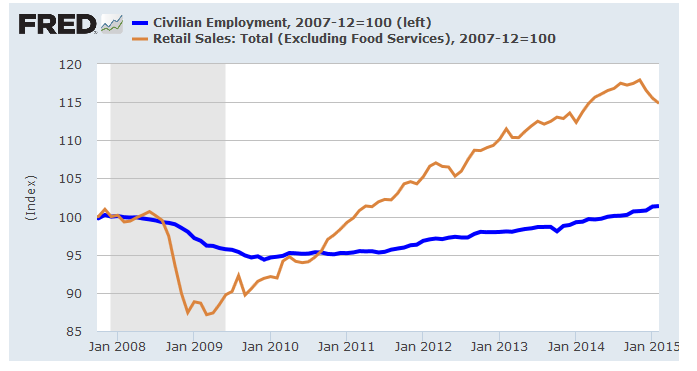

--is that (1) this "weird" stuff really is happening, (2) but not the way BI said, and (3) it's actually a good thing. In the first place BI's numbers are real and true. However the article uses them to support the belief that we got "...plunges in retail sales... ...the unprecedented divergence between job growth and retail sales growth." Reality is that for years now we've not seen falling sales and rising employment, we've had falling employment and climbing sales.  The 'misunderstanding' (a kind way of saying "deceit") was caused by allowing monthly changes in jobs'n'sales to pass for what's really going on with jobs'n'sales. Reality is that the actual cumulative increase in sales since the recession, is really a 15% climb, while total employment's dragged up a meager one percent. Job stagnation looks even worse when we take into account population growth over the period --17 million more people is a 6% expansion that shows how our 1% employment increase is truly inadequate. But we digress. But as long as we're digressing how about we also remember that this so-called 15% boom in sales ignores inflation and population growth. Taking those factors into account we find that real per capita sales is down 5% from the pre-recession high and remember that for decades Americans had been enjoying continuous sales growth-- OK so the economy sucks but that's still not the point. The BI writer (he holds a BA in Religion from Boston University) screwed up by passing on the idea that the drop in sales was an "unprecedented divergence" along with a the graphic that circled an era going back years. Coming back to the Planet Earth the divergence that we do have does not span "years". It's been going on now more like for a couple months. Hey, remember that everyone says "size doesn't matter" so let's be happy with what we got because there're a number of reasons why falling sales and rising employment can even be good for us. For starters it means that people are getting back to work and they're saving for hard times ahead. Americans. Ya can't beat 'em. Another reason is that the past few years of stagnant jobs and rising sales has only been possible because of the rise of spending by the elite wealthy. Whoa --we're not going into some goofy income inequality shtick because equal incomes is what Marx advocated. Bad idea. Our problem is that until recently the risk has been a separation between the rich and poor --an opportunity deficit that threatened to close the book on America's success stories. These past few months offer reassurance that wealth class structure is not that solid after all. Finally my take is that at the very least falling sales --while short term pain-- can be a 'wake-up-call' for the policy wonks that don't know or don't want admit the economy sucks. They might even get off our backs and let us get back to work... |

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; recession; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

To: expat_panama

the added costs of Obamacare took all of the energy savings moving people got, and now that prices are going back up, we are up a creek without a paddle. Oh, and all those economic numbers are made up by Obama.

21

posted on

03/28/2015 5:47:40 PM PDT

by

TexasFreeper2009

(Obama lied .. the economy died.)

To: MichaelCorleone

It would have been, buy Obama delayed the worst parts unilaterally.

22

posted on

03/28/2015 5:48:36 PM PDT

by

TexasFreeper2009

(Obama lied .. the economy died.)

To: Truth29

Both my wife and I (seniors) notice business is definitely down at the various doctors we go to.

My thought is that the mega-deductibles on policies are keeping people away.

23

posted on

03/28/2015 5:52:54 PM PDT

by

nascarnation

(Impeach, convict, deport)

To: expat_panama

It sounds to me like the “powers that be” are simply making a futile effort to resuscitate a very dead patient.

24

posted on

03/28/2015 5:55:31 PM PDT

by

The Duke

(Azealia Banks)

To: 1010RD

To: Truth29

26

posted on

03/28/2015 9:00:20 PM PDT

by

PA Engineer

(Liberate America from the Occupation Media.)

To: PA Engineer

tx fer the link. Many of us have issues w/ Zerohedge but I got bigger issues w/ Obamacare and what it’s doing to the marketplace.

To: expat_panama

28

posted on

03/29/2015 11:42:15 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

That’s a real head scratcher. The main problem with a 401k is non participation so do away. with it? Force everyone into a govt plan. Don’t we already have that in Soc Sec?

29

posted on

03/29/2015 1:05:47 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Read up on Ghilarducci. She’s been selling this stuff for years, and manages to get quoted often in the State-Run Media.

30

posted on

03/29/2015 1:23:06 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Inflation the hidden tax.

31

posted on

03/29/2015 1:28:56 PM PDT

by

bmwcyle

(People who do not study history are destine to believe really ignorant statements.)

To: bmwcyle

Inflation the hidden tax.People say that, the reasoning being that if the gov't prints too much extra money then the gov't gets to buy more stuff w/o earning it and the people find their savings buy less stuff. Wealth goes from the people to the gov't.

We can say that deflation is a hidden tax too. The reasoning is that the gov't prints not enough money so prices go down --including wages-- but what doesn't go down is last year's taxes and loan payments. The gov't gets to buy extra stuff w/ the tax revenue so wealth leaves the people and goes to the gov't.

To: abb

Sounds like USA Today and CNBC are back trying to push the idea that Americans don't know how to save enough for retirement --their argument is that with 401(k)'s "the median for savers aged 55 to 64 in 2013 was $76,381". Not very much considering that the rule of thumb is that only 4% of savings can be counted on to replace for lost annual income.

The thing is that on average for each and every dollar that Americans have in 401(k)'s they also got another $30 elsewhere socked away. So just because the article found "millions" that can't take care of themselves, the fact remains that there are still hundreds of millions that can. We sure don't need more gov't control of people's retirement savings.

To: expat_panama

34

posted on

03/29/2015 4:14:22 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: central_va

when did you first realize you are an American enemy?

35

posted on

03/29/2015 4:22:11 PM PDT

by

bert

((K.E.; N.P.; GOPc.;+12, 73, ..... Obama is public enemy #1)

To: expat_panama

Listening to the interview. The woman’s a straight-up Marxist.

36

posted on

03/29/2015 4:23:26 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

After the shock of the Depression and the lack of consumer goods to buy during WWII, Americans were heavy into saving for a rainy day and making regular deposits into bank accounts. I’m the son of a WWII Marine and a member of the clean your plate club and fix it or mend it.

As a baby boomer, I had the benefit of a booming economy, good & cheap education and always had work, never cashed an unemployment check.

The booming economy fooled a lot of my generation into not worrying about the economy or saving for retirement.

We boomers also read Dr.Spock and spoiled our kids with love & possessions, so our kids are even less into saving. Plus, with school cost rising like rockets, our kids are not in a position to save as I did.

The 2008—>to God knows when recession has turned we citizens into debtors and our government into a monster that eats both our money and privacy. I still believe America has a future, but we citizens have to work harder and take care of our families on our own. More government isn’t the solution, it’s still the problem as Reagan said.

As a saver and pay off your debts guy, my retirement investments are heavy into big and medium cap stocks that pay dividends & mutual funds/ETFs that are similar. With low interest rates bonds just do not attract me. I’m a gold bug and believe 5% of savings should go into physical gold or GLD/IAU. It’s also good to have cash on hand and a stash the family can live on for a month or two if all hell breaks out. I have little faith our government will be on the job, considering how it fails simpler tasks.

37

posted on

03/29/2015 5:10:02 PM PDT

by

RicocheT

(us)

To: abb

Listening to the interview.Into about 10 min. I began to break out in a systemic allergic reaction itching head to toe. Turned it off and felt better immediately...

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Happy Monday morning! Futures are seeing stocks up and metals down at 3 hours before opening +0.71% and -0.56% respectively. Traders may be expecting good news w/ announcements at opening bell for Personal Income/Spending, PCE Prices - Core, and Pending Home Sales, or maybe it's something in the news --there's sure a lot of it:

World stocks gain after Yellen signals gradual rise in rates World stock markets were buoyant Monday as investors cheered Fed chief Janet Yellen's comments signaling that U.S. interest rates would rise only gradually. Chinese stocks soared on hopes for more economic

Oil prices drop on weak demand, potential Iran deal

Small investors blame losses on brokers they once trusted

Business forecasters boost 2-year outlook for US economy

America's Economy in 2015 – Lower Unemployment and Inflation, More Spending

European, Asian shares rise, helped by Chinese stimulus Reuters - 9 hours ago LONDON (Reuters) - Shares rose on Monday with Asian stocks buoyed by hopes for stimulus to boost China's economy, but the euro slipped on more concern about Greece's finances.

MarketsOil sags as traders reverse Yemen bid Financial Times - an hour ago US and international oil prices slid as underlying volatility soared on Monday, days after tensions in Libya sent the commodity higher.

A Controversial Theory That Has Yellen Worried - Alex Rosenberg, CNBC

Economy Is Soon To Emerge From Its Slump - Rex Nutting, MarketWatch

Google Controls What We Buy, Read, Plus O's Policies - Kyle Smith, NYP

To: PA Engineer

Could also be the public is more aware of Obamas blunders overall, not to mention the status in the M.East with Iran and other ME nations.....it’s scary for some and they are going to hold onto their money.

40

posted on

03/30/2015 4:09:13 AM PDT

by

caww

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

(excerpt from)

(excerpt from)