Posted on 03/01/2015 5:34:21 AM PST by expat_panama

Good Morning (--or maybe early afternoon) a late start with this already--

Date Time (ET) Statistic Actual Briefing Forecast Market Expects Prior Revised From 5-Mar 7:30 AM Challenger Job Cuts 20.90% NA NA 17.60% - 5-Mar 8:30 AM Initial Claims 320K 300K 295K 313K - 5-Mar 8:30 AM Continuing Claims 2421K 2400K 2404K 2404K 2401K 5-Mar 8:30 AM Productivity-Rev. -2.20% -1.60% -2.30% -1.80% - 5-Mar 8:30 AM Unit Labor Costs -Rev 4.10%

--and later we get Factory Orders and Natural Gas Inventories. Stock futures are up and climbing seeing indexes +0.26 and metals +0.21% although those are right now trading off a bit w/ gold $1,200.65 and silver $16.25. Yesterday's stocks were an S&P500 distribution day but the thinking is that we still got a lot of momentum left....

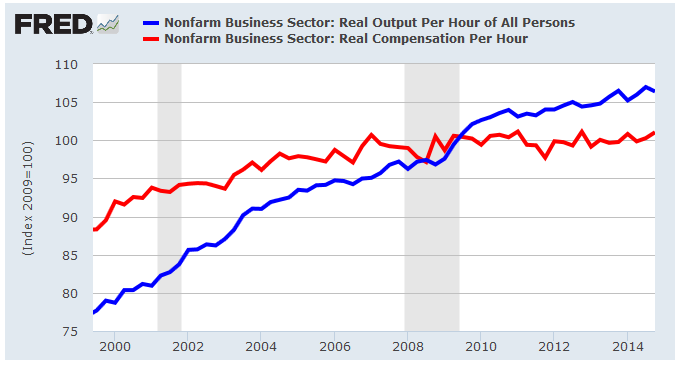

Nobody's talking about it but before '07 when the U.S. got taken over by the professional victims we had climbing real wages along with climbing output. Since then we've seen output stalling and the beginnings of a wage crunch. My bet is in further wage cuts.

Oil Glut Sparks Latest Dilemma: Where to Put It All

As storage tanks near capacity, some predict spillover will send crude prices even lower

By Nicole Friedman

Updated March 5, 2015 3:17 p.m. ET

In a world awash in crude, oil producers and traders are facing a billion-barrel conundrum: where to put it all.

U.S. crude-oil supplies are at their highest level in more 80 years, according to data from the Energy Information Administration, equal to nearly 70% of the nation’s storage capacity. A key U.S. storage hub in Cushing, Okla., is expected to hit maximum capacity this spring. While estimates are rough, Citigroup Inc. believes European commercial crude storage could be more than 90% full, and inventories in South Korea, South Africa and Japan could be at more than 80% of capacity.

The danger of running out of places to stash crude: Some analysts predict prices, already down 50% since June, could spiral even lower as producers sell oil at a discount to the few remaining buyers with room to store it. Consumers, though, would continue to be big winners as refineries convert an ocean of crude into gasoline and other fuels.

snip

Here’s what I don’t get. The production level hasn’t grown that much in the last 6 months when the price started to fall. Why isn’t it being absorbed through demand particularly at lower energy costs?

I think this is the formula that applies. You’re probably more up to speed on this, than am I. Been a while since Econ 301.

http://www.tutor2u.net/economics/content/topics/elasticity/elastic.htm

If the PED is less than one, the good is inelastic. Demand is not very responsive to changes in price. If for example a 20% increase in price leads to a 5% fall in quantity demanded, the price elasticity = 0.25

Factors that determine the value of price elasticity of demand

1. Number of close substitutes within the market - The more (and closer) substitutes available in the market the more elastic demand will be in response to a change in price. In this case, the substitution effect will be quite strong.

2. Luxuries and necessities - Necessities tend to have a more inelastic demand curve, whereas luxury goods and services tend to be more elastic. For example, the demand for opera tickets is more elastic than the demand for urban rail travel. The demand for vacation air travel is more elastic than the demand for business air travel.

3. Percentage of income spent on a good - It may be the case that the smaller the proportion of income spent taken up with purchasing the good or service the more inelastic demand will be.

4. Habit forming goods - Goods such as cigarettes and drugs tend to be inelastic in demand. Preferences are such that habitual consumers of certain products become de-sensitised to price changes.

5. Time period under consideration - Demand tends to be more elastic in the long run rather than in the short run. For example, after the two world oil price shocks of the 1970s - the “response” to higher oil prices was modest in the immediate period after price increases, but as time passed, people found ways to consume less petroleum and other oil products. This included measures to get better mileage from their cars; higher spending on insulation in homes and car pooling for commuters. The demand for oil became more elastic in the long-run.

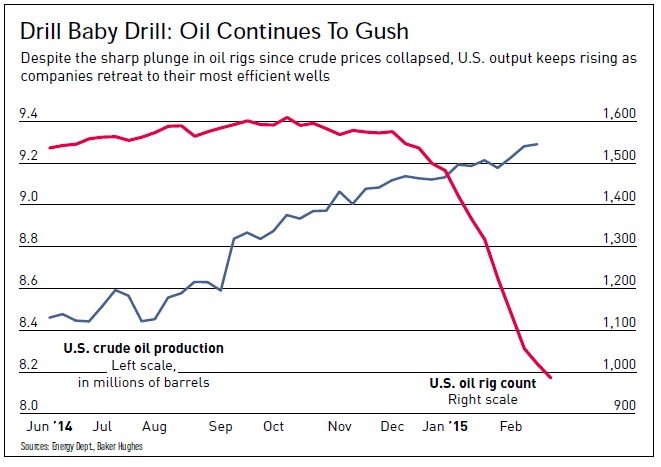

According to IBD's data mining with the Energy Dept. production's been continuously increasing:

Nice find. Imagine what our rating would be if Obama’s people weren’t in charge.

Happy Friday! Futures traders have metals dropping 0.39% (long-standing base is failing) and stocks flat/off at -0.06%. Ending the week with a big report stack this morning:

Nonfarm Payrolls

Nonfarm Private Payrolls

Unemployment Rate

Hourly Earnings

Average Workweek

Trade Balance

Consumer Credit

Here’s an interesting presentation (infographic really) from GS on Millennials. A lot of people my age (Gen X) and older (Boomers) think the Millennials are “going to have to change”. That’s not going to happen. They are too big.

http://www.goldmansachs.com/our-thinking/outlook/millennials/index.html

Back that up a bit (or change the scale). 8.4 million barrels per day to 9.2 million is a 10%ish increase. Not enough to drive a 50% decrease in WTI and a 35% decrease in rig counts. I still wonder why now. Best answer I have is bubbles pop they don’t deflate...

Here’s my prediction for NFP - “Weather”

:-)

NFP +295K

U3 5.5%

Labor Force fell 178K driving the U3 downward

U6 11.0% down from 11.3%

Janet Yellen was spotted in a mad rush to raise rates. ;^)

Apple to replace AT%T in the DOW.

Maybe it was. Oil markets are notoriously inelastic both in supply and demand so a 10% unneeded increase will go right into very expensive storage. That expense will force the dumping of the stock pile even below cost as dealers cut their losses. What raised my eyebrow was the extreme differences in rig production that could permit so many shutdowns. We're also seeing an accelerated increase in the efficiency of the remaining wells that account for production boosts.

We're agreeing that the price is falling, that production is up, and rigs are being shut down. That's the "what" that we agree on. The "whys" I'm offering here are conjecture. OK, so they're learned, expert, and brilliant but I'll confess they're still just conjecture.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.