Skip to comments.

Stock Run-up 3 Weeks Old, Experts Confused-- Investor Thread March 1, 2015

Weekly investment & finance thread ^

| Mar. 1, 2015

| Freeper Investors

Posted on 03/01/2015 5:34:21 AM PST by expat_panama

[excerpt from Stock-market crash of 2016: The countdown begins] [excerpt from Stock-market crash of 2016: The countdown begins]Dow will drop 50% as market replays 2008, 2000 and 1929. That will translate into the DJIA crashing from today’s 18,117 down 50% to about 9,000. Ouch, the Dow crashing all the way below 10,000. Unimaginable. Bulls will hate it. No wonder our brains tune out, turn off. Instead, we prefer the happy talk that will just keep coming out of Wall Street and Washington till the 2016 collapse. We’ll just keep denying reality ... till it’s too late, and we suffer another $10 trillion loss is on the books.

Deja vu 2000: irrational exuberance, dot-com technologies

Remember 1999. Just 16 years ago. Roaring hot “irrational exuberance.” Renewed stock market mania. Wall Street was hot. Stocks roaring. Back then investors demanded insane annual returns during the worldwide millennium celebrations: the top 19 mutual funds had 179% to 323% annual returns.

Yes, dot-com stockholders expected 100% plus returns on zero revenues...

[snip]

...Deja vu the Crash of 1929: and the long Great Depression...

[snip]

...Yikes, it took 13 long years to break even from Wall Street’s losses of 2000 and 2008. And now investors are being warned that the Crash of 2016 will be even worse, with new losses of 50%. In short, the market really is bad news.

But still, here we are again, panicking: Fearing that 2016 will repeat 1929, fearing that Wall Street and Main Street, tens of millions of Americans, plus the Fed, the SEC, Washington politicians in both parties will refuse to prepare for the Crash of 2016. Will deny hearing the warnings ... of the Crash of 2016, one that promises in the end to become bigger and badder and far more dangerous than 2008, 1999 and 1929 combined. Listen closely, the countdown to the Crash of 2016 has started. |

|

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’] [excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]DI’ll give veteran MarketWatch columnist Paul B. Farrell his due: The man knows how to draw clicks.

It’s hard to avoid an article with the headline: “Stock Market Crash of 2016: The Countdown Begins.”

While many seasoned consumers of financial journalism might be inclined to dismiss an article with such a bombastic headline right off the bat, I’m always willing to at least consider the arguments behind such a claim.

If such a crash is a year off, it’s important to start preparing. A 50% decline in stock-market value is a sharper drop than we endured in 2008.

Fortunately for long investors everywhere, there is little about the article that should send anyone cashing out of stocks...

[snip]

...The bigger issue on trial here is the idea that investors should make big asset bets based on bold market forecasts, whether by professional money managers or journalists....

[snip]

...“Sure, they suffered steep losses (and likely lost some serious sleep) as stocks cratered during the financial crisis,” Egan writes. “Yet they also enjoyed a dramatic rebound in U.S. stocks as the system stabilized. The S&P 500 is up over 200% since the bottoming out in March 2009.”

He adds that it may be tempting to stay on the sidelines. However, holding too much cash for fear of a market crash will almost certainly cause you to miss extended periods when markets perform well.

|

More precision confusion from experienced professionals:

More precision confusion from experienced professionals:

* * * * * * * * * * * * * * * * * *

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-86 next last

To: All

I don’t normally watch the TV program “60 minutes” but last night I did. They done a piece on Lumber Liquidators that wasn’t pretty. If you seen it, it would make you want to short the stock but I see it’s up slightly. Their Chinese made laminate flooring does not meet legal standards on formaldehyde levels.

41

posted on

03/02/2015 7:23:33 AM PST

by

BipolarBob

(I may be bi-polar but at least I like myselves.)

To: expat_panama

First trading day of March 2015 and the market opens up. Spring is in the air and the bulls romp in the pasture. It will continue for a while absent really bad news here or abroad.

42

posted on

03/02/2015 9:26:43 AM PST

by

RicocheT

(us)

To: RicocheT

Sure seems like it, I know I’m having fun! I do have to avoid thinking about congress tho...

To: BipolarBob

Huh. I used to own it.

iirc they'd been Rush sponsors but they quit using the 'slut' thing as an excuse, but the main problem was dealing w/ the leftist attacks over wood cutting being bad for ecology. They had a big law suit/inventory confiscation over 'protected' woods at one time. Maybe this 60minutes was just the latest left wing attack.

To: expat_panama

45

posted on

03/02/2015 11:06:33 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

huh, that wasn’t in this morning’s news, it just came out this aft.! Interesting...

To: expat_panama

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

To: Wyatt's Torch

Whoa, lot of stuff there —tx! Wording in the title (”US Economic Outlook Edging closer to Liftoff”) is saying the US economy has still not “lifted off”. That’s not the party line of most PhD’s...

To: expat_panama

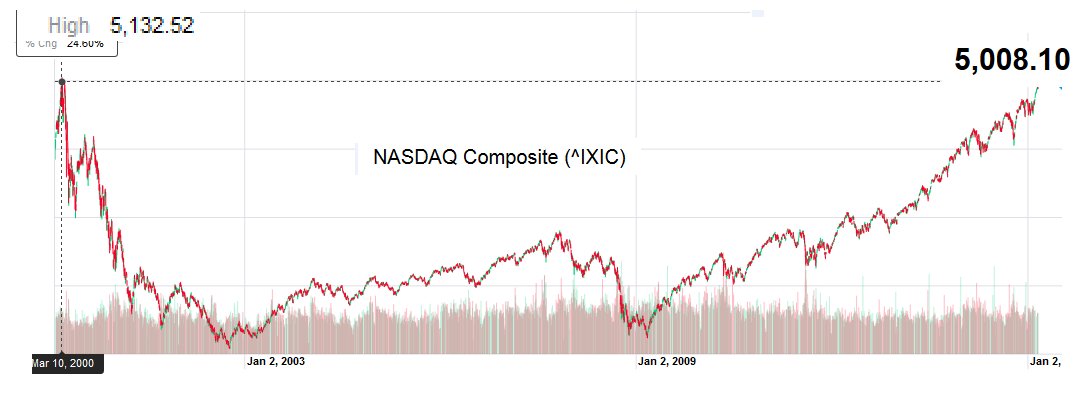

Nice fifteen year cup on the NASDAQ.

50

posted on

03/03/2015 5:38:53 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

To: expat_panama

F sales -2% vs exp of +5%

Oops...

To: Wyatt's Torch

“Ooops” is right, but the stock price is recovering from its 4% opening slam.

To: Lurkina.n.Learnin

Yeah, the tech folks keep telling us to never try to use technical indicator patterns like cup’n’handle etc. on indexes, but we all do it anyway. My bet’s on a NASDAQ break-though.

To: expat_panama

The APPL Dow instead of IBM:

To: All

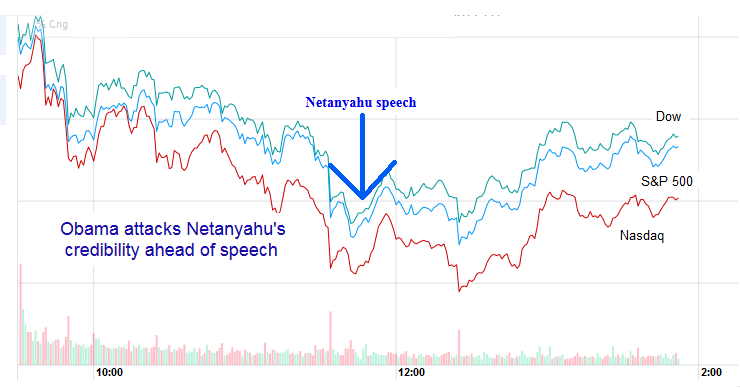

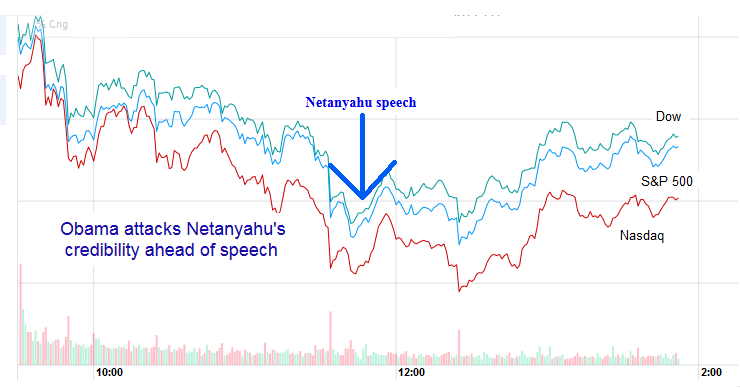

Market Watch headline on

this thread:

"U.S. stocks retreat from records after Netanyahu speech"What actually happened:

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good morning and the futures traders (metals -0.38%, indexes -0.30%) are beginning to tell us "take the money and run!" True, both stocks'n'metals have been flat for the better part of a week now but they may be seeing things in terms of a rally that's showing its age. Reports galore today--

MBA Mortgage Index

ADP Employment Change

ISM Services

Crude Inventories

Fed's Beige Book

--to go w/ lively FR econ threads:

To: expat_panama

58

posted on

03/04/2015 6:48:37 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama; All

What's going on? Stocks are down, gold and silver are down, at the grocery prices of some basic foods that had stayed stable were up and there were shortages of some items.

Add to that what I'd call a common sense factor. Fuel bills for February are going to be a nightmare in a large part of the country. What's that going to do to the economy in the near term?

59

posted on

03/04/2015 8:51:09 AM PST

by

grania

To: grania

What's going on? Stocks are down, gold and silver are down...Actually, they're up --all major indexes are now higher than they were two hours ago. OK, you mean they're down from where they were at close/business yesterday. True, but they're still higher than they were 2 weeks ago. It goes on and on and it's not news that stock prices fluctuate. You asked; imho they're right now generally down (see I agree on using your time frame) because the current buying wave seems like it's cresting --like steering a car as we first correct one way and then back the other.

Then again, I may be wrong...

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-86 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

[excerpt from Stock-market crash of 2016: The countdown begins]

[excerpt from Stock-market crash of 2016: The countdown begins]

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]

More precision confusion from experienced professionals:

More precision confusion from experienced professionals: