Skip to comments.

Average US Household Wealth Plunges to Only $656,039!! Details: Jan. 11 Investment & Finance Thread

Weekly investment & finance thread ^

| Jan. 11, 2015

| Freeper Investors

Posted on 01/11/2015 10:06:38 AM PST by expat_panama

| |

|

|

|

| |

Average U.S. |

|

| |

Household Wealth |

|

| |

|

|

|

| |

Real Estate |

$186,702 |

|

| |

Durables |

$44,374 |

|

| |

Deposits |

$81,497 |

|

| |

Stocks/Business |

$422,126 |

|

| |

Bonds |

$27,139 |

|

| |

Misc. |

$7,598 |

|

| |

|

____________ |

|

| |

Total Assets |

$769,435 |

|

| |

|

|

|

| |

Debts |

-$113,397 |

|

| |

|

_____________ |

|

| |

Net Worth |

$656,039 |

|

| |

|

|

|

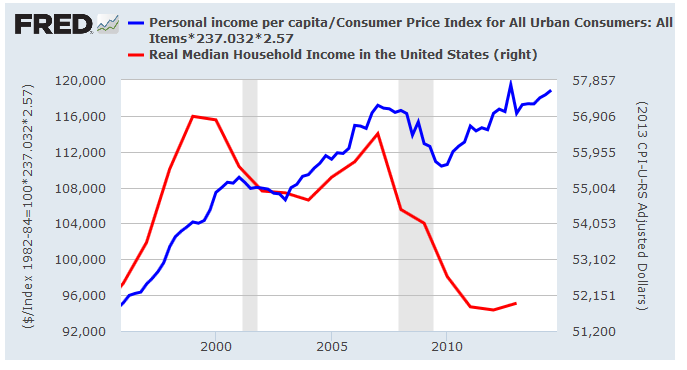

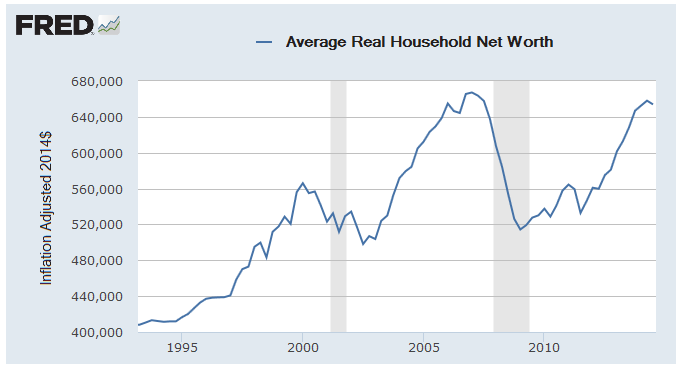

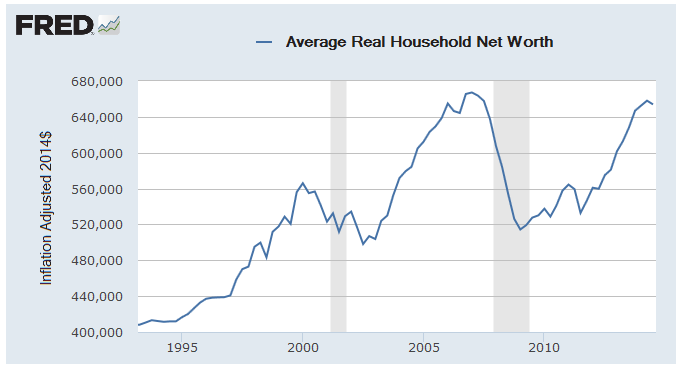

Something that snuck by me (and most people) last month was the Fed's quarterly Flow of Funds Report --their bigass number-dump that says where all America's money has gone. My favorite part is the one on household balances (Table B.100 page 117) and the big secret that the press has been hiding is the fact that that total private wealth actually dropped in the third quarter 2014! Ah yes, our unemployment rate's just 5.6% and a good time's being had by all-- yeah right.  Then we hear "aw jeeze guys, let's not forget America's wealth is steady --off less than 2/10ths of % of the previous quarter's all time high. So there. Time to stop and think about inflation and population growth --and we slam into the fact that real average household wealth is still less than it was before all the hope'n'change. What we got is that even after all the work Americans have been doing for the past seven years we've gotten nowhere --in fact we're worse off: the average American household has fallen to a mere ⅔ of a $million. Hmmm. A household w/ a over $113 grand in mortgages/debts on assets (mostly stocks'n'real-estate) totaling $769K. Off hand I don't remember my bank saying I got a balance of $81,497. |

|

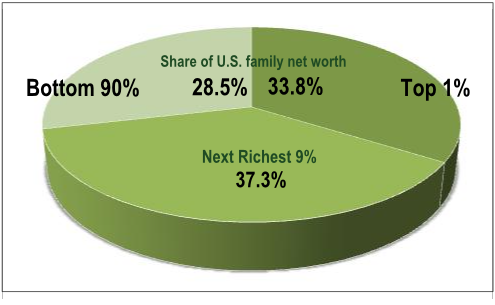

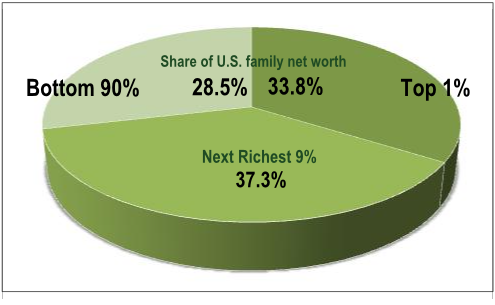

OK, y'all are probably way ahead of me saying that these are averages --all skewed by the fact that the vast majority of us are slogging away and that money-grubbing one percent has the overall numbers distorted way off from how the vast majority lives (more on average/mean incomes here). Maybe. |

|

| ↨ mandatory Occupy Wall Street income and wealth inequality graphics (click to enlarge)  |

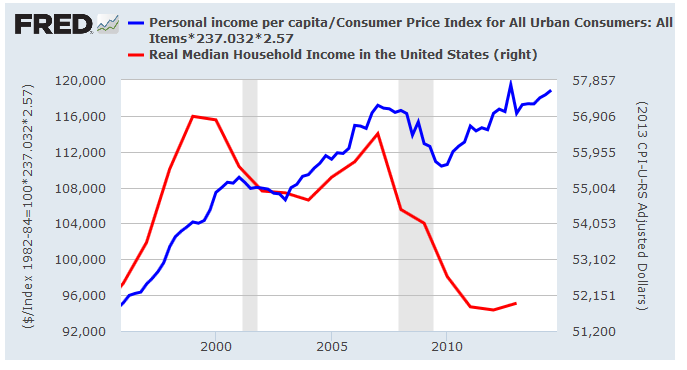

The Fed stats picked up from the Census Bur. tell us that median real household income has fallen, but the Bureau of Economic Analysis that average real incomes are twice the median and are increasing. I mean, I can hate the over-achievers as much as the next guy but at some point we need to notice that somehow we left Numberland and we now find we've wandered over into the Fantasy Kingdom of the Political Hacks. |

* * * * * * * * * *

In the mean time I'm struggling to find a way to make do w/ only $656,039 to my name. Yeah, I know I don't have $80-some K in the bank but I got this really neat Sox baseball cap that I know I could get a half mil. on Ebay...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; householdwealth; networth; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-126 next last

To: expat_panama

http://www.wsj.com/articles/oil-extends-selloff-despite-strong-chinese-trade-oil-data-1421127568?mod=WSJ_hp_LEFTTopStories

Oil Extends Selloff on UAE Minister’s Comments

Nymex Crude Oil Futures Drop Below $45 Per Barrel

By Georgi Kantchev

Updated Jan. 13, 2015 4:28 a.m. ET

LONDON—The oil market extended its selloff Tuesday, coming close to six-year lows after the United Arab Emirates’ oil minister said the Organization of the Petroleum Exporting Countries would stand firm on its decision to keep output unchanged.

The market shrugged off strong trade data out of China and pushed below the $45 a barrel mark for the U.S. oil benchmark.

Brent crude for February delivery fell 2.8% to $46.09 a barrel on London’s ICE exchange. On the New York Mercantile Exchange, light, sweet crude futures traded at $44.87 a barrel, down more than a dollar from Monday’s settlement.

“We are still very much sentiment-driven and the sentiment will continue to be negative as long as there is no change in production,” said Thina M. Saltvedt, senior oil analyst at Nordea Bank Norge. “Oil is still piling up.”

Market participants estimate that the supply of crude is currently overshooting tepid demand for the commodity by as much as 2 million barrels a day.

81

posted on

01/13/2015 1:55:17 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good morning it's a beautiful day! Stock futures are rosy, up +0.56% just like yesterday --oops: Stocks Hit With Distribution. This time will be different maybe. After all, metals futures are +0.12% up today too just like yesterday and they ended soaring (gold'n'silver now $1,238.75 & $16.94). Reports start trickling in today w/ JOLTS - Job Openings and Treasury Budget. Breaking news direct from the Living-in-Interesting-Times wire service:

To: cynwoody

Thanks for the info! Don’t know why I hadn’t found it searching in the same place for the same info —must not have used the right key words.

To: expat_panama

To: Wyatt's Torch

85

posted on

01/13/2015 8:04:02 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

To: expat_panama

To: Wyatt's Torch

With the growth of the internet and own-job-protecting “human resources” bureaucrats, no one has a clue how many actual job openings there are. How are multiple ads for the same job filtered out? How are recruiters stockpiling candidates by advertising for non-existent jobs filtered out?

Or, if a company advertises for an experienced diesel mechanic and pays $10 per hour, is that a real “unfilled” job opening?

There’s always a demand for people with true technical skills, from woodworking to software.

88

posted on

01/13/2015 8:41:19 AM PST

by

hlmencken3

(“I paid for an argument, but you’re just contradicting!”)

To: Wyatt's Torch

since January 2001Wait a sec., Jan. 2001 was supposed to be right when the worst recession in history began.

To: expat_panama

Da bears are winnin for now.

90

posted on

01/13/2015 10:51:07 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

To: expat_panama

Rut roh... From Gundlach's presentation this afternoon:

To: ConstantSkeptic

I was thinking of the average American. You and your husband are obviously above average. Most people have no capital to speak of. Labor is easier for them and a small business is best.

93

posted on

01/13/2015 2:01:59 PM PST

by

1010RD

(First, Do No Harm)

To: 1010RD

I was thinking of the average American. You and your husband are obviously above average. Most people have no capital to speak of. Labor is easier for them and a small business is best. If a person doesn't have capital, just labor, what small business are they supposed to start? How is that better for them financially than being an employee and then investing a portion of their wages in the stock market?

And I'm still perplexed by your comment that "the US and state governments make stock ownership expensive."

94

posted on

01/13/2015 4:00:05 PM PST

by

ConstantSkeptic

(Be careful about preconceptions)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

YIKES! oops, sorry didn't mean to shout & wake everyone up but for pitty sake we just start an uptrend and the indexes fall back down thru their 50-day moving averages. Somehow yesterday started out so nice, reversal, "Market Under Pressure", and now futures traders are looking at another -0.15%. Hmmm, that was -0.58% just a little while ago... Metals did great spiking to 3-month highs but right now profit-takers are calling for a -2.51% plunge. No small part of all this (imho) is today's data tsunami:

MBA Mortgage Index

Retail Sales

Retail Sales ex-auto

Export Prices ex-ag.

Import Prices ex-oil

Business Inventories

Crude Inventories

Fed's Beige Book

Related threads --much to discuss:

To: expat_panama

Hello!! Wake up! Money never sleeps, pal!!

96

posted on

01/14/2015 10:48:49 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Wyatt's Torch

That’s even more proof (as if more were needed) that U.S. education is the best in the world —the market doesn’t lie.

To: ConstantSkeptic

It sounds like you have a relatively limited perspective. Taxicabs, street vending, hair braiding, beauty care, construction trades, etc. are all types of “businesses” which most often hold the sole proprietorship form.

You’ve heard of the Federal Tax Code? States have those, too. There are strict limits on investing as an individual via tax deferred accounts. I won’t list all the ways, but you can take it from here.

98

posted on

01/14/2015 2:04:03 PM PST

by

1010RD

(First, Do No Harm)

To: Wyatt's Torch; expat_panama

It would be interesting to see that chart with the grad degrees broken down. I bet real studies pay a lot more than all the BS studies do. Things like business, medicine, law and the sciences.

99

posted on

01/14/2015 2:24:31 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Absolutely, but the fact that the averages come out so clearly above the others proves that either the good degrees pay so well that they bring the averages up, or that most poeple know better and study the good stuff. Either way, U.S. Ed rocks.

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-126 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson