Skip to comments.

Average US Household Wealth Plunges to Only $656,039!! Details: Jan. 11 Investment & Finance Thread

Weekly investment & finance thread ^

| Jan. 11, 2015

| Freeper Investors

Posted on 01/11/2015 10:06:38 AM PST by expat_panama

| |

|

|

|

| |

Average U.S. |

|

| |

Household Wealth |

|

| |

|

|

|

| |

Real Estate |

$186,702 |

|

| |

Durables |

$44,374 |

|

| |

Deposits |

$81,497 |

|

| |

Stocks/Business |

$422,126 |

|

| |

Bonds |

$27,139 |

|

| |

Misc. |

$7,598 |

|

| |

|

____________ |

|

| |

Total Assets |

$769,435 |

|

| |

|

|

|

| |

Debts |

-$113,397 |

|

| |

|

_____________ |

|

| |

Net Worth |

$656,039 |

|

| |

|

|

|

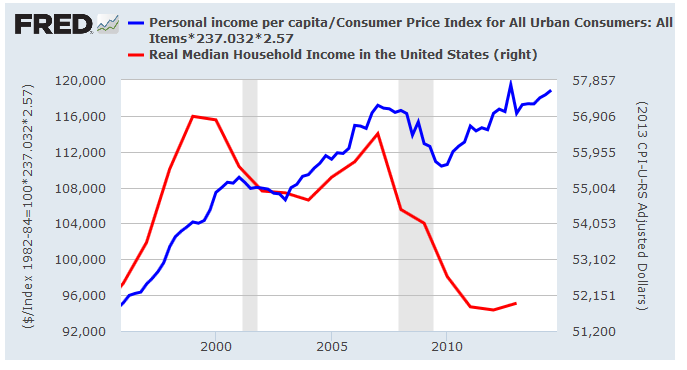

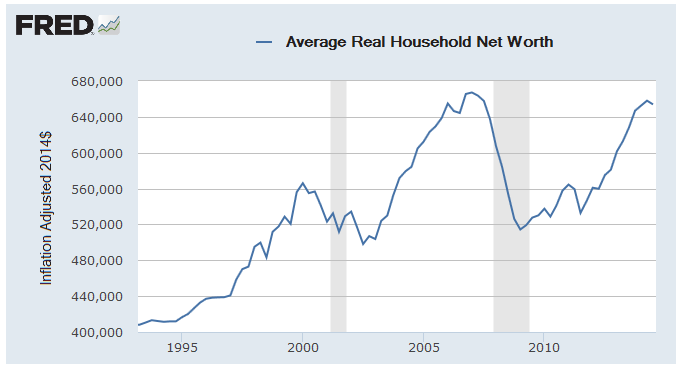

Something that snuck by me (and most people) last month was the Fed's quarterly Flow of Funds Report --their bigass number-dump that says where all America's money has gone. My favorite part is the one on household balances (Table B.100 page 117) and the big secret that the press has been hiding is the fact that that total private wealth actually dropped in the third quarter 2014! Ah yes, our unemployment rate's just 5.6% and a good time's being had by all-- yeah right.  Then we hear "aw jeeze guys, let's not forget America's wealth is steady --off less than 2/10ths of % of the previous quarter's all time high. So there. Time to stop and think about inflation and population growth --and we slam into the fact that real average household wealth is still less than it was before all the hope'n'change. What we got is that even after all the work Americans have been doing for the past seven years we've gotten nowhere --in fact we're worse off: the average American household has fallen to a mere ⅔ of a $million. Hmmm. A household w/ a over $113 grand in mortgages/debts on assets (mostly stocks'n'real-estate) totaling $769K. Off hand I don't remember my bank saying I got a balance of $81,497. |

|

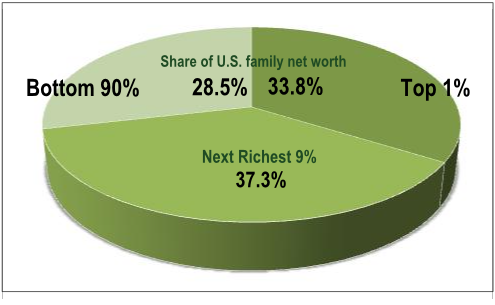

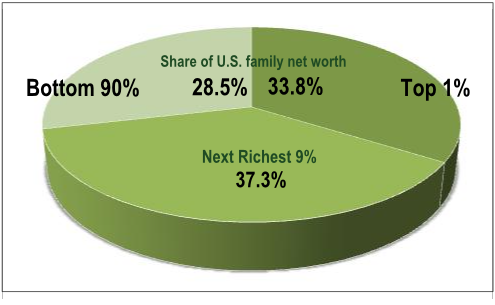

OK, y'all are probably way ahead of me saying that these are averages --all skewed by the fact that the vast majority of us are slogging away and that money-grubbing one percent has the overall numbers distorted way off from how the vast majority lives (more on average/mean incomes here). Maybe. |

|

| ↨ mandatory Occupy Wall Street income and wealth inequality graphics (click to enlarge)  |

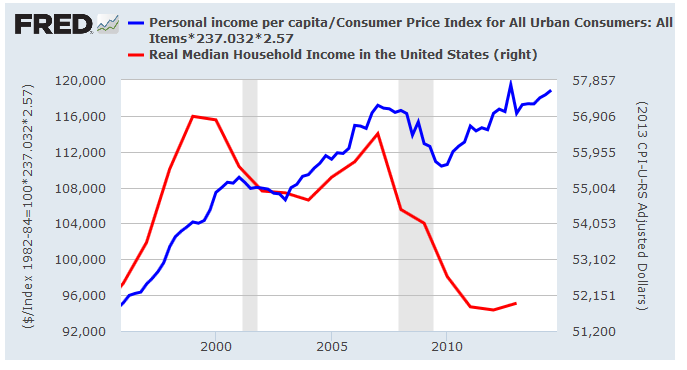

The Fed stats picked up from the Census Bur. tell us that median real household income has fallen, but the Bureau of Economic Analysis that average real incomes are twice the median and are increasing. I mean, I can hate the over-achievers as much as the next guy but at some point we need to notice that somehow we left Numberland and we now find we've wandered over into the Fantasy Kingdom of the Political Hacks. |

* * * * * * * * * *

In the mean time I'm struggling to find a way to make do w/ only $656,039 to my name. Yeah, I know I don't have $80-some K in the bank but I got this really neat Sox baseball cap that I know I could get a half mil. on Ebay...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; householdwealth; networth; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 121-126 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

We got it made in the shade ping.

Comment #3 Removed by Moderator

To: expat_panama

To: expat_panama

I stopped after “Average”.

5

posted on

01/11/2015 10:17:01 AM PST

by

CatOwner

To: CatOwner

To: expat_panama

$422,126 in stocks and business assets for the average American? Then things are really skewed, because wouldn't the "average" put a US household in the top 5% or so? And how does that jive with half the US population receiving some form(s) of benefits?

If this statistic is true, it means that "averages" have become meaningless. A sensible statistician with no prior agenda would look at quartiles and medians.

JMHO

7

posted on

01/11/2015 10:21:14 AM PST

by

grania

To: proxy_user

...about $4 million, but no one knows for sure ...and nobody could really know for sure anyway; the wife & I were talking about this and merely saying how much the house was worth fogged up the convo beyond all recognition.

To: expat_panama

Bill Gates walks into a bar.. The average wealth of the patrons and staff becomes well over a billion $.

Until he walks out.

9

posted on

01/11/2015 10:23:28 AM PST

by

cicero2k

To: expat_panama

I stopped when I thought it meant I was going to have to count what I have, because that is so depressing.

10

posted on

01/11/2015 10:26:29 AM PST

by

pallis

(I like white people)

To: grania

Meaningless blog post. The meaningful number would be median, upper half and lower half.

Median net worth of US families is less than $100k, and it’s been going down under Obama.

11

posted on

01/11/2015 10:26:36 AM PST

by

hlmencken3

(“I paid for an argument, but you’re just contradicting!”)

To: expat_panama

Remember that the $422,000 for stocks and bonds is based upon current values. I think most people will be devastated when it finally becomes apparent that most of the publicly traded corporations have been gutted and have little or no value. Creative accounting, stock buybacks with borrowed money, assets marked to fictitious values, etc. will become to the forefront as people try to cash in for retirement.

12

posted on

01/11/2015 10:28:25 AM PST

by

RetiredTexasVet

(Benghazi Clinton killed 4 & injured a dozen as SOS, imagine what she could do as CinC.)

To: expat_panama

When calculating my net worth, I normally do not include non-financial assets. That makes everything a lot simpler.

Unless you own rental property, your real estate is just a place to live and an expense. You can’t very well live without having a place to live, whether you buy it or rent it.

It does count as part of your estate; your heirs will sell it and spend the money!

To: RetiredTexasVet

It depends on how you want to evaluate companies. Standard economic theory says a company is worth the value of its discounted future after-tax cash flows. Of course, there are many gaps in GAAP, but you can’t hide lack of real profits in the long run.

I usually tend to ignore the income statement and look at the cash flow statement.

To: proxy_user

So its really not what you make but what you keep.

15

posted on

01/11/2015 10:33:23 AM PST

by

al baby

(Hi MomÂ…)

To: expat_panama

Lol...I got $650...that’s before taxes. Somebody talk to the CEO of my company. We have to increase our productivity in order for him to afford a 6000 square foot garage for his collectable autos.

16

posted on

01/11/2015 10:33:48 AM PST

by

Dallas59

To: grania; CatOwner

$422,126 in stocks and business assets for the average American?--the average American household.

You're right though, the word 'average' has it's limits. iow, it screams "FOOD FIGHT!!!". The Fed just posts the totals and here's how it's broken down:

|

|

(billion) |

| Corporate equities |

$12,885 |

| Mutual fund shares |

$7,620 |

| Security credit |

$893 |

| Life insurance reserves |

$1,259 |

| Pension entitlements |

$20,499 |

| Equity in noncorporate business |

$9,188 |

To: expat_panama

You can’t take it with you!

To: hlmencken3

And while it was posted in News instead of Bloggers, at least it wasn’t excerpted

19

posted on

01/11/2015 10:39:36 AM PST

by

bigbob

(The best way to get a bad law repealed is to enforce it strictly. Abraham Lincoln)

To: expat_panama

The average household has half a million dollars in stocks or business, bonds, or deposits? What planet is he living on?

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 121-126 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson