Something that snuck by me (and most people) last month was the Fed's quarterly Flow of Funds Report --their bigass number-dump that says where all America's money has gone. My favorite part is the one on household balances (Table B.100 page 117) and the big secret that the press has been hiding is the fact that that total private wealth actually dropped in the third quarter 2014! Ah yes, our unemployment rate's just 5.6% and a good time's being had by all-- yeah right. Then we hear "aw jeeze guys, let's not forget America's wealth is steady --off less than 2/10ths of % of the previous quarter's all time high. So there.

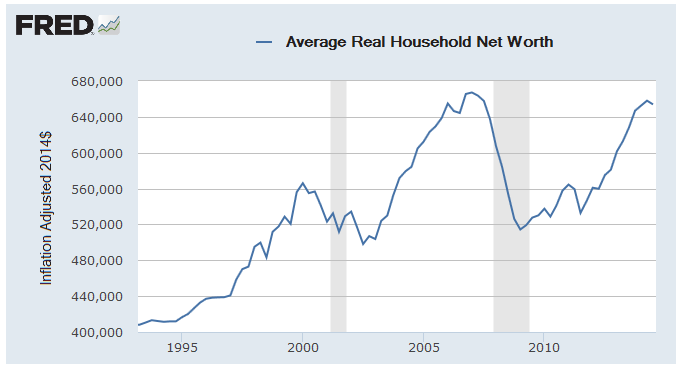

Time to stop and think about inflation and population growth --and we slam into the fact that real average household wealth is still less than it was before all the hope'n'change. What we got is that even after all the work Americans have been doing for the past seven years we've gotten nowhere --in fact we're worse off: the average American household has fallen to a mere ⅔ of a $million. Hmmm. A household w/ a over $113 grand in mortgages/debts on assets (mostly stocks'n'real-estate) totaling $769K. Off hand I don't remember my bank saying I got a balance of $81,497.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

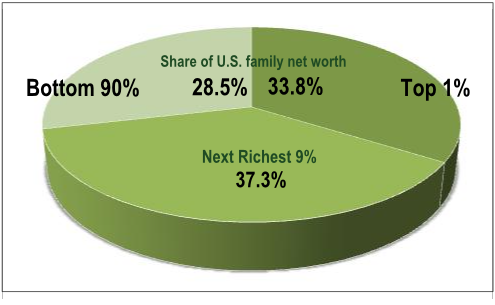

OK, y'all are probably way ahead of me saying that these are averages --all skewed by the fact that the vast majority of us are slogging away and that money-grubbing one percent has the overall numbers distorted way off from how the vast majority lives (more on average/mean incomes here). Maybe.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

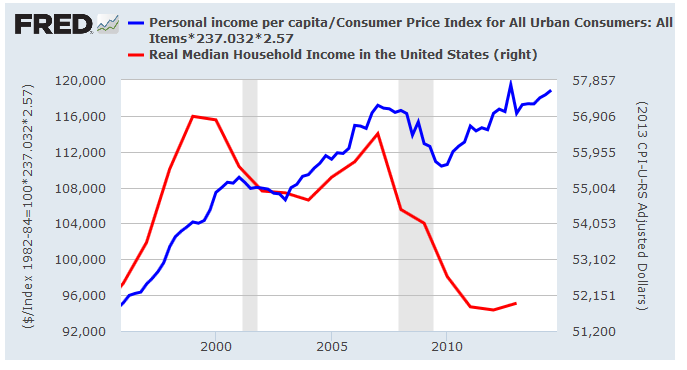

The Fed stats picked up from the Census Bur. tell us that median real household income has fallen, but the Bureau of Economic Analysis that average real incomes are twice the median and are increasing. I mean, I can hate the over-achievers as much as the next guy but at some point we need to notice that somehow we left Numberland and we now find we've wandered over into the Fantasy Kingdom of the Political Hacks. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

* * * * * * * * * *

In the mean time I'm struggling to find a way to make do w/ only $656,039 to my name. Yeah, I know I don't have $80-some K in the bank but I got this really neat Sox baseball cap that I know I could get a half mil. on Ebay...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |