Skip to comments.

Commodity Prices Are Cliff-Diving Due To The Fracturing Monetary Supernova—The Case Of Iron Ore

davidstockmanscontracorner.com ^

| 12-30-2014

| David Stockman

Posted on 12/31/2014 6:13:00 AM PST by Riflema

Crude oil is not the only commodity that is crashing. Iron ore is on a similar trajectory and for a common reason. Namely, the two-decade-long economic boom fueled by the money printing rampage of the world’s central banks is beginning to cool rapidly.

(snip)

Nowhere is this more evident than in China’s vastly overbuilt steel industry, where capacity has soared from about 100 million tons in 1995 to upwards of 1.2 billion tons today. Again, this 12X growth in less than two decades is not just red capitalism getting rambunctious; its actually an economically cancerous deformation that will eventually dislocate the entire global economy. Stated differently, the 1 billion ton growth of China’s steel industry since 1995 represents 2X the entire capacity of the global steel industry at the time; 7X the size of Japan’s then world champion steel industry; and 10X the then size of the US industry.

(snip)

In short, when the credit and building frenzy stops, China will be drowning in excess steel capacity and will try to export its way out— flooding the world with cheap steel. A trade crisis will soon ensue, and we will shortly have the kind of globalized import quota system that was imposed on Japan in the early 1980s.

(Excerpt) Read more at davidstockmanscontracorner.com ...

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: bubble; commodities; economy; oil; oilprice; steel; stockman; war

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-66 next last

To: Riflema

What are the Chinese to do with all that excess capacity in steel, transportation, buildings. One thing the Chinese were doing with their stockpiles of stored commodities was using them as collateral for loans from Western banks...in some cases the same stockpile was used as collateral several times for loans from different banks.

Where that money is now is anyone's guess.

41

posted on

12/31/2014 7:22:40 AM PST

by

mac_truck

( Aide toi et dieu t aidera)

To: central_va

So the total amount of beef exports is up 1% from last year and you believe that is because the dollar is weakening?

http://www.usmef.org/downloads/statistics/2014-10-beef-exports.pdf

This despite all the US dollar indexes that show the dollar is strengthening.

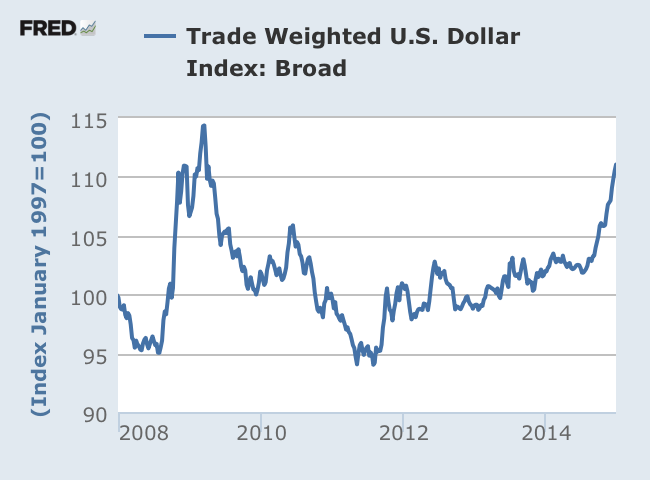

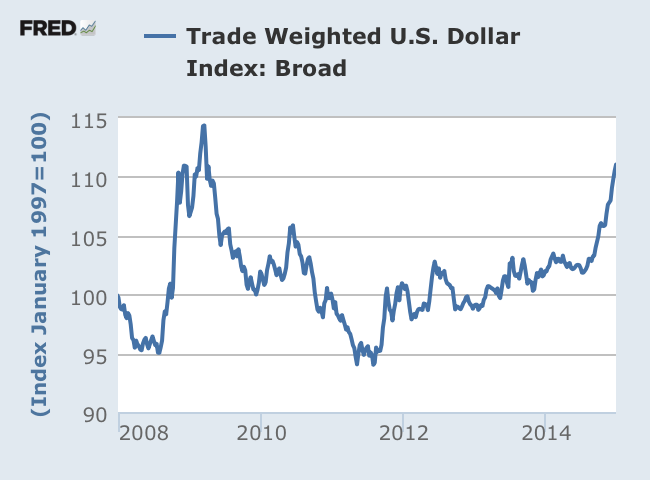

The trade-weighted dollar tracks the U.S. greenback's value against a basket of other currencies, representing both developing and emerging markets. It's a broader measure than the regularly cited dollar index and the best indication of how a strong dollar hurts American companies that do business overseas.

The broad trade-weighted dollar is up 9 percent this year, now at the highest point since March 2009, when financial crisis fears had risk-averse investors pouring into the U.S. currency. It's well above its average historical price over the last 15 years and now just 3.6 percent away from reaching those crisis highs.

- - - - - - - - - - -

Dollar index on track for best year since 2005

http://www.marketwatch.com/story/dollar-index-on-track-for-best-year-since-2005-2014-12-31

he ICE Dollar index was heading on Wednesday for a rally of more than 12% for the year so far, on track for its biggest yearly gain since 2005.

42

posted on

12/31/2014 7:28:31 AM PST

by

thackney

(life is fragile, handle with prayer.)

To: dennisw

It’s ridiculous. I really miss having laying hens - and I will again after I build my new, more secure, coop.

I got tired of feeding the hens to the raccoons. @#$%^&*!

43

posted on

12/31/2014 7:44:22 AM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Wyatt's Torch

Fascinating yes, but you can get one to follow the other, or one to happen in some sectors while the other occurs in different ones. And money supply has little to do with hyper inflation, some would argue that it is complete collapse of confidence in a currency.

44

posted on

12/31/2014 7:44:32 AM PST

by

Riflema

To: mac_truck

Which leads to the inevitable question: how good is the data getting fed up to the higher levels of the Chicom regime? The multiple tiers of corruption below can’t help them make useful decision. So, for instance if they think they have so many million tons of copper in reserve, what happens to the war plan when the fraud is exposed? Interesting times.

45

posted on

12/31/2014 7:47:58 AM PST

by

Riflema

To: Chickensoup

Log/Stumpage prices will probably go up over the next few years with North American housing starts.

Demand for logs going offshore will probably go down more because of the strength of the Dollar in relation to other currencies. However, domestic consumption will be going up.

US lumber production is ramping up.

To: thackney

So the total amount of beef exports is up 1% from last year and you believe that is because the dollar is weakening?Let me help you . From the link I provided.

Total US beef exports:

2004: $809 Million

2013: $6,157 Billion

An increase of over 700% since 2004 !

Where do you get 1%. You CAN read a simple chart?

Total US Beef exports. CLICK HERE.

47

posted on

12/31/2014 8:01:37 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: buwaya

Yes. We don’t need Middle East oil, because this here nation’s resources are HUGH (I’m series). Let the Chinese deal with headchoppers on the ground in the M.E., shooting their police, shooting up their military bases, blowing up their trains and crashing airliners into their skyscrapers.

48

posted on

12/31/2014 8:03:56 AM PST

by

Rodamala

To: Riflema

Rog... I knew what you meant.

49

posted on

12/31/2014 8:06:29 AM PST

by

Rodamala

To: woodbutcher1963

Well perhaps a mid year cutting?

50

posted on

12/31/2014 8:06:45 AM PST

by

Chickensoup

(Leftist totalitarian fascism is on the move.)

To: central_va

You keep going back to 2013 data, I used your link for the latest report this year and linked directly to it.

I said “up 1% from last year”. That is actual amount of beef, not the current price in dollars.

Beef exports are affected by more than the strength of the US dollar.

The dollar is not weakening this year, or last year.

Have a great New Years Eve.

51

posted on

12/31/2014 8:13:29 AM PST

by

thackney

(life is fragile, handle with prayer.)

To: Chickensoup

Contact a timber appraiser... not a logger, but an appraiser. The market is all over the place and he will know what species command a good market price.

Part of my timberlot was logged out by Amish in May of 2013... selective cut, skidded out with a team of horses to a mill set up on the property. I was told that anything under 14” was left... one section looks like it was heavier cut than the rest... they left all the slab wood and the tops... but it is such a PITA to get in there because the ground is so wet. I am g3tting ready to have an appraiser just assess what remains and take recommendations for managing the resource so I can get 10-20 cords of firewood out of it a year and timber to cut when it comes time again... if the market is right.

52

posted on

12/31/2014 8:16:36 AM PST

by

Rodamala

To: Riflema

What is not mentioned in the article (and obviously not the point of it) is the crashing demographics in China. A rapidly aging population that is leaving a ton of bad debt to a smaller and younger population. I tell my kids all the time that managing China’s decline will be much more dangerous than her rise...

53

posted on

12/31/2014 8:40:51 AM PST

by

fatez

(Ebola, Obama's solution for shovel ready jobs... Bring out your dead!!!)

To: Chickensoup

54

posted on

12/31/2014 8:48:28 AM PST

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: Diana in Wisconsin

No raccoon would get past me! Electric fencing plus cyclone fencing buried 6 inches. Plus when digging the trench for that fence I will .......

Hard wire 10ft lengths of 2" pvc pipe to the bottom rungs of the cyclone fence...then bury it all in the trench

Two rows electric fence wire at the top slanting outward

55

posted on

12/31/2014 9:04:07 AM PST

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: Wyatt's Torch

Actually, I wrote a whole book called “Biflationary Depression” explaining it.

56

posted on

12/31/2014 9:25:31 AM PST

by

DaxtonBrown

(http://www.futurnamics.com/reid.php)

To: bert

Well, considering that tariffs were the way the founders originally planned funding the fedgov...

I don’t see any trolling here.

57

posted on

12/31/2014 10:07:59 AM PST

by

Don W

(When blacks riot, neighborhoods and cities burn. When whites riot, nations and continents burn))

To: central_va

News flash: The dollar is strengthening against nearly every currency (best of a bad lot).

To: dfwgator

I think nobody caught that.

59

posted on

12/31/2014 5:52:37 PM PST

by

Reynoldo

To: dennisw

Right. Look at booming Japan!

60

posted on

12/31/2014 8:46:22 PM PST

by

1010RD

(First, Do No Harm)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-66 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson