Posted on 11/17/2014 7:53:25 AM PST by deport

In a deal that shows just how quickly falling prices can upend the energy industry, Halliburton

is buying rival oilfield services company Baker Hughes in a cash-and-stock deal worth $34.6 billion.

(Excerpt) Read more at beaumontenterprise.com ...

Having spent some “time” with B-H, never be surprised when the accountants, that are all powered in B-H, will dump any sector/Division to rescue red quarter projections. They have no loyalty beyond “this quarter” and everyone in B-H knows and reflects it.

Still, every section is not produced simultaneously, correctly as “limits to the flow rate to prevent damage to the reservoir”, which does not mean they cannot also hold some sections until the price/demand returns. Otherwise the Boom/Bust would be a much steeper rollercoaster ride.

I would think it would be far cheaper and better to operate the choke valve at the surface for the whole lateral than require a shut down of the well to bring in another hydro frac crew.

Assuming the investors wanted to wait a few years to get paid for the oil instead of today.

boy, that’s a pts trigger. was it really necessary? I have seen death but that is just over the line.

Their oil is heavy, high sulfur, low gravity crude and nasty stuff, but who really wants to fool around with a dictatorship that will take an oil company's assets on a whim?

Let 'em hurt.

Weatherford has been growing, too.

Is it a misconception that every section of horizontal is not initially fraced, which would leave other sections available for another frac when production ramp-up is needed?

Considering that it seems to take almost as long to get all the frack equipment staged as it does to do the actually frack (7-10 days), it just makes since to do it all at one time.

I have heard of wells being ‘refracked’ several years later to use new techniques to increase production.

Not only are there porosity/permeability variations in the formation laterally, but generally, porous beds may be discontinuous, have permeability barriers, or just so thin it is difficult to stay within one bed.

Because the frac will follow the path of least resistance, multiple stages give more control and (hopefully) more uniformity to the area drained by the wellbore.

While the stages are technically separate fracs, they are done as part of the same event, sequentially, from the distal end of the wellbore, working back toward the heel of the curve.

The objective is to produce all of those separately fracced sections at once when the well is put on line.

It would be pretty rare to drill a lateral through multiple formations (intentionally, anyway), and usually the excursions from the target formation are not produced, depending on rock type and legal restrictions.

I have worked high angle gas wells in Western Colorado which targeted two different sandstone layers, but that was back in the early '90s.

As a general rule, when there are multiple formations which will produce in a vertical well, the deepest ones are produced first, and as those deplete, the wells may be plugged back, casing perforated in another zone and produced.

Depending on jurisdiction, it may be against the rules to co-mingle oil from different age formations, despite as many as four or five viable producing formations in a well.

For instance, in North Dakota, while you could do a dual completion in a vertical well from the Duperow (Devonian) and the Fryburg (Mississippian), you are not legally allowed to co-mingle the oil produced.

Thanks Joe.

I seem to remember in Alaska some wells having laterals added later at a different field (different depth). Not the same as the original discussion in this thread.

Refreshing to get factual information, as opposed to half-informed retorts!

You guys are great.

The early Elm Coulee Field (MT, Bakken) wells (single laterals) quickly gave way to two and three lateral wellbores, either open-hole sidetracked from the first lateral in the Bakken, or with windows cut in the casing and redrilling the curve to the pay and drilling a lateral from there.

Those wells were on a 640 acre spacing, generally (one section, one mile square), and that was an effort to enhance production.

As technique improved, later wells in North Dakota in the Bakken were drilled on 1280 acre spacings (2 miles by 1 mile) and parallel wells running the length of those spacings from one pad have proven to be a superior arrangement.

That’s a great point. Once the upfront costs (sunk costs) are paid up the marginal productivity is profit.

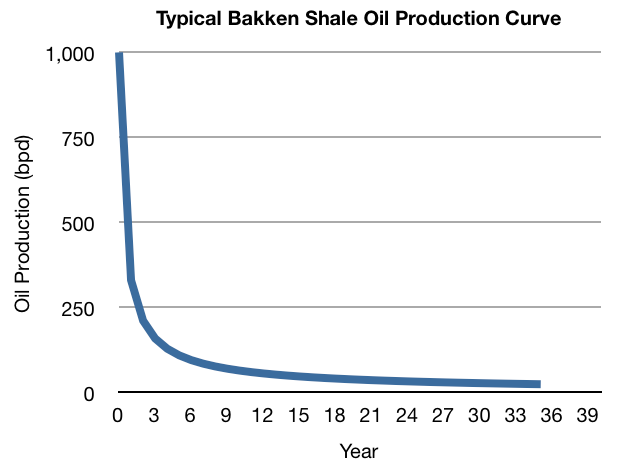

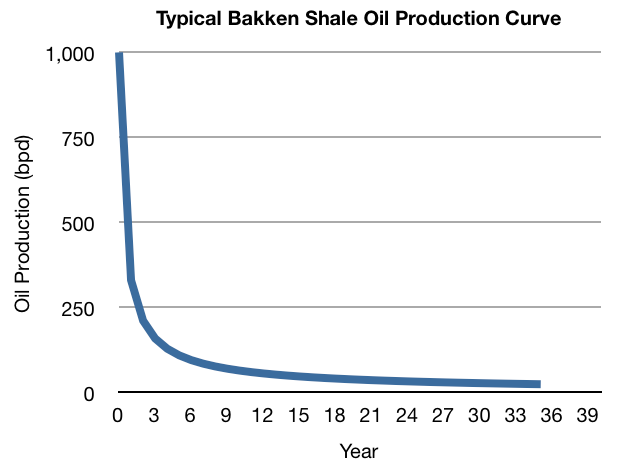

The problem for overall US production can be seen in post #31 for these newer shale wells.

But as long as you’ve covered your sunk costs and are covering your variable costs that well can be profitable for a long time.

But as long as you’ve covered your sunk costs

- - - -

That tends to be the problem with an $8~10 million well.

I was going by the chart you posted here: http://www.freerepublic.com/focus/news/3229517/posts?page=30#30

If I’m following it correctly figuring $70-100/bbl, then those numbers indicate $23-33mm for the first year, falling to $11+mm in the second year and $4mm the third year.

I am not well versed in the economics of oil wells, but the first three years $43 million has to cover the costs along with some drywells, too. Then look at the out years you capture another $30-60mm. I mean there’s got to be some profit in there somewhere, right?

Most are making profits; they wouldn’t be drilling otherwise.

Wellhead prices, depending on location, can be quite lower than the price at the Cushing, Oklahoma terminal. $10~20 less in Bakken has been normal lately. When there are not enough pipelines, the expense of rail comes out of the profit. (so does pipe transport, just less)

http://peakoilbarrel.com/wp-content/uploads/2014/11/Rune-1.png

http://finance.yahoo.com/news/wti-midland-spread-short-term-130012961.html

I don’t know a good source for production costs, and any other cost associated with exploration, etc.

I would use a breakeven cost for comparison.

http://www.reuters.com/article/2014/10/23/idUSL3N0SH5N220141023

One of the problems smaller producers have gotten into was the debt they took on in order to drill these relatively expensive wells. Finance charges from before the well is drilled and only payed off years afterwards.

http://www.bloomberg.com/news/2014-09-08/halcon-s-wilson-drills-more-debt-than-oil-in-shale-bet.html

I don’t mean to suggest that many of the wells won’t be profitable.

I believe at $70 we will still see growth in production, just slower growth than we would see in $100.

The typical or average charts shows the fields can support those prices. But there are more marginal areas of the field that will produce half that rate. Places that justify drilling and making money at near $100 but more questionable return at $70.

Also, don’t forget to take the royalty payment out of the top. 1/8 royalties tend to be long past. 1/5 and 1/4 are more common these days.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.