Posted on 10/25/2014 10:04:09 AM PDT by Kaslin

Since all economic theories – even Marxism and socialism – recognize that capital formation is a key to long-run growth, higher wages, and improved living standards, it obviously doesn’t make sense to penalize saving and investment.

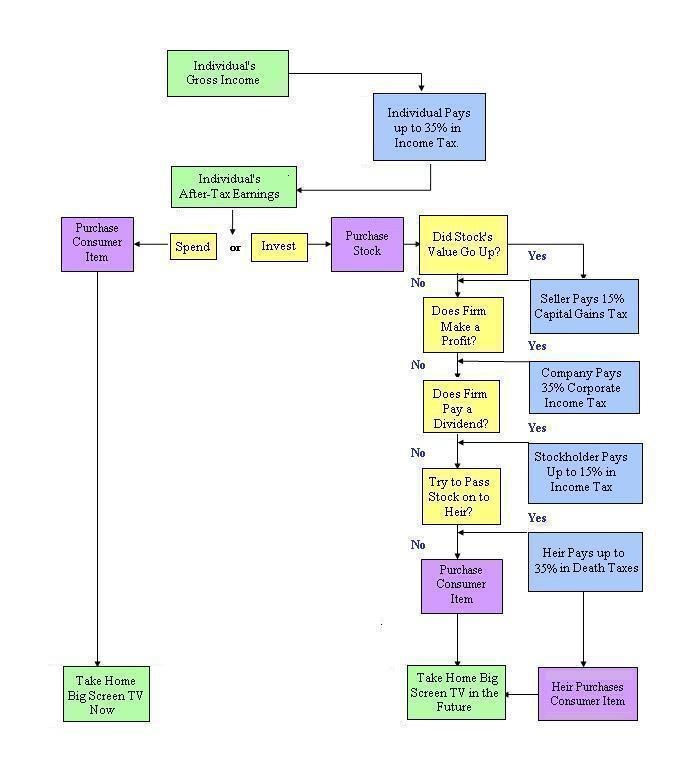

Yet that’s exactly what happens because of double taxation in the United States, as can be seen by this rather sobering flowchart.

Yet that’s exactly what happens because of double taxation in the United States, as can be seen by this rather sobering flowchart.

So how can we fix the problem? The best answer, particularly in the long run, is to shrink the burden of government spending so that there’s no pressure for punitive tax policies.

Good reform is also possible in the medium run. Policy makers could implement a big bang version of tax reform, replacing the corrupt internal revenue code with a simple and fair flat tax. That automatically would eliminate the tax bias against saving and investment since one of the key principles of the flat tax is that income gets taxed only one time.

That being said, there’s no chance of sweeping tax reform for the next few years (and maybe ever), so let’s look at some pro-growth incremental reforms that would reduce or eliminate the extra tax penalties on income that is saved and invested.

On the investment side of the ledger, any policies that lower or end the capital gains tax and the double tax on dividends would be desirable.

But let’s focus today on the saving side. And let’s start by explaining how a fair and neutral system would operate. Here’s what I wrote back in 2012 and I think it’s reasonably succinct and accurate.

…all saving and investment should be treated the way we currently treat individual retirement accounts. If you have a traditional IRA (or “front-ended” IRA), you get a deduction for any money you put in a retirement account, but then you pay tax on the money – including any earnings – when the money is withdrawn. If you have a Roth IRA (or “back-ended” IRA), you pay tax on your income in the year that it is earned, but if you put the money in a retirement account, there is no additional tax on withdrawals or the subsequent earnings. From an economic perspective, front-ended IRAs and back-ended IRAs generate the same result. Income that is saved and invested is treated the same as income that is immediately consumed. From a present-value perspective, front-ended IRAs and back-ended IRAs produce the same outcome. All that changes is the point at which the government imposes the single layer of tax.

The key takeaways are in the first and last sentences. All savings should be protected from double taxation, not just what you set aside for retirement. And that means government can tax you one time, either when you first earn the income or when you consume the income.

Our friends to the north can teach us some lessons on this issue.

Here are some excerpts from a column in the Wall Street Journal, authored by my colleague Chris Edwards and Amity Shlaes of the Calvin Coolidge Foundation.

Some Republicans are advocating a giant child tax credit, but there are more effective means for helping the middle class. One is a tax program already road-tested in the country whose populace most resembles our own, Canada. It’s called the Tax-Free Savings Account and TFSA, as most Canadians refer to it, is a roaring success. …what is this Canadian savings account? The nearest U.S. equivalent would be Roth Individual Retirement Accounts. With a Roth, workers pay taxes on earnings before they put their cash into the account. The money then grows tax-protected, and people pay no tax when they withdraw it.

But these accounts are much better than Roth IRAs.

Though these savings accounts were introduced only five years ago, 48% of Canadians have already signed up. That compares with only 38% of U.S. households owning any type of IRA—though IRAs have been around for decades….Roth accounts have numerous restrictions. You can’t open a Roth easily if your earnings are above certain limits: $191,000, for example, for a married couple filing jointly. You can’t withdraw cash whenever you feel like it, at least not without daunting penalties. …Canada’s TFSAs are like Roth IRAs—but supercharged. Citizens may deposit up to $5,500 after-tax each year, and all account earnings and withdrawals are tax-free. However, unlike Roth IRAs, funds can be withdrawn at any time for any reason with no penalties or taxes. Another feature: The annual limit on a contribution carries over from year to year if a citizen doesn’t reach it. So if a Canadian contributes $2,000 this year, he can put away up to $9,000 next year ($3,500 plus $5,500). There are other attractive features: Unlike in a Roth, there are no income limits for individuals contributing to a TFSA, and there are no withdrawal requirements at retirement.

In other words, the Canadian accounts are like unlimited or unrestricted Roth IRAs.

And because the government isn’t trying to micro-manage how people save, Canadians are very receptive. Chris adds some additional information in a post forCato at Liberty.

…released new data confirming the popularity of TFSAs. In just the past year, TFSA account assets increased 34 percent, and the number of accounts increased 16 percent. In June 2014, 13 million Canadians held $132 billion in TFSA assets. Given that the U.S. population is about 10 times that of Canada, it would be like 130 million Americans pouring $1.3 trillion into a new personal savings vehicle. …In just five years, TFSAs have become the most popular savings vehicle in Canada, outstripping the Canadian version of 401(k)s.

Here’s a chart Chris included in his blog post.

And he adds some more analysis on the importance of simple vehicles to protect against double taxation.

Everyone agrees that Americans don’t save enough, so why don’t we kick-start a home-grown savings revolution with a U.S. version of TFSAs? …Canada has now run the real-world experiment on such accounts, and it has succeeded brilliantly. TFSAs, or USAs, are a better way to handle savings in the tax code. Currently, many people are scared off by the complexity of U.S. savings vehicles and by the lack of liquidity in retirement accounts. TFSAs solve these problems.

I guess we’ll have to wait and see whether American policy makers pay attention and follow Chris’ sage advice.

P.S. I realize I’m being picky, but I wish the Canadians didn’t use the term “tax-free savings accounts.” After the all, the income is taxed before it gets put into the accounts. Though even a nit-picker like me realizes that it might be a bit awkward to call them “no-double-taxation savings accounts.”

P.P.S. I do like that Chris and Amity argued that the accounts would be better than big child tax credits, particularly since I also argued in the Wall Street Journal that there were better ways to help the middle class.

P.P.P.S. Canada also can teach us important lessons on other issues, such asspending restraint, corporate tax reform, bank bailouts, and privatization of air traffic control. Heck, Canada even has one of the lowest levels of welfare spendingamong developed nations.

P.P.P.P.S. No wonder the two most capitalistic places in North America are in Canada. And Canada ranks above the United States in the Economic Freedom of the World Index.

P.P.P.P.P.S. Though there are still plenty of statists north of the border, so I’m not sure it’s the best escape option for advocates of small government. Though I doubt leftists no longer see it as an escape option, which was the premise of this joke that circulated after the 2010 election.

However, I won't move to ANY "snow" state so why would I move to Canada? Brrrr. One does have to pay for nicer weather, especially when it's RELATIVELY bug-free.

you do know that even in British Columbia there is a sun belt, producing peaches, tomatoes, grapes, cherries, etc.....Kelowna and Penticton for example....

What are the chances of our political pirates doing something like this?

I believe it, of course. Summertime everywhere produces wonderful produce. That's what summers do.

Both Canadian cities are by water and look to be most attractive.

Canada Ping!

The fact the the entire Republican Party did not rise up in scornful wrath at Hillary's idiotic pronouncement about job creation indicates that any genuine reform is still a long way off. You can't play the game to be "nice to the girl/respectful to the feminist" when that "girl" is perfectly willing to use the ghastly apparatus of the Security State against you to accomplish her goals.

ZERO. They will fiddle and play and posture until there is nothing left.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.