[click pix to enlarge]

[click pix to enlarge]Posted on 10/19/2014 11:18:38 AM PDT by expat_panama

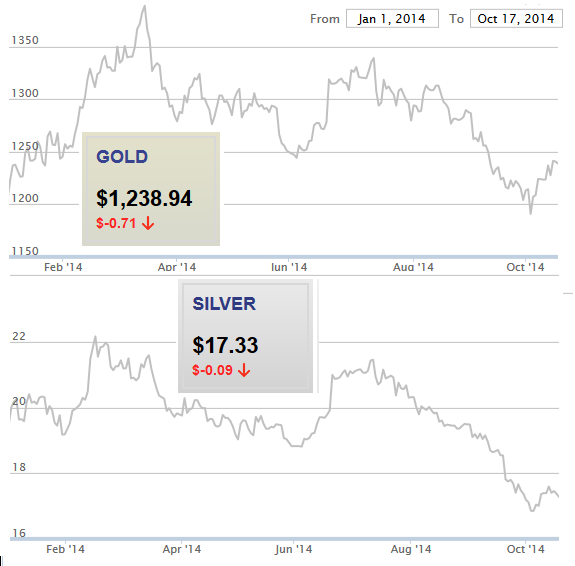

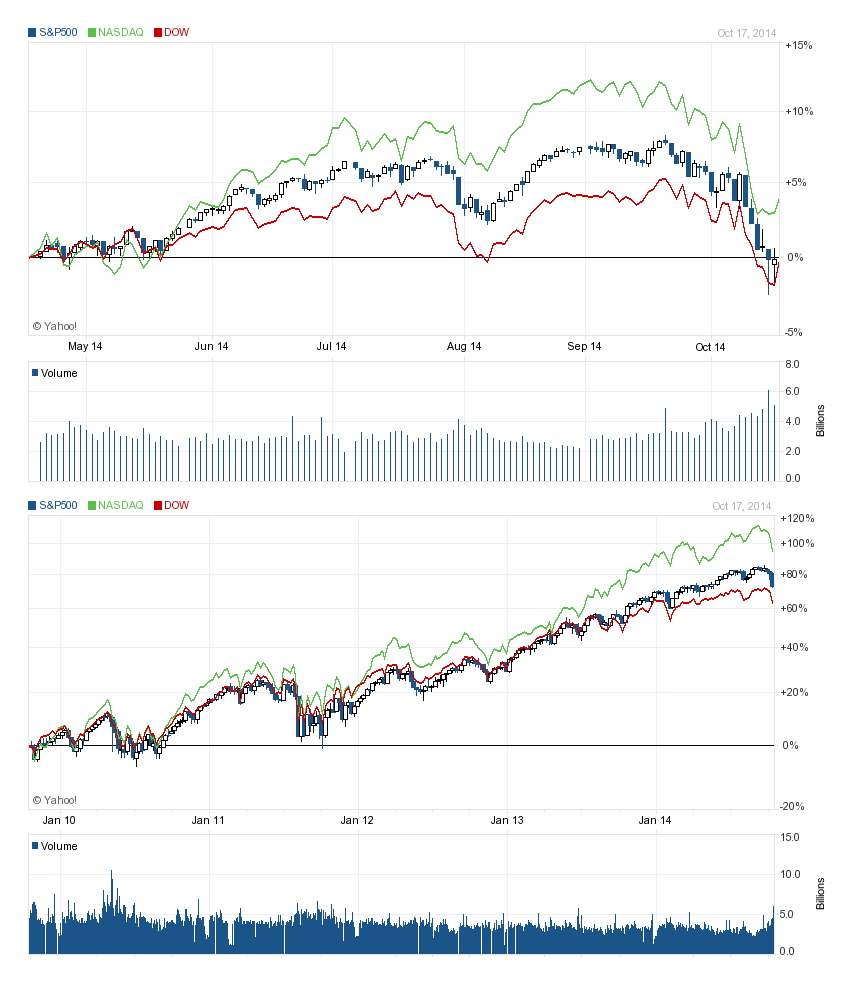

This past week saw upside reversals across the board coming out with prices holding steady in spite of the hammering we had over the past month or two.

The October metals rally held on to its gains, in fact market prices show gold's just about clawed back to break-even for 2014. That's said, metals' role in price trends ahead is become increasingly controversial (re Gold And Silver - Financial World: House Of Cards Built On Sand) even while many see a bright tomorrow with other commodities (We Maintain Our Outlook For Higher Prices For Commodities).

Stocks. OK, so IBD won't call it an "uptrend" (the follow-through has got to be no earlier than the fourth day of the rebound or it ain't official), but the upside surge was led by leading stock leaders. They call them 'leading' stocks for a reason. Well, sometimes they call 'em 'bellwether' stocks but the term makes me nervous 'cause a bellwether is often the animal trained to lead the mindless unquestioning herd into the meat packing plant.

I digress.

So we've been in "market in correction" for a while and we punched down through the famous 200-day moving average, so for 2014 it really is a big deal. Maybe that says more about how spoiled we've been getting lately. I mean the earlier swings over the past half decade kind of make these past two years seem well, nice.

[click pix to enlarge]

The big question of course is whether stock indexes are right now 'over priced' or not, and for that I like to compare say, the S&P500 to total U.S. corp. net worth. Someone correct me if they see anything I don't but I honestly think they've been tracking together since the last decade's high. Not only that, but recent growth seems actually subdued --check out this 1950-2014 plot showing total corp networth and how the trend in raising business capital has been more and more turning away from bonds over into stocks.

Also on that note. Please forgive my broken record but it has got to mean something that historic American growth for corp net worth has always been over 7% yearly, but since 2007 growth has only averaged a paltry one percent.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

|

Tuesday, October 21, 2014 |

||||||

| Markets | yesterday | today | |||||

| metals | Gold continuing up to $1,245.85 & silver to $17.37 | Futures @ 3 hrs. before opening +0.38% | |||||

| stocks | (from here) Nasdaq jumped nearly 1.4% on the fourth day of its rally attempt. Normally, that would be a strong enough gain to qualify as a follow-through day, but NYSE and Nasdaq volumes were well below Friday's levels. | Futures +0.07% | |||||

Only big report today is Existing Home Sales.

Brighter China data fails to lift stocks, dollar sags Reuters - 10 hours ago LONDON (Reuters) - A two-day rebound in global shares slowed and the dollar edged lower on Tuesday, as slightly above forecast Chinese growth data failed to erase concerns that the world's second-biggest economy is losing momentum.Gold Goes Up As U.S. Dollar Falls Down Gold futures rose as the U.S. Last week’s stock market turmoil was a boon for gold prices. Gold and stocks tend to move in opposite directions as the precious metal is seen as a store of value and a hedge against economic turbulence, while equities tend to benefit from U.S. Barrons.com

Funny how the headlines like to imply that Buffet lost money, but it was his fund's money, and along w/ all the other holdings by yesterday's close the fund actually came out a half $B ahead. Kind of reminds me of all the "Buffet Bets on Crash" stories we've been getting.

Dow futures up 75 this morning

Hit gas sales too, no wonder gas prices have been flat for a few years now.

A lot of that is the refiners have sold off their retail sales to independents. Our consumption has not fell that drastically.

Like I said back here http://www.freerepublic.com/focus/news/3217123/posts?page=8#8

Knee braces are going to be the hot item.

Pretty simple: Whatever the Government CONTROLS, and the SIZE to which it GROWS, is coming out of the TAX PAYER’S pocket.

Neat! Yesterday's gap-up moved stocks from correction to uptrend and this morning indexes look future-flat. Our ever-volatile metals were solid yesterday (gold at a six-week high) tho they're back down today. Announcements: MBA Mortgage Index, CPI, Core CPI, Crude Inventories.

Is It Time to Jump Back In Stock Market? - Chris Ciovacco, Ciovacco Capital

Reuters Upbeat earnings, hopes of more ECB stimulus lift mood in Europe European shares edged up and the euro hit a one-week low against the dollar on Wednesday, driven by upbeat company earnings results and hopes of corporate bond buying by the European Central Bank. Several sources told Reuters on Tuesday the ECB was considering buying corporate bonds on the secondary market and may make a final decision as...

Here We Go Again With Easy, Govt Subsidized Mortgages - Editorial, IBD

How China May Explain The Drop In Gold - Calafia Beach Pundit

What Is Bond Market Volatility Signaling? - GaveKal Capital

Investors pile into oil at swiftest clip in two years

Ebola becomes a business problem

I have some stock in pfizer and Proctor and Gamble and Walmart. What do you think.? If only pfizer could come up with an ebola cure..LOL

tracking btt

Obama Tax Hikes Drive Federal Tax Revenue Above $3 Trillion for First Time Ever

“The Treasury Department released this month figures showing that federal tax revenue exceeded $3 trillion in fiscal year 2014—the first time revenue surpassed that mark.

Yet the deficit was still almost $500 billion.

Clearly, the government continues to spend too much. We should tax enough to fund the legitimate functions of government, like national defense, homeland security, public health and others, but no more.”

The focus on the deficit is needed but more important is the debt.

A fall in the deficit results in an increase in the debt. Debt reduction not deficit reduction should be the goal.

One thing for certain .... it seems that for the time being freepers who are sitting on their cash waiting for the dow to drop below 10k before they buy back in are going to have to continue to wait.

Its difficult to reduce the debt if you don’t end deficit spending.

PG, PFE, and WMT all have decent dividends, which are likely safe. I don’t see any of the three going out of business in our lifetime. They know what they’re doing. However, not a lot of growth in PFE and PG over the past ten to fifteen years.

If you’re young, equities are the place to be, as you have a long time horizon in which to invest.

The time to buy is when everyone else is selling, and then hold until everyone else is buying. So said J. Paul Getty.

If you get a buying opportunity in any of those three stocks, take advantage.

Well of course but a reduction in the deficit is politically comfort while a continued increase in the debt is not.

Note my use of the term focus

Yeah couldn’t have anything to do with GDP increasing... Has to be the tax hikes... SMDH

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.