Skip to comments.

Investment & Finance Thread (Apr. 20 edition)

Daily investment & finance thread ^

| 04/20/2014

| Freeper Investors

Posted on 04/20/2014 1:14:39 PM PDT by expat_panama

Here's what others are saying about what's going on--

Gold / Silver / Copper futures - weekly outlook: April 21 - 25

Investing.com - Gold prices ended the week sharply lower on Thursday, falling below the $1,300 level as indications that the U.S. economic recovery is progressing dampened safe haven demand for the precious metal.

Gold ends week below $1,300 level on stronger U.S. economic outlook

Gold ends week below $1,300 level on stronger U.S. economic outlook

On the Comex division of the New York Mercantile Exchange, gold futures for June delivery ended Thursday’s session at $1,294.90 an ounce. The precious metal ended the week down 2.34%. The Comex was closed for Good Friday.

Gold came under pressure after upbeat U.S. data on manufacturing and employment pointed to underlying strength in the economy.

The Labor Department reported the number of people filing for unemployment benefits edged up to 304,000, below analysts’ forecasts and not far from the six-and-a-half year low of 300,000 touched the previous week. [more here]

U.S. stocks ended a holiday-shortened week with the Standard & Poor’s 500 making its biggest weekly gain in nine months. For the four days, the S&P 500 added 2.7 percent and both the Dow Jones industrial average and the Nasdaq Composite advanced 2.4 percent.

The weekly result is worth noting because it marks a strong turnaround after six weeks of turmoil that primarily affected overpriced information technology, biotechnology and other issues, mostly in the Nasdaq Composite.

By the end of last week, the bursting of that bubble was showing an increasing tendency for the selling to spread to the broad market. That hasn’t happened, at least not yet. In its reversal from an oversold condition, the market benefited from several developments... [more here]

--and IBD still hasn't announced this correction's 'follow-thru-day', although fwiw if we get more consolidation it might be as early as Tuesday...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: financial; goldbugs; hr2847; randsconcerntrolls; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-72 next last

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Show prep for tomorrow morning ping.

To: expat_panama

Well, looks like one should NOT buy gold stocks or gold. Poised for a fall, isn’t it?

3

posted on

04/20/2014 3:32:26 PM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: MeneMeneTekelUpharsin

I’m hanging on to what I have. IF a major correction occurs then things may change faster than I can key in a trade. I hold onto a core.

To: expat_panama

5

posted on

04/20/2014 4:38:57 PM PDT

by

abb

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Happy New Week everyone, beginning with stock futures mixed/up and metals futures plunging big time (full map here). Only econ report today is Leading Indicators --what can that tell us about investing if investing trends is one of the leading indicators? Heads-up topics:

Asian stocks subdued on Ukraine caution, dollar firms vs. yen Reuters - 10 hours ago TOKYO (Reuters) - Asian stock markets were subdued on Monday, as tensions in Ukraine kept investors cautious amid an absence of catalysts as several markets remained closed for the Easter holiday.

It's Final -- Corn Ethanol Is Of No Use Forbes - 12:12am OK, can we please stop pretending biofuel made from corn is helping the planet and the environment? With huge subsidies for ethanol in gasoline, with all States now selling gasoline having some ethanol blend, and a general misconception that these ...

To: expat_panama

To: expat_panama

KCG: THE LOOK…April 20th, 2014

U.S. stock-index futures were little changed, after the Standard & Poor’s 500 Index posted its

biggest weekly gain since July, amid corporate-earnings reports.

Halliburton Co. climbed 1 percent in early New York trading after forecasting profit growth for the second quarter. Barrick Gold Corp. and Newmont Mining Corp. advanced after people with the knowledge of the matter said talks to merge the two companies could be revived. Athenahealth Inc. fell 1.8 percent

after reporting quarterly earnings that missed projections.

Futures on the S&P 500 expiring in June rose 0.2 percent to 1,861.2 at 7:43 a.m. in New York today. Dow Jones Industrial Average contracts added 29 points, or 0.2 percent, to 16,372.

“I suspect most companies are going to raise guidance for the upcoming quarters thanks to the pumped up demand and the spring thrall,” Patrick Spencer, who helps oversee more than $100 billion as head of equity sales at Robert W. Baird & Co. in London, said in a phone interview. “The economy remains in a

sweet spot. I’m very optimistic for this year.”

The S&P 500 jumped 2.7 percent last week, rebounding from the previous week’s technology-led selloff, as corporate earnings from Morgan Stanley to Citigroup Inc. and Yahoo! Inc. surpassed estimates. The gauge is 1.4 percent away from its record high reached April 2. U.S. equity markets were closed on

April 18 for the Good Friday holiday.

European stocks posted a weekly gain as better-than-estimated U.S. data bolstered investor

confidence the economic recovery is on course, outweighing an escalation in the crisis in eastern Ukraine.

UniCredit SpA rose 4 percent and Banco Popolare SC advanced 6.6 percent after Berenberg Bank said Italian lenders will benefit the most if the rebound in the European economy continues. Tesco Plc added 3.1 percent after reporting trading profit that beat estimates. Afren Plc helped a gauge of oil-and-gas companies post the best performance among industry groups. ASML Holding NV tumbled 7 percent after forecasting second-quarter sales that trailed analysts’ projections.

The Europe Stoxx 600 Index added 1.1 percent to 332.43 in the holiday-shortened week. The benchmark gauge has climbed in four of the last five weeks and increased 1.3 percent in 2014.

• Support:1857, 1850, 1837

• Resistance:1870, 1876, 1889

It’s becoming much harder for companies to close initial public offerings.

Moelis & Co. and Weibo Corp. were among six issuers seeking $100 million or more in the U.S. that had to accept less than they had anticipated, data compiled by Bloomberg Show. Only two companies last week raised an amount that was within the range they expected.

On average, the eight companies priced their offerings at 12 percent below the mid-point of their marketed range, the CHART OF THE DAY shows. That’s the biggest discount since the third week of October, after the U.S. government shut down following a budget impasse, data compiled by Bloomberg show.

Almost $18 billion of newly issued shares have flooded the U.S. market in 2014 — from midpriced-hotel chain La Quinta Holdings Inc. to King Digital Entertainment Plc, the maker of Candy Crush. This 60 percent jump in supply from the same time last year, coupled with a selloff in risky assets, explains the difficulty late-comers have had, according to Larry Haverty of Gamco Investors Inc.

“Investors have said more or less ‘enough’,” said Haverty, whose firm in Rye, New York oversees $46 billion in assets. “If you look at IPOs over the last three or four months, they’ve been very richly priced. It’s not necessarily closing the IPO window, but it’s a brief pause.”

While 167 companies are still on tap to raise $12 billion through U.S. IPOs, the calendar for the rest of April looks bare with only two issuers seeking less than $100 million combined, data compiled by Bloomberg show.

That doesn’t include Alibaba Group Holding Ltd., which could file a prospectus for its IPO as soon as this month, people familiar with the matter have said. The share sale by China’s largest e-commerce company could be the biggest in over two years.

To: Wyatt's Torch

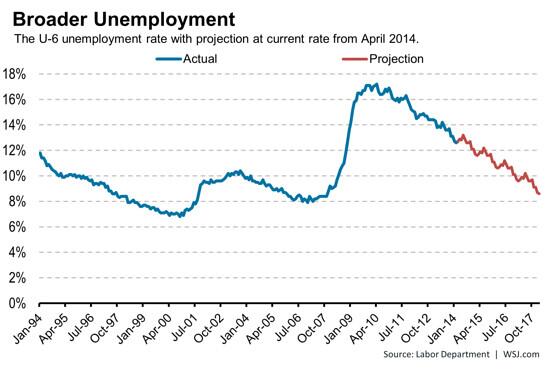

Our friends at PBS may be right if we assume massive policy shifts on the state and federal levels. We've been having some progress at times in specific sectors but progress since for more 'house-cleaning' has seemed no better than spotty. On unemployment, this is the part we can know for sure--

--and we can only hope PBS is right about the next four years.

To: Wyatt's Torch

Futures on the S&P 500 expiring in June rose 0.2 percent... ...The S&P 500 jumped 2.7 percent last week...A lot of strong signs out there on big caps and this past week my behavior has had to conform to what I can see. I've never really liked stodgy old dinosaurs much but we don't want to let our aesthetic comforts get in the way of earning a living and feeding our families...

To: abb

tx abb, I needed that glimmer a nice news to greet me over my morning coffee today ;)

To: BipolarBob

...change faster than I can key in a trade. I hold onto a core.Same here. Over the recent years we've been having a lot of choppy indecisive markets where so-called proven signals can suddenly find themselves 'disproved'. For me it's been leaving my core just fine thank you.

To: MeneMeneTekelUpharsin

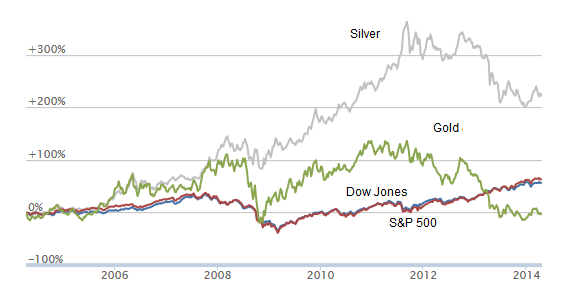

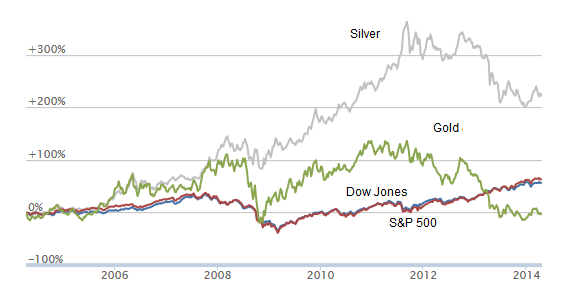

one should NOT buy gold stocks or gold. Poised for a fall, isn’t it?That's what a lot of futures traders are saying. Metals markets can yield far bigger rewards--

---but I kind of like roller coasters I know more about.

To: expat_panama

Gold shares dropped hard today.

14

posted on

04/21/2014 8:16:34 AM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: MeneMeneTekelUpharsin

—and stocks are a bit on the upside. There are folks that know metals really well and make a fortune on short selling drops like today’s gold.

To: expat_panama

They gold stocks dropped even more.

16

posted on

04/21/2014 10:52:03 AM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: expat_panama

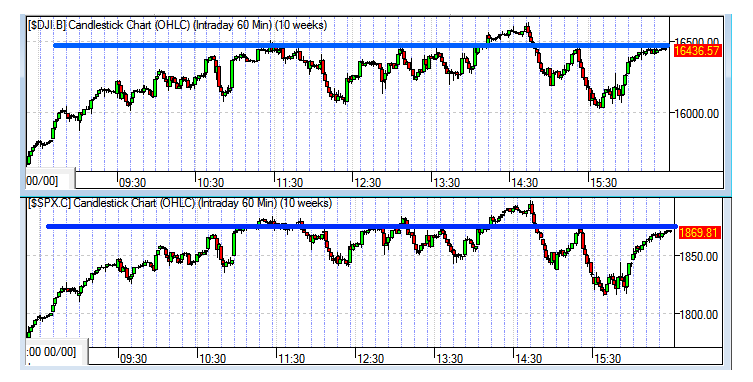

NYSE MAC DESK MID-DAY MARKET UPDATE:

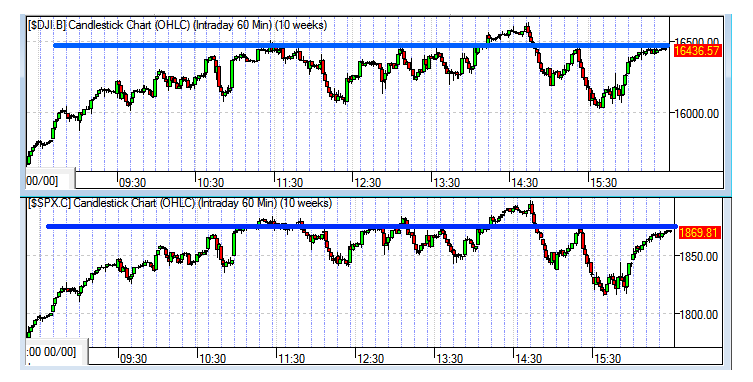

DOW 16,439 (+30 points), S&P500 1868 (+4 handles), Brent Crude $109.93/barrel (+$0.40), Gold $1,286.00/oz. (-$7.40)

MARKET DRIVERS: (Stocks are modestly higher in a very quiet session amid a round of generally positive earnings reports and a pair of upbeat economic data releases.)

• The Conference Board’s index of U.S. leading indicators rose by 0.8% in March – the largest increase in four months – topping consensus while providing an important sign that the U.S. economic expansion will strengthen following the harsh winter weather.

• The Federal Reserve Bank of Chicago’s National Activity Index for March came in at 0.20 which was in-line with the Street’s consensus estimate.

• The Japanese trade deficit widened to ¥1.45 trillion yen, or about $14.1 billion in March. Exports climbed by just 1.8%, missing expectations for a 6.5% gain. Meanwhile, energy costs caused imports to jump 18.1%.

• On the earnings-front, Halliburton is trading at a new 52-week high after the company reported Q1 top and bottom-line digits that topped the Street’s consensus estimates.

• In addition, Advanced Micro Devices has rallied by 12%(!) after the semiconductor maker reported late Thursday Q1 adjusted EPS and revenue that exceeded expectations and provided an upbeat sales growth outlook for the current quarter.

• Just hit the tape: Meb Keflezighi won today’s Boston Marathon with an unofficial time of 2 hours, eight minutes and 36 seconds, the first American male to win the race since 1983.

Definitely one of the quietest trading sessions of the year, both in terms of trading volume and volatility as the major indices have been essentially range-bound since the opening bell. However, that does not mean we have nothing to report. Check it out:

1- If the Dow and S&P 500 can finish on the plus-side today, it would mark the first 5-day winning streak for the major indices of 2014.

2- Last week, the S&P 500 Index posted its biggest weekly gain since July, and at last look, the index was up 1.13% year-to-date.

3- This promises to be the busiest week of the quarter for earnings releases as 159 companies in the S&P and eleven Dow components are scheduled to report their Q1 digits between today and Friday.

4- Regarding earnings, more than 70% of the companies that have announced results so far this season have beaten analysts’ profit estimates. For the record, Street analysts project that earnings at S&P 500 companies increased 0.7% in Q1, while revenue climbed 2.6%, according to the average estimate.

… Moving on, the Dow has settled into a narrow trading range in an extremely quiet session, with just ~215M shares on the tape at this time… Internally, breadth is bullish across the board. Advancing Issues: 2410 / Declining Issues: 1789 — for a ratio of 1.3 to 1. New 52-Week Highs: 240/ New 52-Week Lows: 40… Meanwhile, in the trading pits the 10-year US Treasury has rallied, dropping the yield back below the 2.7% level, (2.698%), while gold is near a three-week low amid improved risk appetites and less of a reliance on the safe haven trade… By the way, in case you haven’t heard, the Zen-Master has begun to make his presence known in NYC as the Knicks canned Coach Woodson and all of his assistant coaches this morning. And to our friends up in Beantown celebrating Patriot’s Day today: “Boston Strong!” -— Have a tremendous day!

John’s Options Commentary: Option investors appear to be very optimistic today. With the SPYders (SPY) trading around $186.74, customers are paying roughly 35 cents for more than 97,000 May 192 calls. The transactions are opening and express a very bullish view of the markets over the next 4 weeks—we shall see! The Market Vectors Semi Fund or SMH also sees bullish flow today. With the ETF trading $45.08, a customer buys a 14,500-lot of Aug 50 calls for 37.5 cents. Investors have also bought the Aug 47 calls, as more than 4,700 contracts have changed hands so far today. The activity appears to be another bullish view, this time on the chip over the next 4 months. The Emerging Markets Fund (EEM) saw a bullish three-way spread trade earlier this morning. With the EEM trading $41.80, a 10,000-lot of Dec 35 puts was sold at $1.00 on the ETF to buy the Dec 42 - 46 (1X2) call ratio spread, 10,000 times. It looks as if the investor sold the puts to help finance the call spread. The Call Dec 42 calls traded at $2.45 while the 46 calls were sold (twice) at 90 cents. The net proceeds on the transaction was 35 cents. I looks as if the customer is looking for the EEM to climb to the $46.00 level by December expiration. The VIX is treading water today, up .06 to 13.42.

Sector Highlights brought to you by http://www.streetaccount.com/

• Energy outperforming with the S&P Energy Index +0.4%

o Brent crude higher by $0.40 to $109.93. Natural gas (0.6%).

o Oil services topping gains with the OSX +0.5%. HAL +3.1% in focus after beating earnings expectations. Analysts pointed to better LatAm performance and the company’s guidance for close to 20% NAM margins by the end of the year. BHI +1.9% and SLB +1.4% the other notable gainers. The former continuing its post-earnings rally from Thursday. NE (1.2%) was downgraded at Global Hunter Securities, which notes the uncertain contracting environment and limited near-term catalysts.

o Refiners outperforming, led by PSX +1.1% and TSO +1%

o E&Ps underperforming with the EPX (0.4%). NFX (1.4%), PXD (1.4%) and WTI (1.4%) leading the way lower. SM +1.2% the notable performer to the upside.

• Healthcare outperforming with the S&P Healthcare Index +0.4%

o Pharma outperforming with the DRG +0.7%. AZN +5.5% in focus amid reports that PFE +0.8% is considering a bid for the company. ENDP +2.2% and ACT +1.3% the other notable outperformers. Note the latter announced the acquisition of four products from AKRX +2.1%. TEVA (0.1%) underperforming after the Supreme Court denied its request for injunction on the Copaxone decision. Sell-side said a generic launch of Copaxone will create a new overhang for shares.

o Biotech mixed with the IBB +0.2% and NBI +0.2%. SRPT +42.5% the notable performer amid plans for Eteplirsen NDA by year-end. Barron’s also had a positive feature on the company, believing shares could double. The stock was upgraded at William Blair today. MNTA +6% another outperformer amid the Supreme Court’s decision in the TEVA Copaxone case.

o Other notable performers: ATHN (8.2%), which missed earnings expectations.

• Tech outperforming with the S&P Information Technology Index +0.3%

o Hardware largely outperforming with AAPL +0.8% . Bunch more previews hit today. Focus seems to be on issues such as June quarter guidance (expectations seem fairly lackluster), capital allocation, upcoming product cycle, China Mobile ramp. EMC +1.1% also reports on Wednesday. Some talk about low expectations heading into the print. Somewhat positive commentary on name out of Credit Suisse and BMO today.

o Semis outperforming with the SOX +0.5%. AMD +12.3% the standout following its beat and raise. High short base said to be contributing to outsized rally. MU +3.8% on the back of an upgrade at Drexel Hamilton. Semicap equipment narrowly mixed despite some concerns over collaboration between Samsung and Global Foundries in mass producing 14nm FinFET.

o Internet mixed following last week’s reprieve for momentum/high-valuation names. FB +2.1% one of the best performers. Company expected to reveal mobile-ad-network plans later this month. Stock also reiterated buy at both Goldman and CRT heading into earnings this week. GOOGL (0.9%) extending Thursday’s post-earnings pullback. Recall Street largely defended stock following softer results.

• Industrials in-line with the S&P Industrials Index +0.2%

o Multis underperforming. LII (3.8%) the laggard after reporting Q1 results. RBC (1%) and IR (0.9%) also underperforming. Upside limited with GE +0.2% and DOV +0.2% topping gains.

o Machinery underperforming. TEX (1.4%), OSK (1.3%) and JOY (1.1%) leading the space lower.

o Transports mostly lower. Airlines underperforming. Rising oil prices cited as a headwind. Note the space has sharply outperformed this year. ALK (1.5%), SKYW (1%) and DAL (1%) the notable performers. YRCW (1.2%) and ABFS +0.7% the notable performers among the trucking names. Railways outperforming, led by KSU +1% and NSC +0.4%. Note increased rail traffic. AAR reported rail traffic is up 33 of the past 38 weeks.

o Other notable performers: PWR (2.1%), USG (1.8%)

• Materials underperforming with the S&P Materials Index +0.1%

o Precious metals equities underperforming. Underlying assets lower today, with SLV (1.3%) leading GLD (0.7%) to the downside. Merger chatter between NEM +6.4% and ABX (2.6%) in focus. Latest reports indicate the issues stalling a merger include exactly what might be spun out. PAAS (3%) and SSRI (3%) the other notable performers.

o Industrial metals underperforming. CENX (3.8%) leading the aluminum space lower. Global miners underperforming with VALE (1.3%) and RIO (0.6%). Steel space mixed, with X (2.1%) underperforming while RS +1.1% tops gains. CLF (2.4%) the other notable performer among the industrial metals names.

o Other notable performers: OI (1.7%), EMN (1.3%)

• Financials underperforming with the S&P Financials Index +0.02%

o Banking group getting most of the attention. BKX +0.1%. Mixed overall performance with several regionals holding up better. STI +1.8% after reporting one of the strongest set of results for Q1. Street positive on lower expenses, better fees, strong credit quality and commercial loans. C (0.6%) the laggard among the money centers after outperforming last week when its results came in better than feared. Some sell-side notes out today discussing earnings season for the group. Focus has been on revenue headwinds, particularly in terms of mortgages. Lingering NIM pressure another widely discussed overhang. Also some attention on slowing improvement of credit trends. Trading held up a bit better than expected, while commercial loan growth another positive.

To: Wyatt's Torch

Thinking that in spite of all the 'great expectations' the big caps really aren't going anywhere new today..

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Good morning team, supposedly futures have metals soaring and stocks holding their own, but yesterday's market wrap-up saw the jump in very light trade. Someone help me on this but imho it's not telling us we got more downside or more upside, but more like we still got no clear direction. We got home-sales today though. News from the usual reliable sources:

To: expat_panama

Everybody’s awfully quiet today.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-72 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson