Posted on 04/25/2013 9:57:06 AM PDT by blam

Why Silver Price will Soar To $250 An Ounce

Commodities / Gold and Silver 2013

April 25, 2013 - 05:46 PM GMT

Peter Krauth - Money Morning

Peter Krauth writes: All bull markets go through periods of consolidations and corrections. And precious metals are no exception.

There has been plenty about gold's swan dive, but less talk about silver. And at this point there's more potential for silver than gold...significantly more.

Because the global silver market is relatively small, silver prices tend to be more volatile; the pounding selloff we witnessed in silver this past month is a testament to that fact. But volatility works both ways, so when silver rises, its price can explode higher.

That's exactly what happened in April 2011, when silver prices rose by 170% in the space of just 7 months. That's why silver investors say investing in silver is like buying "gold on steroids."

And right now, it looks like the silver market is on the cusp of doing the same thing all over again. According to our research, the next stop could be $40 by year's end, and $60 by the end of 2014. And much higher after that.

Here are five key factors that will drive silver higher - significantly higher - in coming years.

Silver Driver No. 1: Relentless Buying of Physical Silver

Despite the drubbing that silver took in mid-April, there's one fact that most observers are ignoring: the physical silver market.

While gold and silver prices took a pounding, silver investors were not running to unload their silver -- quite the opposite. In fact, savvy investors were flocking to buy physical silver.

Even as silver prices dropped, buyers stepped up, and supply became so scarce, premiums nearly quintupled from 8% to 37% above spot prices. And that's if you could even get your hands on it. Essentially, no one was selling, yet a lot of buyers recognized that silver was "on sale" and decided to stock up.

In the first three months of 2013, the U.S. Mint sold more than 15 million American Silver Eagle bullion coins. That's the first time ever the Mint has sold this many coins so early in the year, setting a record in the 27-year history of the series.

Coin dealers across the U.S. have been regularly selling out of their inventories, desperate to get new allocations.

With investors buying 56 times more physical silver than physical gold, Main Street is setting the pace, while Wall Street is oblivious to the trend.

Silver Driver No. 2: Silver ETFs Are Bulking Up

As savvy retail investors have been soaking up physical silver, so have the silver exchange traded funds (ETFs).

In the first quarter of 2013, over 140 tons of gold was sold by physically backed gold ETFs. But remarkably, silver ETFs bucked that trend.

In that same slice of time, the world's silver ETFs actually added 20 million ounces to their vaults. That's nearly $600 million worth of silver being bought within just three months, all while silver prices were steadily declining.

Now, silver ETF shareholders are a combination of both retail and institutional investors. But 20 million ounces flowing in is a clear sign of recognizing value and steady hands.

This kind of action is especially revealing. It signals that once an ounce of physical silver is bought, its owners have "sticky" hands, and they are very reluctant to sell.

Silver Driver No. 3: Sentiment is So Bearish, It's Time To Buy

Investor sentiment is often a great indicator - a great contrarian indicator, that is.

That's because the herd usually does the right thing at exactly the wrong time. It's what we call the Dumb Money.

Silver contracts are traded on futures exchanges. And one of the most useful gauges of investor sentiment is something called the Commitment of Traders Report (COT), produced weekly by the Commodity Futures Trading Commission.

When the speculators' (dumb money) net short silver positions reach a major high, it's nearly always a perfect contrarian signal. That's typically when the silver price is either at or very near a major low.

And it's exactly how things played out in 1997, 2000, 2001, and 2005. Each and every one of those instances marked exact or near-term lows from which silver prices either quickly shot higher, or began an extended rally.

In the weeks surrounding the April silver price selloff, silver short positions reached their highest levels in nearly 20 years. That's an extremely bullish indicator for higher silver prices ahead.

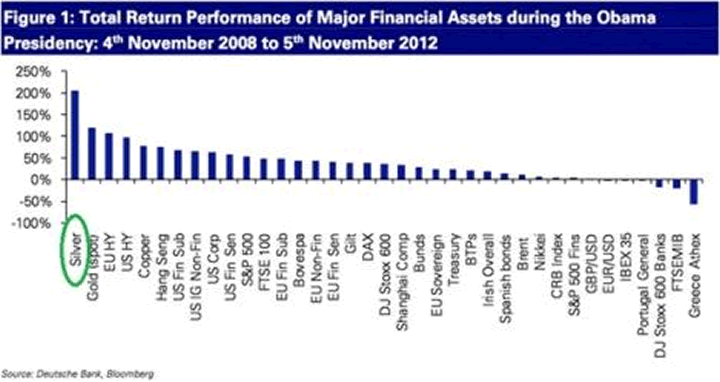

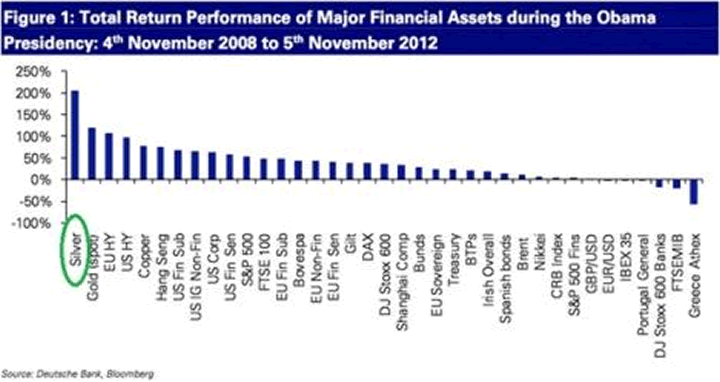

Silver Driver No. 4: Obama's Back, And He's Good for Silver

The president has been very good for silver prices. In fact, he was so good, he helped make silver the best-performing major financial asset during his first term.

Now that Obama has sealed another four years, and Federal Reserve Chairman Ben Bernanke's still in place and relying heavily on the printing press, I'm fully expecting a repeat performance. Thanks, guys, for more of the same.

Silver Driver No. 5: Insurance Against Government Theft Back in 1933, President Roosevelt seized privately held gold by signing into law Executive Order 6102.

FDR's official motive was to "provide relief in the existing national emergency in banking, and for other purposes..."

That single act criminalized the "hoarding" of gold by the public, giving people less than a month to turn in their gold.

Fast forward to 2013, and 80 years have gone by. Today, the 1933 gold confiscation is no longer common knowledge. But students of history realize the risk of a similar threat surfacing again.

Interestingly, silver was not targeted by Executive Order 6102. Now, we can't know if there will ever again be anything akin to this Oval Office edict - much less what it might cover and might say.

But going on the past, and considering the size of the silver market relative to gold, silver could be a way to own a precious metal that just might sidestep any risk of future confiscation.

Silver is much less widely owned than gold, and that could help keep it off the official radar.

Where will silver ultimately peak?

The bull market in silver is far from over. Given how silver has reacted after a strong selloff in the past, we could easily see the precious metal regain the $40 level by year's end. And in 2014, $60 silver is looking very attainable.

If the 1970s bull market in silver is any indication, we could see silver reach $125 by the time this bull market finally peaks.

But this time around, if the fundamental drivers are so entrenched, and global demand is so powerful, we could actually see silver at double that level, finally reaching $250 per ounce.

Needless to say, I've been following this story for a while and in Real Asset Returns I keep my readers ahead of all the risks and opportunities in precious metals, the miners and the various instruments that you can use to make the most out of your strategic metals positions. And they've profited mightily from it.

But there's a lot more upside to come.

And we're not the only ones thinking silver has much, much higher to go.

Eric Sprott, the billionaire Canadian resource guru, recently said:

"I think silver will be the investment of this decade whereas gold was the investment of the last decade. Silver will outperform gold. I believe silver will trade down 16:1 ratio to gold...Your return will be 300% more. If you have the patience and can stomach the volatility, I think silver will by far be the better investment going forward."

Wouldn’t surprise me, but when silver hits $250 an ounce, you won’t be able to pay for lunch at McDonalds with $100.

What about copper and brass?

I have at least 50 pounds of clean #1 stripped heavy gauge copper cable, and over 100 pounds of cleaned stripped salvaged brass of large diameter valves.

Sure glad I no longer have any need to purchase rolls of Tri-X.

Hard to believe but, once upon a time, One Dollar US was nearly an ounce of silver.

“...no longer have any need to purchase rolls of Tri-X.”

Ha! I spent many hours of my life developing Tri-X.

And now I have an enlarger, darkroom supplies, and SLRs that were once so valuable to me and are now just obsolete objects.

It defiantly will unless it doesn’t. So says The Oracle

Me too. You don’t know anyone who makes a digital film replacement insert for old-style SLR’s do you?

I’m just glad to be in the black with my $14/oz Silver, purchased in 1980.

Figured if the Hunt brothers were paying that price, it was a safe bet....

Only took 30 years to break even.....LOL!

I’ve been hearing ads for TUNGSTEN on the radio.

I saw jewelry made of tungsten for sale back during Christmas shopping........

A friend of ours raises Alpacas. They make quite a bit of stuff from their hair but the socks intrigued me. They have threads of silver in them to reduce mildew, mold, etc. to prevent athlete’s foot.

Silver really IS an industrial material. There is a strong demand for it. And junk silver coins add another attribute.

I like junk silver a lot.

mark

If silver hits $250 I would be tempted to sell silver and buy gold.

In inflated dollars the 1979 peak of $47.80 translates to about $156.

If it hit $1000 an ounce I still wouldn’t sell.

Sell gold! Buy silver! Wait, what about tungsten??

“They have threads of silver in them to reduce mildew, mold, etc. to prevent athlete’s foot.”

_____________________

From the website below:

“In America, pioneers moving west put silver and copper coins in their water barrels to keep it clean.”

Ha, I just heard one of those tungsten ads today for the first time myself. I LOL’d as it’s so hated among us goldbugs for its criminal uses.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.