Posted on 12/13/2022 9:36:50 AM PST by SeekAndFind

Answer: nope. Even if it might be accurate this time. Which it might be … or may not.

The BEA will publish the consumer price index report for November tomorrow morning. Economists expect it to drop, as did the producer price index in last Friday’s report. But they’ve expected it to drop significantly all year, and yet here we are:

At this time last year, economists were predicting that inflation would swiftly fade in 2022 as supply chain issues cleared, consumers shifted from goods to services spending and pandemic relief waned. They are now forecasting the same thing for 2023, citing many of the same reasons.

But as consumers know, predictions of a big inflation moderation this year were wrong. While price increases have started to slow slightly, they are still hovering near four-decade highs. Economists expect fresh data scheduled for release on Tuesday to show that the Consumer Price Index climbed by 7.3 percent in the year through November.

That begs the question: Should America believe this round of inflation optimism?

“There is better reason to believe that inflation will fall this year than last year,” said Jason Furman, an economist from Harvard who was skeptical of last year’s forecasts for a quick return to normal. Still, “if you pocket all the good news and ignore the countervailing bad news, that’s a mistake.”

There are some reasons to believe that inflation may moderate. In the first place, the Federal Reserve has been showering the economy with interest-rate hikes, hoping to tamp down demand and slow the price increases on goods and services. As the NYT observes, the supply chains are beginning to heal, both here in the US and in China, where Beijing has finally abandoned widespread lockdowns to deal with COVID. (That may change as transmission rates spike through the roof.)

On the other hand, there’s not been much indication that Biden or his team are rethinking energy policies. The price of gas at the pumps has come down to its level as of the end of last year, but electricity prices remain elevated, and those prices will impact consumer prices. In fact, the editors of OilPrice.com see even more restrictions coming from the White House on domestic production:

Despite pleading with oil and gas companies to boost their output in recent months, to tackle global shortages and rising prices, President Biden is once again hitting the industry hard by proposing a greater emissions reduction in operations. And he’s not the only one, as the U.K. and EU look to reduce gas flaring and venting practices to curb their methane emissions in line with climate pledges.

The Biden Administration has proposed a rule to further limit methane leaks and gas flaring on public land, which could have a significant impact on the industry if passed. It would build upon the extension of the Environmental Protection Agency’s (EPA) 2021 rule that requires drillers to detect and plug leaks at well sites across the country. The Interior Department is recommending the new rule to support Biden’s aim of reducing emissions and meeting U.S. climate pledges. It would mean stricter monthly time and volume limits on gas flaring in oil and gas operations.

In other words, energy prices will likely remain elevated over January 2021 levels for the entirety of the Biden presidency. That in itself should have people skeptical about the prospects for inflation reduction, not to mention the fact that the Biden administration still hasn’t adopted the kind of supply-side tax and regulatory policies that would allow us to grow supply without killing demand and jobs.

Still, investors seemed pretty hopeful today, but even that has a caveat:

The Dow Jones Industrial Average jumped Monday, clawing back some of the steep losses from the previous week, as traders looked ahead to a highly anticipated Federal Reserve meeting and new inflation data.

The blue-chip Dow added 528.58 points, or 1.58%, to 34,005.04. That was its first close over 34,000 since Dec. 2. The S&P 500 gained 1.43% to close at 3,990.56, and the Nasdaq Composite rose 1.26% to 11,143.74. …

“Today’s action is mostly a reflex bounce after last week’s poor performance,” said Yung-Yu Ma, BMO Wealth Management chief investment strategist. “There’s probably some cautious optimism ahead of tomorrow’s CPI report, but also some underlying concern. We can see that concern today in an up market for equities that actually has the VIX rising quite sharply.”

“Europe, which outperformed last week is down today while the U.S. is bouncing,” he added. “It speaks to a choppy market with low conviction; strong markets have better uniformity.”

The best policy: hope for the best, prepare for the worst. There’s no real reason to get optimistic about inflation while inflationary tax and regulatory policies continue, however.

I don’t trust the NYT either.

Well, the RAT “media” will convince the ignorant “americans” that inflation has eased. There’s an election coming up. Boy Biden (Hunter) will be running for president and will reduce the price of a gallon of gas from 12 bucks to 7.00 bucks. “Americans” will rejoice! Eggs will go from 9.50 a dozen to 7.95.

A bigger question: Should anyone believe a damn thing the NYT writes?

When it comes to predictions, I put economists on the same level as stock research analysts, which is seven levels below a chimp randomly throwing darts at a dartboard. Paul Krugman wins the all time prize for abject blindness coupled with innate stupidity and topped off with a heap of dishonesty

Hell no!

Inflation will go away when the federal government balances its budget. Good.luck with that.

Basically, Asymmetrical Information is not for public consumption.

Supply and demand is not inflation.

As long as there is a war on fossil fuels inflation will continue.

Inflation has already started decline. Employment is still too hot so the FED must keep raising rates as well as selling off bonds (which everyone ignores yet it has just as much effect as raising rates). Also, it takes months for an interest rate raise to work its way into the economy.

So far, so good.

I can predict with absolute certainty that next year inflation will either go up, go down, or stay the same.

Anyone who claims more certainty than that is either lying or does not understand the situation. If I knew for a fact what any economic measure would do in the next year, I could retire as a billionaire at the end of the year.

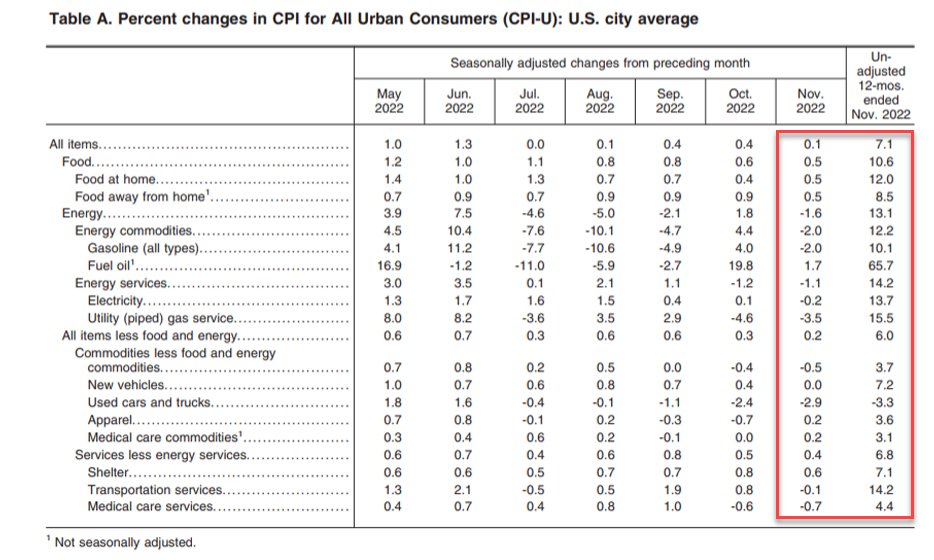

The inflation numbers were released already. Inflation came in cooler than expected. “The consumer price index, a key inflation barometer, jumped by 7.1% in November from a year earlier, the U.S. Bureau of Labor Statistics said Tuesday. Economists expected a 7.3% annual increase.”

The CPI reading for November was the smallest 12-month increase since December 2021, and down from 7.7% in October. "Across the board, we saw a moderation of inflation," said Mark Zandi, chief economist at Moody's Analytics. "That's what's most encouraging. It's not one or two special factors."

A big caveat is that these numbers may not reflect reality.

I kind of disagree about economists working for Wall Street banks and brokerages. I spent a career on Wall Street working with bank and brokerage economists as well as stock researchers with big paychecks. The reason for my original post is based on my experience working with them. They are the ones I had in mind. They can tell you what happened but, God forbid, you follow their chimp prognostications as to what will happen

I kind of disagree about economists working for Wall Street banks and brokerages. I spent a career on Wall Street working with bank and brokerage economists as well as stock researchers with big paychecks. The reason for my original post is based on my experience working with them. They are the ones I had in mind. They can tell you what happened but, God forbid, you follow their chimp prognostications as to what will happen

You should have thrown the current Secretary of The Treasury Janet Yellen in there below the chimp randomly throwing darts at a dartboard.

At least the chimp hits the board occasionally.

Transitory..../s

We have a similar saying in trading commodities.

Good salesmen sell. Bad salesmen teach how to sell.

I got my undergraduate degree in Finance 40 years ago. The one thing that has stuck with me the most from my Finance courses all those years ago is all of the studies that show if you buy a portfolio of stocks entirely at random you get a higher average rate of return than 50% of the professional money managers.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.