Posted on 12/03/2020 10:11:40 AM PST by Kaslin

Changing the financial rules about college moving forward is a separate debate. Changing the rules retroactively, however, is dishonorable and unjust.

Two massive potential federal programs to ease the financial burden of college are being debated. One involves some type of free college program, and the other some type of student loan bailout. There is, however, a fundamental ethical difference between the two. The first affects the decisions of students moving forward, while the second rewards only select people based on past actions.

Even at a very young age, children know it’s blatantly unfair to change the rules of a game while it’s being played, but especially after the game is over. Millions of families made critical life decisions about college based on the financial rules and options at the time. They decided how much student debt (if any) they were willing and able to take on.

They made choices. Many made sacrifices. If some want to change the financial rules about college moving forward, that’s a separate debate. Changing the rulebook retroactively is both dishonorable and unjust.

Imagine six high school seniors who have nearly the same GPA, comparable middle-class families, and similar life aspirations. They all have a passionate interest in the arts and want to buy a home someday. All are accepted into an expensive, prestigious liberal arts college that none can afford without taking on about $50,000 in student debt. Then reality sets in.

Ashley chooses to attend the expensive college, her dream pick. She majors in art history and, rather than work part-time, focuses on her social life, social causes, and grades. With her father as a cosigner, Ashley obtains federal student loans for the full $50,000 and hopes to obtain a coveted job at a museum after graduating. Fair enough.

Bryson abhors the idea of taking on any debt. He ultimately decides to skip college altogether and instead works for four years at the local supply store. He opts for fewer opportunities to have fewer liabilities.

Crystal reluctantly agrees to forgo her dream college experience. She instead attends the more affordable local public college and takes extra classes to graduate in three years. Crystal opts for a less prestigious name on her diploma in exchange for saving more money for a down payment on a home. She conscientiously completes one year of loan payments after early graduation.

Diego, like Ashley, attends the dream college but majors in civil engineering. He works 20 hours per week for four years, which takes a toll on his grades. While he would rather hang out in the student section during the basketball games, he instead works the concessions. Diego opts for less of the college experience and accepts average grades in exchange for graduating with minimal debt that he will quickly pay off as an entry-level engineer.

Eunice also goes to the dream college, where she enrolls in the military science program, earns an Army ROTC scholarship, and agrees to a post-college commitment. She opts for significantly less freedom — both during and after college — to graduate debt-free.

Franklin attends the dream college, majors in art history, and will later be Ashley’s competition for that museum position. His father’s credit record with the local bank enables him to obtain a student loan with a slightly lower interest rate than the federal loan rates. Franklin smartly opts for the private loan to lower his total payments.

Fast-forward to four years after these six graduated from high school when the federal government suddenly offers up to $50,000 in student loan bailouts. Yes, Ashley is thrilled and relieved that she’s no longer on the hook for that huge loan she signed. All who are not Ashley are relatively disadvantaged for not being able to foresee the future.

Guess what, Bryson: you could have had a paid-for college education by now. Crystal, oops, you could have attended your prestigious dream college, plus avoided 12 loan payments that will not be reimbursed. Sorry, Diego, you just learned that you did not have to work 20 hours per week for four years; it’s a bummer that you missed out on all those fun experiences and now don’t have the competitive grades for grad school.

Eunice, it turns out you didn’t need to crawl under barbed wire through the mud after all, but thank you. Franklin, can you believe that you still owe the entire $50,000 plus interest because you selected the wrong type of loan?

People who champion federal student loan bailouts focus almost exclusively on the hardships of certain borrowers and are dismissive of everyone else. We’re told that Ashley had no choice if she ever wanted a professional career but all the others, well, they each made a choice and should now quietly live with it.

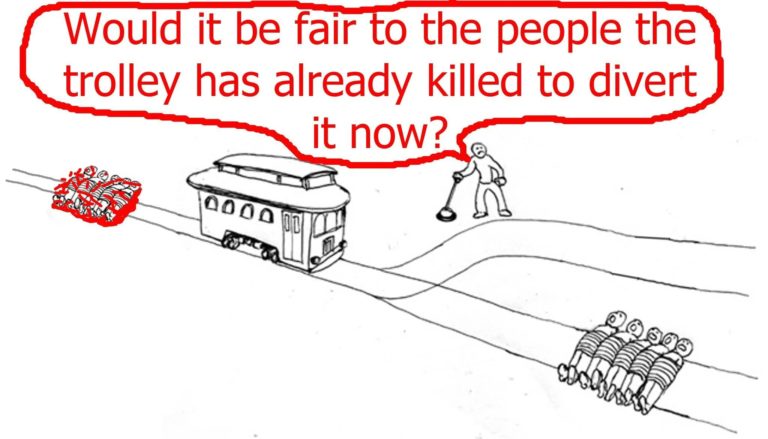

Newsweek recently published an article in strong support of student loan bailouts that widely disseminated a tweeted cartoon by Georgia State law professor Anthony Michael Kreis. The cartoon references a classic ethical thought experiment regarding a trolley.

Here’s the problem. The analogy doesn’t apply to student loan bailouts. To be fair, it does apply to some type of free college program moving forward. It shows that even though people suffered in the past, others need not have a similar outcome in the future. Whether people suffer by making college payments is highly debatable, but yes, you can pull the switch to change the future.

Student loan bailouts, however, are different. It’s trying to pull the switch to alter the past, and only for a select few. Moreover, those who agreed to a student loan were never tied to the tracks against their will.

If student loan bailouts happen, the five innocent people on the track about to get hit will be Bryson, Crystal, Diego, Eunice, and Franklin, along with the tens of millions of young people like them who did not possess the right crystal ball.

Where’s Ashley? She hopped on the trolley as a passenger. The only question now is whether she is going to pay her fare.

“Socialism will only work in two places; in heaven where it is not needed, and in hell where they already have it. Capitalism is the unequal distribution of wealth. Socialism is the equal distribution of poverty. Communism is nothing but socialism with a gun at your back.”

Winston Churchill

As it stands right now, the people who are unable to manage their college debt due to loss of work, etc. are not allowed bankruptcy protection. If they changed that one thing, the people who don’t want a bankruptcy on their record who can pay back their debts, will repay them. The others should be allowed to file.

I have not been consulted by anyone about assuming debt to go to college. Therefore, those who assumed these debts need to buck up and pay them back.

If the debt is more than one can pay off, all I can say is, "Sorry about that".

Take it out of the endowments of the universities that exploited them.

Universities do believe in “fairness,” don’t they?

The tuition bailouts are simply a mass vote-buying scheme. Offer someone $10 to vote for a candidate, and it’s a crime, but offering people $10,000 - $100,000 in debt forgiveness is considered ok. Something is terribly wrong here.

I think that would be fine - for future loans. The core principle that makes this so dangerous is the effect of the government RETROACTIVELY changing rules.

And trust me on this one, if they did have that rule in the past, a LOT of people that were able to get these loans would not have qualified. That’s kinda the whole point of having people sell themselves into indentured slavery - to make damned sure they pay the debt.

“The others should be allowed to file.”

Graduste. File and get $200k debt wiped out!

No brainer!

That trolley analogy is typical of the rat, lib mindset. Nobody is asking these fools to lay down on the tracks in the first place.

As long as all the good jobs are given to foreign trash H1Bs, yeah it’s fair to ask for student loan forgiveness. There are 5 million of us well-qualified American Engineers permanently underemployed or unemployed.

Republicans decided that the Cheap Labor Indian Express was far too valuable a commodity.

One more example of how Dems dumb down Americans and corrupt their values at the same time.

Do that, and the problem goes away quickly. So do about half the Universities and Colleges in the country.

The ones that survive might end up lowering their tuition and offering more useful courses of study.

Win-Win-Win.

‘You missed the part where the Government stops making student loans.”

Nope.

Rest easy, nothing will be done. The student loan program was designed by Democrats to create a new underclass of debt slaves beholden to voting for Democrats for vague promises of relief.

Solving this problem would remove the Democrats leverage over these voters. Think about the decades of promises Democrats have made to the black community, have they kept them?

So in the end, these debtors will receive nothng but band-aids and platitudes, while the Democrats “fight” to save them from the “rapacious” Republicans.

All I know is that I put a few thousand of my son’s tuition on my line of credit a few years ago. Got low rates, and am still paying. I doubt I’ll get any relief.

I have student load debt from a later in life doctorate and, as much as I would like to have that debt forgiven, disagree with it. At the article says, no one make a student take out loans. Sorry, snowflakes, a college education is NOT a civil right. Each and every one of them received at least a high school education. IF Congress really wanted to help, they could immediately reduce the interest rate on student loans to zero. And could subsidize private loan interest rates as well. But, that, as we know, is not the goal. The goal is to buy an impressionable group of voters.

Absolutely. There is no sensible reason education debt is not dischargeable.

And spare me the “you can’t repossess an education” argument.

You also can’t repossess medical care or anything else not secured in a loan contract.

I have a student load that I took out for my daughter in 2010. It will be paid in full next week.

I paid mine in full over 6 years. So do I get a refund?

Medical costs listed in bankruptcies have gone WAY down since The Affordable Care Act. Some might say a silver lining of ObamaCare.

It is true that you can’t repossess a college education.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.