Skip to comments.

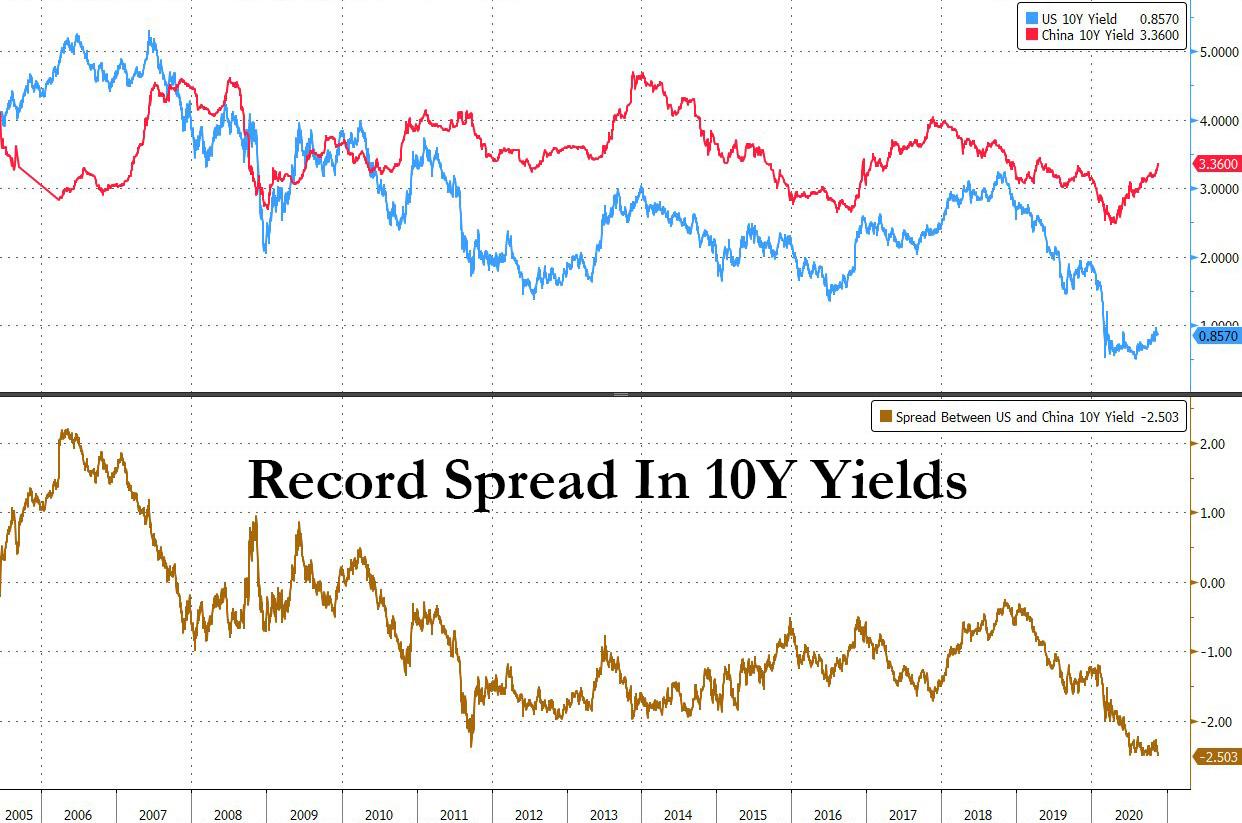

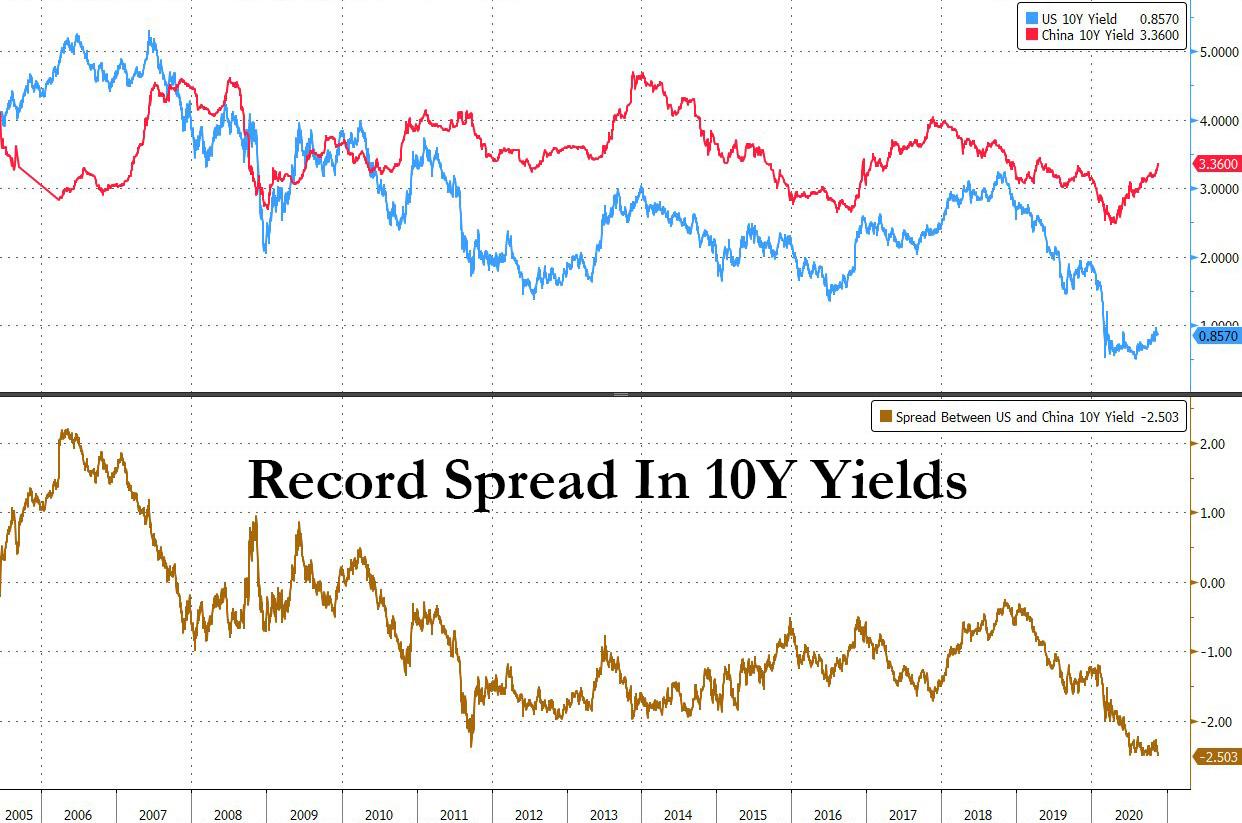

Tensions in the Chinese Bond Market As State Owned Companies Default: Chinese 10 Year Yield Premium Over US Treasuries Hits Record High

USSA News ^

| 11/19/2020

| Tyler Durden

Posted on 11/19/2020 7:35:00 AM PST by SeekAndFind

With US Treasury yields capped around 0.90% amid concerns that in the absence of fiscal stimulus the Fed will need to step in with more easing (either in the form of extending QE maturities, or an outright expansion in QE), China is facing a different set of challenges and following the recent rout in the bond market following several unprecedented SOE defaults, overnight the Chinese 10Y yield rose another 2bps to 3.36%, and almost 90bps from the all time low of 2.48% hit in April.

As a result, the premium for China’s 10-year government bonds over U.S. Treasuries of same duration has climbed to 250 basis points, the highest on record.

A big part for the continued push higher in Chinese yields is the PBoC's "limited approach" to dealing with recent SoE defaults, which we profiled on Monday in "China's Bond Market Turmoil Worsens As More State-Owned Companies Default."

Still, as Caixin reported overnight, the series of bond defaults by Chinese state-owned enterprises is now on the radar screen of the country’s top economic planner. At a routine press conference Tuesday, National Development and Reform Commission (NDRC) spokesperson Meng Wei called for local governments to step up supervision through project screening to prevent default risk for enterprise bonds.

Risk prevention for enterprise bonds has been relatively good with no defaults this year despite SOE defaults in the corporate bond category, NDRC says

Overall, risk prevention for enterprise bonds has been relatively good and there has been no default this year, Meng said. The cumulative default rate of enterprise bonds is at the lowest level among corporate debts, she said.

As discussed previously, the number of defaults by China’s SOEs is expected to rise marginally next year as the central bank shifts toward a more neutral policy stance amid an economic recovery, according to a Fitch report released Monday. Also on Monday, China’s central bank pumped 800 billion yuan of liquidity into the money market Monday through its medium-term lending facility helping to relieve some of the anxiety that’s gripped institutions and investors after the recent bond defaults, although judging by the continued drift higher in yields, tensions remain.

Investor appetite for debt from weaker SOEs is likely to ebb as market liquidity tightens, a trend that Yongcheng’s surprise default may accelerate, Fitch said. Before the Yongcheng default, five SOEs failed to repay debt from January through October, close to levels seen in the previous two years, according to Fitch.

Amid the investor strike following the SOE defaults, at least 20 Chinese companies have suspended planned bond sales worth 15.5Bn yuan ($2.4bn) over the past week, as the high-profile defaults of three state-owned enterprises and questions about the solvency of a fourth unnerved investors in the world’s second-largest bond market, the FT reported.

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: asia; bondmarket; bonds; china; default; trade; treasuries

To: SeekAndFind

2

posted on

11/19/2020 7:36:15 AM PST

by

griswold3

(Democratic Socialism is Slavery by Mob Rule)

To: SeekAndFind

And this is what always happens when government interferes in the market. Everybody loses. Wish those receiving subsidies realized that.

3

posted on

11/19/2020 7:55:00 AM PST

by

Pining_4_TX

(I'm old enough to remember when you actually had to be able to do something to be hired to do it.)

To: SeekAndFind

How can these finance houses have any Idea what the interest rates are in China when there is No transparency anywhere in their economy.

I for one would not one dime of mine invested anywhere in China. The ChiCom Government can’t be trusted.

4

posted on

11/19/2020 7:57:14 AM PST

by

puppypusher

( The world is going to the dogs.)

To: SeekAndFind

China Inc is a ponzu scheme.

SOEs send RMB around the circle by purchasing often unneeded items from other SOEs. Concrete, steel, and glass for instance to build new buildings that will sit empty. But those sales make their reported numbers look good.

5

posted on

11/19/2020 8:01:25 AM PST

by

datura

(If you have to cheat, you didn't’ win.)

To: SeekAndFind

I have a financial planner that I show my portfolio to once a year. I make my own investment decisions, Ijust ask his opinion / advice. He always, without fail, tells me I need to have much greater international content. And I politely tell him 'nope'.

I do not trust foreign nations, especially fascist ones like China, to maintain a regulated and fair market. I also don't trust dictators to make sound decisions and not destroy their economies. As imperfect as it is, I'd rather thave a broad selection of US securities than a 'risk mitigation' of securities from nations run by socialists, communists, fascists, or dictators. Which is almost everywhere but here (for the most part ... for now)

6

posted on

11/19/2020 8:15:40 AM PST

by

pepsi_junkie

(Often wrong, but never in doubt!)

To: SeekAndFind

I still can’t get past how anyone in the Financial community would even consider a Communist country’s bond market to be credible ...

7

posted on

11/19/2020 9:28:24 AM PST

by

SecondAmendment

(This just proves my latest theory ... LEFTISTS RUIN EVERYTHING)

To: SeekAndFind

China is doing very, very well.

They are running (huge) trade surplusses.

Massive.

Have been, forever.

8

posted on

11/19/2020 10:02:24 AM PST

by

cba123

( Toi la nguoi My. Toi bay gio o Viet Nam)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson