Posted on 12/29/2019 6:15:19 PM PST by SeekAndFind

As China struggles to deal with the slowdown of the world’s second-largest economy, it has embarked on a new strategy of placing financial experts in provinces to manage risks and rebuild regional economies.

Since last year, Chinese President Xi Jinping has put 12 former executives at state-run financial institutions or regulators in top posts across the nation’s 31 provinces, regions and municipalities, including some who have grappled with banking and debt difficulties that have raised fears of a financial meltdown.

Only two top provincial officials had such financial background before the last leadership reshuffle in 2012, according to Reuters research.

Among the experts promoted is Beijing Vice Mayor Yin Yong a former deputy central bank governor, and Shandong Deputy Provincial Governor Liu Qiang , who rose through the nation’s biggest commercial banks, from Agricultural Bank of China to Bank of China.

Another newly promoted official, Chongqing Vice Mayor Li Bo, had until this year led the central bank’s monetary policy department.

The appointments — overseeing economies larger than those of small countries — would appear to put those officials in the fast lane as China prepares a personnel reshuffle in 2022, when about half of the 25 members of the Politburo could be replaced, including Chinese Vice Premier Liu He, who is leading economic reform while doubling as chief negotiator in trade talks with the US.

“Bankers are now in demand, as local governments are increasingly exposed to financial risks,” said Feng Chucheng, a partner at Plenum, an independent research platform in Hong Kong.

“These ex-bankers and regulators are given the task of preventing and mitigating major financial risks,” he said.

The appointments have come as economic growth has slowed to its weakest in nearly three decades, while government infrastructure investment has fallen.

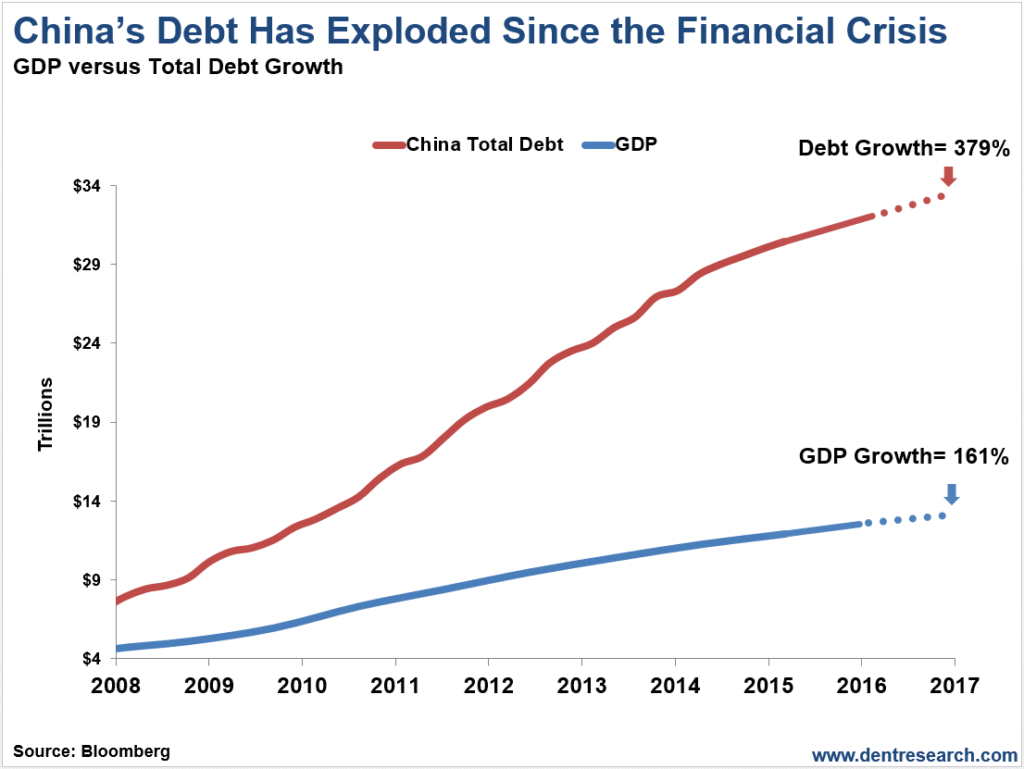

Five regional banks were hit with management or liquidity problem this year, raising the prospect of devastating debt bombs lurking in unexpected corners.

“We need to be well-prepared with contingency plans,” Xinhua news agency said after a major annual economic meeting headed by Xi this month.

The economy faced “increasing downward economic pressure amid intertwined structural, institutional and cyclical problems,” it said.

With pressures mounting, local governments are expecting to take the lead in managing their financial scares and cutting the cost of rescue with local intervention, analysts said.

“Appointing financial vice governors to provinces can help better integrate financial policies into local practice, and to prevent financial risks beforehand,” said He Haifeng, director of Institute of Financial Policy at the Chinese Academy of Social Science, a government think tank.

“Such appointments have also showcased a change of manner in official appointments,” He said.

Financial executives were long shunned for leadership positions.

Banks were nationalized after the Chinese Communist Party took power in 1949 and many bankers were purged during the Cultural Revolution.

Xi started to stress the importance of financial expertise and to elevate the status of executives in 2017.

“Political cadres, especially the senior ones, must work hard to learn financial knowledge and be familiar with financial sectors,” Xi said in a national meeting on financial affairs.

Half of the 12 former financial executives elevated to provincial leadership posts under Xi were born after 1970.

Liaoning Vice Governor Zhang Lilin, 48, a veteran banker who spent two decades in the nation’s third-largest lender, Agricultural Bank of China, was appointed days after three state-controlled financial institutions announced investment in the then-troubled Bank of Jinzhou.

how does that saying go… Keep an eye out for a cornered animal is most vicious when cornered! I would not doubt for one minute these evil communist bastards start a war with the USA!

... even as producer prices, a driver of industrial profits, slumped below zero earlier in 2019, a clear indicator that China's enterprises desperate for lower rates.

Our chance to export Paul Krugman ?

Win the trade war — collapse China and get Chinese money out of US politics.

Drill, Baby, Drill — become an oil superpower, change the Middle East and get Arab money out of US politics.

Drain the swamp — remove corrupt US officials and arrest the leaders, get Soros money out of US politics.

MAGA

Remember, China is not a free country, banking and the financial systems are run by the CCP. Xi does a lot of PR for the external world but internally he is under a lot of pressure from the forces who really run China.

Trump knows this and that’s why he keeps turning the handle of the vise.

It is going to be an epic writedown of bad debt, and revaluation of of their currency. The working people are going to have their net worth halved.

Domestically, they can fudge the numbers, and continue to print their Monopoly money, but in dollar terms, the reckoning is approaching.

It is going to be Epic.

The best cure for them would be to throw off the Communist Party rule.

I like the way you think!

These people are so GD stupid. Every member of the Chinese leadership at every level should begin by immersing themselves in the works of Adam Smith, Murray Rothbard, Ludwig von Mises, and Ayn Rand. They might just learn a thing or two.

Could it actually lead to a resurgence of Maoism?

As China struggles to deal with the slowdown of the world’s second-largest economy, it has embarked on a new strategy of placing financial experts in provinces to manage risks and rebuild regional economies...

...and to be sacrificial lambs when the economy tanks.

The Patrick Lumumba memorial university in Moscow.

Out with the engineers...in with the bankers. An admission of failure.

Nothing can save them and these “experts” will probably make things worse.

In 40 years China has become the second largest economy. They have definitely learned more than a thing or two.

China is more likely to face a slow, grinding, multi-decade zero growth period (as well as population decline), like Japan.

It is interesting that Xi and the party have been increasing control recently as they are under increased stress and pressure. Trump is a major threat to them as he has displaced their appointment for the economic throne and slowed the wealth redistribution from our nation to China AND he is showing the Chinese people (who respect him) what freedom can do for a nation and people.

The real question may be “how does this all end?”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.