Skip to comments.

Embattled Federal Reserve chairman tells White House officials he'll meet face-to-face with Trump

Daily Mail UK ^

| December 27, 2018

| Francesca Chambers

Posted on 12/27/2018 11:52:59 AM PST by COUNTrecount

Embattled Federal Reserve chairman tells White House officials he'll meet face-to-face with Trump in bid to end feud that left stock markets reeling over fears president will fire him

Dow Jones closed up 1,086.25 points, or 4.98 per cent, on Wednesday

It was the stock index's largest single-day points gain in U.S. history

Follows biggest-ever Christmas Eve plunge for markets on Monday

White House officials tried to soothe fears over Trump's fury at Federal Reserve

He's upset about rate hikes and reportedly said he wanted to fire the fed chair

Federal Reserve Chairman Jerome Powell is now telling the White House that he'd be willing to meet with President Trump to discuss their differences

The president and the federal reserve chairman have been on an untenable collision course that has delved into the murky waters of whether the nation's chief executive has the authority to fire the head of the United States' central banking system.

Federal Reserve Chairman Jerome Powell is now telling the White House that he'd be willing to meet with President Trump to discuss his concerns about the independent agency's rate hikes, the Wall Street Journal reports.

A face-to-face chat with Powell could quell some of the president's anger about the Fed policies that Trump blames for the dramatic stock losses an instability in the market, despite a sustained unemployment rate of 4.1 percent or less over the last 14 months.

'A meeting between the two should be helpful,' Larry Kudlow, head of the president's economic, told the Journal. 'Right now, their relationship is like a stock looking for a bottom. There’s only upside.'

(Excerpt) Read more at dailymail.co.uk ...

TOPICS: News/Current Events

KEYWORDS: fed; fedchair; fedchairman; jeromepowell; trumpfed

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-136 next last

To: Alberta's Child

There’s a lot more than the stock market that is affected by the FOMC manipulating interest rates.

One of the biggest problems with the FOMC is that there primary premise that economic growth causes inflation is completely wrong.

Two of the worst effects of their manipulation are going against Trump’s important policies. The strong dollar is causing the trade deficit to go up. And the increase in short term government securities interest rates is greatly increasing the interest we pay on Obama’s debt, which is adding a lot to the budget deficit.

Hopefully Powell resigns. He’s not going to change his mind and neither is Trump.

21

posted on

12/27/2018 12:36:55 PM PST

by

Moonman62

(Give a man a fish and he'll be a Democrat. Teach a man to fish and he'll be a responsible citizen.)

To: All

It should be like that scene from the Godfather. Brains or signature on a promise not to raise rates until after 2020 w/o serious actual inflation.

22

posted on

12/27/2018 12:36:57 PM PST

by

newnhdad

(Our new motto: USA, it was fun while it lasted.)

To: Alberta's Child

23

posted on

12/27/2018 12:37:06 PM PST

by

Dartoid

To: beekay

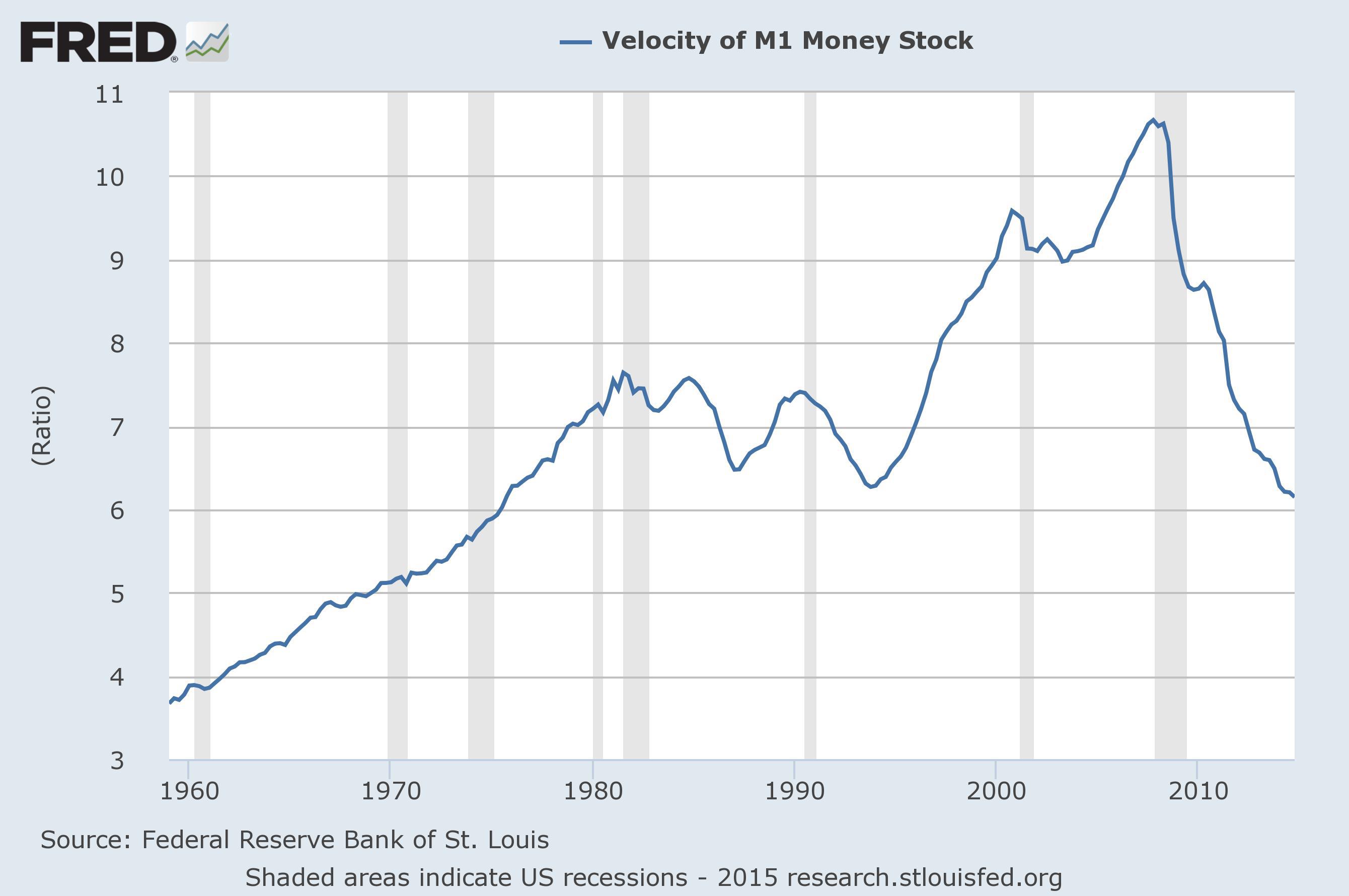

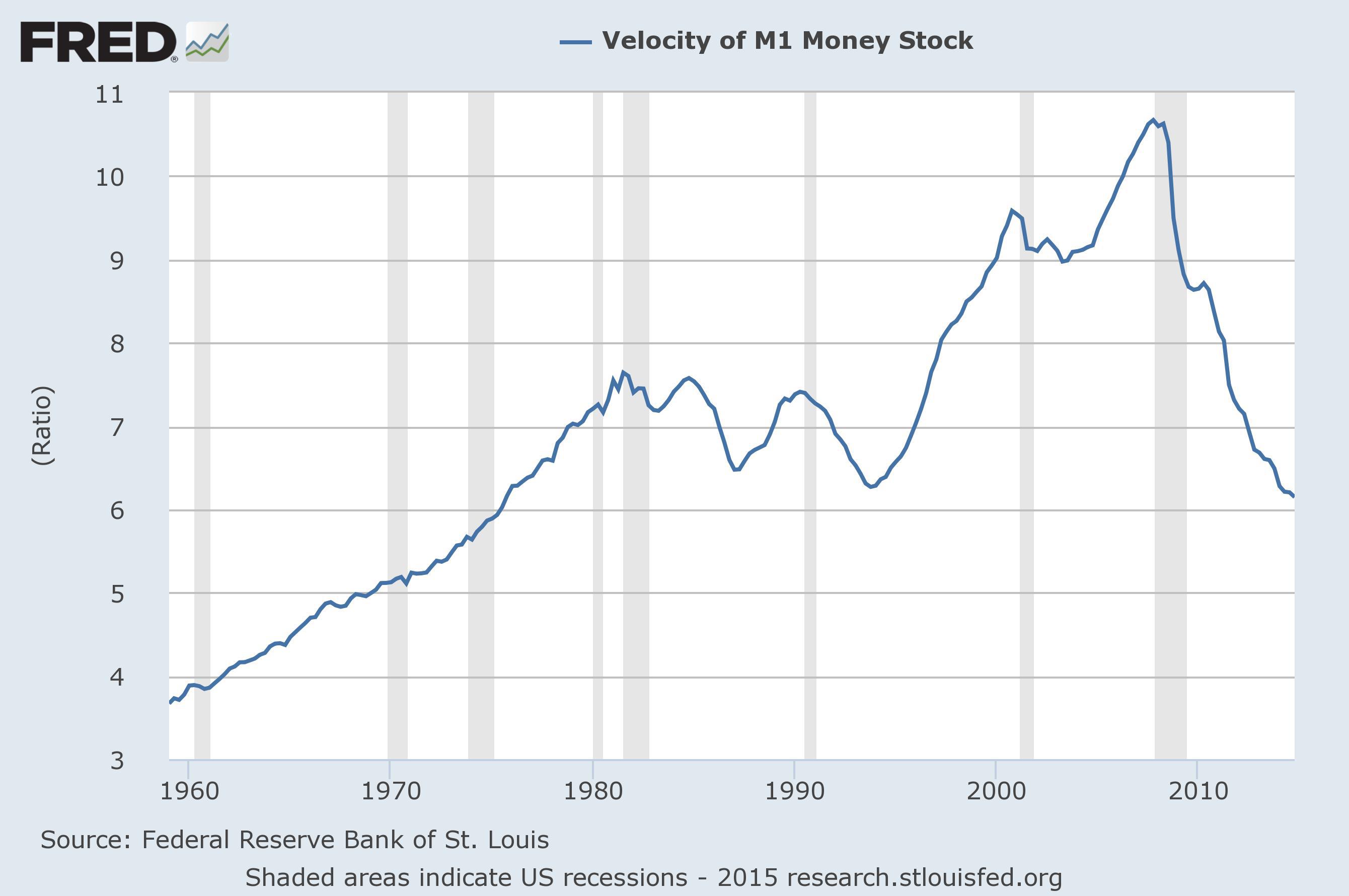

This is what the FED was looking at when they established the policy of winding down the QE process starting in 2016:

I'm no economist, but that looks like a classic "liquidity trap" to me ... where growing liquidity had the opposite of its intended effect. Basically, reducing interest rates to near 0% actually resulted in investors sitting in cash and earning nothing on the money.

24

posted on

12/27/2018 12:40:41 PM PST

by

Alberta's Child

("I'm a cool dude in a loose mood! Hey -- two ginger ales for my girls!")

To: Alberta's Child

Jerome Powell is the only FED chairman in the history to come out and say US economy is heading toward recession after a very good stock market run and purposely after the election. He raised the rate 3 times. Making me feel like he did it in a mission to tank the economy. And how long he has been in the position? If you look at the damage, he has to resign.

To: Alberta's Child

There you have it, folks ... A U.S. company that has never paid a single penny in dividends is somehow worth nearly $400 billion? This stock market decline is a case of fixing delusions, for the most part.S&P dividend yields have been around 2% for the past 30 years.

The market clearly reacted to Powell's unfortunate and anticipated comments about raising interest rates.

To: Dartoid

I had a Freeper get on here a few months ago and tell me that financial reports no longer mattered when it comes to buying and selling stocks.

Just think about that and ask yourself if that makes any sense.

The last time I heard that from someone who seemed reasonably intelligent was right before the tech stock collapse in 2000.

27

posted on

12/27/2018 12:43:13 PM PST

by

Alberta's Child

("I'm a cool dude in a loose mood! Hey -- two ginger ales for my girls!")

To: freedom1st

28

posted on

12/27/2018 12:43:48 PM PST

by

JayGalt

(You can't teach a donkey how to tap dance.)

To: FreeReign

To: Sacajaweau

——raising interest rates for no reason.——

Au contraire mi amiga........ he had a good and seemingly valid reason

The rates were raised to slow economic growth and dampen inflation

Growth > 3% -> inflation > 2% allowable target

He plainly stated that in his address the next day

His reason was to control American business by controlling the money supply and the economy

30

posted on

12/27/2018 12:47:04 PM PST

by

bert

( (KE. N.P. N.C. +12) Invade Honduras. Provide a military government)

To: FreeReign

The FED published its interest rate strategy in 2015 when growth was anemic at best. That didn’t stop the S&P from reaching new highs regularly after that, did it?

31

posted on

12/27/2018 12:48:48 PM PST

by

Alberta's Child

("I'm a cool dude in a loose mood! Hey -- two ginger ales for my girls!")

To: Alberta's Child

A.C., you might be able to answer my question.

For simplicity’s sake, assume the entire value of the market can be stated in a single index.

Suppose the index started at 5,000 on a particular day. During the day the value fell to 4,000, but by the end it had regained the entire amount and closed at 5,000.

Did anything happen that day in real terms?

32

posted on

12/27/2018 12:52:23 PM PST

by

ArGee

(I trust people with freedom more than I trust government with power.)

To: ArGee

For day traders of index options, yes.

33

posted on

12/27/2018 12:53:15 PM PST

by

Pelham

(Secure Voter ID. Mexico has it, because unlike us they take voting seriously)

To: LibFreeUSA

“The U.S. Economy does not depend on just one single person for pete’s sake. This is so whacked out.”

Don’t spoil the story.

34

posted on

12/27/2018 12:53:59 PM PST

by

Pelham

(Secure Voter ID. Mexico has it, because unlike us they take voting seriously)

To: ArGee

Did anything happen that day in real terms? It depends on whether you bought or sold any stocks. If you didn't, then "nothing happened" in real terms. If you did, you may have lost money (if you bought at 5,000 and sold at 4,000, in the most extreme case) or gained money (if you bought at 4,000 and sold at 5,000, in the opposite extreme case).

Most stocks are owned in mutual funds, and the managers of those funds will often look to buy and sell multiple times within a day if they think there are opportunities to make money.

35

posted on

12/27/2018 12:55:27 PM PST

by

Alberta's Child

("I'm a cool dude in a loose mood! Hey -- two ginger ales for my girls!")

To: Pelham

So, wealth shuffled around but didn’t change in the aggregate? Some won and some lost?

36

posted on

12/27/2018 12:55:57 PM PST

by

ArGee

(I trust people with freedom more than I trust government with power.)

To: ArGee

Think of it like buying and selling your home.

If you bought it for $100,000 and it's now worth $300,000 just a few years later, then you can make a lot of money on the deal. But that $200,000 gain only happens if you sell it now.

If the value of the home goes back down to $200,000 you didn't lose any money even though it was worth $300,000 at some point. You're still $100,000 ahead.

37

posted on

12/27/2018 12:58:51 PM PST

by

Alberta's Child

("I'm a cool dude in a loose mood! Hey -- two ginger ales for my girls!")

To: LibFreeUSA

The Fed is not one person

There are severl that fear that which is out of thier tight control

38

posted on

12/27/2018 12:59:00 PM PST

by

bert

( (KE. N.P. N.C. +12) Invade Honduras. Provide a military government)

To: Aevery_Freeman

The Fed doesn’t coin money nor does it make loans to the government.

The Constitution is silent on paper money and credit, which banks have had the right to create since day one.

The government borrows money from investors. The Fed is not an investment bank and any earnings the Fed has go to the Treasury.

39

posted on

12/27/2018 12:59:07 PM PST

by

Pelham

(Secure Voter ID. Mexico has it, because unlike us they take voting seriously)

To: Alberta's Child

But they’re actually pretty steady — or rising very slowly. In face, the yield on a 30-year Treasury note was 3.06% yesterday — which is lower than it’s been at the end of every month from September onward.Yeah I know. 3%? I lived through double digit interest and inflation rates. These 1/4 increases are predictable and have likely been factored into the market for quite awhile. This volatility will continue until the China trade war is resolved.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-136 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson