Posted on 02/12/2018 3:07:26 PM PST by SeekAndFind

Corporate earnings in the fourth quarter have been stellar.

With 80.7% of the S&P 500’s market cap having reported earnings through the market close on Friday, February 9, 74% of companies are beating bottom-line estimates. Earnings are topping analyst expectations by an average of 4.8%. This is better than the 68% beat rate by an average of 4.7% seen over the last three years, according to data from Credit Suisse.

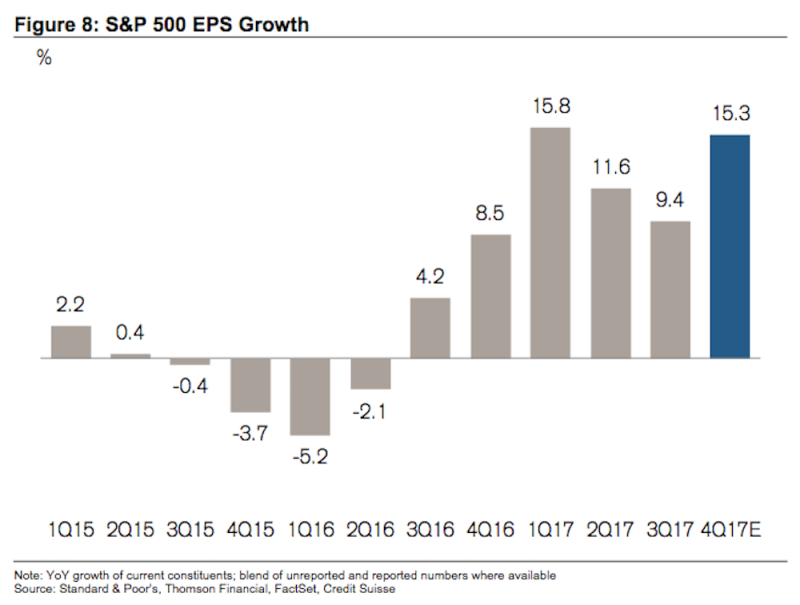

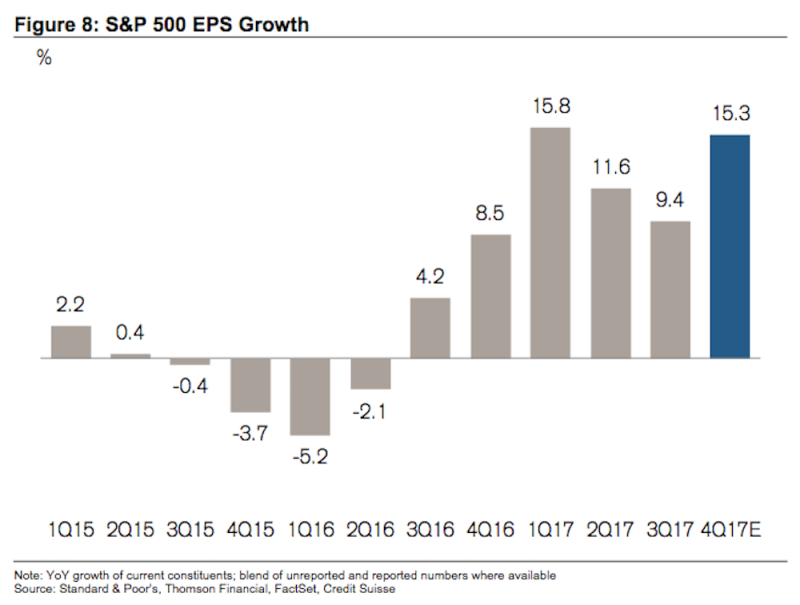

Credit Suisse also notes that earnings per share growth in the fourth quarter is expected to hit 15.3%, which would be the second-best quarter since the start of 2015.

But if current earnings beats relative to expectations hold through quarter-end, earnings per share could rise 15.9% against last year, which would be the strongest quarter for earnings growth since 2015.

Markets, however, have recently been enduring their most turbulent stretch in years, with the major averages falling more than 5% in the first full week of February. The nine-day drop of 10.04% from peak-to-trough seen through February 8 was the largest nine-day drop from an all-time high since at least 1980.

Disappointing market performance along with strong fundamentals — meaning good economic growth, good earnings, strong balance sheets, etc. — is not as surprising, however, as it might seem.

In a note to clients earlier this month, Bank of America Merrill Lynch noted that strong earnings do not provide the kind of backing for strong stock market performance that many investors expect. Market history shows that periods of strong earnings have often been associated with double-digit earnings growth. And earnings periods like the current one — where the benefits of tax reform are making earnings expectations in the coming quarters far better than had been expected — are exceptional and quickly discounted by investors.

(Excerpt) Read more at finance.yahoo.com ...

The market went up last year on these earnings.

It went down this year based on next year’s earnings, which will not increase as much, as well as next year’s interest rates.

How does the market know what will happen next year? That is a very interesting question....

For me, all the recent earnings increases do, on a market average basis, is BEGIN to bring earnings UP TO the over valued average P/E ratio condition (based on prior so called “expectations”) the stock market has been in for over a year.

Even should the stock market NOT keep climbing greatly, it is (a) already above this time last year, and (b) last year it was already in near bubble territory as far as the history of the average P/E ration goes.

That is not to say it is time to dump U.S. stocks, just that instead it is a good time to hold. Things will likely see more volatility as the feds stimulus is wound down and interest rates start to approach historic norms.

The market(traders) hasn’t a clue what is coming down the road any more than we do. It’s all a guess based on projected earnings.

Aside from unexpected incidents such as war, catastrophic events and the like, the main impetus for the market are earnings. Earnings good markets up, earnings miss markets down.

It’s really not complicated

No the market is tanking because interest rates are rising. Look for companies to report strong earnings next two quarters. Watch for the revision of December GNP to above 3% to boost stock prices again

mostly correct, but the question is why are interest rates rising, not just in the usa but globally. during the era of obambi, sovereign debt piled up and gov’s needed to push rates down so their service costs were lower. Now that the orange one is slashing regulations and unleashing the American business spirit, the world has to react. The demand for new debt by business is rising globally as a new economy is being created. Like any commodity debt is scarce unless its to fund socialist endeavors. As the proportion of debt demand moves to commercial productive endeavors, the price, ie interest rate goes up. An interesting consequence of rate increases is the fall in bond prices. If the idiots in gov would just start purchasing debt back they let at 0%, the cost would be less then the selling price.

Worth remembering that those companies that shared w/ employees the tax break windfall in Q1 will register even higher earnings in Q2 precisely because of those expenditures.

Nicely played.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.