And the derivatives time bomb goes off, and there goes the world economy.

Posted on 09/06/2017 11:06:59 AM PDT by DFG

Federal Reserve vice chair Stanley Fischer is resigning from his post at the central bank effective in mid-October, the Fed announced Wednesday.

Fischer cited “personal reasons” in his resignation letter to President Donald Trump. Fischer’s term as vice chair was slated to end on June 12, 2018.

“It has been a great privilege to serve on the Federal Reserve Board and, most especially, to work alongside Chair [Janet] Yellen as well as many other dedicated and talented men and women throughout the Federal Reserve System,” Fischer wrote.

(Excerpt) Read more at finance.yahoo.com ...

Same as it ever was.

This could be the biggest news of the year barely covered by the fake legacy media.

Or a big nothing burger.

I don’t know enough to speculate.

But if hawks are nominated, the QEs stops, rates rise and the Fed starts to unload the balance sheet...

Housing go boom.

Why did he have to submit a letter to Trump? Isn’t the Reserve a private, not public, institution?

You think it’s a good idea to keep interest rates artificially low forever? What are we going to do when we have a problem?

Nope.

The question is when.

The problem with low rates is the government has been printing and then borrowing money for free. At a measly 4 percent the debt service on the current debt exceeds revenue. This problem didn’t happen over night, but you can bet the media will convince the public Trump did it.

The answer is probably six years ago. Look at what happened to Japan in 1990.

Nobody wants to be anywhere near her No. 2.

Yes, painted into a corner.

May as well lay them all off. The Fed exists for one reason - to pump the stock market for their Goldman Sachs buddies. The market is doing great.

Good news. Trump needs as many friends at the Fed as he can get. It’s the one tool that can be used to prevent him from reelection, if they cause a recession too soon.

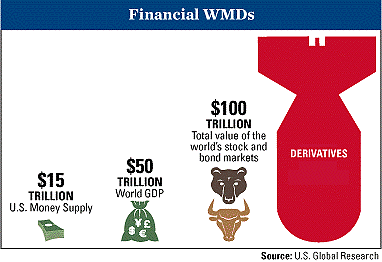

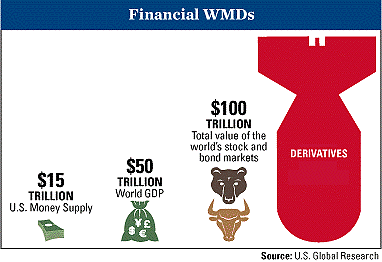

And the derivatives time bomb goes off, and there goes the world economy.

Which rates are they keeping artificially low?

How do they do it?

Debt held by the public is currently $14.42 trillion. 4% of that is about $577 billion.

The Federal goobermint took in over $3.267 trillion last year.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.