But you just said it was okay for Apple not to obey the tax laws in the EU because they're socialist. Why are you praising them for obeying the law to help repress dissidents in Communist China, then?--is it okay to bow to Maoist dictatorships but not Fabian ones? And you admitted that Google and Facebook illegally put their resources at the service of Hillary's campaign, yet you're trying to claim it's impossible for Apple to illegally skirt FEC regulations--like the Clintons never skirted FEC regulations, right?--and like Apple never skirted tax regulations. Wow, they must really sell you some whoppers at those cell meetings in Berkeley.

Apple CEO Tim Cook was considered by Hillary Clinton as US Vice President pick according to leaked emails

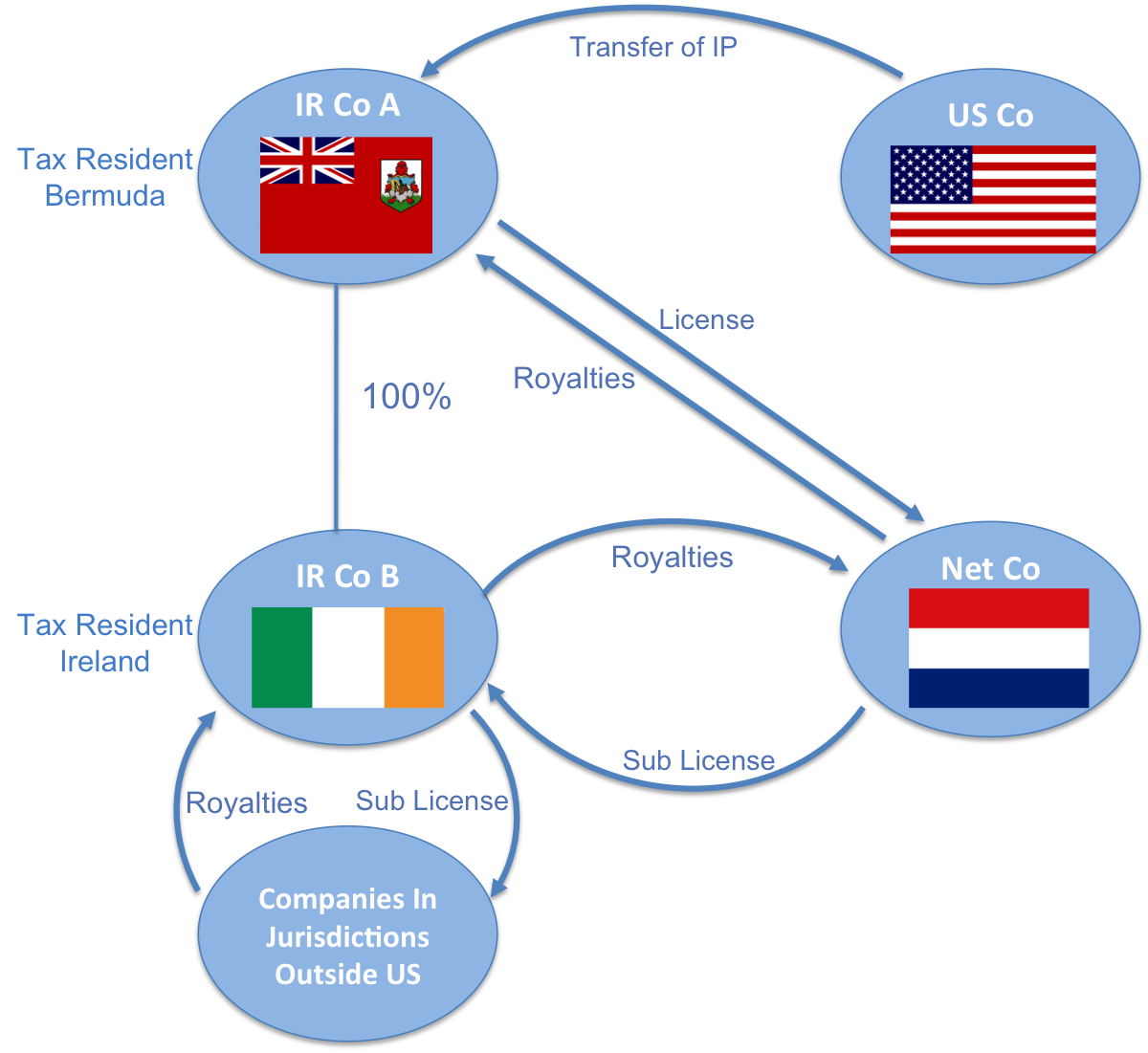

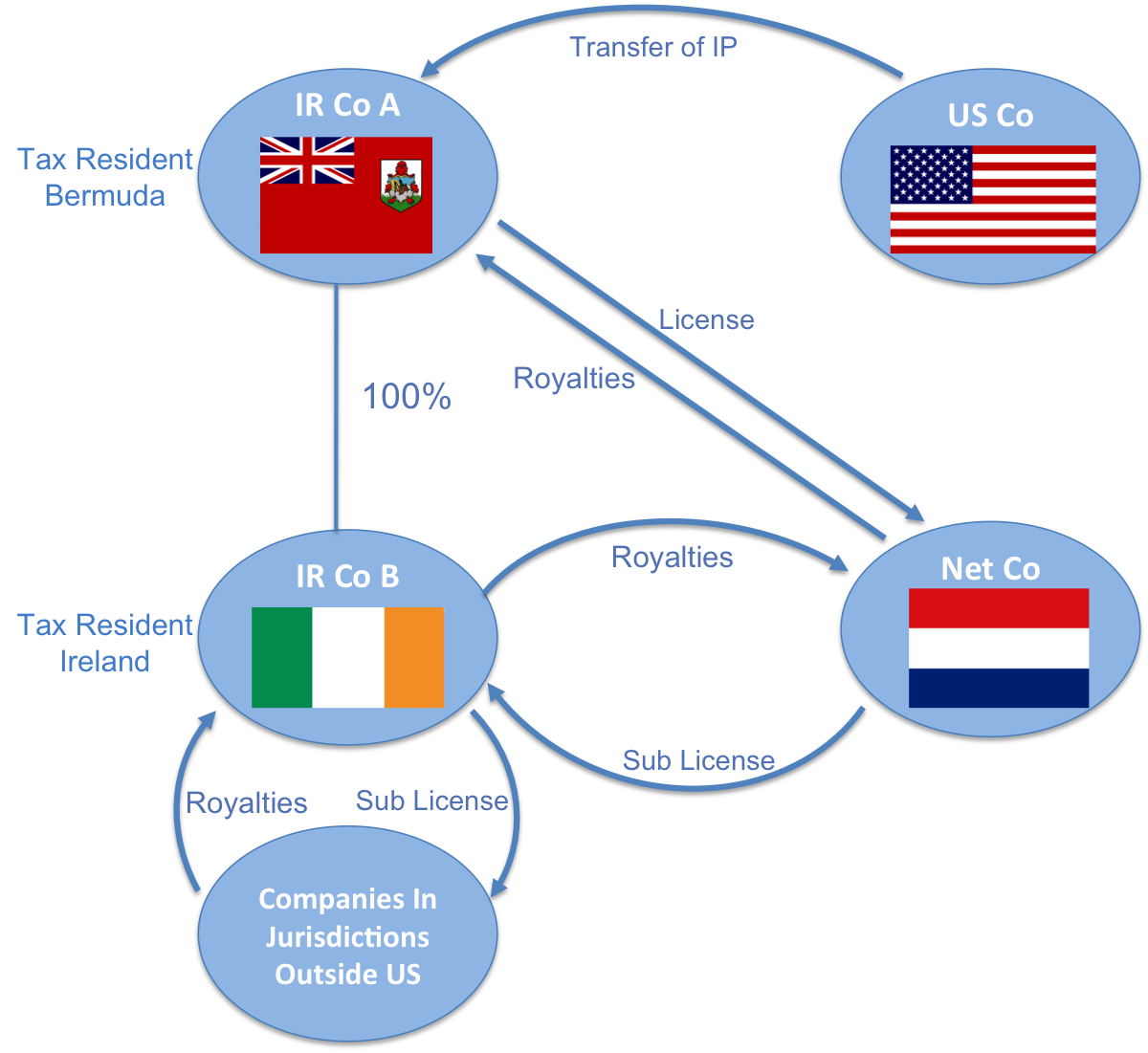

"In May 2013 when Tim Cook, Apple CEO, told a US Senate panel that Apple does not transfer intellectual property to offshore tax havens to avoid US tax and does not hold money on a Caribbean island. He was drawing a sharp contrast with the likes of Google, Microsoft, Intel, Oracle and Facebook. In effect Apple was different to US companies that used well-known island tax havens using loopholes such as the Double Irish Dutch Sandwich. . .Apple had a similar model to Microsoft's. Both transferred the economic rights of some of their intellectual property (IP) to their Irish units and Apple had a shell firm subsidiary in the British Virgin Islands besides Irish non-resident subsidiaries with addresses at its Cork campus. . . .Apple Computer Inc. Limited, the main overseas subsidiary of Apple, dated from 1980 when Apple opened its Irish facility in Cork — it was non-tax resident from the outset and had no employees.". . .In effect allocating 65% of earnings as foreign is a fiddle and no tax is paid on most (or deferred long-term) of it because it is booked through fake Irish firms. Tim Cook was asked by The Washington Post about comments by Joseph Stiglitz, the Columbia University economist, made on Bloomberg [television], where the latter called Apple’s profit reporting in Ireland a “fraud”. . .: How Apple found a bigger tax loophole than the Double Irish

But you just said it was okay for Apple not to obey the tax laws in the EU because they're socialist. Don't raise strawman arguments by trying to put words in my posts I never wrote, idiot. I never said what you claimed.

I said, quite succinctly, that Apple is obeying Ireland's tax laws and that the Treaty signed by all nations that created the EU, it's basic constitutional document, prohibits the central EU government or any of its entities, from interfering in any way with member nations' tax laws or regulation. Even Ireland, the US's Internal Revenue Service, and international tax law experts, all of whom are appealing the EU Commission on Competition's overreaching order—which is beyond the scope of that Commission's authority—agree that Apple was in complete compliance with the Irish tax laws, and international tax laws. They are ALL pointing out the fact the violation of the Treaty, which supersedes all regulations and statutory laws, just as a constitution does.

You are using the tactics of the leftist socialists and your blizzard of meaningless drivel from those same socialist sources means NOTHING. . . nor do you propagandistic photoshopped images with Apple logos with communist symbols prove anything except your delusional mindset.

I am an Economist also, and I've also been a CEO. After being accused of exactly what you are claims as fact now, Apple CEO Tim Cook testified under oath before the US Senate Investigating committee that Apple has not transferred any intellectual property out of the US. It is held here and licensed here. He also submitted documentary evidence backing his sworn testimony. The investigation was dropped.

Besides that provable testimony, idiot, Apple does not make a large profit from licensing intellectual property. It licenses intelectual property from other entities to build its products and uses its library of IP to trade licenses with other companies who need the license. It's NOT A BIG PROFIT POINT, Apple just is not a major vendor of IP licensing. Apple is not in the business of selling software, which most IP is related to, but rather sells HARDWARE. What you described works as a business model for Microsoft and Google, companies that sell digital rights, not Apple.

Your diagram was a theoretical example of what Apple could be doing is exactly identical to the chart drawn by the Senate committee staffers that was thoroughly debunked in Senate testimony in May of 2014. There's not an iota of difference. Nor does it matter when the income is taxed in the US no matter where it's earned under international tax law. Apple owns every one of its subsidiaries and their income flows through to it, and is taxed here. As was pointed out in the testimony, that's why those few entities PAID NO INCOME TAX, the money they received came only from Apple owned entities and went to Apple owned entities. . . they were essentially accounting way stations coordinating and consolidating and holding APPLE OWNED FUNDS on a short term basis. PAY ATTENTION. In a way it's an internally Apple owned and operated private BANK with only one class of customer, Apple wholly owned subsidiaries. That's why the only actual income they ever reported, as noted, was interest, which these know nothing socialists found "suspicious" only because they haven't a clue of how businesses in the real world need to operate. However, it's standard practice under GAAP. look that acronym up if you don't know what it means.

My small company even has one such legal entity like that. It receives our credit card transactions. It has no employees, just an address, and a bank account. It prevents our primary business account from being in chaos from multiple deposits and withdrawals from the service agencies. We transfer the balances in that account to our business account after they get done with all their deposits and fee withdrawals.

Are you at all familiar with the Sarbanes Oxley Act of 2002? I doubt it, because if you were you'd realize that over and above the minor matter of perjury charges for lying to Congress, if Cook were lying about the facts of where Apple's intellectual property is owned (again these are matters of PUBLIC RECORD, Fedora), then Cook have would opened himself to having uttered FALSE STATEMENTS AFFECTING the well being and financial condition of Apple, causing Sarbanes Oxley to kick in and the literally draconian PERSONAL FINES AND PRISON TERMS associated with violating SOX rules and regulations. Cook would have been personally liable for mandatory $10,000,000 and possibly maximum $20,000,000 fine for EACH false statement, and either ten or twenty years incarceration in a Federal penitentiary. . . and Apple cannot reimburse him for those fines.

Do you really, seriously think Tim Cook is that stupid or that Apple is worried so much about a few measly millions in royalties to the point they are going to play IP games with multiple companies and double Dutch sandwich schemes, when their hardware profits generate MULIPLE BILLIONS OF DOLLARS EVERY QUARTER? Use your brain for something besides fertilzer for hair.