Skip to comments.

What Could Raising Taxes on the 1% Do? Surprising Amounts

New York Times ^

| OCT. 16, 2015

| PATRICIA COHEN

Posted on 10/18/2015 2:33:04 PM PDT by expat_panama

“Right now, the wealthy pay too little,” Hillary Rodham Clinton said at this week’s Democratic debate in Las Vegas, “and the middle class pays too much.”

“Right now, the wealthy pay too little,” Hillary Rodham Clinton said at this week’s Democratic debate in Las Vegas, “and the middle class pays too much.”

But what could a tax-the-rich plan actually achieve? As it turns out, quite a lot, experts say. Given the gains that have flowed to those at the tip of the income pyramid in recent decades, several economists have been making the case that the government could raise large amounts of revenue exclusively from this small group, while still allowing them to take home a majority of their income.

It is “absurd” to argue that most wealth at the top is already highly taxed or that there isn’t much more revenue to be had by raising taxes on the 1 percent, says the economist Joseph E. Stiglitz, winner of the Nobel in economic science, who has written extensively about inequality. “The only upside of the concentration of the wealth at the top is that they have more money to pay in taxes,” he said.

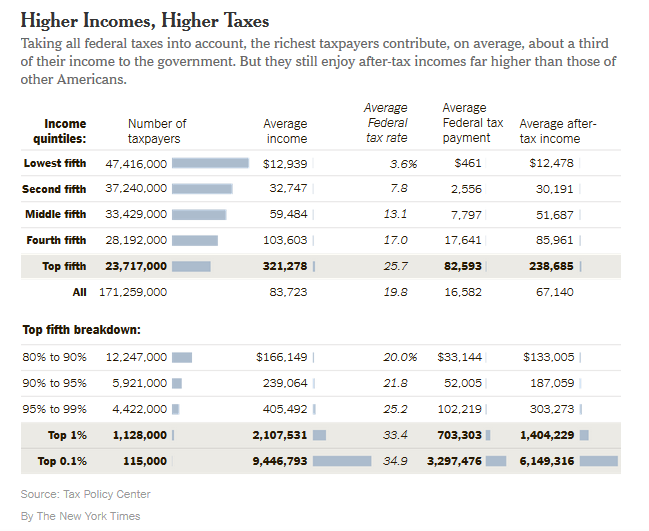

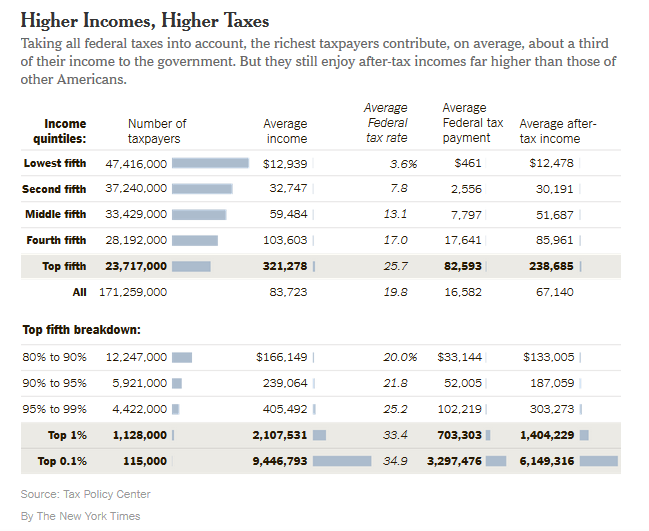

The top 1 percent on average already pay roughly a third of their incomes to the federal government, according to...

[snip]

By comparison, the band of taxpayers right below them, in the 95th to 99th percentile, pay on average about $1 out of every $4. Those in the bottom half pay less than $1 out of every $10.

(Excerpt) Read more at nytimes.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; taxes

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-68 next last

To: expat_panama

No “Barf” alert? Pure unadulterated crap. What happens when the government gets this added revenue? Government grows wanting even more. The real issue is the growth, waste, purpose and management of government, not taxing the rich. Thou shall not covet. Government is too big already and now matter how much it taxes, it spends it profligately, uselessly, and then wants more. Nonsense!

2

posted on

10/18/2015 2:38:53 PM PDT

by

Fungi

To: expat_panama; SunkenCiv; Nachum; Mr. T; SoothingDave

Funny, that “only pay 1/3 of their income in taxes” line.

See, at just at $96,000.00, we pay 47% of our “wages” in taxes and (er) “mandatory fees”: federal direct income taxes, my company’s “share” of those federal income taxes, company social security taxes, my social insecurity, unemployment insurance, medicare, state, county real estate taxes, gasoline taxes, city taxes, county sales taxes, phone taxes, taxes insdie my natural gas bill, taxes inside my electric bill, taxes inside my car rental bills, taxes inside my hotel bills, taxes inside my fees to file my taxes ... fees to file my taxes, fees to buy software to file my taxes, taxes inside the airport on the plane ride, taxes inside the airport when I buy food at the airport, airport “use fees” ...

3

posted on

10/18/2015 2:41:11 PM PDT

by

Robert A Cook PE

(I can only donate monthly, but socialists' ABBCNNBCBS continue to lie every day!)

To: expat_panama

Always punish the people who contribute the most.

Always reward the people who contribute the least.

See where that gets you.

4

posted on

10/18/2015 2:41:19 PM PDT

by

ClearCase_guy

(I've switched. Trump is my #1. He understands how to get things done. Cruz can be VP.)

To: expat_panama

Those in the bottom half pay less than $1 out of every $10.

Absolutely moronic logic and absence of facts. Those in that group pay little or no tax and in fact get a rebate from the government, a sort of negative income tax. Try to confiscate a huge percentage of the "Big Money" wealth in the USA and watch it all turn to Sheite as the money havens around the world suck it up. Just look at what happened when the cheese eaters tried it a couple of years ago.

5

posted on

10/18/2015 2:41:46 PM PDT

by

Don Corleone

("Oil the gun..eat the cannoli. Take it to the Mattress.")

To: expat_panama

To: expat_panama

The key is to cut gov’t spending, since the real tax burden equals nominal taxes plus deficit.

If you keep the same level of gov’t spending, but increase the tax rate, you’re just moving money between taxes and deficits.

7

posted on

10/18/2015 2:47:03 PM PDT

by

MUDDOG

To: Don Corleone

Why punish the successful? Doesn’t that discourage people from wanting to succeed if the government is going to penalize them for it? Last year my daughter made about $62,000 (lots of overtime) and taxes killed her. She finds it very discouraging to work her butt off just to give more to the government, especially the way they waste money.

To: expat_panama

It is “absurd” to argue that most wealth at the top is already highly taxed How absurd is all the Quantitative Easing?

9

posted on

10/18/2015 2:49:26 PM PDT

by

P.O.E.

(Pray for America)

To: expat_panama

How about cutting spending by 1%? Penny Plan

10

posted on

10/18/2015 2:51:21 PM PDT

by

stocksthatgoup

(When the MSM and Elites want your opinion they will give it to you.)

To: expat_panama

Raising taxes on the rich would certainly be effective as in it would have an effect. It would chase large numbers of them into lower tax venues and would cause others to take less money as taxable income. It would raise consumption by the rich and depress savings and investment. Rolls Royce was a common car on the roads in England back when the Rich could pay in come cases more than 100% of their income. Why invest if you must turn it all over to the government? It is better to use it for display and comfort.

11

posted on

10/18/2015 2:51:41 PM PDT

by

arthurus

(Het is waar. Tutti i liberali sono feccia.)

To: expat_panama

Rush has been demolishing this debate for years.

12

posted on

10/18/2015 2:53:14 PM PDT

by

Extremely Extreme Extremist

(I am going to get those guns out of peoples hands. - Hillary Clinton 10/05/2015)

To: expat_panama

Aided by a phalanx of lawyers and accountants, the rich have become adept at figuring out ways to shift earnings that would normally be taxed at the top 39.6 percent rate on ordinary income into capital gains,I'd love to hear more about this claim.

13

posted on

10/18/2015 2:54:05 PM PDT

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: P.O.E.

How absurd is all the Quantitative Easing? QE ended a year ago.

14

posted on

10/18/2015 2:55:22 PM PDT

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: Toddsterpatriot

Remember though that studies have shown that at least 87% of the numbers used in political discussions are pure fiction.

To: Fungi

This NYT article is statistical bull sh-t. The lower 50% may pay some income tax but due to their income levels they benefit from many federal programs that actually make them net beneficiaries as opposed to tax payers. In effect they pay not one penny of taxes!!!!!

The real answer to the tops 10 percent of tax payers is not to raise their taxes. They are high enough as it is and I would posit to high.

I would suggest this scenario for high earners:

1. Have your profits and income taxed at the max today of 33% and if you consider state tax closer to 40%, and if you live in New York, greater than 50% or choice #2.

2. Choice two is to have any of your profits taxed at half that level, if those profits are invested in start up companies that provide jobs for America.

The top 10 percent love making more money. Choice #2 gives them the opportunity to make more money and give jobs to Americans and those people will pay taxes. Everybody wins. If their companies are successful, America wins. If their companies do not succeed, the loss is borne by the top 10% and not the Federal Government and in effect the tax payers.

Today there are many trillions of dollars of profits sitting offshore. The companies that own these profits will not bring them home because of our insane tax rates on company profits. These dollars will never come home under our present tax laws. Let them bring them back at a very reduced tax rate and they will invest the dollars in making American jobs.

Adam Smith, “Wealth of Nations.” It is really that simple.

16

posted on

10/18/2015 3:01:37 PM PDT

by

cpdiii

(Deckhand, Roughneck, Geologist, Pilot, Pharmacist THE CONSTITUTION IS WORTH DYING FOR)

To: expat_panama

Take everything over $500,000 in income and you get enough $ to run the Fed Government for less then 30 days.

We do not have a taxing problem, we have a spending problem

17

posted on

10/18/2015 3:02:16 PM PDT

by

MNJohnnie

( Tyranny, like Hell, is not easily conquered.)

To: expat_panama

by what honorable logic is anyone required to pay more than a third of their income in taxes? The graduated income tax is an application of Willie Suttons logic.

18

posted on

10/18/2015 3:02:28 PM PDT

by

muir_redwoods

(Freedom isn't free, liberty isn't liberal and you'll never find anything Right on the Left)

To: expat_panama

Something about “eating the seed corn”.

Nobody ever applied to a person of modest income for venture capital, or for an investment in acquisition of somebody else’s start-up venture that turned profitable.

Neutering that most efficient machine ever developed for the INCREASE of wealth.

Matthew 25: 14-30

14 “For it will be like a man going on a journey, who called his servants[a] and entrusted to them his property. 15 To one he gave five talents,[b] to another two, to another one, to each according to his ability. Then he went away. 16 He who had received the five talents went at once and traded with them, and he made five talents more. 17 So also he who had the two talents made two talents more. 18 But he who had received the one talent went and dug in the ground and hid his master’s money. 19 Now after a long time the master of those servants came and settled accounts with them. 20 And he who had received the five talents came forward, bringing five talents more, saying, ‘Master, you delivered to me five talents; here I have made five talents more.’ 21 His master said to him, ‘Well done, good and faithful servant.[c] You have been faithful over a little; I will set you over much. Enter into the joy of your master.’ 22 And he also who had the two talents came forward, saying, ‘Master, you delivered to me two talents; here I have made two talents more.’ 23 His master said to him, ‘Well done, good and faithful servant. You have been faithful over a little; I will set you over much. Enter into the joy of your master.’ 24 He also who had received the one talent came forward, saying, ‘Master, I knew you to be a hard man, reaping where you did not sow, and gathering where you scattered no seed, 25 so I was afraid, and I went and hid your talent in the ground. Here you have what is yours.’ 26 But his master answered him, ‘You wicked and slothful servant! You knew that I reap where I have not sown and gather where I scattered no seed? 27 Then you ought to have invested my money with the bankers, and at my coming I should have received what was my own with interest. 28 So take the talent from him and give it to him who has the ten talents. 29 For to everyone who has will more be given, and he will have an abundance. But from the one who has not, even what he has will be taken away. 30 And cast the worthless servant into the outer darkness. In that place there will be weeping and gnashing of teeth.’

Them as got, gets. Them as turn miser, have nothing to show in the end.

19

posted on

10/18/2015 3:03:50 PM PDT

by

alloysteel

(Do not argue with trolls. That means they win.)

To: expat_panama

Hitlery haves over 2 billion in a tax exempt foundation. Does anyone think that her tax plan will touch any of that?

20

posted on

10/18/2015 3:04:08 PM PDT

by

fella

("As it was before Noah so shall it be again,")

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-68 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

“Right now, the wealthy pay too little,” Hillary Rodham Clinton said at this week’s Democratic debate in Las Vegas, “and the middle class pays too much.”

“Right now, the wealthy pay too little,” Hillary Rodham Clinton said at this week’s Democratic debate in Las Vegas, “and the middle class pays too much.”