Emerging market corporate debt has grown to $18bn Photo: International Monetary Fund

Emerging market corporate debt has grown to $18bn Photo: International Monetary FundPosted on 09/30/2015 4:23:20 AM PDT by expat_panama

The International Monetary Fund (IMF) has issued a double warning over higher US interest rates, which it said could trigger a wave of emerging market corporate defaults and panic in financial markets as liquidity evaporates. The IMF said corporate debts in emerging markets ballooned to $18 trillion (£12 trillion) last year, from $4 trillion in 2004 as companies gorged themselves on cheap debt.

It said the quadrupling in debt had been accompanied by weaker balance sheets, making companies more vulnerable to US rate rises.

"As advanced economies normalise monetary policy, emerging markets should prepare for an increase in corporate failures," the IMF said in a pre-released chapter of its latest Financial Stability Report.

Emerging market corporate debt has grown to $18bn Photo: International Monetary Fund

Emerging market corporate debt has grown to $18bn Photo: International Monetary Fund

It warned that this could create a credit crunch as risks "spill over to the financial sector and generate a vicious cycle as banks curtail lending".

In a double warning, the IMF said market liquidity, or the ease with which investors can quickly buy or sell securities without shifting their price, was "prone to sudden evaporation", particularly in bond markets, when the Federal Reserve started to raise interest rates.

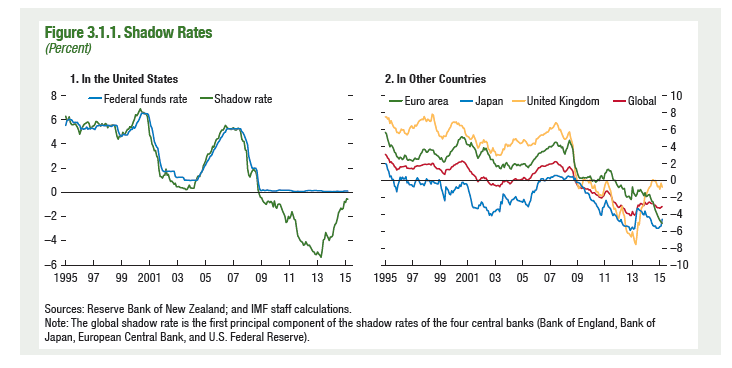

It said a steady growth environment and "extraordinarily accommodative monetary policies" around the world had helped to maintain a "high level" of liquidity. However, it warned that this was not the same as "resilient" liquidity that could support markets in time of stress.

Gaston Gelos, head of the IMF's global financial stability division, said these factors were...

(Excerpt) Read more at telegraph.co.uk ...

imho U.S. corp. debt is reasonable for the population and econ growth. What I don't consider reasonable is the way America loves Trump's soak the rich redistribution:

Donald Trump's Tax Plan Mistakenly Removes More From Tax Rolls

Catherine Rampell: Trump Tax Cuts: A Christmas Tree For The Rich

ah, and a hat tip to Chgogal for the link.

After all the deductions and loopholes, the wealthy pay about 23 percent federal tax on average.

25 without the loopholes is actually a tax increase on them.

A beautiful morning all! Last day of the quarter and instituional managers are making their portfolios look good (The Return of Window Dressing??) leading futures traders today to boost stock indexes up +1.19% and metals +0.95%. Econ announcements today (prep for tomorrows flood warning):

7:00 AM MBA Mortgage Index

8:15 AM ADP Employment Change

9:45 AM Chicago PMI

10:30 AM Crude Inventories

Other stuff:

Why Econ. Policymakers Make Such Huge Mistakes - Steve Forbes, Forbes

Can Glencore Survive? The Answer Is Simple - Ben Wright, Daily Telegraph

Fed Chairman Yellen, Kindly Meet Mae West - Doug Kass, Kass' Korner

After the Declines, Are Stocks Overvalued? - Eric Nelson, Servo Wealth Mgt.

Bull Will Resume When We're Older, Wiser - Mark Hulbert, MarketWatch

What the Critics of Income Inequality Ignore - Elizabeth MacDonald, Fox

This is why I at least favor the no-loophole flat rate income tax that Steve Forbes proposed in 1996, though I would set the rate at 18.75% after the generation initial earned income exemption to get rid of even the FICA (Social Security) tax. Even 18.75% would benefit the rich, especially since they no longer have to put their net worth in non-US banks just to keep it out of the hands of the IRS.

Yes. We exported our inflation and created the huge bubble overseas.

Now everyone is beginning to see.

not all of us love it, especially the bottom end paying none.

The top and middle is being bilked again

That may be what left-wing hacks say, but as far as actual revenue the IRS gets from folks at various income levels here's where we are:

Top 1% pay nearly half of federal income taxes - CNBC.com

imho this we really don't want this to get worse.

Oil-Rich Nations Are Selling Off Their Petrodollar Assets at Record Pace

Dying Petrodollar Ripples Through Markets As Asset Managers Bemoan Loss Of Saudi Bid

What, the other 95% of the world has no mind of its own? The world is people and reality of supply and demand. Debt's cost (interest) has been plunging world wide--

-- and blaming everything on the U.S just doesn't wash.

i dont like prgoressive taxes and i dont like anyone paying no taxes. Like i said, even a 5 percent tax on those people is another 100 billion in revenue.

also, they most likely get snap, housing help, etc.

25k isn’t a lot of money but i lived on 20k when i was 27. The rent was 600 and now it would be about 1000. they should be fine. And if they had a bunch of kids, that’s not my problem. America isn’t a charity it’s a business and things need to change.

I didn’t write that. You sure have the right guy :)

Gregory Mannarino-Greatest Theft in History Coming

https://www.youtube.com/watch?v=tTVPFBktngg

Does this mean that if the fed raises the borrowing rate in the US, the whole planet takes a financial dive and blames us ?

A financial mene mene tekel upharsin to all of the corrupt.

Exactly. Well said.

Trump’s a NY Democrat businessman. His world view is that of a billionaire union member. He’s not transformative, but regressive. He’s Truman or Kennedy or Scoop Jackson. I had hoped for a Moynihan so as to undo the Deep State via welfare reform, but no.

Luckily with Pres. Trump we’ll be winning so much I won’t notice.

I would hesitaite to answer because i’m not quiet sure. I know the market would go down which would affect other markets. As interest rates increase and you can get a descent return on money without risk, money will be taken out of the market.

a half point is a lot when it comes to billions in loans. There will be less liquidity and since liquidity was so easy to borrow, companies ran up huge debts, which, without constant liquidity, are going to be tough to pay off.

or something like that :)

Checkmate, Ms Yellen

Yeah ... I like that too

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.