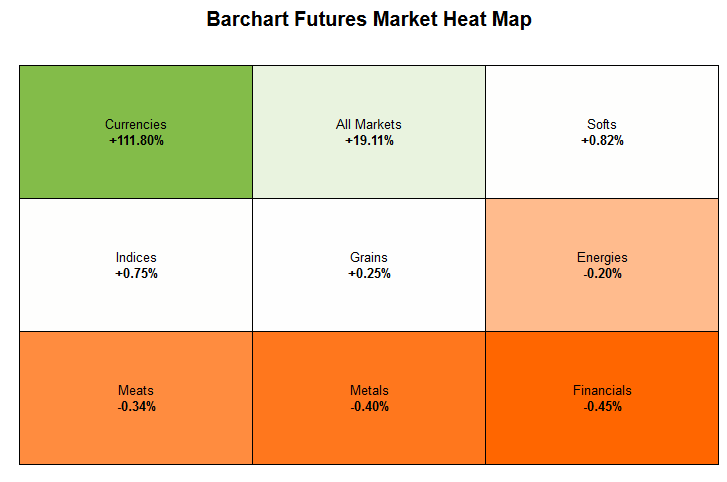

GOOD MORNING!!!! --here's 1K words worth of picture about today's futures marts:

Posted on 06/22/2015 5:28:18 AM PDT by expat_panama

Juncker called the latest proposals from Greece a "good basis for progress", while EU Economic Commissioner Pierre Moscovici said he was "convinced" agreement will be reached.

Spain's finance minister Luis de Guindos said a deal was not possible on Monday, however, meaning it may be the scheduled leaders summit on Thursday before any agreement is reached.

Investors appeared willing to give the protagonists in the saga the benefit of the doubt.

"The odds seem to shift in favor of a compromise," said Rainer Guntermann, rates strategist at Commerzbank.

At mid-session in Europe, Germany's DAX .GDAXI and France's CAC 40 .FCHI were up 2.8 percent at 11,353 points and 4,949 points, respectively, with Britain's FTSE 100 .FTSE up 1.3 percent at 6,796 points.

Greek stocks were 6 percent .ATG higher, while Greek bank shares surged 16 percent .FTATBNK.

The broader EuroFirst300 index of leading European shares was up 1.7 percent at 1,555 points .FTEU3, with prices also boosted by merger and acquisition activity. Related Coverage

› Resistance to Greek drama hints at euro's strength

In Asia, MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.9 percent, its biggest rise in more than two months, while Japan's Nikkei stock index .N225 added 1.3 percent.

Chinese mainland markets were closed on Monday for a holiday, after posting their biggest weekly loss since 2008 last week.

SUNNY DAY?

In bond markets, Spanish and Italian 10-year yields were both down around 10 basis points at 2.19 percent, the lowest in 10 days.

The flip side of investors' renewed appetite for risk was a fall in safe-haven German bonds, which pushed the 10-year Bund yield up around 10 basis points to 85 basis points, a 10-day high.

(Excerpt) Read more at reuters.com ...

>>> “The odds seem to shift in favor of a compromise,”

And odds of actual fulfillment of said compromise is nil.

Greeks and indeed other EU zones had seen this played out for the last 4 (or 5?) years.

Why change now?

Kick Greece out of the EU and the Euro. They chose a marxist, so to hell with them. No more money from producers to lazy slobs.

Why doesn't Greece just DO IT? The debt can never be paid off, and pretending just cedes control to German banks. Meanwhile, why would any sane person keep money in the banks? Why would anyone who doesn't have to use money instead of barter?

Actually, you're in good company w/ that view, and today's George Will column seems to even want a Greek default: Greek Default Would Be a Valuable Economic Lesson - George Will, NR

I guess it’s because the Greeks are hoping to get money (vendor financing) from the ECB so that they don’t default for a few more months or weeks.

It’s “Give us money or we can’t pay our debts”. Literally!

But while it has a chance of working Greece will keep trying to do it.

The ECB is offering 7+ Billion in exchange for pension cuts and some austerity. The Greeks just want the 7+ Billion and are already declaring their debt to be odious.

At the end of the day the Greeks will (I believe) default, but stay in the Euro: printing their own Calpers IOU currency to meet liquidity constraints.

>>> Why doesn’t Greece just DO IT?

Because!

As stated in another article about Greece, tourists are still flocking there for a cheap deal, butcher shop owners still get paid with cash for their meat products. And the Greek people still retire at age 50 if not before, “with their future promised to them”.

And the endless rounds of default talks will just subside, yet again. Until the next time.

BINGO!

decision-making by crisis is standard Brussels politicians operating procedure (Fixed)

Always a problem but there are two edges to that sword. Sure, nobody wants to wait for the car to burn out before they check the oil, but the at the same time we don't need bureaucrats stickin' their thumb anywhere they want and "fixin' what ain't broke'.

Where I am is that we can't just say the Greeks are slobs and to hell w/ 'em because like it or not the world is just too interconnected. So maybe the Marxist Greek leaders are finally sobering up. I'd love to be able to say that about the U.S. head of state...

“All will be well, because... unicorns!”

(stocks go up)

“At least until the end of the month, when everything collapses... unless there is intervention from magical fairies!”

--followed by another last minute last-ditch break-through. Ah-- market price fluctuations, are they great or what!?

The EU is not about to let Greece Default. They know that would be the beginning of the end for the EU. Look for them to just extend the payment deadline and kick the can down the road again.

Great Chart... thanks for posting.

It’s the age old problem between debtors and loaners. Borrowers don’t want to pay anything back but they also want to borrow in the future too, so they end up paying something just to keep their rating alive. Lenders are really in the same bucket ‘cause while they’d love to foreclose but they don’t want their bond holdings to suddenly become worthless, and they’d also just end up w/ fewer future borrowers. That’s why lenders talk tough but still try to work out a deal.

My pleasure. Every early morning before opening bell I click on the link to see how the new day’s shaping up and today was a rare event —powering up like gangbusters. It’s a fun rally to enjoy but imho a repeat tomorrow seems like a pipedream.

Why is the whole worlds financial well being tied to a relatively small basket case economy that is Greece?

It may be the smallest building on the block but if it bursts into flames we all want to put the fire out fast. We could question why we ever let that fire trap in the neighborhood in the first place but first maybe we need to clean up our own house first.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.