Skip to comments.

From 1st Quarter (zero GDP or what?) to Q2 (sell in May or buy?)--Investor Thread May 5, 2015

Weekly investment & finance thread ^

| April 5, 2015

| Freeper Investors

Posted on 04/04/2015 1:03:19 PM PDT by expat_panama

| YTD --January, February, and March 2015: |

|

Looking ahead --April, May, and June 2015: |

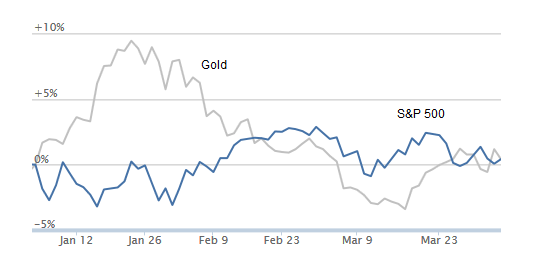

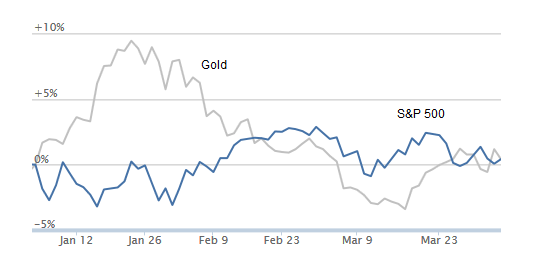

Hope everyone enjoyed their first quarter! Not bad --not only have both gold and the S&P500 come out positive but the NASDAQ punched above 3% (annualized to more than 14%) but silver's come out 6% ahead -a 26% rate/year. Market prices are great the way we can follow up-to-the-second reports, but for stats on the general economy we'll have to wait until the folks who're paid for being smarter than us are ready to make up their minds. What we got so far is that they say our earnings are up, our unemployment rate's down, and our first quarter consumer confidence is at long last to a multiyear optimistic high! . Uh huh. So how come we keep hearing about the "official" zero percent GDP for this past quarter? I mean, we heard it from Zero Hedge (It's Official: Fed Sees 0.0% GDP Growth In The First Quarter), from CNN Money (Atlanta Fed Cuts Q1 Growth Estimate to Zero) and it's been hashed over on this related thread (NO April fools Joke). Fact is that nobody seriously is saying Q1 GDP was flat and the Fed never said it was --"officially" or otherwise. It wasn't even merely the Atlanta Fed Bank saying it. What this was all based on was the raw data from one of the pages on the Atlanta Fed's webite showing how a computer model (which had been fed these numbers) somehow came up w/ 0.0% and was upgraded the next day to 0.1%. Bottom line is we don't quite want to dump our life savings into "sackcloth and ashes" futures just yet. |

|

There's an old calendar affect called "Sell in May and Go Away definded by Investopedia as:A well-known trading adage that warns investors to sell their stock holdings in May to avoid a seasonal decline in equity markets. The "sell in May and go away" strategy is that an investor who sells his or her stock holdings in May and gets back into the equity market in November - thereby avoiding the typically volatile May-October period - would be much better off than an investor who stays in equities throughout the year.

However, Mark Hulbert (Investing guru predicts 12% rise in stocks over six months agr) is one of many who don't go along. Thomas Aspray at Money Show (One Seasonal Trend Investors Should Ignore)  goes so far as to point out how for years now the second half's been no slouch --averaging double-digit gains. goes so far as to point out how for years now the second half's been no slouch --averaging double-digit gains. Yeah, we don't know for sure what the second half of 2015 will be like yet, but what we do know right now is that the "sell in May" people have been doing poorly for several years. That said this next quarter is still heavy on the uncertainty side, one major wild card that MichaelCorleone turned me on to was Middle East tensions and the Iran deal. He pointed out "...oil, the US Dollar, and defense contractors like Lockheed and Raytheon? Seems to me the ME just got a lot more dangerous, especially for Israel."; All I can say is that I'll have to agree with our president when he said that "the Middle East is a problem that has plagued the area for decades." Uh huh.

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: 1stquartergdp; economy; financial; gdp; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-57 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

To: expat_panama

My strategy this summer is to by index puts with 3 months time equity and at par value, then sell them with 2 months time equity left — take the loss or the gain, and walk my way Thru Sept. Or my money runs out.

Or something like that.

There is going to be a crash between now and inauguration day 2017.

3

posted on

04/04/2015 1:16:40 PM PDT

by

Usagi_yo

(The declining morals of the West vs the increasingly brutal Jihadists. Coincidence?)

To: Usagi_yo

Puts and calls are unusable methods for us seniors. We can’t risk our lifetime savings on volatile stuff. Trading a small percentage in fast moving puts and calls is more headache than it is worth.

I think you got it right..there will be a severe correction between now and iauguration dau 2017. More likely in 2016. Seniors would be well advised to keep some powder dry in case that becomes reality.

4

posted on

04/04/2015 1:23:17 PM PDT

by

entropy12

(Real function of economists is to make astrologers look respectable.)

To: expat_panama

In one breath they say, "The market is riding on a sea of cheap money!" and in the next, "The market's down jobs disappointment."

Absurdity! "Jobs disappointment" can mean only one thing: more cheap money.

5

posted on

04/04/2015 1:25:35 PM PDT

by

9thLife

("Life is a military endeavor..." -- Pope Francis)

To: rsflynn

not sure if I pinged you, my list wasn’t quite updated...

To: Usagi_yo

going to be a crash between now and inauguration day 2017That was sure true in '09, big time. My take is that if (in the extremely unlikely case) those same policy sentiments take over again as in '08, then maybe I will be buying sackcloth'n'ashes futures.

To: entropy12

It’s trickier for seniors and I certainly don’t recommend it for the Novice, but the leverage is fantastic. I’m a gambler and I’ll risk 5% of my bankroll on this. Even 1 put can become incredibly valuable on a big panic swing. I’m a retired senior too on fixed income, little savings.

My brother recommends ‘baskets’ of stock etf’s? I don’t know. Sounds too much like a derivative to me.

8

posted on

04/04/2015 1:33:45 PM PDT

by

Usagi_yo

(The declining morals of the West vs the increasingly brutal Jihadists. Coincidence?)

To: 9thLife

"Jobs disappointment" can mean only one thing: more cheap money. That would be true if the Fed cared about jobs when it did its rate tweaking. It doesn't. The only thing on the Fed's plate is inflation, and jobs never even gets invited to dinner. If inflation comes back we'll get rate hikes even if there's double digit unemployment --just like in the early '80's. Otherwise it's more zero rates.

To: expat_panama

Inflation is the debtor’s friend.

10

posted on

04/04/2015 1:42:02 PM PDT

by

9thLife

("Life is a military endeavor..." -- Pope Francis)

To: Usagi_yo

recommends ‘baskets’ of stock etf’s?It took me forever but I finally caught on to etfs. All they are is mutual funds that you can buy'n'sell during the day. Right now I got the bulk of my holdings in QQQ (NASDAQ emulator), IWM (Russell 2000), and SPY (S&P500).

To: 9thLife

Inflation is the debtor’s friend.True, if by "debtor" you mean any entrepreneur who's raising capital to hire people and start or expand a business. Those are the kind of people a growing economy and a strong nation needs.

To: expat_panama

Come on. Inflation has always been a strategy for debtor nations.

13

posted on

04/04/2015 1:48:33 PM PDT

by

9thLife

("Life is a military endeavor..." -- Pope Francis)

To: 9thLife

Inflation has always been a strategy for debtor nationsThat's nice. In the mean time there is no entrepreneur who wants next year's sales prices to fall right after he put his life savings into his business so he could double his workforce.

His employees don't want deflationary pay cuts either.

To: expat_panama

Nice? If you say so. It’s only pointed out here because a) it’s obvious and b) it is consistent with the point of my original post, which it seems wasn’t clear enough.

15

posted on

04/04/2015 1:58:29 PM PDT

by

9thLife

("Life is a military endeavor..." -- Pope Francis)

To: expat_panama

In the mean time there is no entrepreneur who wants next year's sales prices to fall right after he put his life savings into his business so he could double his workforce. What entrepreneurs would like is assurance that their life savings will not be devalued by money printing. The money printing doesn't create price increases of course because it is mostly doled out to the largest banks to be used for credit expansion. If credit expansion benefitted entrepreneurs then they would just get a loan instead of using their life savings. But obviously they cannot. Instead they can get a loan to get a new car or expand their kitchen (consumables), and skip all the hard work of entrepreneurship.

But the bottom line is it is money printing, it is fueling a credit bubble, it fails to create sustainable growth (only spurts in consumables depending on consumer confidence). More to the point it adds to the excess misallocated debt and eventual deleveraging which fuels delation, which will of course lead the Fed to double down on its mistakes.

16

posted on

04/04/2015 3:24:30 PM PDT

by

palmer

(Net "neutrality" = Obama turning the internet into FlixNet)

To: entropy12

I just wanted to put in my two cents if it’s okay.

In my experience I’ve never made any consistent money purchasing options. In that respect it’s not worth the headache imo.

The way to go is to be a net seller of options, and capture the time decay. You make money if your forecast is correct on the underlying, almost correct, or not too awful off the mark. Never go naked - always be covered with purchasing farther out of the monies. Less profit, but you won’t lose big.

17

posted on

04/04/2015 4:34:39 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: palmer

It is the only way to tax people who “ don’t pay taxes...”

18

posted on

04/04/2015 5:10:00 PM PDT

by

wastoute

(Government cannot redistribute wealth. Government can only redistribute poverty.)

To: palmer; 9thLife

no entrepreneur who wants next year's sales prices to fall right after he put his life savings into his business so he could double his workforce. What entrepreneurs would like is assurance that their life savings will not be devalued by money printing.

That's true, but I'm not sure how we got over anyone wanting devalued savings.

This all started with 9thLife's post 5 with the idea that the Fed was lowering rates for the sake of jobs. A lot of people say that and they've forgotten that the Fed's goal is to keep a lid on inflation so as to provide "assurance that their life savings will not be devalued" and that if inflation comes along the Fed will (quite rightly) raise rated regardless of what's happening with jobs. We all agree we don't want out of control inflation. (We do don't we?)

Somehow when complaints about the fed and low rates came up, I got the impression that we were talking about whether deflation was OK, If we're not then we're good here. I mean, nobody here wants deflation do they? That's how we got into this low-rate/money-printing situation in the first place, it was to fight that poisonous deflation we got slammed with back in '08.

To: expat_panama

This all started with 9thLife's post 5 with the idea that the Fed was lowering rates for the sake of jobsThat was not the idea, and I'll thank you for acknowledging that you misunderstood so that I don't have to mark you down as someone who puts words in others' mouths.

And the Fed is not lowering interest rates. When was the last time they did they did that?

20

posted on

04/04/2015 6:43:54 PM PDT

by

9thLife

("Life is a military endeavor..." -- Pope Francis)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-57 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

goes so far as to point out how for years now the second half's been no slouch --averaging double-digit gains.

goes so far as to point out how for years now the second half's been no slouch --averaging double-digit gains.