Skip to comments.

NASDAQ Closes in on Dot-Com Peak [Is another bubble around the corner?]

The Data Center Journal ^

| 02/26/2015

| Jeff Clark

Posted on 02/26/2015 7:37:38 AM PST by SeekAndFind

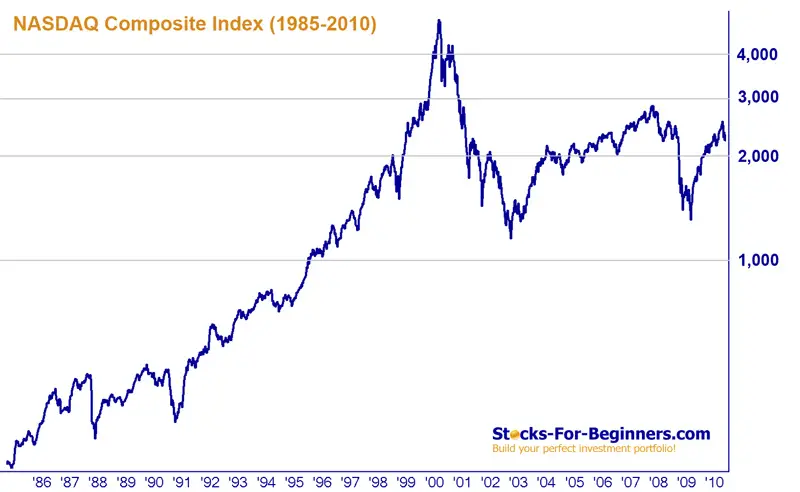

The technology sector has been a hot topic for both bulls and bears, with the former seeing the sky as the limit for company valuations and the latter seeing a bubble set for a 2000-like bust. Following the infamous dot-com crash, the Nasdaq composite index fell from a peak of just over 5,000 to nearly 1,000 in about two years. It never exceeded 3,000 during the time leading up to the Great Recession. In early 2009, the Nasdaq began a relatively steady run to today, when it is again testing 5,000. So, who’s right, the bulls or the bears? To answer that question, it’s necessary to look at what, if anything, has changed.

Company Valuations

Twitter is a common target for those who see a tech bubble because of its valuation relative to its (nonexistent) profits. Its market cap is currently about $31.3 billion; revenue for 2014 was $1.4 billion, but the company lost almost $580 million. Twitter has yet to net a dime. But there’s more to the story than just a few dubious cases. According to CNBC, “The old tech juggernauts that got crushed during the tech crash of 2000—such as Yahoo, Microsoft and Cisco—have nowhere near the astronomic price-to-earnings ratios that they were trading at back then.”

Some greater stability is to be expected simply because the technologies and tech-based business models of the 1990s have matured and, in some appropriate cases, disappeared. Furthermore, the decade and a half that elapsed since the last Nasdaq peak has serious inflation implications. At a low rate, inflation may generally be negligible for a year or two, but after 15 years, the compounding makes even a low rate significant. So, using the U.S. Bureau of Labor Statistics CPI inflation calculator as a benchmark, a peak of 5,000 points in the year 2000 translates into a 2014 level just shy of 6,900 points. In other words, if you dumped, say, $1,000 into a Nasdaq distribution of tech stocks in 2000, the index today would need to be at almost 7,000 to give you back the same buying power.

So, although again reaching Nasdaq 5,000 seems like a breakout moment, it’s actually still far from the equivalent mark set 15 years ago in terms of the buying power of a dollar. And that may even involve rather low estimates of inflation thanks to various changes in the measurement standard over time.

Startup Investment

One of the recognized signs that the technology market was a bubble in early 2000 was the level of investment in startups. Like mortgages before the real-estate crash, venture funding was available to anyone with a pulse by some accounts. According to Statista, “[T]wo venture capitalists in the United States have expressed their worries about the current state of the US startup community. In essence, both are saying that startups are burning through too much cash and that the overall amount of risk currently taken on in Silicon Valley is excessive.

A chart of venture-capital activity shows that although the total investment falls far short of the peak around the dot-com bust, the average investment is roughly the same in nominal terms. (Again, though, that means it’s actually much less—some 35–40%—when taking inflation into account.) Of interest is the fairly flat level for much of the past decade-plus, followed by a sharp uptick in both average investment and total investment starting sometime in 2013.

But even this situation isn’t enough by itself—or combined with the climbing Nasdaq—to call a bubble. As some observers have pointed out, technology is increasingly integrated into business and therefore plays a growing role in the economy. Even in an otherwise stagnant situation, therefore, this market might still see at least modest growth.

Likely more important are the macroeconomic conditions. If we are to claim that Nasdaq 5,000 is different this time, then the most relevant question is what has changed?

Macroeconomic Conditions

The word recovery emerged almost as soon as a recession had been declared in 2009, but any such improvement has appeared mostly in a few perhaps unrepresentative numbers. First, the much heralded labor-force participation rate has plummeted after reaching what may be an uncoincidental peak in early 2000.

In fact, this measure has been used so often that it has even garnered some backlash. Writing at Quartz, Matt Phillips suggests that it is largely due to increasing retirements of aging citizens rather than economic contraction or disincentives owing to welfare spending. Let’s grant him that point for the moment: so, now, who’s going to keep the Social Security Ponzi scheme going? All those STEM graduates who are heaped with debt but can’t find jobs in their fields?

And then there are other indicators such as the real median household income, which is at late 1980s levels according to FRED-compiled data. All these macroeconomic indicators suggest that huge equity prices and growing investments in startups are resting on a foundation of air. But perhaps the biggest key to determining whether there’s a bubble is interest rates.

According to Jim Edwards at Business Insider, “Interest rates are basically at zero and have been for some time. When borrowers are paying close to zero interest on loans, that makes money cheap to get… When interest is at zero, virtually any other kind of investment is likely to pay more because the risk-free alternative [essentially zero-interest bank deposits] is so lousy. So investment asset bubbles get created. Stocks, and other investment assets, tend to go up.” And since interest rates at the bank are below the rate of inflation, saving money means losing money. Naturally, then, the incentive is to find anything that provides a return. Heck, even Twitter looks good if the stock price goes up at just a few percent per annum—who cares about earnings?

Unfortunately for the Federal Reserve, however, any escape from low interest rates is largely blocked by government debt. If the interest rate on the debt rises just a few percentage points, the federal budget will begin cannibalizing itself in earnest just to keep investors happy. And with GDP growth unable to keep up with the rising debt, the only logical conclusion is default—sooner or later, but eventually.

Conclusions

One way or the other, the bull market in technology will be tested: whether by higher interest rates, which makes investment money more expensive, or through the questions raised by a sovereign default, or through inflation, or through some combination thereof. The oil market recently saw an unexpected bust; technology may (or may not) be next on the list of markets for correction.

Is today’s (near) Nasdaq 5,000 an instant replay of the turn of the millennium? In some ways, no, simply because an index of 5,000 today isn’t the same as 5,000 fifteen years ago thanks to inflation. Nevertheless, macroeconomic conditions seem to contradict the run-up in stock prices, and even the rising startup funding of the past couple years seems a bit unfounded. But as with well-chewed bubble gum, the inflation may go on far longer than anyone expects before a burst.

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: bubble; dotcom; nasdaq; stockmarket

To: SeekAndFind

When these people have something like “Snapchat” valued in the billions when it does nothing but allow perverts and kids to send lewd photos to their “friends”, then the market will get what it deserves.

It’s like they never learned from the late 90s.

2

posted on

02/26/2015 7:40:44 AM PST

by

VanDeKoik

To: SeekAndFind

A month before the dot.com crash began the experts were trying to predict if NASDAQ would hit 10,000 before the end of 2000 or not until the first part of the next year.

3

posted on

02/26/2015 7:53:21 AM PST

by

Iron Munro

(Mark Steyn: "fundamentally transformed" is a euphemism for "wrecked beyond repair.")

To: Iron Munro

Exactly. I new it was coming when you could buy any stock with a “dot com” in it’s name and make 40 to 50% on it in 2 days.

To: SeekAndFind

I’m confused. Yahoo! Finance’s ^IXIC chart shows the NASDAQ Composite peaked at 3940 on November 1, 1999. It’s just shy of 5,000 today.

Did they change the makeup of the NASDAQ and readjust the historical data?

5

posted on

02/26/2015 8:19:14 AM PST

by

Yo-Yo

(Is the /sarc tag really necessary?)

To: Yo-Yo

Nasdaq peaked at 5200 on March 10, 2000.

6

posted on

02/26/2015 8:48:52 AM PST

by

Defiant

(Please excuse Mr. Clinton for his involvement with young girls. --Epstein's Mother)

To: Defiant

7

posted on

02/26/2015 8:51:48 AM PST

by

Yo-Yo

(Is the /sarc tag really necessary?)

To: Yo-Yo

8

posted on

02/26/2015 9:33:11 AM PST

by

SeekAndFind

(If at first you don't succeed, put it out for beta test.)

To: Yo-Yo

I can't explain why Yahoo is wrong. All I can tell you is I was trading every single day during 1999 and 2000, watching CNBC all day in front of a computer that had the live screen on it. During the first part of 2000, NASDAQ set records almost every day. It started in the mid-3000s, and was going up 30, 40 or 50 a day, day after day. The bubble was expanding, and the trading was frenetic. I had made a few trades in 99 that I wanted to get out of, and during that period, nearly every one went into the green, and I sold at a gain. I made a lot of money during that time frame, and cashed out most of it on March 10, 2000. That's how I remember the date. Nasdaq topped out, and then the bubble burst.

What the article doesn't detail, though, is that the bursting wasn't all that bad. If I remember right, NASDAQ went down to around 3000 or maybe a little less. It was still overvalued, but it stabilized. Some of the worthless internet stocks had gone bye bye, and the companies that had real business, but were overpriced, had lost a lot of that steam and were more realistic. The multiples were still too high, but not by as much as before. By August, the market was poised for some more moderate growth among real companies. I got back in a little bit, and was doing pretty well. Then 9-11 hit. Nasdaq dropped to around 1000 before it bottomed. Everyone, good companies and bad, lost huge chunks of value. I lost a ton of money. After Bush and Greenspan fired up the printing presses, the market recovered into the 2000s pretty quickly, but growth above that took a very long time.

Anyway, Yahoo is wrong, but I don't know why. I was there. Check Marketwatch and see what it shows.

9

posted on

02/26/2015 9:33:58 AM PST

by

Defiant

(Please excuse Mr. Clinton for his involvement with young girls. --Epstein's Mother)

To: Yo-Yo; SeekAndFind

This

Marketwatch historical quote shows that Nasdaq closed at 5048 on March 10, 2000. The price reached 5200 during the day, but dropped a little at the close. Just as I remembered.

And then it never saw such numbers again. Until now, 15 years of dead money.

10

posted on

02/26/2015 9:39:26 AM PST

by

Defiant

(Please excuse Mr. Clinton for his involvement with young girls. --Epstein's Mother)

To: Defiant

Here’s the thing.

An Index is NOT a fixed set of securities. They are constantly being changed.

EVERY index is actually DESIGNED to go UP !!!!

They always remove the weak and failing companies and replace them with stronger companies.

BTW, I owned a Daytrading office between 1996 and July of 2001.

11

posted on

02/26/2015 9:46:17 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: Zeneta

That is not news. The Nasdaq 100, and the Dow, have changed their components frequently over the years. That is why, especially with the Dow 30, historical comparisons are inapt. There are what, just a few companies on the Dow that were there in the 30s.

12

posted on

02/26/2015 10:01:03 AM PST

by

Defiant

(Please excuse Mr. Clinton for his involvement with young girls. --Epstein's Mother)

To: Defiant

That is why, especially with the Dow 30, historical comparisons are inapt. There are what, just a few companies on the Dow that were there in the 30s.

What you just wrote made it look like your understanding of the DOW 30, has something to do with the 1930’s?

I hope that is not the case.

13

posted on

02/26/2015 10:17:45 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: Zeneta

What are you talking about? What did I say that gives you any impression that the name of the Dow 30 has to do with the 1930s? You read too much into things. I just remember an article when one of the companies in the Dow was replaced not too long ago that talked about how few companies remained in the Dow since the 20s or 30s. There was Coke and GM, and maybe Ford and a few others, but the rest have come and gone. Thank you for your concern, and your patronization.

14

posted on

02/26/2015 11:08:20 AM PST

by

Defiant

(Please excuse Mr. Clinton for his involvement with young girls. --Epstein's Mother)

To: Defiant

My bad.

You could have picked any other decade and it wouldn’t have been a question.

Sorry, again, but sometimes you never know what some people know or think they know.

As for the bubble?

Setting aside our inability to make proper comparisons, I think the markets are sitting on a knife’s edge.

Money moves faster than ever and expectations of future conditions are moving from years to months as a result.

When you trade S&P futures, you refer to the “underlying index” as the “Cash Market”. IMHO, Equities are being traded as if it were cash more and more. Our regulators have put in place “circuit breakers” that protect prices from dramatic moves. Institutional traders are much more inclined to use any derivative they can to hedge their positions.

The entire world is awash in Dollars and these money managers see the same data that we see. They are not stupid, and I don’t think they have any other choice but to be long equities.

I’m not saying that they are correct in their assessment of valuations, what I’m saying is that they have no other choice.

15

posted on

02/26/2015 11:36:50 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: Zeneta

I think you are right about the current market. I have not been in since 2008. I was shorting financials all that summer, and then got out. Saved a few relatives, too. My mistake was I never got back in. I didn't want to participate in a rigged game. Now it is clear I should have gotten back in, but now I think it's too late. Of course, I thought that two years ago, too. One of these days, I will be right, but I could have made millions in the meantime. I have done all right with other investments, but they are not as liquid.

I marvel at the expertise it must have taken to keep this current financial market afloat, and wonder how long they can keep it up. I fear the collapse will be spectacular. Stay safe.

16

posted on

02/26/2015 1:06:58 PM PST

by

Defiant

(Please excuse Mr. Clinton for his involvement with young girls. --Epstein's Mother)

To: Defiant

Thanks.

Back in 08 I called and made great money as the eur/usd broke and I thought the markets would continue to behave in a rational manner. QE*, destroyed virtually all traditional methods of measuring value etc.

What I am seeing today is with the absence of QE*, the economy is resuming its deflationary cycle. The FED only bought some time.

I watch the US Dollar and believe it will continue higher as long as the FED stays away.

That said, I think the FED will actually introduce another round of QE before too long.

17

posted on

02/26/2015 1:22:32 PM PST

by

Zeneta

(Thoughts in time and out of season.)

To: Zeneta

I had a big short on Lehman back in August 08, at the perfect time. Then, the government came in and announced something that indicated that they would backstop everyone ,and my short got crushed. I got out, and that was my last time in the market. I was willing to make informed decisions based on business factors. I was not willing to have to take the risk of the market being manipulated by the government. Who knows what they will do from day to day? Sadly, I was right, they all went belly up a month later. But I couldn't stay in.

American business is remarkably resilient, and can find ways to make money even when the rules change to make it a lot harder. What we can't do is make money when the rules change daily. We need at least a little certainty as to the rules. Obama thrives on an environment of keeping everyone off balance. We figure out a way to get around his hatred of oil; he finds a new way to shut it down. We find a way around his Obamacare (30 hour weeks); he finds a way to get us. It will never end, it will only get worse these next two years. Maybe the wizards can keep us going in spite of him.

18

posted on

02/26/2015 3:45:35 PM PST

by

Defiant

(Please excuse Mr. Clinton for his involvement with young girls. --Epstein's Mother)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson