Posted on 12/30/2014 11:33:06 AM PST by blam

December30, 2014

John_Rubino

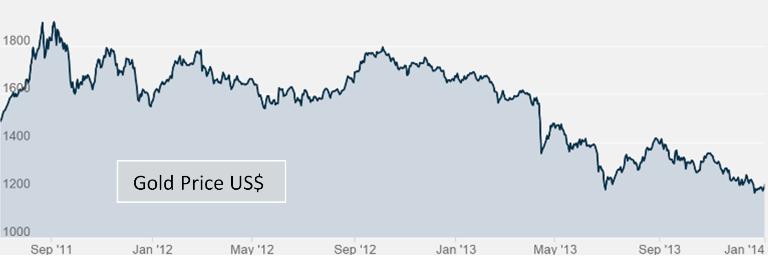

Twelve short months ago, the immediate future looked like a lock. Overvalued equities had to fall, ridiculously-low interest rates had to rise, and beaten-down precious metals had to resume their bull market.

The evidence was overwhelming. Debt in the developed world had risen to $157 trillion, or 376% of GDP, by far the highest level on record and clearly unsustainable. Long-term US Treasury rates had been falling for literally three decades and despite a recent uptick were so low that the only way forward seemed to be up.

Europe and Japan were drifting into recessions that could easily morph into capital-D Depressions. The eurozone would fragment, Japanese bonds and probably stocks would crater, one or more major currencies would implode. No way to know which event would come first and in what order the other dominoes would fall, but without doubt something had to give.

And gold, of course, had had its correction and was, at the beginning of 2014, perilously close to the mining industry’s cost of production. The last time that happened, in 2008, an epic bull market ensued — and gold-bugs were anxious for a replay.

Yet 2014 turned out to be a pretty good year for the powers that be and the economic theories that animate their behavior. Equities boomed, interest rates fell, the dollar soared, and gold ended the year below where it started. Gold miners, after a year of operating at an aggregate loss, have seen their market values crater.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

Most likely by the time the fellow got home got his gold bar and got back to the supermarket the point would be moot being the people who didn't have any gold would have stormed the supermarket and took everything because their welfare/debit cards didn't work.

And in such a scenario if there was food still left and he showed his gold bar to pay for his food he better be "well-armed" because if not he won't be "well-heeled" for long...

“Gold miners, after a year of operating at an aggregate loss, have seen their market values crater. “

Maybe so, but gold was at $250 not long ago. I think gold has done very well for itself and will continue to do so. I did just fine even when Uncle Sugar was printing dollars as fast as the printing presses could go. They tossed in $1 trillion a year and gold still held firm against such manipulations.

I think it was April two years ago. I stupidly bought some. I guess I thought it was going to keep climbing.

No, I don't think anyone believes that.

It became very obvious when gold reached it's peak that there was every intention to drive it down to $1,200.00/oz., that intent was telegraphed by numerous authorities with the ability to move the needle in a significant way. And, that is pretty much where it's hovering today. I said this numerous times on FR to mostly deaf ears, sell.

Of course, that was not a prediction on my part, it was observation of a statement of intent with some weight behind it. People just fall in love with gold and start rationalizing away any threat to the value of it.

Falling in love with an investment is never a good idea.

Why not?

Because the crude oil market is huge and oil is so vital to everyday life in every part of the world that has progressed beyond using draft animals. The market for crude oil is upwards of 90 million barrels a day, every day. A market that big does not turn on a dime. Once again, demand hasn't suddenly halved and supply hasn't suddenly doubled.

Psychological factors aren't involved in demand? Supply isn't just supply today, but also expected supply in the future. Demand isn't just demand today, but expected demand in the future.

With end users psychological factors are miniscule to non existent for a commodity like crude oil. Most people need gasoline every day and will need it in the future. They know this. How do they respond to this fact? Do they hedge their future needs in the commodities market? No. Do they store gasoline for future use. Maybe enough for the lawnmower. So how do psychological factors effect the end user, they don't.

Psychology does effect traders and speculators. That was my point. They speculate in the futures market and when their expectations turned the price went down, it had nothing to do with actual supply and demand for the physical product.

A 10% increase in supply doesn't mean a 10% drop in price.

Ok

Some gold advocates theorize that the TBTF banks are short physical and paper gold. Why would they be?

There are a few theories about that. They are based on the belief that the TBTF banks are basically criminal enterprises who have been given a license to steal. The fact is that they can do whatever they want in the paper markets and no one will be prosecuted and the bank will not fail. The theory is that they are speculating on the price on the down side.

Why wouldn't they be long gold?

If the TBTF banks started to play the futures on the long side, gold would skyrocket in price. If you are short physical gold, you don't want that to happen.

The same way they could drive housing higher, so we'd never have a crash in 2008?

Apples to elephants. The US housing market is huge. The banks were not short real estate. The world gold market is tiny.

If China and Russia were buying up gold, wouldn’t the price be going up instead of down? I believe you that they are buying it, but the reason the price doesn’t reflect it is because of price manipulation in the market.

Yes, I guess you could use your personal stash of physical gold to mint coins. Good luck getting anyone to accept them without drilling each one full of holes to test it.

I don’t dispute the fact that gold has lasting value, the problem is exchanging it for goods and services without losing a large share of the stated value.

Right.

Yes, I guess you could use your personal stash of physical gold to mint coins. Good luck getting anyone to accept them without drilling each one full of holes to test it.

Small scale silver and gold stackers are buying gold and silver coins minted by government mints in Canada, USA, Australia, Austria, South Africa and elsewhere. If I was buying I would buy Canadian Silver Maples. One ounce of .9999 fine silver with a face value of $5. The guy I bought them from is happy to buy them back as they are easily recognizable and very hard to counterfeit. No one is going to start minting their own coins when the perfect example already exists.

I don’t dispute the fact that gold has lasting value, the problem is exchanging it for goods and services without losing a large share of the stated value.

If I was stacking gold or silver coins I would not want to exchange them for goods or services at any time except out of absolute necessity. Maybe if you were out of food or ammo.

“If I was buying I would buy Canadian Silver Maples. One ounce of .9999 fine silver with a face value of $5.”

How much do you pay for that $5 coin?

I don’t like articles that are undated.

“...and a safe in which to store your gold.”

Gold has intrinsic value, paper currency does not.

Why? It's a shiny metal. It's got no more intrinsic value than does green inked paper. You can't eat it. It's probably got less industrial uses than paper.

Yes, it is shiny, and heavy, and indestructible and easily recognizable, and easy to mould and form. That's why it pushed all the other monetary pretenders out thousands of years ago. It is also portable, scarce, divisible, a real store of value, storeable, fungible, and as a bonus it carries no counterparty risk.

Its intrinsic value comes not from any industrial use but from the energy and wealth that is inherently stored in that coin. The ore got dug up through a huge expenditure of energy and labor, it got refined processed and formed with more energy expenditure. Finally it was minted into a recognizable gold coin. All that energy is stored in that coin. That is intrinsic value. The paper in your pocket or worse yet the electronic money in your bank have zero intrinsic value. They can be infinitely produced.

Gold cannot be inflated to worthlessness, paper currency can be.

During the California gold rush, Gold have serious inflation problems. But for the most part, you are right, short of finding a massive gold deposit, gold is largely immune to inflation. Which means using it as a basis for currency almost guaranteeds deflation, and the deflationary depressions that go with it. When we were on the gold standard we had severe business crippling depressions every 20 years. Thank goodness for fiat currency. The inflation on our fiat currency has been well managed in the past and averaged only about 2% a year. Of course if you look at a 100 year chart that looks terrible. But it really should be scary only to idiots hoping to hoard cash for 100 years in their mattress and not even draw interest.

I question how well fiat currency production was managed during 1976-1982. Those were some hard economic times with lots of inflation and lots of unemployment. We are talking about a lot of purchasing power lost over a very short time. If you trust the government to manage the currency I don't have a problem with that. I do not trust them to manage the currency. The US dollar will go to zero at some point in time, just like every other fiat currency since the dawn of civilization.

Gold cannot be declared worthless or "reverse split" by government fiat, paper currency can be.

Sure it can. Our own government even outlawed gold at one point and confiscated it. Every time the government had a major war they came off the gold standard. So a gold standard will always exist only at the whim of Congress.

I love Americans but your thinking tends to be a bit insular at times. The US government can do whatever it wants within its borders but it will never be able to simply declare gold worthless. It is a big world and you live in a part of it. A beautiful, productive part, but only a part.

The US government never "outlawed" gold. They did try to confiscate all the gold in private hands and they reduced the price but they never outlawed it or made it worthless. I doubt very much that they could get away with that today. If you have gold and you feel it is at risk of confiscation, bring it to me and I will get you world price in any major currency with a small mark up for my trouble.

Furthermore, the writ of Congress as it pertains to a "gold standard" only applies to the USA and those citizens who wish to follow their strictures in this regard. How much financial repression the government can get away with is an open question. They have gotten away with a lot so far but declaring all the gold in the world worthless is beyond their power.

Gold maintans its purchasing power over centuries, paper currency always goes to zero purchasing power. Gold is real money, paper currency is currency and there is a difference.

Money is whatever we say it is. Whatever facilitates the trade. There is no difference in gold, paper, or electronic blips.

You could not be more wrong. You are conflating the difference between money and currency. There is a huge difference and it has to do with money's properties as a store of value and its scarcity. Gold is scarce, that's why it retains it value over time. "Electronic blips" or entries on a ledger can be infinitely created. So can paper currency. This destroys their use as a store of value because they can be created infinitely out of thin air. If you trust the government to maintain the purchasing power of the currency, this won't bother you.

The face value would only come into play if silver fell below $5CDN an ounce. If I had silver coins I would not contemplate selling them at face value or really for any price. I would use them as insurance, not as a medium of exchange. If I had to use them to exchange them, things would be really, really bad.

Its intrinsic value comes not from any industrial use but from the energy and wealth that is inherently stored in that coin. The ore got dug up through a huge expenditure of energy and labor, it got refined processed and formed with more energy expenditure. Finally it was minted into a recognizable gold coin. All that energy is stored in that coin. That is intrinsic value. The paper in your pocket or worse yet the electronic money in your bank have zero intrinsic value. They can be infinitely produced.

Gold can be inflated to worthlessness if any of the gold producing countries decide to dump a ton of gold on the market all at once.

Do you truly believe that a gold producing country, acting in its own self interest, would dump gold to lower the value of its own gold holdings and gold mines? Let's look at reality. China produces about 410 tons of gold a year. It imports hundreds of tons more through Shanghai. It does not export a single ounce. This is not accidental. This is a government policy. A PBOC official who tried to export any amount of gold would lose his head before the first shipment reached Hong Kong.

Gold cannot be declared worthless by government fiat, but it can be made almost worthless if a country has a ton of gold and dumps it on the market. Also, gold can be made almost worthless for most people in the U.S. by government fiat if the government makes it illegal to own, buy or sell it (which it has done in the past).

See above for the answer to your first question. Your second question answers itself. Yes the US government can practice financial repression on its own people within its own borders. Too bad for you. It is a big world out there. I question whether they can get away with confiscating gold a second time. If that happens or you have fear that it will happen, bring your gold to me and I will convert it to any major currency less a small markup for my trouble.

Gold has maintained most of its purchasing power, but the price of gold has fluctuated a hell of a lot over the past centuries.

Right, and my guess is that it will continue to do so but, over time, it will retain its purchasing power far better than currency.

The price is entirely a function of current supply and demand. Massively increase the supply or prohibit ownership and cut demand and most of its value will be gone.

This massive increase of supply you refer to will not happen. I don't really know what the price effects of prohibiting ownership in the US to US citizens would be inside the US. I do know that 95% of the world would not be effected by such a prohibition. Assuming that the US government would be taking such gold out of circulation and storing it in Fort Knox then there would be less gold available on a worldwide basis and the price would go up. If they used the confiscated gold to settle foreign debts, the effects outside the US would be negligible. However, the effects would be devastating inside the US.

...put your money into things that earn more money - company stocks, productive land, mineral interests, etc.

I'm with you there, pal. Hard, income producing assets are the way to go.

If you want to protect yourself as much as possible from the inevitable economic downturns, depressions and/or financial armageddon, then also put some of your money in gold, silver and several other commodities. If you invest in commodities hoping to make money by correctly betting whether they will rise or fall in value, then you would do better going to Las Vegas and betting on red or black on the roulette wheel. At least in Vegas you can also get drunk and take in a show.

You are right again. An even better strategy would be to go to Vegas and just drink at the shows, no gambling.

That's funny. Why do you think that?

So how do psychological factors effect the end user, they don't.

Southwest Airlines has almost 46,000 employees. Do you think they worry about fuel prices?

Psychology does effect traders and speculators. That was my point.

And end users and producers. That was my point.

They are based on the belief that the TBTF banks are basically criminal enterprises who have been given a license to steal.

Lots of stupid people have lots of stupid ideas.

The theory is that they are speculating on the price on the down side.

Why would they care? Why only the down side?

If the TBTF banks started to play the futures on the long side, gold would skyrocket in price.

Maybe they made it spike over $1900?

If you are short physical gold, you don't want that to happen.

Sure, but how many people/organizations are short physical gold?

$1000 worth of gold bought in 1980 would be worth about $2200. $1000 dollars from 1980 have inflated to $2865. The price of gold has not keep up with inflation long term.

That’s a good point. Undated articles look like advertising bait for something.

Depends on what you paid when you bought.

That's funny. Why do you think that?

Maybe you should stop laughing and reread the explanation in my last post to you. I am not answering your questions to amuse you and if all you are getting from this is amusement I won't bother with you any more. I will try again. Please note, I am referring to the behavior of end users of the commodity, not industrial organizations or their employees.

Did the average consumer start using half as much gasoline six months ago thereby causing demand to collapse? I see no evidence of that, do you? Psychology does not seem to have effected the producers either, everybody is producing as much as before. You will see a decline in exploration, and drilling, and marginal production will be halted. I don't think you have seen that yet and it has nothing to do with psychology and everything to do with price.

If you think the TBTF banks are not running amok and manipulating every market they can get their hands on with impunity perhaps you should google: "JP Morgan fines" or "JP Morgan market manipulation". They have paid billions in fines for market manipulation in the last few years. They have admitted their guilt. Is anybody in jail? I guess those Forbes reporters are some of the stupid people you refer to.

Yes gold will see $1,900 again and much more.

What institutions are short paper or physical gold?

I don't know. The Federal Reserve has never been audited in over 100 years of operation. I guess we can take them at their word for how much gold they have, and how much they are holding for foreign governments. The Germans are happy to wait 7 years for the Fed to deliver their gold which is supposedly sitting in a vault in New York. The Dutch recently got over 100 tons of their gold so there must be some severe transportation issue with moving a similar amount a few more miles to Germany.

Once again, I will answer your questions seriously but if you want to resort to ridicule or ad homonym attacks you will be having this discussion with yourself. I consider such tactics to be an admission of defeat.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.