Skip to comments.

OPEC Blames Speculators, Non-OPEC Countries, US Frackers for Oil Price Crash

Townhall.com ^

| December 22, 2014

| Mike Shedlock

Posted on 12/22/2014 6:20:58 AM PST by Kaslin

OPEC is pointing the finger at speculators as well as Non-OPEC countries, but especially US shale producers for the crude price crash.

Let's explore that idea in a series of charts. But first let's take a look at the allegation.

The Wall Street Journal reports Gulf Oil Exporters Blame Non-OPEC Producers for Glut.

Gulf oil officials on Sunday defended OPEC’s decision last month to keep its production ceiling intact, blaming producers outside of the group for the glut of oil on the market that has depressed prices.

Speaking at an energy conference in Abu Dhabi, Saudi Oil Minister Ali al-Naimi blamed a lack of coordination from producers outside the Organization of the Petroleum Exporting Countries—along with speculators and misleading information—for the slump.

OPEC officials have singled out American shale producers as a particular problem. U.S. oil production has soared as a result of the shale boom, reducing OPEC exports to the U.S.

Non-OPEC producers “will realize that it is in their interests to cooperate to ensure high prices for everyone,” Mr. Naimi said.

OPEC December Monthly Oil Market Report

Are US shale frackers really to blame for the price crash?

Let's take a look using OPEC's own data. Please consider charts and other analysis from the OPEC December Monthly Oil Market Report.

OPEC vs. Non-OPEC Supply

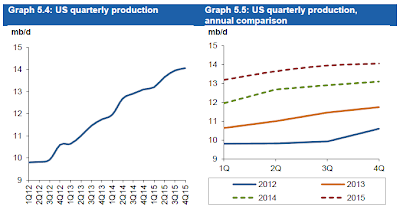

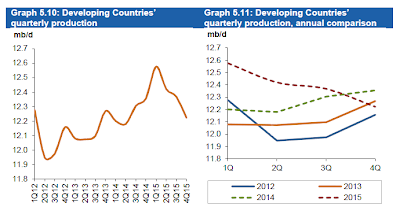

Non-OPEC oil supply is estimated to grow by 1.72 mb/d in 2014 to average 55.95 mb/d.

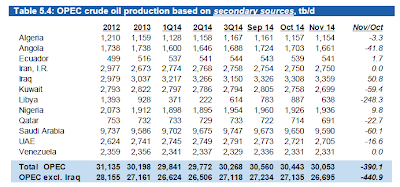

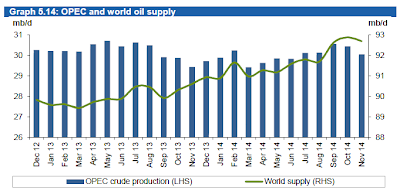

In November, OPEC crude oil production averaged 30.05 mb/d, according to secondary sources, a decrease of 0.39 mb/d over one month earlier.

OECD Americas

OECD Americas’ oil production is estimated to increase by 1.54 mb/d in 2014 to average 19.67 mb/d, the highest among all non-OPEC regions, indicating an upward revision of 10 tb/d from the previous MOMR. Strong estimates for both the US and Canada constitute the main factor behind expected supply growth, while heavy declines are seen in Mexico.

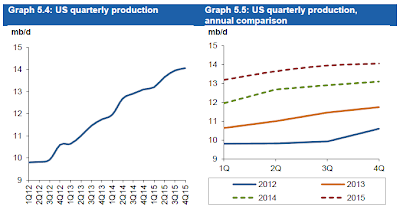

US

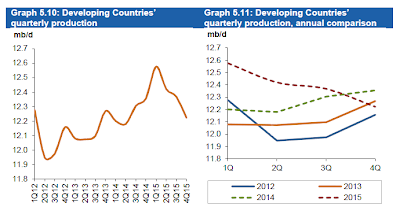

Developing Countries

Russia

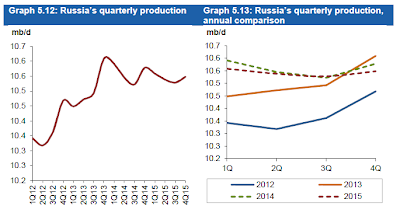

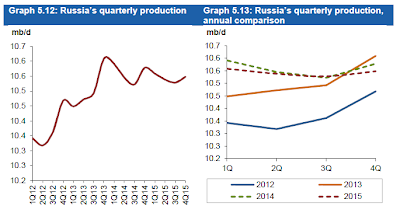

Russia’s oil supply is estimated to increase by 0.05 mb/d in 2014 to average 10.56 mb/d, an upward revision of 20 tb/d from the previous MOMR. Production reached a record 10.67 mb/d in November as per preliminary data, an upward revision of 80 tb/d in 4Q14, with current production data for October and November indicating higher-than-expected output. Russia’s production is expected to average 10.58 mb/d in 4Q14, an increase of 60 tb/d from 3Q14. Based on preliminary oil production by companies in November, not only was output not reduced, but there was an increase in volume. However, it is anticipated marginal barrel output in Russia for 2015 could decline y-o-y, given the impact of sanctions, low prices and lack of large projects expected to come online. Nevertheless, the approval of a tax overhaul by the Russian parliament, reducing crude export duty from its current 59% to 42% in January, could encourage oil producing companies in Russia to produce more.

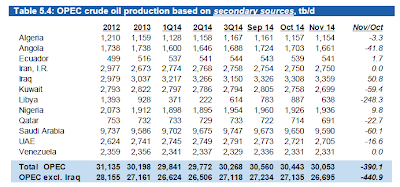

OPEC

Total OPEC crude oil production dropped in November to average 30.05 mb/d, according to secondary sources, down by 0.39 mb/d from the previous month. Production from, Iraq increased, while crude oil output mainly in Libya, Saudi Arabia and Kuwait fell. According to secondary sources, OPEC crude oil production, not including Iraq, stood at 26.69 mb/d in November, down by 0.44 mb/d over the previous month.

OPEC Thousands of Barrels a Day

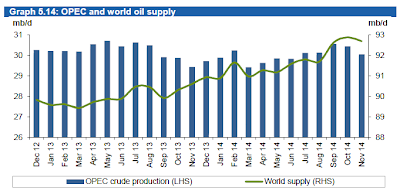

World Supply vs. OPEC Supply

Preliminary data indicates that the global oil supply decreased 0.19 mb/d in November 2014 to average 92.69 mb/d. Non-OPEC supply experienced growth of 0.20 mb/d, while OPEC crude oil production decreased by 0.39 mb/d. The share of OPEC crude oil in the global supply declined to 32.4% in November. This estimate is based on preliminary data for non-OPEC supply, estimates for OPEC NGLs and OPEC crude oil production from secondary sources.

Signaling Out US and Speculators is Ridiculous

Let's dismiss the notion speculators are responsible. Speculators, don't take delivery of significant amounts of oil (if any at all) and they don't set prices, but they can swing day-to-day volatility and perhaps exaggerate trends in both directions for a while.

Ultimately this is a supply-demand issue.

US production is up by 1.45 million barrels a day since a year ago.

Total world supply is about 93 million barrels a day. The increase in US production amounts to 1.56% of global supply. Signaling out the US is absurd.

There are 12 OPEC countries vs. the rest of the world. Those 12 OPEC countries represent 32.4% of global supply.

In total, there are over 200 countries that produce oil according to the US Energy Information Administration (EIA).

An EIA chart (2012 data) will help put things in better perspective.

Countries and Producers Act Independently

It should be pretty easy to spot the problem. Countries as well as oil producers in those countries act independently.

Thus, Saudi Oil Minister Ali al-Naimi's statement "Non-OPEC producers will realize that it is in their interests to cooperate to ensure high prices for everyone” is laughable.

Every country in the world wants the other countries to be the ones to cut supply. Cooperation is not going to happen. OPEC cannot even agree among its own members.

For further discussion, please see What's Behind the Plunge in Oil? Winners and Losers? Boon to Spending or Recessionary?

TOPICS: Business/Economy; Culture/Society; Editorial

KEYWORDS: fracking; oilcharts; oilglut; oilprice; opec; saudiarabia

I am enjoying the lower gas prices and say screw OPEC

1

posted on

12/22/2014 6:20:58 AM PST

by

Kaslin

To: Kaslin

The reality is that there is a worldwide economic slowdown. If there was robust economic growth and activity the demand would stabilize and even cause an increase in oil prices. Less is being used since there is less real economic activity or growth. American economic growth is a paper charade that is built on the phony foundation of borrowed and printed money.

2

posted on

12/22/2014 6:25:47 AM PST

by

allendale

To: Kaslin

"I am enjoying the lower gas prices and say screw OPEC."

The Opecker Princes have been $crew most Americans for over 5 decades with their damn oil Cartel.

Hopefully the oil prices based on supply and demand will destroy these Islamic Opec bastards economically and their S. American dictator buddies and last but not least Putin!

3

posted on

12/22/2014 6:43:22 AM PST

by

Grampa Dave

(The Democrats, who run America are too old, too rich, and too very/very white elitist losers!.)

To: Kaslin

Couple charts to go with those points.

4

posted on

12/22/2014 6:45:32 AM PST

by

thackney

(life is fragile, handle with prayer.)

To: Kaslin

Is there some subtle theme going on; with 0bama and his Saudi buddies?

Funny thing, nothing is ever their fault. They always have a way of pointing to someone else. And it’s not like I consider “fault” or “blame” to be a single point reference in most cases, nor do I think it’s productive. But the fact of the matter is that oil slide occurred on the OPEC meeting where KSA said they would not cut.

5

posted on

12/22/2014 7:01:31 AM PST

by

Attention Surplus Disorder

(At no time was the Obama administration aware of what the Obama administration was doing)

To: Kaslin

Yeah, what "crash"?

Us consumers have been over-paying for gas for how many years now?

6

posted on

12/22/2014 7:24:16 AM PST

by

Slyfox

(To put on the mind of George Washington read ALL of Deuteronomy 28, then read his Farewell Address)

To: Slyfox

This is a well thought out plan by the Saudis. Simply increase output so prices fall to below what the new private oil extraction costs in the US. By doing so, the US shale industry will eventually have to stop production and after 2 years, will be forced to shut down operations and close up. To do so, they will be forced to seal off their wells. Once sealed, the Saudis just cut output again until the price goes back up. Since it really does take 10 years to drill enough US wells to male a difference, they wil enjoy high prices for another 10 years. They are working our system.

7

posted on

12/22/2014 9:21:13 AM PST

by

phalynx

To: Kaslin

As an owner of four oil wells, let me say I will happily accept the downturn in prices if it helps break the back of OPEC.

8

posted on

12/23/2014 10:28:28 AM PST

by

Kenton

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson