Skip to comments.

The Rally Surges Back, But There's Trouble Ahead

Money Morning ^

| November 2, 2014

| Michael E. Lewitt

Posted on 11/02/2014 12:00:24 PM PST by Wuli

The week was dominated by news by central banks as the Federal Reserve ended QE and the Bank of Japan pushed its QE program to new heights. The result was another rally in stocks around the globe that made the mini-correction earlier this month seem like a dream (or a nightmare).

The question is what happens next, and all indications are that markets will continue to ride the wave of central bank liquidity as far as it takes them. Markets were also boosted by a strong initial third quarter U.S. GDP report showing the economy grew at 3.5% and strong corporate earnings reports. With over 360 companies in the S&P 500 having reported third quarter results, profits are up 7.2% and revenue is up 3.9%.

The fact that much of these gains are attributable to non-organic factors such as stock buybacks and low interest rates doesn't seem to bother investors since they expect these factors to continue indefinitely. But the markets only look like they got more attractive.

Particularly in view of news that came out of Japan on Halloween, they just got far more dangerous.

(Excerpt) Read more at moneymorning.com ...

TOPICS: Business/Economy; Editorial; Government; News/Current Events

KEYWORDS: economy; endofqe; federalreserve; qe; stockmarket

For his full analysis, go to the linked article.

I have no absolute opinion, pro or con on his positions. He does make some good points for why he is skeptical about the recent uptick in the U.S. stock markets, and about recent Bank of Japan and Japanese government actions.

1

posted on

11/02/2014 12:00:24 PM PST

by

Wuli

To: Wuli

So ,I assume you are invested in the stock market,when are you going to sell?

2

posted on

11/02/2014 12:10:50 PM PST

by

mdittmar

To: Wuli

Later in the day – though they claim the moves were uncoordinated – the government pension fund announced plans to shake up the $1.2 trillion investment portfolio for the Government Pension Investment Fund. As of June 30, 2014, this portfolio was invested as follows: Japanese bonds – 53.4%; Japanese stocks – 17.3%; foreign stocks – 16.0%; foreign bonds – 11.1%; Short-term assets – 2.3%. The new plan is to increase the holdings of Japanese and foreign stocks by more than 10 percentage points each, which would equate to about $100 billion each based on the size of the fund.So the Japanese are going to be coming here to buy stocks, in order to invest in dollars, and protect themselves from a Yen collapse. This is exactly why foreigners are buying American real estate. We are the world's safe haven right now.

To: mdittmar

You shouldn’t assume anything, and I speak very little, outside of private conversations about any specifics of my own finances. I also rarely make specific investment recommendations to anyone. People need to do their own due diligence & use their own judgements and needs - not mine.

4

posted on

11/02/2014 1:10:02 PM PST

by

Wuli

To: Wuli

Well,you posted this article,not me.

5

posted on

11/02/2014 1:14:54 PM PST

by

mdittmar

To: Wuli; mdittmar

He does make some good points for why he is skeptical about the recent uptick in the U.S. stock markets,when are you going to sell?

rarely make specific investment recommendations to anyone

Right.

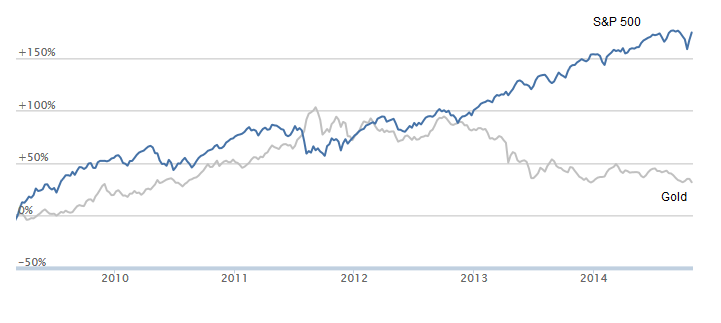

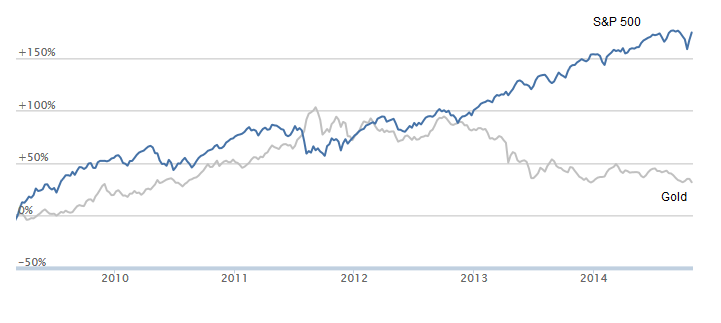

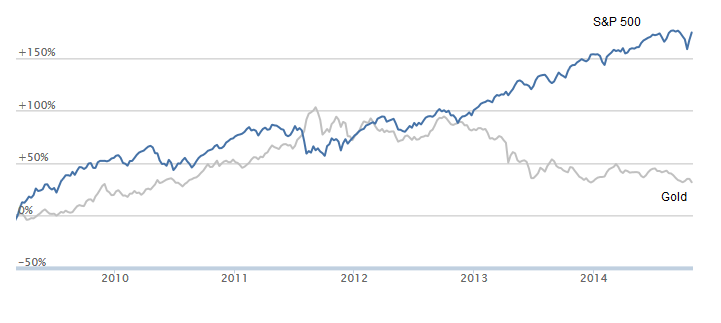

OK so as for Lewitt's "good points", back in early 2009 his view was for more "sagging stocks" and "sooner rather than later (i.e., within five years), gold will trade at $3,000 an ounce."

His ability to see the future doesn't have a very encouraging track record...

To: expat_panama

There you go with them damn charts again!! You know you’re not supposed to back up opinions with empirical data!!

/sarc.

7

posted on

11/02/2014 1:54:48 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

lol!!! —and I actually did “laugh out loud” too!

To: expat_panama

Thanks for posting this chart. It reinforces those of us, who didn't listen to the pied pipers of Gold and before the end of 2012 and during 2013 bought SPY, DVY, DIV and held on to them have done better than the Gold Buggers.

9

posted on

11/03/2014 8:19:21 AM PST

by

Grampa Dave

(Islam/ISIS = The Ebola of religious/political ideologies!)

To: Vince Ferrer

Vince, there has been a housing market boom in the north wino countries in Californicator land for about two years.

At first Canadians, Texans and elites fleeing NYC and LA elites were the predominant buyers.

This past year Asian buyers have surpassed the first leaders.

You can bet with oil prices plummeting, our $ growing stronger, and the world crises, your statement about “So the Japanese are going to be coming here to buy stocks, in order to invest in dollars, and protect themselves from a Yen collapse.” Is happening as well as with other Asians and Euros with half a brain.

10

posted on

11/03/2014 8:24:30 AM PST

by

Grampa Dave

(Islam/ISIS = The Ebola of religious/political ideologies!)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson