Posted on 10/26/2014 10:48:06 AM PDT by expat_panama

Our investing strategy is the mix of our own personal financial needs plus expected future developments in the economy. So the buzz (on these threads) is that the biggest up-coming economic/employment changes impacting our investment choices in the next week or two are the midterm elections, Ebola, deflation, and the war on terror.

We'll share our thoughts here on what we expect, and let's rate our expectations in terms of what we've been having up til now on the 'click-to-enlarge' graphs.

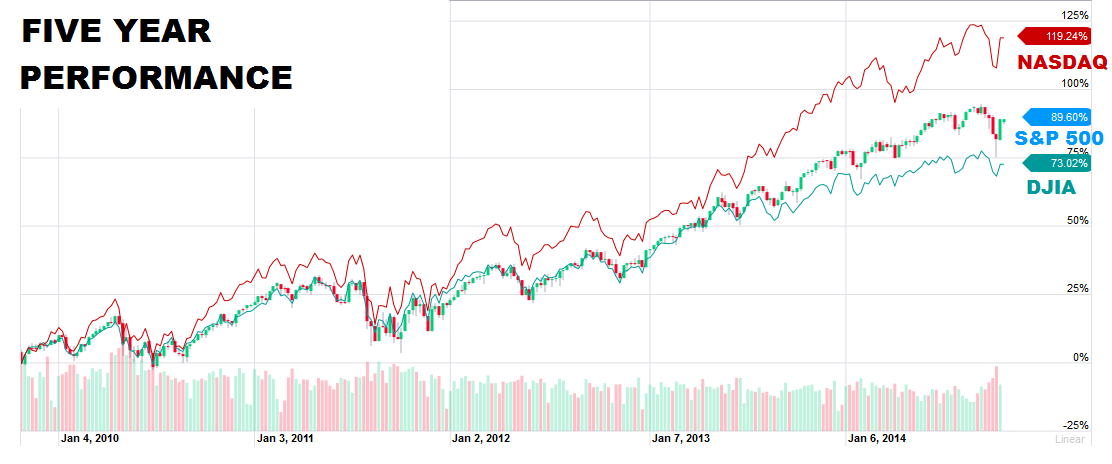

On the right margin we got 5-yr stock index performance for a back drop on our own personal expectations. Fer instance, my guess/wishful thinking is more of the same so I'll say short term up +10% and longer term +20%.

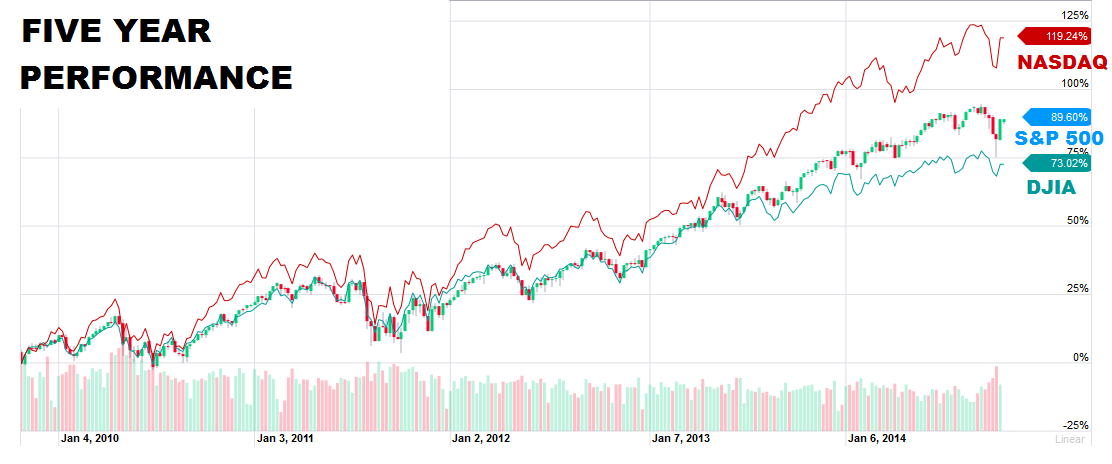

Right below stocks is the past ten years of metals --let's guestimate our expected short&long term trends.

Right below stocks is the past ten years of metals --let's guestimate our expected short&long term trends.

Finally, for discussion we ought to compare our thoughts on what we see supporting our investment expectations --what do we blame for any expected upcoming shift. OK, so we got the election.

<--Here's past party control of congress, and my personal expectations for beginning Jan. '15 is a 60% House and 65% Senate Rep. power shift. [oops, forgot the 'wishful thinking ' tag]

Other newsworthy macro factors coming up in the next couple weeks that should be affecting the economy and our investments include the spread of Ebola, inflation/deflation, war on terror, etc. So we can put at the bottom of the surveypoll/questionaire (SPQ) a vote on where we lob our blame.

OK, funtime! here's the SPQ to fill out and post:

| Change in stock indexes: | ____% short term | ____% long term |

| Change in metals prices: | ____% short term | ____% long term |

| Election results: | ____% Rep. House | ____% Rep. Senate |

| Cause of econ/investment trend (election,ebola,'flation,terror,other?): | ____________________ | |

The idea is to post the results in a graph table here and my guess is it'll take the better part of a week to get it all in. Another option we got is y'all can private reply if you don't want a public commitment -more work for me but that's OK because that way I can change your vote or even make up bogus replies to back up my own prejudices. As for how actual reality compares to our guestimates, prices come out every minute, the election's a week from Tues, and agreement on the cause should probably take a few decades...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

The analysis seems overly complex to me

Run of the mill Blacks and single women voters will create reasons for not making the trip to the polls.

The rats will loose big time

That's exactly what Yellen said (Perspectives on Inequality and Opportunity from the Survey of Consumer Finances):

...inequality in income and wealth, of course, would occur even with completely equal opportunity because variations in effort, skill, and luck will produce variations in outcomes. Indeed, some variation in outcomes arguably contributes to economic growth...

--and it's been ignored by the left becuase they don't want the right to look good and ignored by the right because they don't want Yellen to look good.

agreed

(hat tip to: fivecatsandadog!)

Post to me or FReep mail to be on/off the Bring Out Your Dead ping list.

The purpose of the “Bring Out Your Dead” ping list (formerly the “Ebola” ping list) is very early warning of emerging pandemics, as such it has a high false positive rate.

So far the false positive rate is 100%.

At some point we may well have a high mortality pandemic, and likely as not the “Bring Out Your Dead” threads will miss the beginning entirely.

*sigh* Such is life, and death...

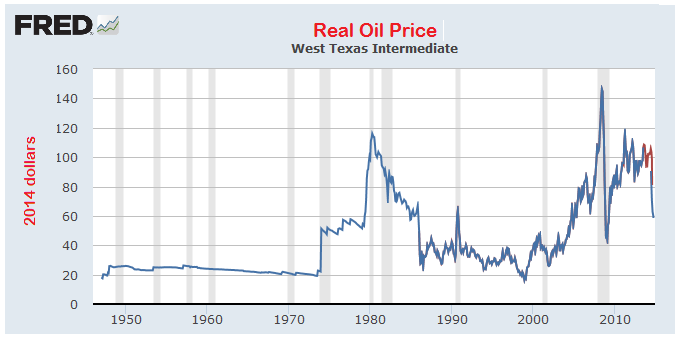

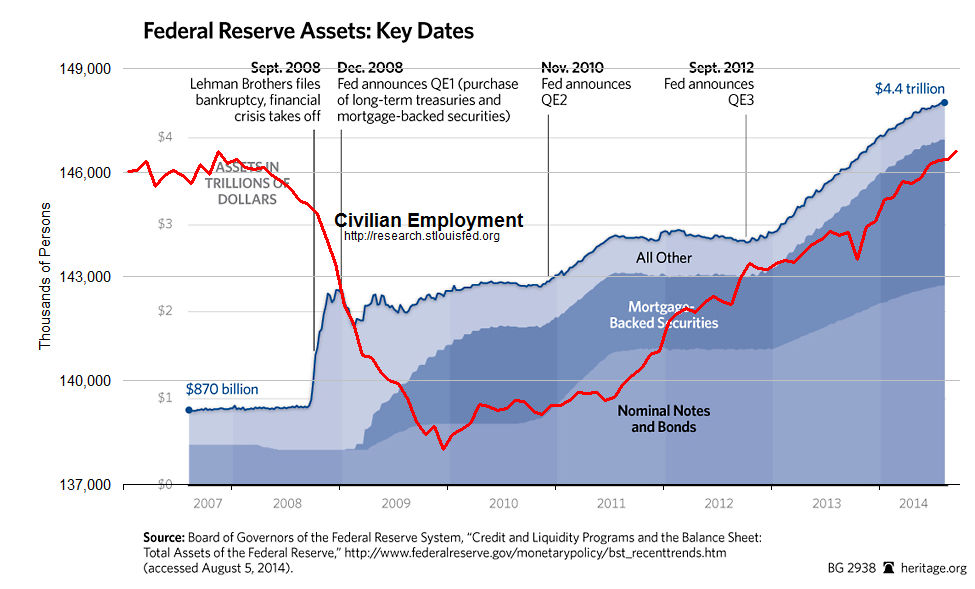

In my mind, the real issue with the economy is the Fed. Will the Fed punish a republican Senate victory by crashing the economy to pave the way for the democrat nominee in 2016?

Or will they wait until after 2016 to crash the economy if a republican wins then?

Otherwise, they would continue finding ways to prop up a huge inflatable in a growing wind.

“Come to think of it, maybe it’s the $100 oil that is had metals prices perched so these past couple years. So a return to sanity in both markets hopefully...”

Higher oil prices impact all of us, who work, are retired and even those on welfare when gasoline/diesel prices go up. Those of us who buy anything that depends on transportation to where we buy our food/goods and we have inflation and loss of disposable income.

Yesterday in the gay Frisco area, the local TV news stations were interviewing drivers/gas buyers with a wide spread of education and probably income levels. Everyone interviewed, said that they would have more money (we call it disposable income) to spend.

A good econ professor at Stanford said the same thing and said that it was a simple and easy understandable process. He and another econ professor said that the decrease in gas/diesel prices come down at this time of the year, most of us will be spending more for the holidays.

All of us get hammered with increased prices at the super market and where ever we shop due to higher oil prices.

When oil prices come down, inflation gets hammered, and that is good for 99.9% of us. When inflation gets hammered, often gold/silver prices get hammered.

Finally, when oil prices come down, the Opecker Princes/Putin and SA dictators get hammered. That is a good thing.

When gold/silver prices get hammered, smart money goes to areas that help our economies not the gold counters.

What ailing the economy is gov't regs and the tax'n'spending. The president can do more of that by executive order --I know it's not legally possible but it makes so much more sense than the Fed crashing the economy with what, the inter-bank discount rate?

In my opinion they’d plausibly do it. Just abruptly end QE....something like that.

In the long run, that’s best for the nation, but the short term effect will be pain that will carry into the 2016 campaign.

They actually did that in 2011, in fact they didn't just stop buying bonds but they also began selling bonds.

Businesses kept hiring anyway, in fact the rate of new hiring even increased.

Who all said that the dip two weeks ago was a buying opportunity? Give them a gold star!!

It was a group effort, don't you remember?:

Investment & Finance Thread Market Bounce Re-cap

Weekly investment & finance thread ^ | Oct. 19, 2014 | Freeper InvestorsTo: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...Buying-opportunity ping.

Thanks for the ping!

Good morning --moving along at mid-week!

Yesterday closed w/ stock indexes leaping up over the 50-day MA w/ metals flat, and this morning's futures see stock indexes flat w/ metals roaring. Reports today: Mortgage Index, Crude Inventories, FOMC Rate Decision. fwiw:

Feds Eerily Double Down On Housing - Stephen Moore, Washington Times

WhatsApp: Facebook's $21.8 billion acquisition lost $138 million last year Economic Times - an hour ago By David Gelles There was never any doubt that Facebook's acquisition of WhatsApp - now valued at $21.8 billion - was about gaining users before profits.

Stocks advance on hopes Fed stays dovish Financial Times - 6 hours ago Wednesday 08:00 GMT. European stocks are near three-week highs as investor sentiment is buoyed by a generally supportive corporate reporting season and hopes the Federal Reserve will display its willingness to leave borrowing costs at record lows for ...

As voter stress over economy cools, Wall Street ignores midterms

Four reasons the market will rally for the rest of 2014 Pessimism regarding the U.S. markets and economy abound, but there is more good than bad here if investors would merely take the time to look at the facts.. MarketWatch ^DJI 17,006.00 1.12%

Orbital Sciences Corp. (ORB)

http://finance.yahoo.com/q?s=orb&ql=1

Change in metals prices: _+5__% short term _+100__% long term

Election results: __57_% Rep. House _50_% (Tie/dim). Senate. Hope I am wrong, but we are already seeing significant voting irregularities.

Cause of econ/investment trend - QE hangover results in Crash Part 1. Second shoe drops when some unforeseen geopolitical or terror event triggers an economic downturn that will be felt until about 2025-2030.

Some finance smart ass was tweeting ORB’s 10K risk factors moments after the explosion. Brutal.

Earnings call is done! Stock up ~5% today so my work is done :-)

We’re all very grateful for the work you do Wyatt, that 5% will really come in handy. Thanks!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.