Posted on 10/26/2014 10:48:06 AM PDT by expat_panama

Our investing strategy is the mix of our own personal financial needs plus expected future developments in the economy. So the buzz (on these threads) is that the biggest up-coming economic/employment changes impacting our investment choices in the next week or two are the midterm elections, Ebola, deflation, and the war on terror.

We'll share our thoughts here on what we expect, and let's rate our expectations in terms of what we've been having up til now on the 'click-to-enlarge' graphs.

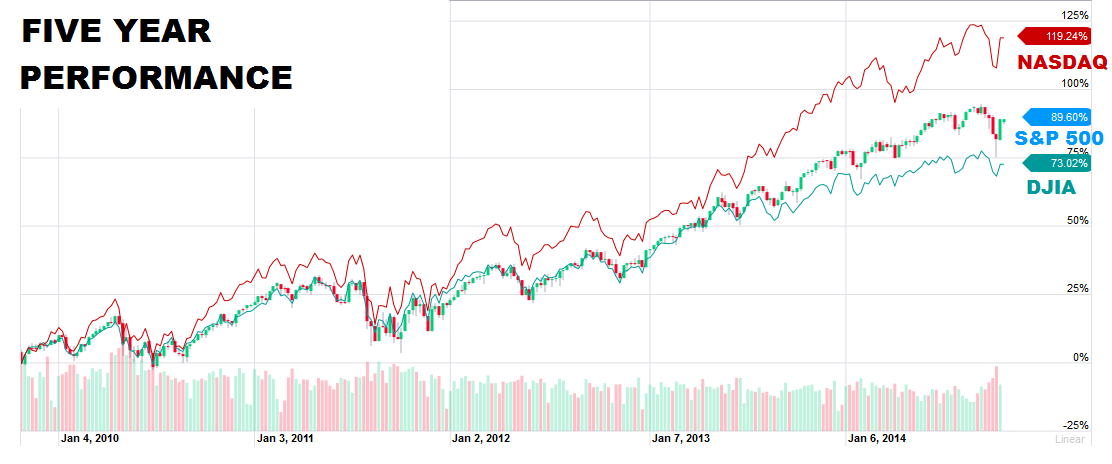

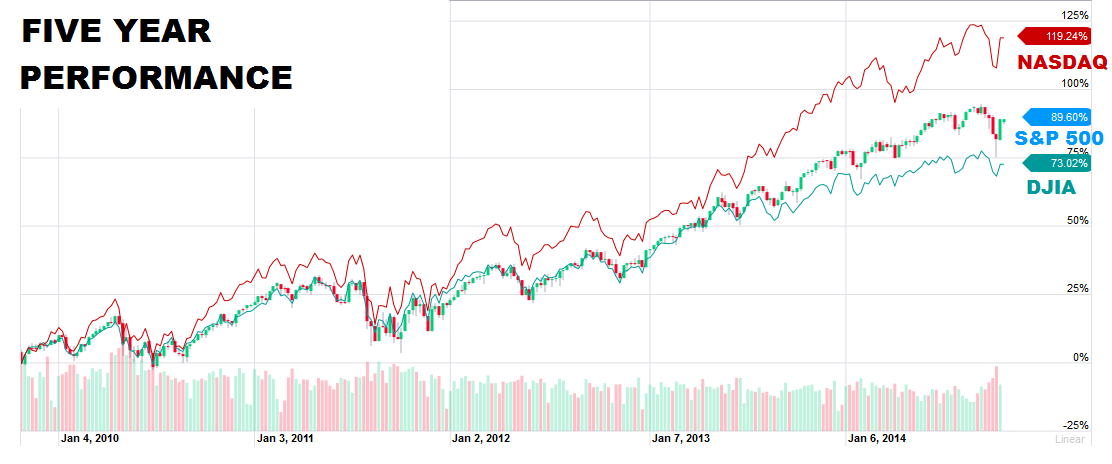

On the right margin we got 5-yr stock index performance for a back drop on our own personal expectations. Fer instance, my guess/wishful thinking is more of the same so I'll say short term up +10% and longer term +20%.

Right below stocks is the past ten years of metals --let's guestimate our expected short&long term trends.

Right below stocks is the past ten years of metals --let's guestimate our expected short&long term trends.

Finally, for discussion we ought to compare our thoughts on what we see supporting our investment expectations --what do we blame for any expected upcoming shift. OK, so we got the election.

<--Here's past party control of congress, and my personal expectations for beginning Jan. '15 is a 60% House and 65% Senate Rep. power shift. [oops, forgot the 'wishful thinking ' tag]

Other newsworthy macro factors coming up in the next couple weeks that should be affecting the economy and our investments include the spread of Ebola, inflation/deflation, war on terror, etc. So we can put at the bottom of the surveypoll/questionaire (SPQ) a vote on where we lob our blame.

OK, funtime! here's the SPQ to fill out and post:

| Change in stock indexes: | ____% short term | ____% long term |

| Change in metals prices: | ____% short term | ____% long term |

| Election results: | ____% Rep. House | ____% Rep. Senate |

| Cause of econ/investment trend (election,ebola,'flation,terror,other?): | ____________________ | |

The idea is to post the results in a graph table here and my guess is it'll take the better part of a week to get it all in. Another option we got is y'all can private reply if you don't want a public commitment -more work for me but that's OK because that way I can change your vote or even make up bogus replies to back up my own prejudices. As for how actual reality compares to our guestimates, prices come out every minute, the election's a week from Tues, and agreement on the cause should probably take a few decades...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

SPQ ping.

Here’s mine:

Change in stock indexes: ___+10_% short term ___+20_% long term

Change in metals prices: _-5___% short term __-20__% long term

Election results: __60__% Rep. House _65___% Rep. Senate

Cause of econ/investment trend (election,ebola,’flation,terror,other?): _________none of the above___________

On the economy, I don’t trust it but I have never been so busy and feel like I need to work as much as possible just in case the economy comes off the rails.

huh, new futures link for me —tx! Seems traders are looking at Dec. 14.

Got it! [setting up spreadsheet...]

Those are Fri. closing PM numbers. Futures market opens in about 15 min.

Good morning to all! At 2-1/2 hours before opening we got index futures off -0.18% and metals up 0.15%. Whole lot of waitin'n'seein going on. In fact, the only report today is Pending Home Sales at 1-1/2 hrs into trading. News is ok tho...

Threads:

Putin and the Opecker Princes and South American Oil producing despots take another hard kick be their economic belts.

Crude oil just broke $80.

In morning trade on Monday, the price of crude oil fell below $80 a barrel for the first time since mid-2012 as energy prices continue to plummet around the world.

The most recent drop in oil, which has been a bear market since topping out at about $107 during the summer, follows a cut in oil-price expectations from Goldman Sachs’ Jeff Currie over the weekend.

Currie took his oil-price forecasts for WTI Crude to $75 a barrel in the first quarter of 2015 and to $70 a barrel in the second quarter of next year.

Excerpt go to the link for the full article.

http://www.businessinsider.com/crude-oil-falls-below-80-october-27-2014-10

imho what’s weird is not the falling price but the fact it’s been high since ‘08. Getting out oil’s market price back to 1950 shows a long term price in inflation adjusted 2014 dollars at around $30/barrel, but recent past has it more like $100.

I’m expecting OPEC etc. to continue collapsing and another decade or two of $30.

As both of us old and basic minded economic goats know, the lower prices of oil/gasoline/diesel helps us as consumers and our economy. Look at the prices of Gold/silver with the middle east crisis. No longer is a middle east crisis a stimulus to increase the price of gold/silver and oil.

Bad Stock-Market Timing Fueled Wealth Disparity

Research Shows Many Households Sold Shares During Downturn

By Josh Zumbrun

Oct. 26, 2014 7:17 p.m. ET

Millions of Americans inadvertently made a classic investment mistake that contributed to today’s widening economic inequality: They bought high and sold low.

Late in the stock-market booms of the 1990s and 2000s, more U.S. families clambered into stocks as indexes surged. Then, once markets tumbled, many households sold and took losses.

Those that held on during the most recent collapses reaped the benefits as stocks nearly tripled between 2009 and today.

The split path is one driver of stark inequality in the U.S. Many workers have seen their wealth and incomes drop despite more than five years of economic expansion in the U.S. Some fear the gap, widening for decades, could fracture society and slow the nation’s potential for economic growth in the long run.

A link to this thread has been posted on the Ebola Surveillance Thread

Busy day today!

Busy day today!

Tuesday, October 28, 2014 |

||||

| Markets | yesterday | today | ||

| metals | Rally faltering w/ gold at $1,228.75 & silver at $17.31 | Futures @ 2-1.5 hrs. before opening +0.31% | ||

| stocks | Struggling to claw back thru 50-day averages: "... fought back from early selling to end narrowly mixed Monday. The Nasdaq rebounded from a 0.7% deficit to end fractionally higher. It also closed a hair above its 50-day line for a second straight session. Monday marked a third straight gain for the tech-heavy index. Hurt by energy stocks, the S&P 500 ended lower by 0.2%..." (from here) | Futuress +0.56% | ||

Reports: Durables, Case-Shiller 20-city Index, and Consumer Confidence. News:

- The Rich Regret Not Investing More In 2014 - Nanci Hellmich, USA Today

- Hillary's Anti-Business Talk Exposes Radical Roots - Stephen Moore, IBD

- Fed Dissension May Well Intensify In Coming Months - Peter Ireland, E21

- Asia markets mixed, eyes on Fed meeting

My problem is that good income/wealth distribution numbers are so hard to come by because of the politics. It’s kind of like how globalwarming political hacks have scarfed up all the original temperature records. Makes getting at the facts of the question extremely difficult.

Come to think of it, maybe it’s the $100 oil that’s had metals prices perched so these past couple years. So a return to sanity in both markets hopefully...

“Wealth inequality” is usually a direct result of how hard or smart one works.

Always been so, always will.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.