But relative to oil:

http://www.cmegroup.com/education/files/energy-price-spread-natural-gas-vs-crude-oil-in-the-us.pdf

Yet despite these three major bullish pressures, the price on the long-term futures strip remains below $5/Mcf. Possible explanations include speculators who are afraid that shale gas production will come roaring back; producers who, seeing prices above $4/Mcf, sold on the futures market to lock in revenues; and the prospect that, actually, the long-run equilibrium price is about $4/Mcf. There has not been a major increase in drilling at these prices but production has stabilized.

Which, oddly enough, is about where prices settled out after the long nightmare of price controls (from 1954) and phased decontrol (1978-85), adjusting for inflation of course. For those of us who have long argued that energy prices tend to be mean-reverting, this is a pleasant affirmation.

..................

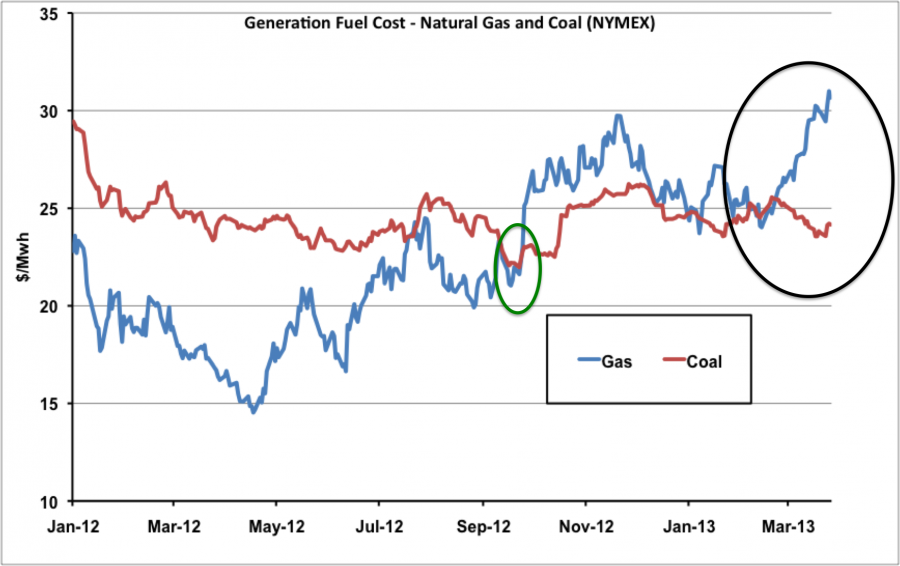

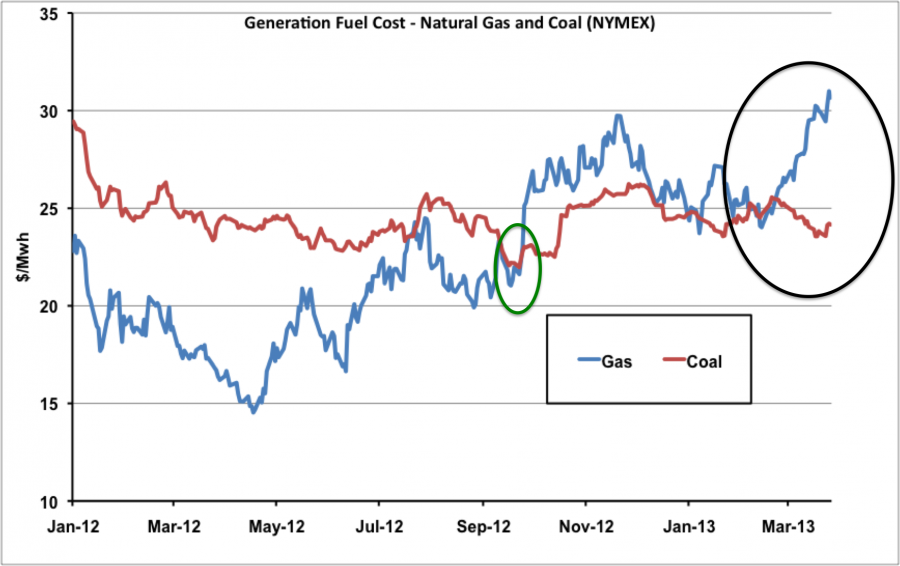

We got into this discussion a couple months back to the effect that the mean price of natural gas is in the $4 range which was similar in terms of price per btu’s to the current price of coal. And that both coal and natural gas were near their long term mean price. But oil in terms of btu’s was much higher. That the mean long term price for oil in terms of equivalent btu’s for oil gas and coal was somewhere in the $40@barrel range.

We were unable to confirm that with hard numbers.

But relative to oil:

http://www.cmegroup.com/education/files/energy-price-spread-natural-gas-vs-crude-oil-in-the-us.pdf