But relative to oil:

http://www.cmegroup.com/education/files/energy-price-spread-natural-gas-vs-crude-oil-in-the-us.pdf

But relative to oil:

http://www.cmegroup.com/education/files/energy-price-spread-natural-gas-vs-crude-oil-in-the-us.pdf

That link you posted had the clinching info

http://www.cmegroup.com/education/files/energy-price-spread-natural-gas-vs-crude-oil-in-the-us.pdf

In BTU terms, $1 of natural gas can obtain 200,000 units of

energy (at a spot rate of $5/million BTU) compared to $1 of

WTI oil which garners 60,000 units of energy (at a spot rate

of $97/barrel). This is a whopping 330% energy content

price gap – even after the polar vortex and deep freeze

have raised natural gas prices. This massive energy price

gap raises questions about how long it may persist, and our

read of the market consensus appears to measure the time

required to narrow the gap in decades, while our own base

case scenario is that it could happen in just three to five

years.

..................

330% means oil has to go down to the low 30’s @ barrel in order to have comperable btu/price to coal and natural gas.

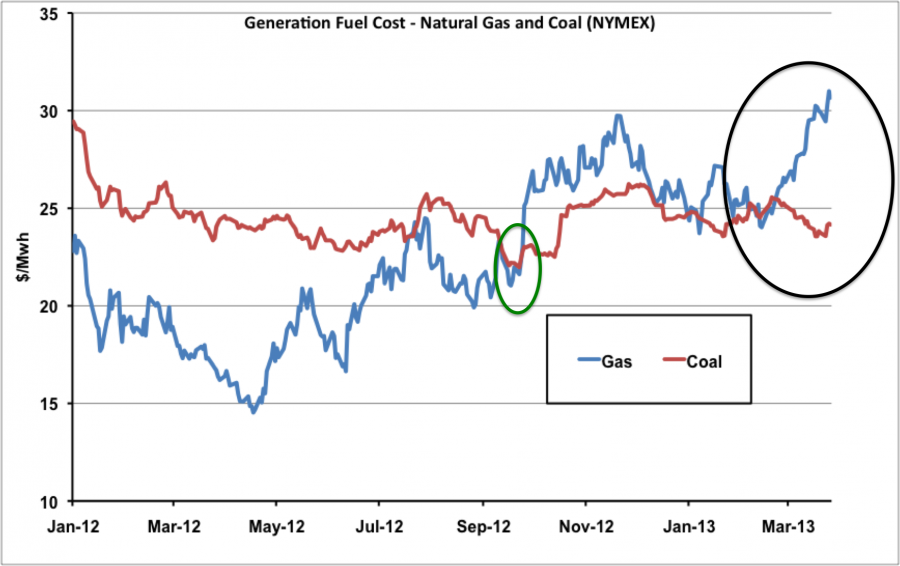

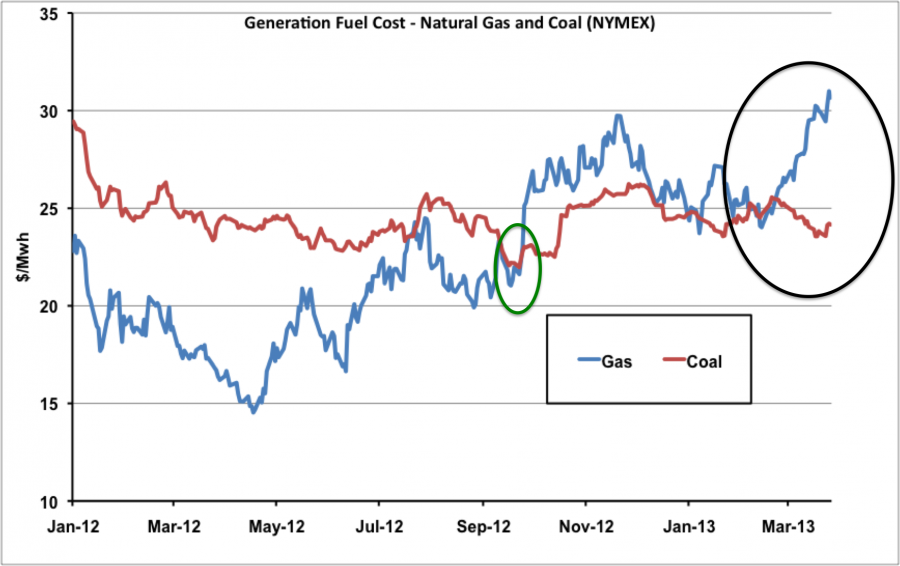

Or natural gas has to move up in price.

The article goes on to speculate on the direction of prices. The article is all over the place on this point Probably the safest guess as to the direction of prices is held by the options market which currently points to higher natural gas prices and lower oil prices in the next five years.

at this point you’d have to go well duh.