I still get push-back on FR from some who insist that the Federal Reserve exists only to "smooth out" business cycles and that my suspicions are but tin-foil delusions.

The Federal Reserve was formed, though, for two reasons: to protect foolish banks from bankruptcy and to ensure that the Federal Government would never have to worry about selling its debt [but that's only payback for the right of ensuring that foolish banks could be protected from bankruptcy].

1 posted on

04/19/2014 4:36:32 PM PDT by

BfloGuy

To: BfloGuy

Isn’t quantitative easing another way to devalue monies already in circulation, thereby sabotaging the purchasing-power of the average citizen?

2 posted on

04/19/2014 4:39:44 PM PDT by

OneWingedShark

(Q: Why am I here? A: To do Justly, to love mercy, and to walk humbly with my God.)

To: BfloGuy

It is a hostile takeover of the markets by the federal reserve and the communists. Period. They now have more “wealth” bought up that is more than 1/4th of the entire stock market value. They have performed illegal money laundering and ‘bought’ massive amounts of controlling interests in the markets.

3 posted on

04/19/2014 4:41:36 PM PDT by

CodeToad

(Arm Up! They Are!)

To: BfloGuy

There were only two purposes behind QE:

1. To fund government deficit spending without raising interest rates

2. To protect the bottom line of Goldman Sachs executives.

4 posted on

04/19/2014 4:43:20 PM PDT by

Hoodat

(Democrats - Opposing Equal Protection since 1828)

To: BfloGuy

The only function of the FED is to control the US economy and make Trillions of dollars for the super rich that forced implementation of the FED in the first place.

5 posted on

04/19/2014 4:45:31 PM PDT by

mountainlion

(Live well for those that did not make it back.)

To: BfloGuy

There’s no legitimate reason for the Treasury to issue bonds and sell them for dollars, thus, borrowing dollars, when it has legitimate authority to create dollars.

Dollars get created in either case, but if the Fed creates dollars and Treasury borrows dollars, the govenment, i.e., the taxpayer, has debt. Every dollar created has to be “paid back” out of future taxes.

If the Treasury created its own dollars and the Fed was not allowed to, the Treasury would not have to borrow.

7 posted on

04/19/2014 4:58:19 PM PDT by

PieterCasparzen

(We have to fix things ourselves)

To: BfloGuy

Interesting article, but there's another angle to this that doesn't get a lot of exposure:

Since QE3, the Fed's program of quantitative easing now involves two separate bond purchases: (1) government bonds, and (2) mortgage-backed securities. This article does a good job of explaining the first part, but doesn't even mention the second. The whole purpose of having the Fed buy MBS debt was to prop up the value of securities that were backed by mortgages on real estate that couldn't be "written down" at all. In other words ... if I buy a home for $500,000 with a $400,000 mortgage and I immediately default on the loan, then the bank takes possession of the home. If the home is only worth $300,000 after my default, then I am out my $100,000 and someone else(the bank or the holder of the security instrument that was created and backed by the mortgage) is out another $100,000. But the problem here is that someone (the prior owner) has the original $500,000 that I paid for the home. I have said for several years now that the whole purpose of having the Fed buy the MBS that was created out of my $400,000 was to restore the original value of the mortgage and "legitimize" the dollars that had been created out of thin air when I took on the mortgage.

8 posted on

04/19/2014 5:05:40 PM PDT by

Alberta's Child

("I've never seen such a conclave of minstrels in my life.")

To: BfloGuy

At the moment, Janet Yellen’s worries about finding buyers of government bonds can only be getting worse. For much of last year, foreign central bank purchases of U.S. bonds in aggregate fell. As of October of 2013, they had been negative for three and six months. Then they turned up a smidge, only to fall again, so that the last three months show a decrease of just over 12%.And now you know why the politicians are so desperate for amnesty. They need the 30 million influx to continue the debt ponzi scheme.

10 posted on

04/19/2014 5:38:32 PM PDT by

AmusedBystander

(The philosophy of the school room in one generation will be the philosophy of government in the next)

To: BfloGuy

Hey, don’t feel bad.

I’m in the minority re contending a number of things on these matters as well.

The net result is that without the Fed as it exists currently, we might actually have fiscally-responsible government.

What a novel concept.../s

To: BfloGuy

12 posted on

04/19/2014 6:15:12 PM PDT by

TBP

(Obama lies, Granny dies.)

To: BfloGuy

This arguement makes perfect sense.

And the USA would be in very deep trouble.

However, the fracking revolution and the stock market have come just in time.

The deficit is expected to fall again in 2014 from 680 billion to 480 billion.

Probably half of that is the stock market — which the fed is blowing up— but also half of that is from the fracking revolution which is adding another 100 billion to federal revenues annually. That number will double in three years.

The bottom line is that by the time obama is out of office in January 2017 the federal budget will be nearly balanced.

That is absent any outside forces you can expect both the stock market and the oil patch to be adding 200 billion to federal revenues while the republicans keep federal spending in check.

The pubbies will do pretty much the same thing as Newt’s congress did under clinton. They’ll take the heat while Clinton/Obama get the credit for the balanced budget.

I totally agree that people simply will hardly ever know the terrible bullet that the USA dodged.

But it has been dodged.

14 posted on

04/19/2014 6:28:58 PM PDT by

ckilmer

To: BfloGuy

The central banks simply created money in their own currency and used it to buy our bonds. Japan started out using trade surplus dollars to buy our bonds, but switched to printing. China still uses their trade surplus with us to buy stuff from us, not bonds but hard assets. It is quite a stretch to think that the US would ever recover enough or tax enough to pay those bonds back. Everybody with a slight clue has known that for a decade or two now, but the charade continues nonetheless.

The choices are default, inflation or growth and we have to keep pretending that we are going to grow out of it, yet the very existence of QE is what prevents long term growth.

15 posted on

04/19/2014 6:37:47 PM PDT by

palmer

(There's someone in my lead but it's not me)

To: BfloGuy; All

16 posted on

04/19/2014 6:41:30 PM PDT by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: BfloGuy

The best criticism of the Fed is that it too often does its job poorly, not that it was ill-founded or that it is unnecessary.

A key reason for the creation of the Fed is that without a central bank, the essential function of providing emergency liquidity and acting as lender of last resort must fall to private bankers. Specifically, in the panic of 1907, that role fell to J. P. Morgan and a small group of bankers aligned with him.

Although Morgan was much pilloried during his lifetime, in that instance, he and his allies acted with regard for the public interest and stabilized the US financial system in a moment of crisis. Yet a systemic vulnerability had become clear and made a potent argument for the creation of a central bank.

Notably, in 1932 and 1933, due to a lack of political direction and a lapse in the absence of a new appointed chairman, the Fed failed to perform its duty as lender of last resort. This led to a catastrophic lack of liquidity and the wave of bank failures that aggravated and defined the Great Depression.

It is sometimes argued that there would be no need for emergency liquidity and a systemic lender of last resort if fractional reserve banking were abolished. Unfortunately, that is not the case, because mismatches in maturity between assets and liabilities may arise, or normally sound assets may lose their value in a major financial crisis.

Ultimately, as long as an economy relies on lending, there will be a need for standby emergency liquidity and a lender of last resort. The problem is that such a role may weaken the discipline of free markets in punishing bad lending practices and improvident bankers.

The financial crisis of 2008 stemmed directly from an excess of lending to the US housing sector. The Fed had the power to act against the bad lending practices but did not do so. While the Fed performed well enough during the crisis, their prior errors should not be excused, just as we would not excuse failure to remedy an obvious fire hazard simply because the resulting fire was suppressed just short of total destruction.

To: BfloGuy

From November 7, 2010:

Palin to Bernanke: ‘Cease and Desist’

As President Obama prepares for the G20 summit in South Korea this week, Sarah Palin is challenging the Federal Reserve’s monetary policy, which will likely be a key issue at the talks. On Monday, in a keynote address at a trade-association convention in Phoenix, Palin will urge Fed chairman Ben Bernanke to “cease and desist” his “pump priming.” The United States, she says, “shouldn’t be playing around with inflation.”

Here are snippets from Palin’s prepared remarks obtained by National Review Online:

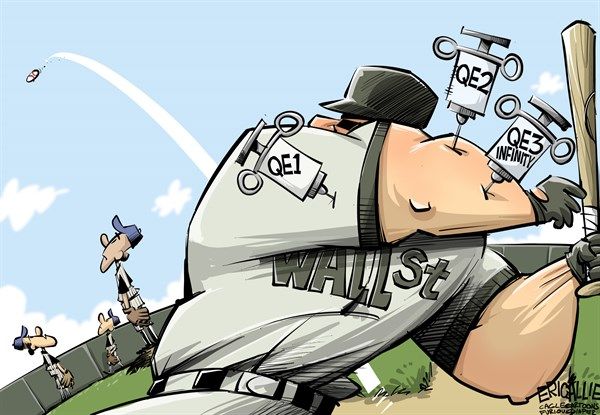

I’m deeply concerned about the Federal Reserve’s plans to buy up anywhere from $600 billion to as much as $1 trillion of government securities. The technical term for it is “quantitative easing.” It means our government is pumping money into the banking system by buying up treasury bonds. And where, you may ask, are we getting the money to pay for all this? We’re printing it out of thin air.

The Fed hopes doing this may buy us a little temporary economic growth by supplying banks with extra cash which they could then lend out to businesses. But it’s far from certain this will even work. After all, the problem isn’t that banks don’t have enough cash on hand – it’s that they don’t want to lend it out, because they don’t trust the current economic climate.

And if it doesn’t work, what do we do then? Print even more money? What’s the end game here? Where will all this money printing on an unprecedented scale take us? Do we have any guarantees that QE2 won’t be followed by QE3, 4, and 5, until eventually – inevitably – no one will want to buy our debt anymore? What happens if the Fed becomes not just the buyer of last resort, but the buyer of only resort?

All this pump priming will come at a serious price. And I mean that literally: everyone who ever goes out shopping for groceries knows that prices have risen significantly over the past year or so. Pump priming would push them even higher. And it’s not just groceries. Oil recently hit a six month high, at more than $87 a barrel. The weak dollar – a direct result of the Fed’s decision to dump more dollars onto the market – is pushing oil prices upwards. That’s like an extra tax on earnings. And the worst part of it: because the Obama White House refuses to open up our offshore and onshore oil reserves for exploration, most of that money will go directly to foreign regimes who don’t have America’s best interests at heart.

We shouldn’t be playing around with inflation. It’s not for nothing Reagan called it “as violent as a mugger, as frightening as an armed robber, and as deadly as a hit man.” The Fed’s pump priming addiction has got our small businesses running scared, and our allies worried. The German finance minister called the Fed’s proposals “clueless.” When Germany, a country that knows a thing or two about the dangers of inflation, warns us to think again, maybe it’s time for Chairman Bernanke to cease and desist. We don’t want temporary, artificial economic growth bought at the expense of permanently higher inflation which will erode the value of our incomes and our savings. We want a stable dollar combined with real economic reform. It’s the only way we can get our economy back on the right track.

23 posted on

04/20/2014 9:46:54 AM PDT by

Bratch

To: BfloGuy

http://en.wikipedia.org/wiki/Hjalmar_Schacht

In August 1934 Hitler appointed Schacht as Germany’s Minister of Economics. Schacht supported public-works programs, most notably the construction of autobahnen (highways) to attempt to alleviate unemployment – policies which had been instituted in Germany by von Schleicher’s government in late 1932, and had in turn influenced Roosevelt’s policies. He also introduced the “New Plan”, Germany’s attempt to achieve economic “autarky”, in September 1934. Germany had accrued a massive foreign currency deficit during the Great Depression, which continued into the early years of the Third Reich. Schacht negotiated several trade agreements with countries in South America and southeastern Europe, under which Germany would continue to receive raw materials, but would pay in Reichsmarks. This ensured that the deficit would not get any worse, while allowing the German government to deal with the gap which had already developed. Schacht also found an innovative solution to the problem of the government deficit by using mefo bills. He was appointed General Plenipotentiary for the War Economy in May 1934[9] and was awarded honorary membership in the NSDAP and the Golden Swastika in January 1937.

To: BfloGuy

It’s bad enough that they’re creating money out of thin air. It’s even worse that we, the taxpayer have to pay it back. Can we create our federal tax payments out of thin air, too?

31 posted on

04/21/2014 4:11:56 PM PDT by

grania

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson