Record margin debt always leads to a happy ending in the markets/sarc

Posted on 03/10/2014 4:18:48 AM PDT by MeneMeneTekelUpharsin

SAN FRANCISCO (MarketWatch) — A number of warning signals are flashing in the stock market, and while not indicative of an imminent crash, they’re telling investors to exercise caution, say market strategists.

Stocks finished higher last week, ending on a choppy Friday highlighted by the release of a better-than-expected job report. The Dow Jones Industrial Average DJIA +0.19% advanced 0.8%, the S&P 500 Index SPX +0.05% rose 1% to close at another record high of 1,878.04, and the Nasdaq Composite Index COMP -0.37% finished up 0.7% for the week. All except the Dow are higher for the year, which is still down 0.8% in 2014.

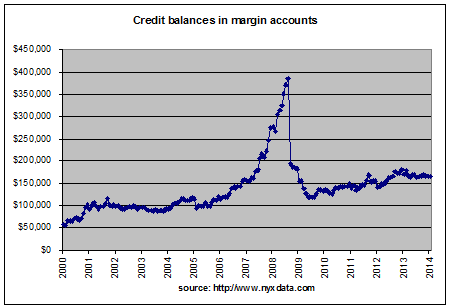

The gains haven’t come without a share of fretting that the good times can’t last. Among the warnings signs: The indexes’ string of record highs; high levels of margin debt, or borrowings to finance stock buys; the slim number of prior bull markets that have lasted past this point; and valuations that are close to levels when stocks last peaked.

Margin debt, which tends to spike alongside stock rallies and pullbacks, has been rattling investors for months . “As that debt goes up, the market’s foundation gets shakier and shakier,” said Brad McMillan, chief investment officer for Commonwealth Financial. “The correction could be deeper.”

Also of concern is the bull market’s fifth birthday on Monday. The average bull market only lasts about 4.5 years, putting the current one in rarefied territory. Of the 12 bull markets since World War II, only half have lasted five years, and only three have made it to their sixth birthday.

(Excerpt) Read more at marketwatch.com ...

Well, it is not a great time to buy.

The market goes up on seemingly any news, positive or negative. And usually when the market runs up in advance of a number being released, it sells off on the news. Recently, we have seen it continue rising.

At some point we will have a 15%-20% correction.

Sure, sure we will.

No, we will just continue rising to 50,000 with no pullbacks. After all that is how the market has always worked/s

I do not see where they include the Fed actions on this “rattling” of the market? Keep in mind they have been doing the draw down now for several months.

The over-inflated market is overdue for a correction. This time the correction is not based on any of the normal market activities, but on statist and elitist flights of fanciful fantasy compliments of the Fed.

According to the doom'n'gloomers at dshort.com. They say they're getting their numbers from the NYSE but actual account margins give a different story:

Margin debt is at an all time high.....I have seen that from several sources.

Margin debt is at an all time high. Absolutely no disputing the numbers:

http://www.nyxdata.com/nysedata/asp/factbook/viewer_edition.asp?mode=table&key=3153&category=8

Buying on margin makes no sense to me. The ones who benefit are the brokers who get commissions and have nothing to lose when playing with other people’s money. Many people have no idea their brokers are using borrowed money to invest. Make sure your brokers aren’t doing this. There are a lot of law suits out there.

That chart is absolutely not accurate if compared tp Nyx data.

That chart is not the margin debt but the credit balance.

Either he was woefully mistaken or willfully deceptive.

One can make enormous profits using margin....the key is to do so judiciously.

It is akin to sailing in a boat. If you could make your sail have 5 times the square feet of ours, it could really propel you.....just watch out for any winds....it could also tip you over easily.

Wasn't it stopped at the end of the Great Depression? I can't understand the logic to it, either. There's already enough risk in the stock market. Why add to that by paying brokers commissions or paying to borrow money to take that risk?

I've become so cynical. The numbers have felt rigged for quite some time, back to GWB maneuvers to prop it up. The stock market is propped up because interest on CD savings is near zero. A drop in the stock market now would scare Yeltsin out of raising interest rates on savings.

Unless they bring the whole stock market down with them

Huh?

If they lose, they lose their money.

If so many people lose that it brings down the stock market, even those who didn’t invest on margin lose. Look what happened to the mortgage market when too many people were in over their heads....even responsible borrowers lose out.

Free people have a right to buy and sell what they own at prices they're willing to accept, and that applies whether it's the stock market, the fish market, or the super market. If your local grocer decides that he's better off if he unloads good food below cost then what we do is help him off by stocking up. We don't need the loony lefties making it illegal.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.