Money is not going into new jobs

There is a

negative ROI on

injecting Capital into this economy

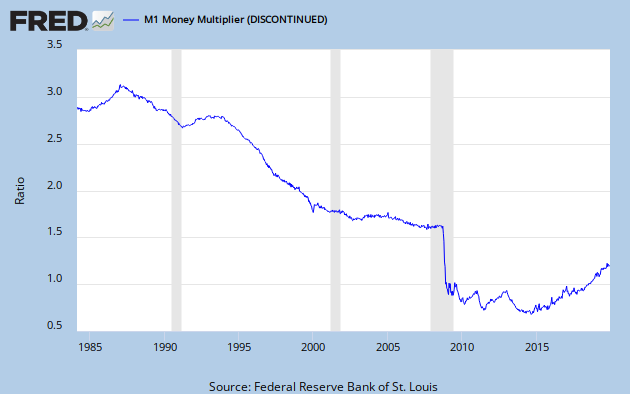

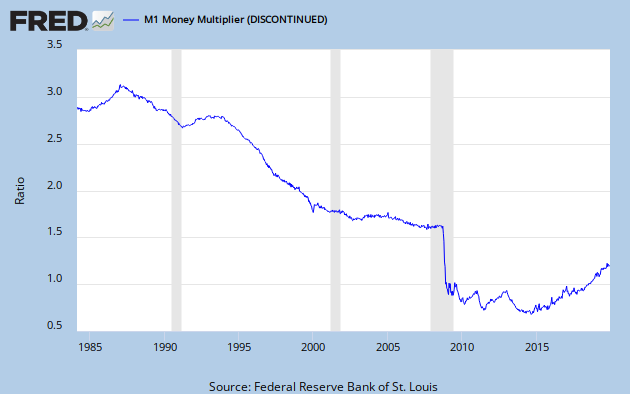

M1 Multiplier is PERSISTANTLY below 1.0, and dropping

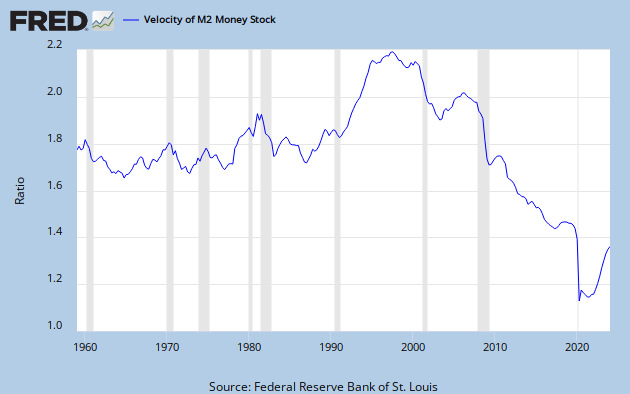

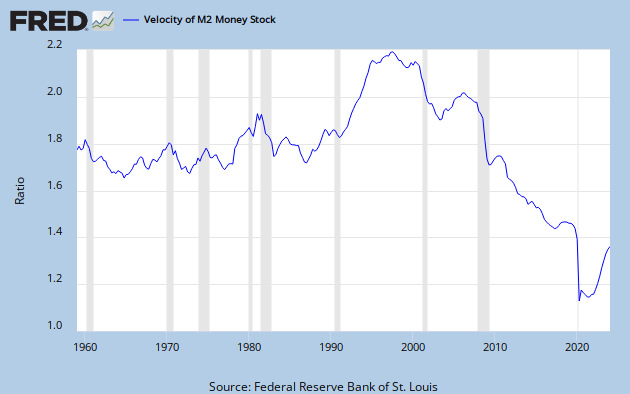

M2 Velocity is sinking rapidly

Banks are holding onto money, instead of investing it

Remember, Monetary Velocity is the Single Best Indicator of Economic Health

Unemployment is becoming permanent

Corporations are sequestering Money, instead of investing

Well, if money velocity is dropping as the chart you present shows, this tells us that all these QE’s the Fed is doing isn’t really affecting the economy.

It also tells us that THAT is the main reason why despite the FED pumping money, inflation is relatively tame.

There is an explanation as to why Money Growth does not necessarily lead to inflation here (for those interested):

http://www.forbes.com/sites/johntharvey/2011/05/14/money-growth-does-not-cause-inflation/