Posted on 09/08/2013 7:41:09 AM PDT by SeekAndFind

Have you heard about the "wonderful" employment numbers that were just released? Last month, the unemployment rate declined to 7.3 percent. Somehow this happened even though the percentage of working age Americans with a job actually declined and the number of private sector workers fell by 278,000. So how did the federal government magically produce a drop in the unemployment rate even though less people have jobs? Well, they did it by pretending that more than half a million Americans "dropped out of the labor force" last month. If the government is to be believed, the number of Americans that want to work dropped by an astounding 516,000 in a single month even though the population of our country is constantly increasing. The federal government continues to feed us absolutely absurd numbers month after month, and at this point "the official unemployment rate" is essentially meaningless.

But that doesn't mean that Barack Obama is about to drop the charade. In fact, he continues to insist that the economy is getting better. The following is an excerpt from one of Obama's recent weekly radio addresses...

Over the past four and a half years, we’ve fought our way back from the worst recession of our lifetimes. And thanks to the grit and resilience of the American people, we’ve begun to lay a foundation for stronger, more durable economic growth.

Oh really?

Does he actually believe that anyone is still buying what he is saying?

The cold, hard truth is that the U.S. economy has not recovered while Obama has been in the White House. If you doubt this, please see my previous article entitled "33 Shocking Facts Which Show How Badly The Economy Has Tanked Since Obama Became President".

Since World War II, the percentage of working age Americans that is employed had always bounced back dramatically after a recession ended.

Unfortunately, that has not happened this time.

As you can see from the chart posted below, the percentage of working age Americans with a job has stayed below 59 percent since late 2009. This chart reflects the most recent employment numbers...

So where is the recovery Obama?

Can he possibly put a positive spin on the chart above?

Of course not.

The truth is that the official unemployment rate should still be up around 10 percent like it was a few years ago.

But that wouldn't make Obama look very good, would it? So the U.S. government has been pretending that millions upon millions of Americans have been "leaving the labor force". This has pushed the labor force participation rate to a 35-year-low...

At this point, we have more than 90 million Americans that are considered to be "not in the labor force"...

On Friday, the BLS reported that the 90,473,000 Americans not currently in the labor force marked the first time the figure exceeded the 90 million threshold.

In January 2009, when President Obama first took office, there were 80.5 million Americans 16 years and older not in the labor force, meaning the number of Americans not in the labor force has increased 10 million during his presidency.

For men, the BLS reported the labor force participation rate, the percentage of the population working or considered looking for work, was 63.2 percent in August, basically unchanged from 63.5 percent in July. It’s also a record low.

How low can that number possibly go?

Meanwhile, the quality of our jobs continues to decline rapidly as well. If you can believe it, at this point more than 40 percent of all U.S. workers actually make less than what a full-time minimum wage worker made back in 1968.

As a result, the U.S. middle class is steadily dying. The following is from a recent Yahoo article...

It’s the elephant in the room no one wants to talk about…

The middle class in the U.S. economy is on the verge of collapse. Yes, I said collapse. That social class that once helped the U.S. economy grow and prosper is coming apart. Will the U.S. economy ever be the same without it or is this the new norm?

For much more on this, please see my previous article entitled "44 Facts About The Death Of The Middle Class That Every American Should Know".

And unfortunately, things look like they may start getting a lot worse for ordinary Americans.

There are a couple of major events which could potentially cause our economic decline to accelerate greatly in September...

#1 Fed Tapering

Right now, there is not much demand for U.S. Treasury bonds. Foreigners have become net sellers of U.S. Treasuries and domestic demand has become quite weak. Without the Federal Reserve buying up tens of billions of dollars worth of U.S. Treasuries each month, where will the demand come from?

That is a very good question. If the Fed starts to taper quantitative easing in September, that is almost certainly going to send bond yields soaring. Already, bond yields have been rising steadily, and if they get too high it is going to be absolutely disastrous for the U.S. economy.

#2 War With Syria

If the U.S. attacks Syria, it will likely cause financial markets all over the planet to descend into chaos and send the price of oil skyrocketing.

And that assumes that the conflict is limited to only the United States and Syria. If Syria decides to retaliate by launching missiles at Israeli cities, that will set off a major regional war in the Middle East and the consequences for the global economy will be off the charts.

So as bad as the U.S. economy is right now, the truth is that things could easily get much, much worse.

Let us hope for the best, but let us also prepare for the worst.

Unbelievable, not just astonishing. August would be when all of the graduates from schools are entering the job market.

There's no good way to spin the situation when the the number of jobs increases while private employment decreases. That means there are more public sector jobs but less private sector jobs to pay the bill.

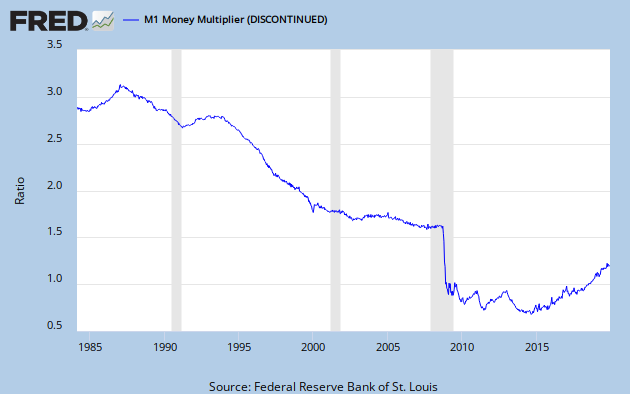

M1 Multiplier is PERSISTANTLY below 1.0, and dropping

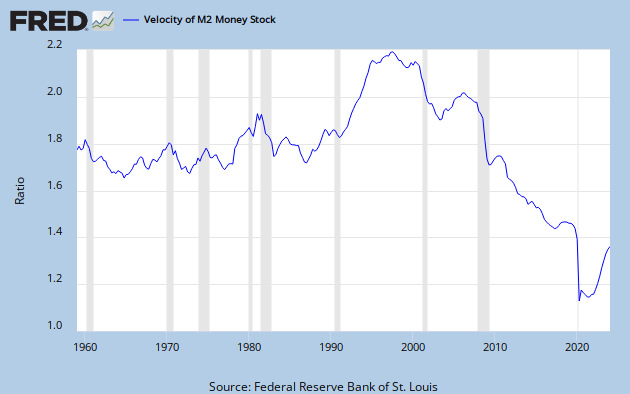

M2 Velocity is sinking rapidly

Banks are holding onto money, instead of investing it

Remember, Monetary Velocity is the Single Best Indicator of Economic Health

Unemployment is becoming permanent

Corporations are sequestering Money, instead of investing

A fed employee I know was very recently talking with glee about the 1% increase for fed employees Zero proposed. I was floored. Where is that money coming from?! So much for that sequestration thingy, huh?

Well, if money velocity is dropping as the chart you present shows, this tells us that all these QE’s the Fed is doing isn’t really affecting the economy.

It also tells us that THAT is the main reason why despite the FED pumping money, inflation is relatively tame.

There is an explanation as to why Money Growth does not necessarily lead to inflation here (for those interested):

http://www.forbes.com/sites/johntharvey/2011/05/14/money-growth-does-not-cause-inflation/

When Zero and his destroy the last private sector job, the unemployment rate will be at an unheard of “Zero” He considers this to be a way to justify that our nickname for him is in tribute to a good thing...

Does it also show that the economy and the Market aren't really in-sync with each other? Not being an economist, I really don't understand the glues that bind in this area.

Also see Liquidity Trap

http://en.wikipedia.org/wiki/Liquidity_trap

A liquidity trap is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels

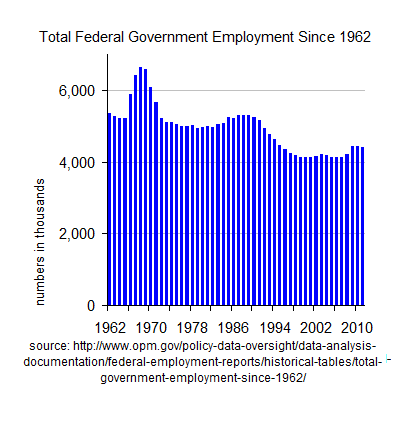

But government jobs are up over 300,000!

Number of Gov’t Workers Up 324,000 in One Month – Private Sector Down 278,000

http://www.freerepublic.com/focus/f-news/3063577/posts

“inflation is relatively tame.”

According to the government statistics. But that chocolate shake I bought recently cost me $5.00. Seems not all that QE money is just sitting in the bank.

We are the foundation for any economic growth--America's most vital resource--it's people.

Yep. He's begun to "lay" us, alright.

We've never been so screwed, and it's just the beginning.

That may be how that CNS article quoted the BLS, but it's not what the BLS says. The actual numbers show total government (federal, state, local) employment grew by 0.008% --17,000 jobs-- all of which were local government. Federal level saw no hiring and state gov't's shrunk. FWIW over the decades federal government employment's been shrinking --ok up a bit with Obama but nowhere near as high as it was when Reagan was president.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.